Income Tax Rebate For Higher Education Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

Web 10 sept 2018 nbsp 0183 32 For many of us education costs be it for secondary or higher education constitute a significant outlay from the disposable income available This makes us think Web 20 nov 2022 nbsp 0183 32 Qualified Higher Education Expense Expenses such as tuition and tuition related expenses that an individual spouse or child must pay to an eligible post

Income Tax Rebate For Higher Education

Income Tax Rebate For Higher Education

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2023/01/Irish-Tax-Rebates-36-1.jpg?resize=727%2C1024&ssl=1

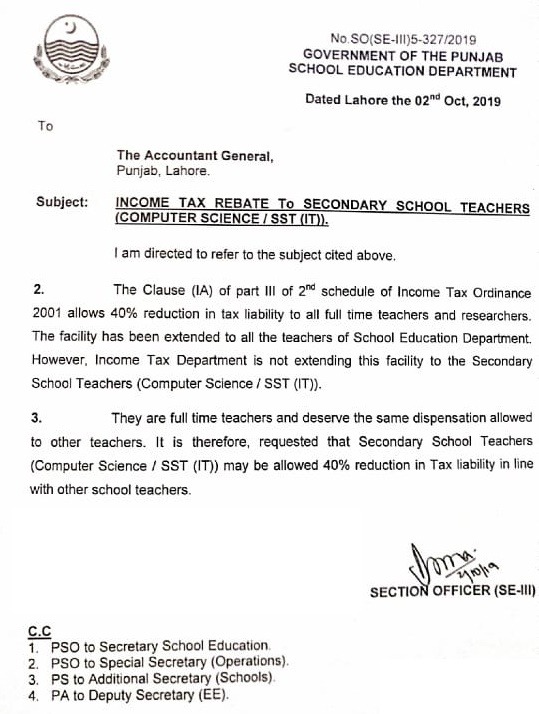

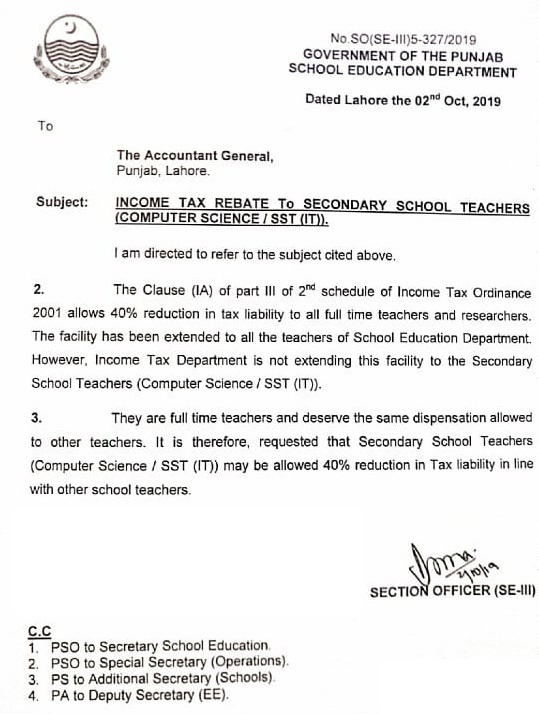

Income Tax Rebate 40 To All Teachers Of School Education Department

https://employeesportal.info/wp-content/uploads/2019/10/Income-Tax-Rebate-40-to-All-Teachers-of-School-Education-Department.jpg

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Web An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961 The best part about this Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Web 27 juin 2023 nbsp 0183 32 Updated on Dec 28th 2022 3 27 43 AM 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information regarding education tax works for higher

Download Income Tax Rebate For Higher Education

More picture related to Income Tax Rebate For Higher Education

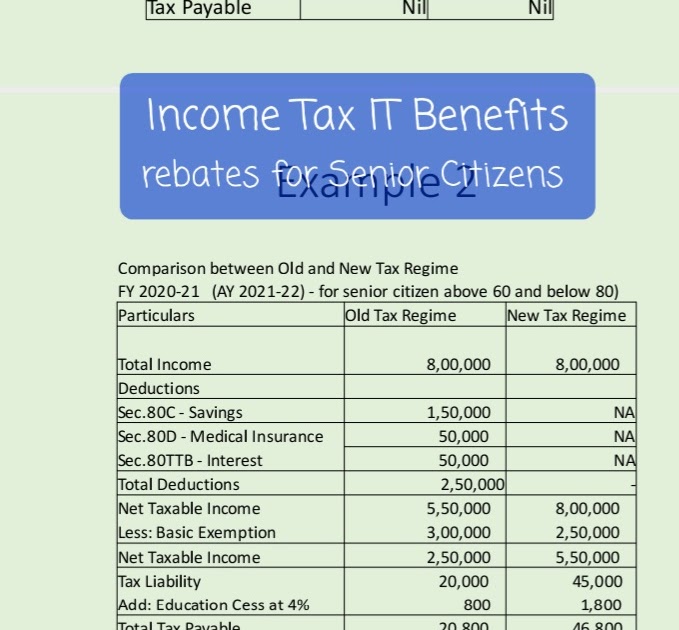

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Education Property Tax Rebate Continues In 2022 City Of Portage La

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax Act You can take education loan tax Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are met Tax benefits have been laid down under

Web 31 mai 2023 nbsp 0183 32 Section 80E is the income tax deduction from taxable income which covers the deduction on the interest component paid on higher education loans from the Web The spending for pursuing education can let you save on income taxes You can claim a deduction of Interest paid on a loan taken for pursuing higher education from taxable

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

https://www.irs.gov/publications/p970

Web Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity

https://www.financialexpress.com/money/income-tax/income-tax-benefits...

Web 10 sept 2018 nbsp 0183 32 For many of us education costs be it for secondary or higher education constitute a significant outlay from the disposable income available This makes us think

Individual Income Tax Rebate

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

What To Know About Montana s New Income And Property Tax Rebates

Section 87A Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Pin On Tigri

Pin On Tigri

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

P55 Tax Rebate Form By State Printable Rebate Form

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax Rebate For Higher Education - Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution