Income Tax Rebate For Medical Expenses Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about

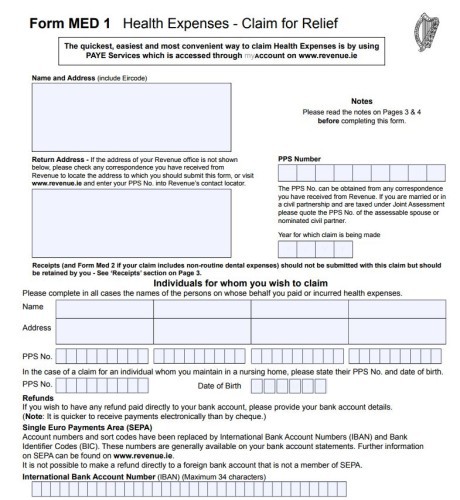

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income Web 16 ao 251 t 2023 nbsp 0183 32 Tax relief on medical expenses Introduction What healthcare expenses can I claim tax back on Travelling abroad for treatment Dental and optical eye

Income Tax Rebate For Medical Expenses

Income Tax Rebate For Medical Expenses

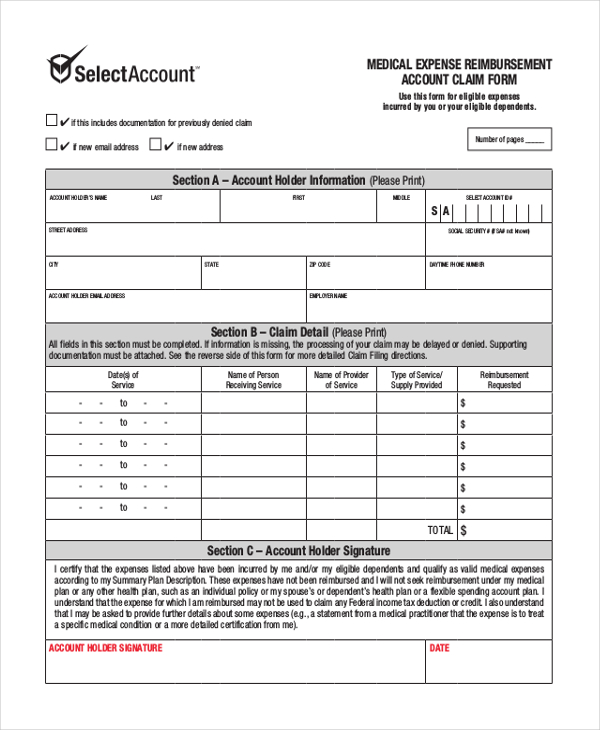

https://images.sampleforms.com/wp-content/uploads/2016/08/MEDICAL-EXPENSE-REIMBURSEMENT-ACCOUNT-CLAIM-FORM.jpg

