Income Tax Rebate For Housing Loan Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs Web Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house loan This is

Income Tax Rebate For Housing Loan

Income Tax Rebate For Housing Loan

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

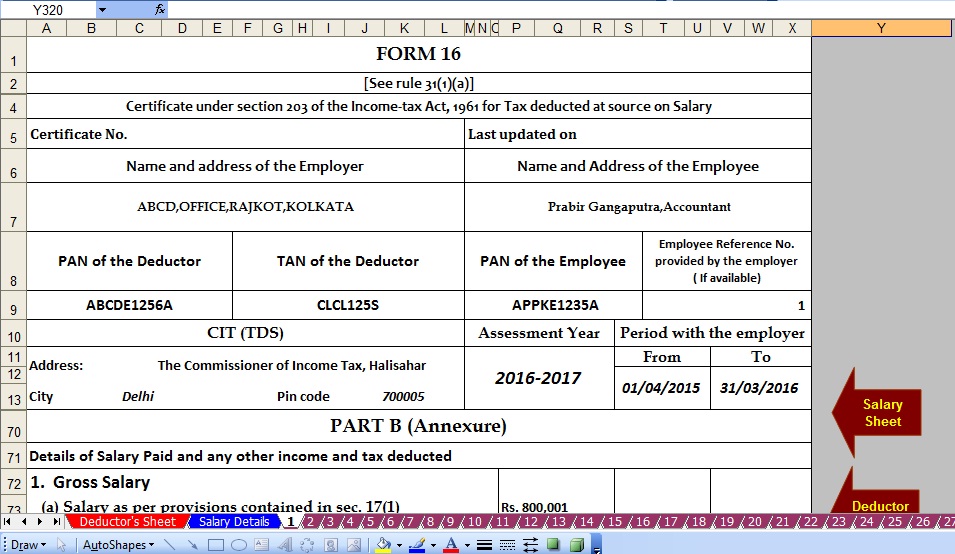

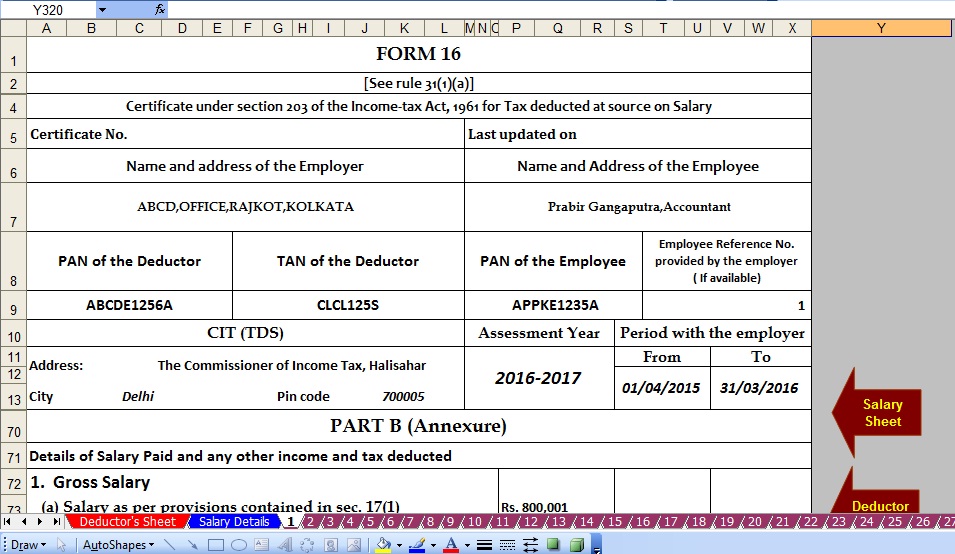

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web Yes you will definitely get income tax benefit on home loan under section 80 C D Regardless of the number of property there are associated benefits of filing income tax return Be sure to check with a professional about Web Income Tax Rebate Remaining Amount Taxable Income Tax Amount 18 lakh per annum 3 50 000 Housing Loan Principal Interest Rs 14 50 000 Rs 14 50 000

Download Income Tax Rebate For Housing Loan

More picture related to Income Tax Rebate For Housing Loan

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 24 janv 2022 nbsp 0183 32 If you want to understand how to get tax benefits on a second home loan you need to be aware of the deductions available u s 80C of Income Tax Act Under this section one can claim a deduction Web 19 avr 2021 nbsp 0183 32 For interest on home loans the tax benefit is available under Section 24 b For a maximum of two self occupied properties taken together you can claim upto Rs 2

Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Web Section 80C Deductions under this section can help you with tax benefits of up to Rs 1 5 lakhs on the principal amount Section 24 Under this section you are allowed to enjoy

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

https://www.hdfc.com/blog/home-finance/home-loan-tax-benefit

Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Property Tax Rebate Application Printable Pdf Download

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

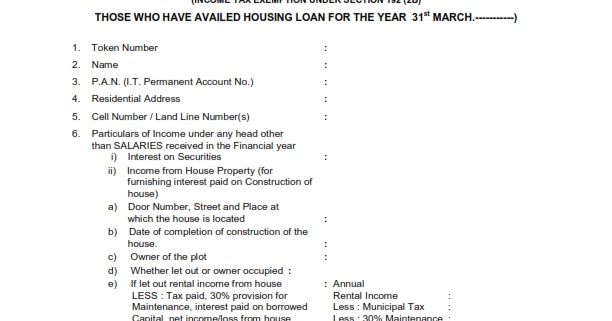

Housing Loans Joint Declaration Form For Housing Loan

Housing Loans Joint Declaration Form For Housing Loan

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

GST HST New Housing Rebate Rebates House With Land Home Construction

Income Tax Rebate For Housing Loan - Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for