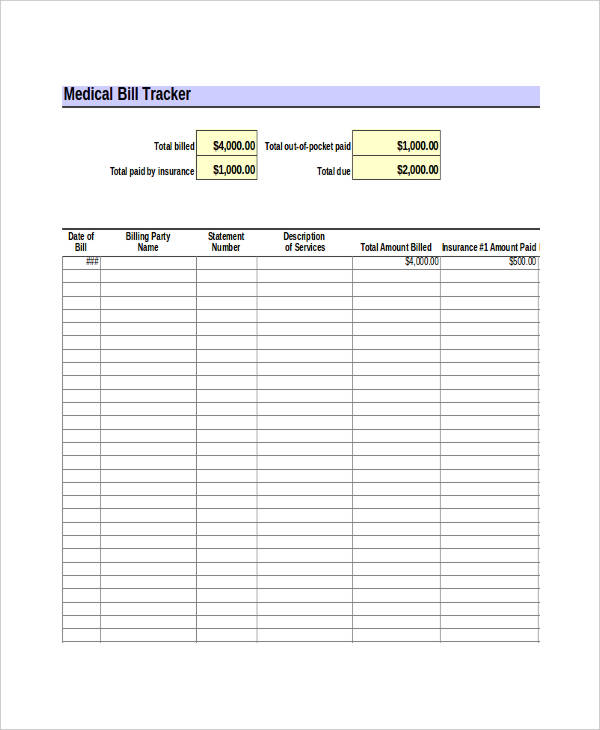

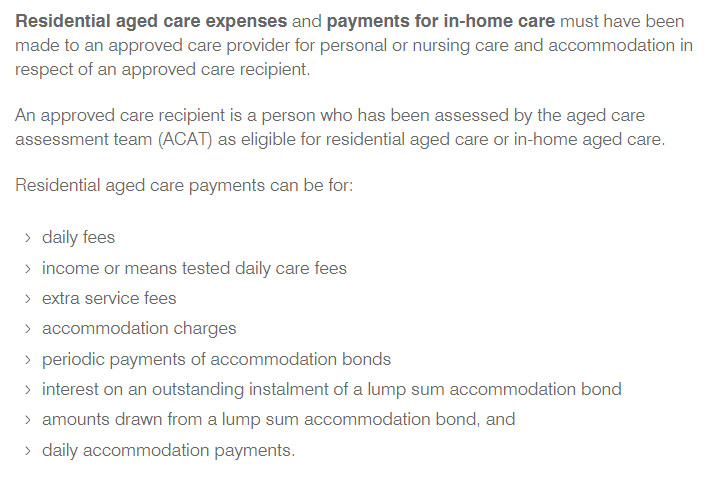

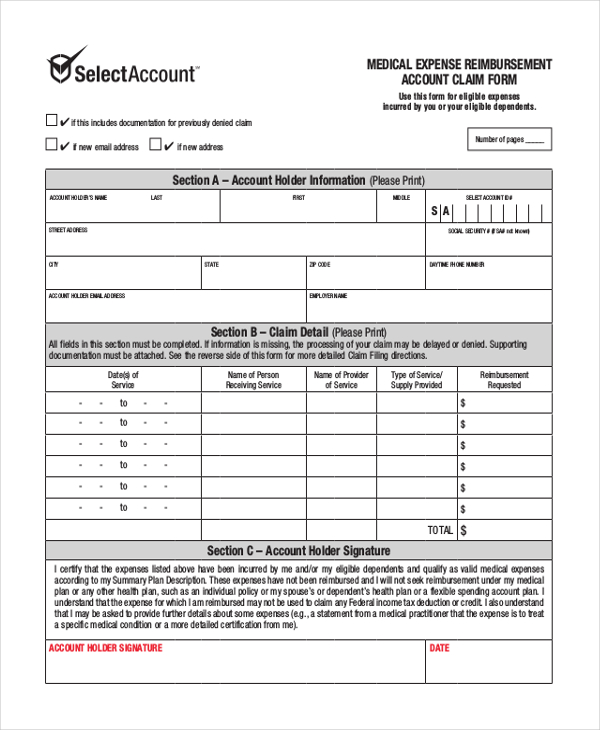

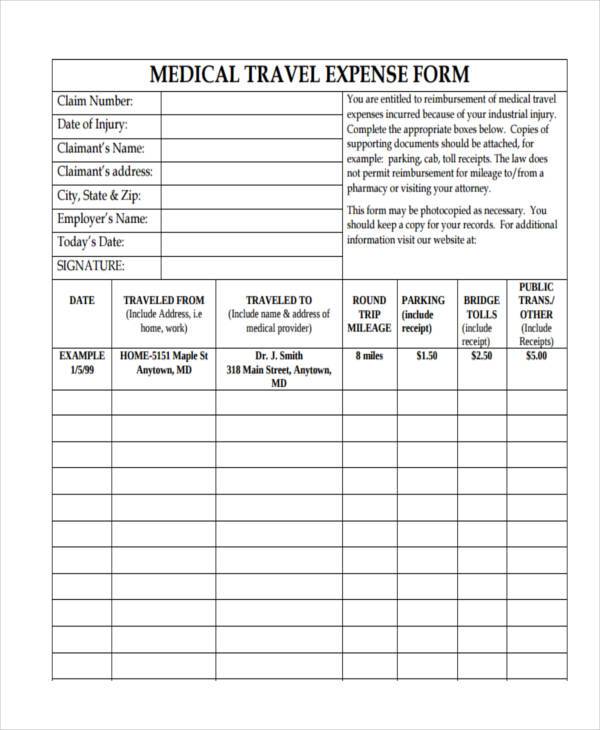

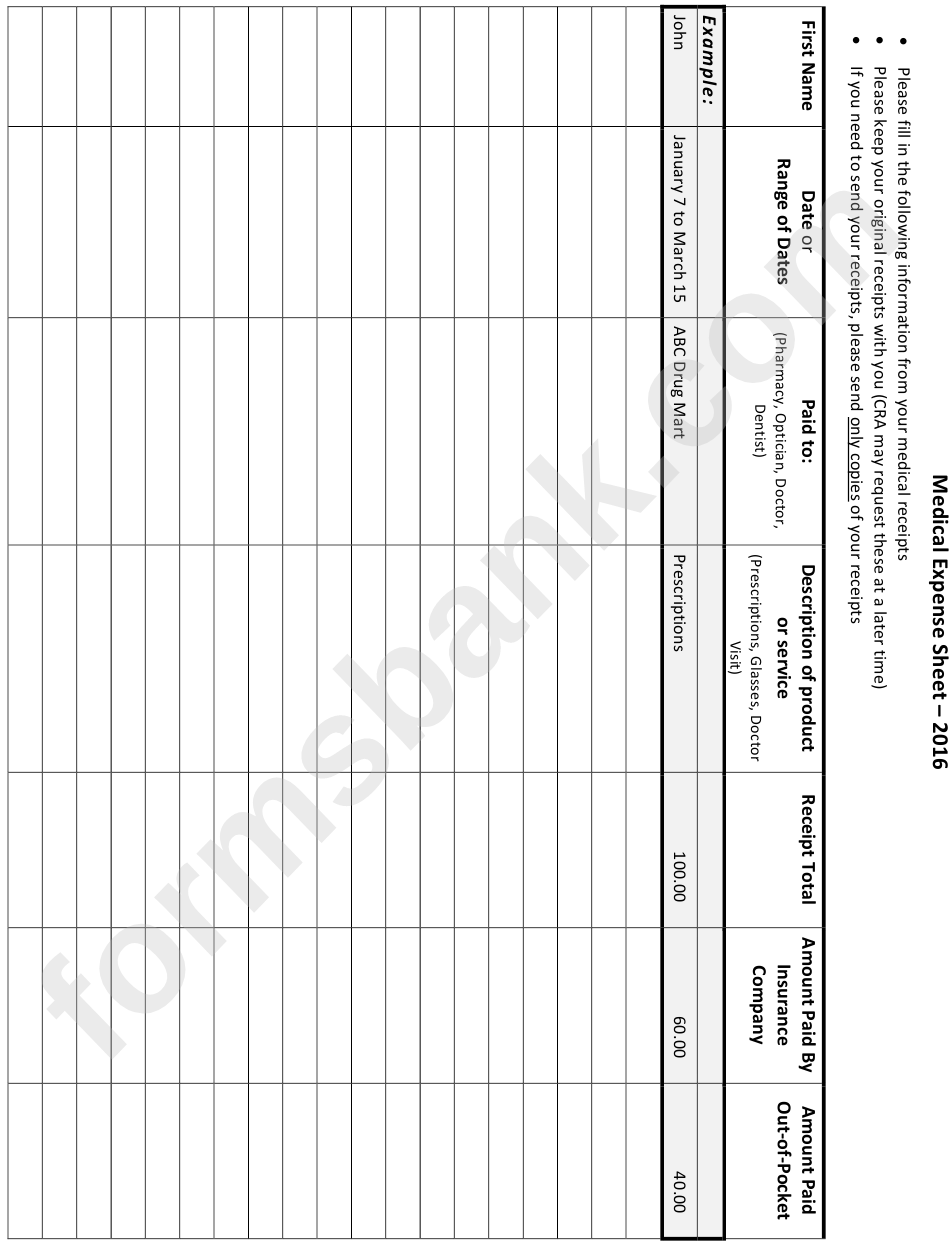

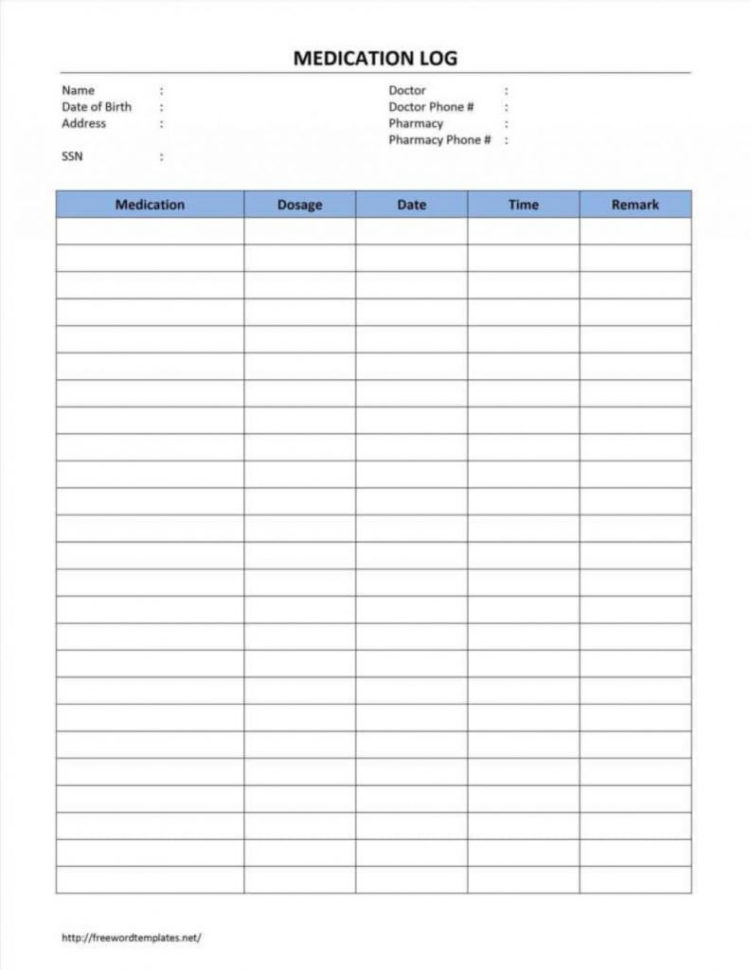

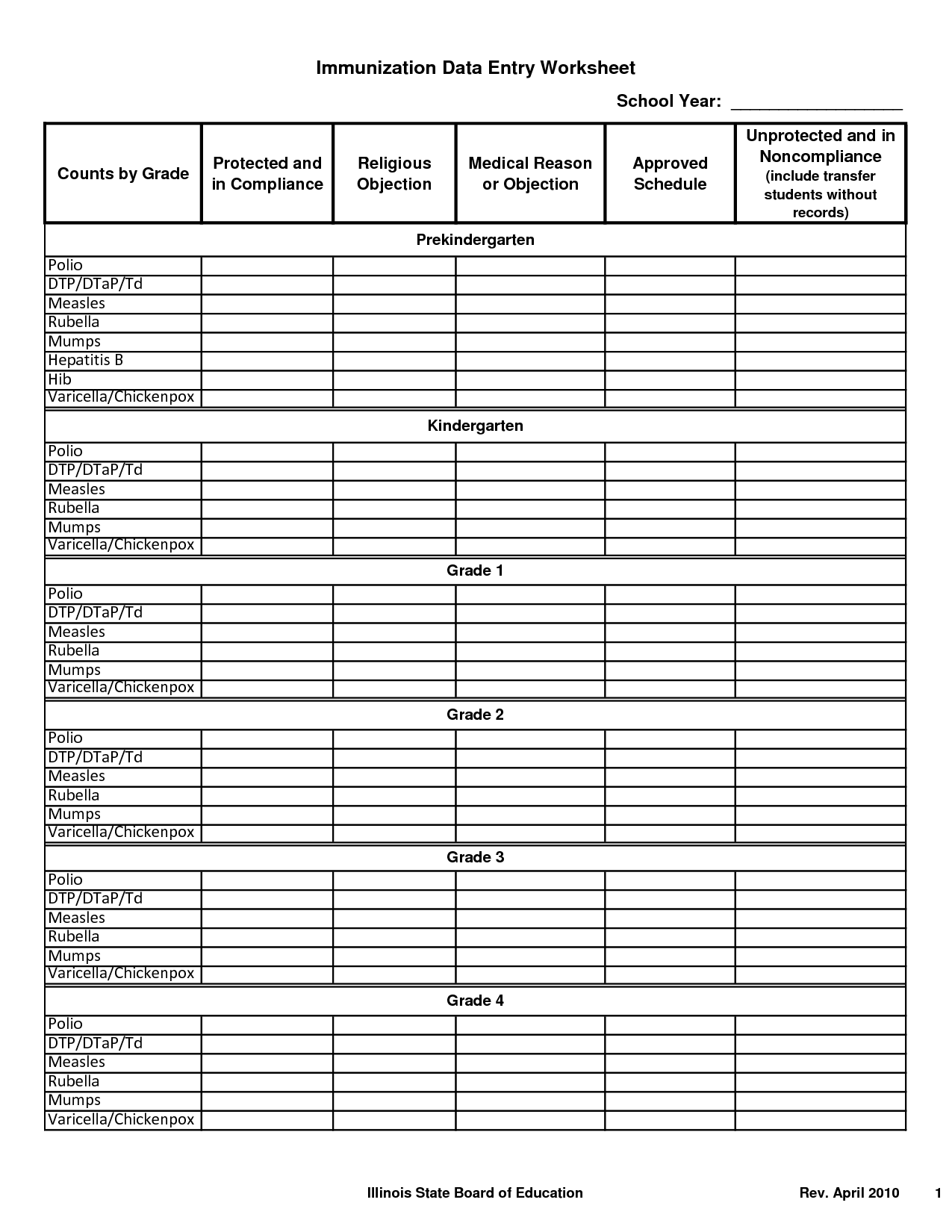

FREE 13 Expense Report Forms In MS Word PDF Excel

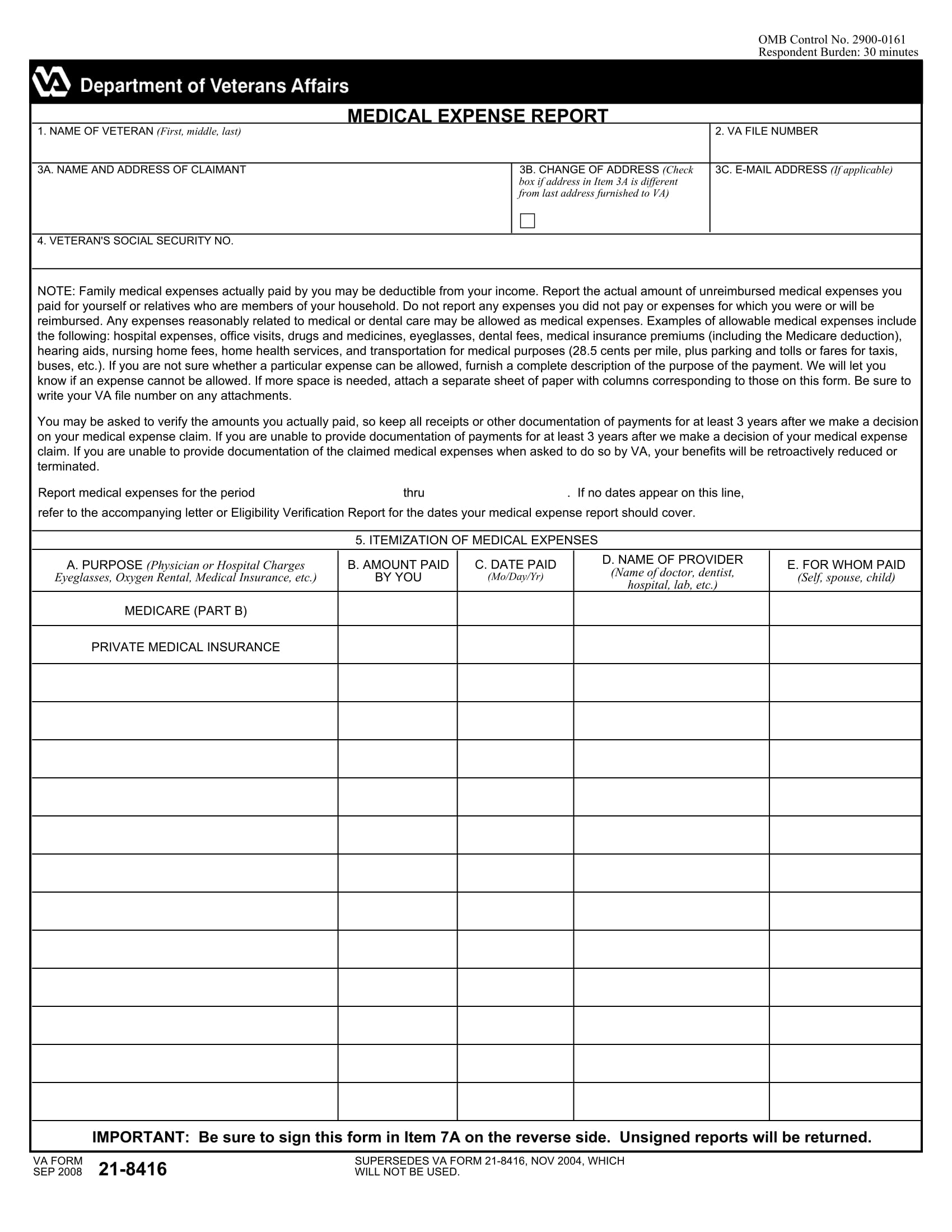

https://images.sampleforms.com/wp-content/uploads/2017/11/Medical-Expense-Report-Form-1.jpg

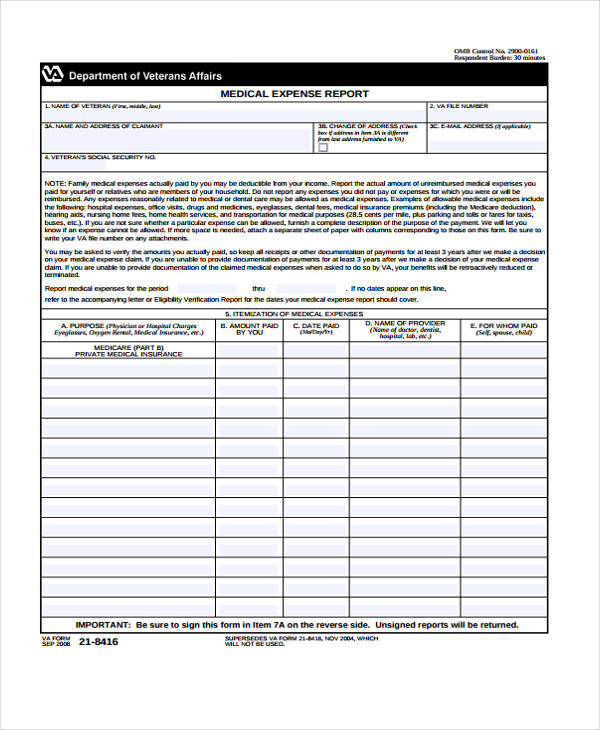

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Expense-Report-Form.jpg

Web 14 juin 2018 nbsp 0183 32 If medical expenses incurred for senior citizens taxpayer family and parents are not covered under any medical insurance you can claim a deduction for the said Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

Web 26 avr 2023 nbsp 0183 32 You must reduce your total deductible medical expenses for the year by any amount compensated for by insurance or any other reimbursement of deductible Web 24 oct 2022 nbsp 0183 32 Medical Expenses You Can Claim Under Income Tax Reliefs For 2022 October 24 2022 Lifestyle Money Management Tax Written by Haziq Alfian Part of

Download Income Tax Rebate For Medical Expenses

More picture related to Income Tax Rebate For Medical Expenses

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

https://www.pdffiller.com/preview/391/382/391382225/large.png

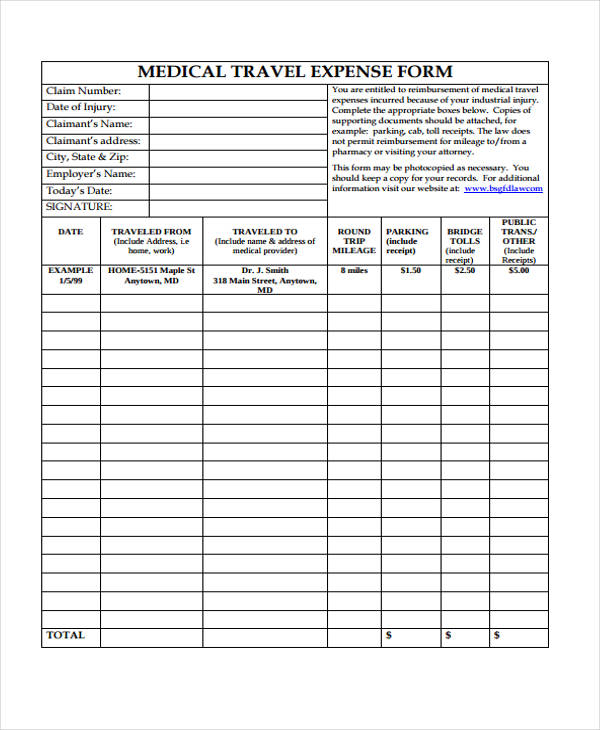

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

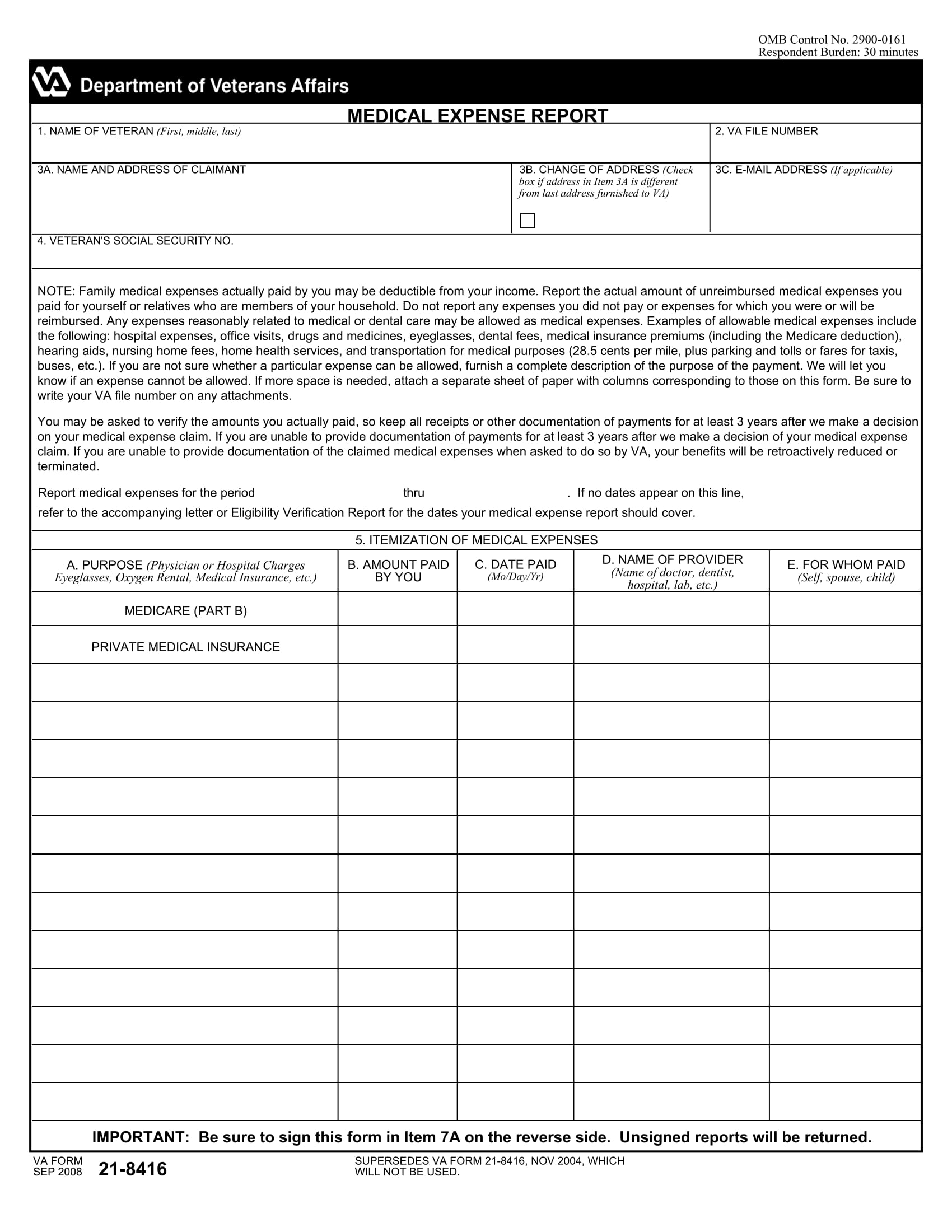

Web 12 f 233 vr 2023 nbsp 0183 32 In 2022 the IRS allows all taxpayers to deduct their total qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income if the taxpayer uses IRS Schedule A to itemize Web You could claim the medical expenses tax offset for net eligible expenses relating to disability aids attendant care aged care Net expenses are your total eligible medical

Web 16 nov 2022 nbsp 0183 32 Date Thursday 6 October 2022 Time 17 00 19 00 YouTube https youtu be YAAPPDqXb5s What is it An Additional Medical Expenses Tax Credit Web 31 mars 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if

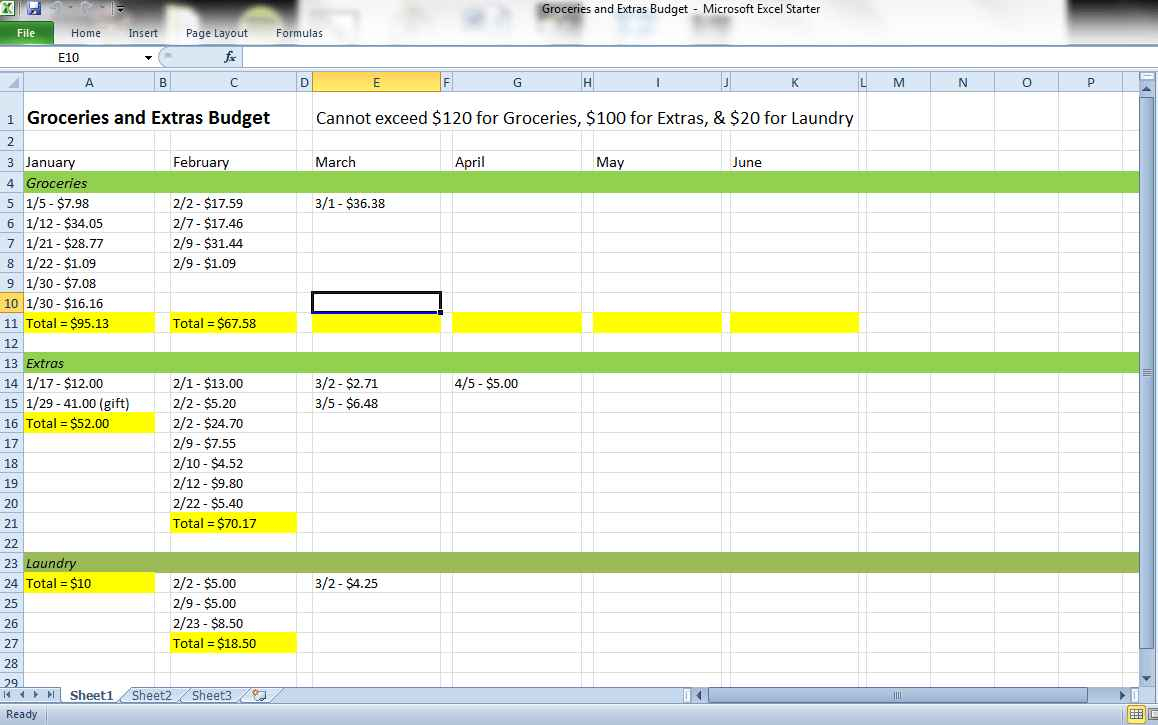

33 Expense Sheet Templates

https://images.template.net/wp-content/uploads/2017/06/Excel-Medical-Expense-Sheet.jpg

Claiming The Medical Offset Tax Rebate

https://daughterlycare.com.au/wp-content/uploads/2019/07/medical-expense-payments.jpg

https://www.thebalancemoney.com/medical-e…

Web 12 janv 2023 nbsp 0183 32 Most taxpayers can claim medical expenses that exceed 7 5 of their adjusted gross incomes AGIs subject to certain rules Though the deduction seems simple there are a variety of rules about

https://economictimes.indiatimes.com/wealth/t…

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

33 Expense Sheet Templates

Keep Track Of Medical Expenses Spreadsheet Db excel

FREE 44 Expense Forms In PDF MS Word Excel

Why Do So Few Irish People Claim Back Their Medical Expenses

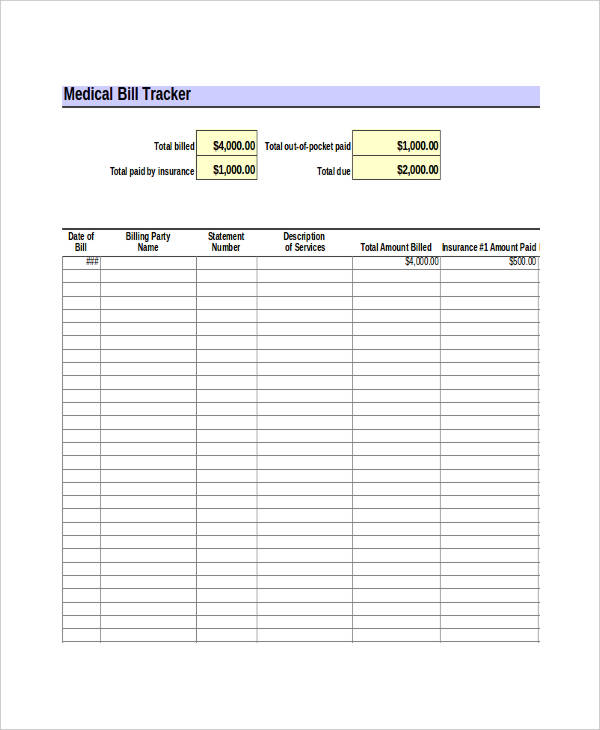

10 Patient Medical Bill Tracker Sample Excel Templates

10 Patient Medical Bill Tracker Sample Excel Templates

Medical Expense Sheet Printable Pdf Download

Medical Expense Spreadsheet Templates Google Spreadshee Medical Expense

Medical Expense Spreadsheet Pictures To Pin On Pinterest PinsDaddy

Income Tax Rebate For Medical Expenses - Web 5 sept 2023 nbsp 0183 32 As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs 19 200