Income Tax Rebate For Residential Plot Loan Web 24 ao 251 t 2023 nbsp 0183 32 There are two ways to gain tax benefits on a plot purchase loan Under Section 80C You may deduct the principal repayment component of both your plot and

Web 12 janv 2023 nbsp 0183 32 Post completion of house or building construction the plot owner can claim the below plot loan income tax benefits 1 Plot Loan Tax Benefits under Section 80C Web 12 mai 2021 nbsp 0183 32 If you intend to keep the piece of plot as it is there is no income tax relief Here s why Income tax experts point out that income from house property considers

Income Tax Rebate For Residential Plot Loan

Income Tax Rebate For Residential Plot Loan

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

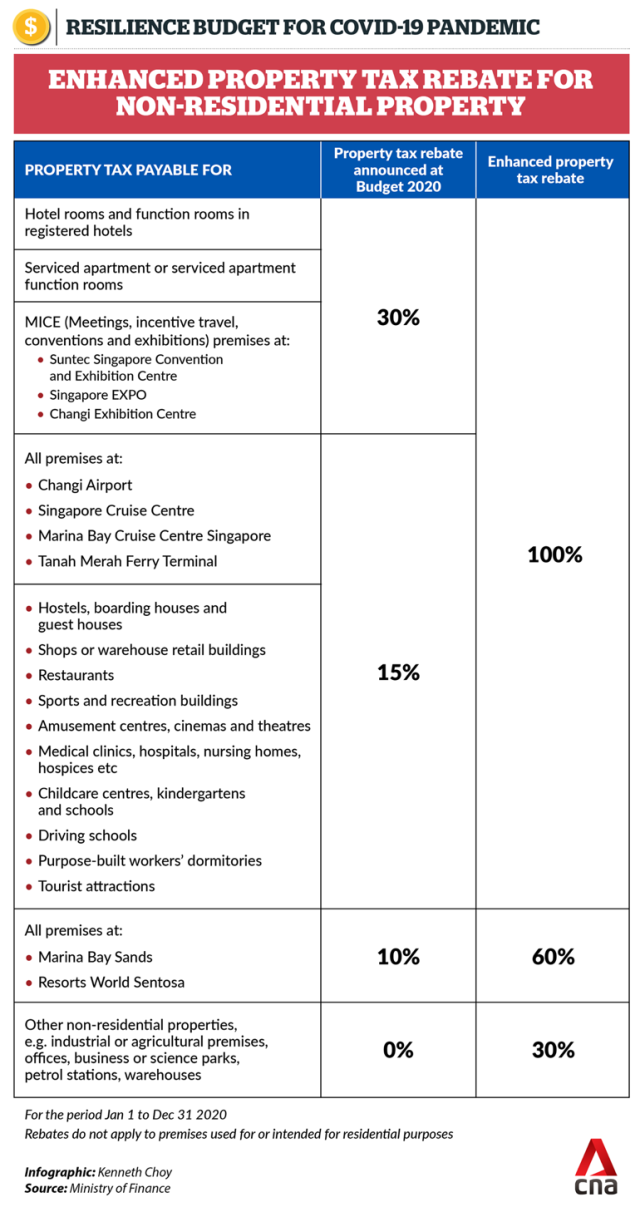

Covid 19 Property Tax Rebate To Help Individuals Business

https://s.yimg.com/ny/api/res/1.2/yJNzwJ3csyff8.xorzA7bg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTEyMDc-/https://media.zenfs.com/en-US/icompareloan_com_725/eceeb4dada0c90f43842260fc0198344

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web Tax benefit under Section 80C As per Section 80C of the Income Tax Act you can avail deduction on the principal repayment component of your plot loan up to a maximum of 150 000 per annum The principal amount Web 30 sept 2022 nbsp 0183 32 You may be allowed for a deduction under this section for the portion of your home and plot loans that relates to the principal payments and ignores the plot loan interest rate This permits a

Web 5 f 233 vr 2023 nbsp 0183 32 The maximum amount that can be claimed is up to Rs 1 5 lakh But to claim this deduction the house property should not be sold within five years of possession Web Under section 80 c of the Income Tax Act tax deduction of a maximum amount of up to Rs 1 5 lakh can be availed per financial year on the principal repayment portion of the

Download Income Tax Rebate For Residential Plot Loan

More picture related to Income Tax Rebate For Residential Plot Loan

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

INCOME TAX REBATE ON HOME LOAN

http://bit.ly/LcipDI

Web 18 f 233 vr 2019 nbsp 0183 32 House loan Location and Purpose Residential plot Any location Loan to Value LTV 70 80 85 Tenure of the loan 15 years 30 years Tax Deduction Eligible under condition Eligible Web 9 juin 2015 nbsp 0183 32 No Tax Benefits Unlike a housing loan which is eligible for tax deduction for payment of both interest as well as the principal amount land loans do not offer any

Web 19 avr 2022 nbsp 0183 32 You can avail of a maximum deduction of Rs 2 lakhs and you can claim this deduction only if you reside in the house constructed in that particular plot Thus if you Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration

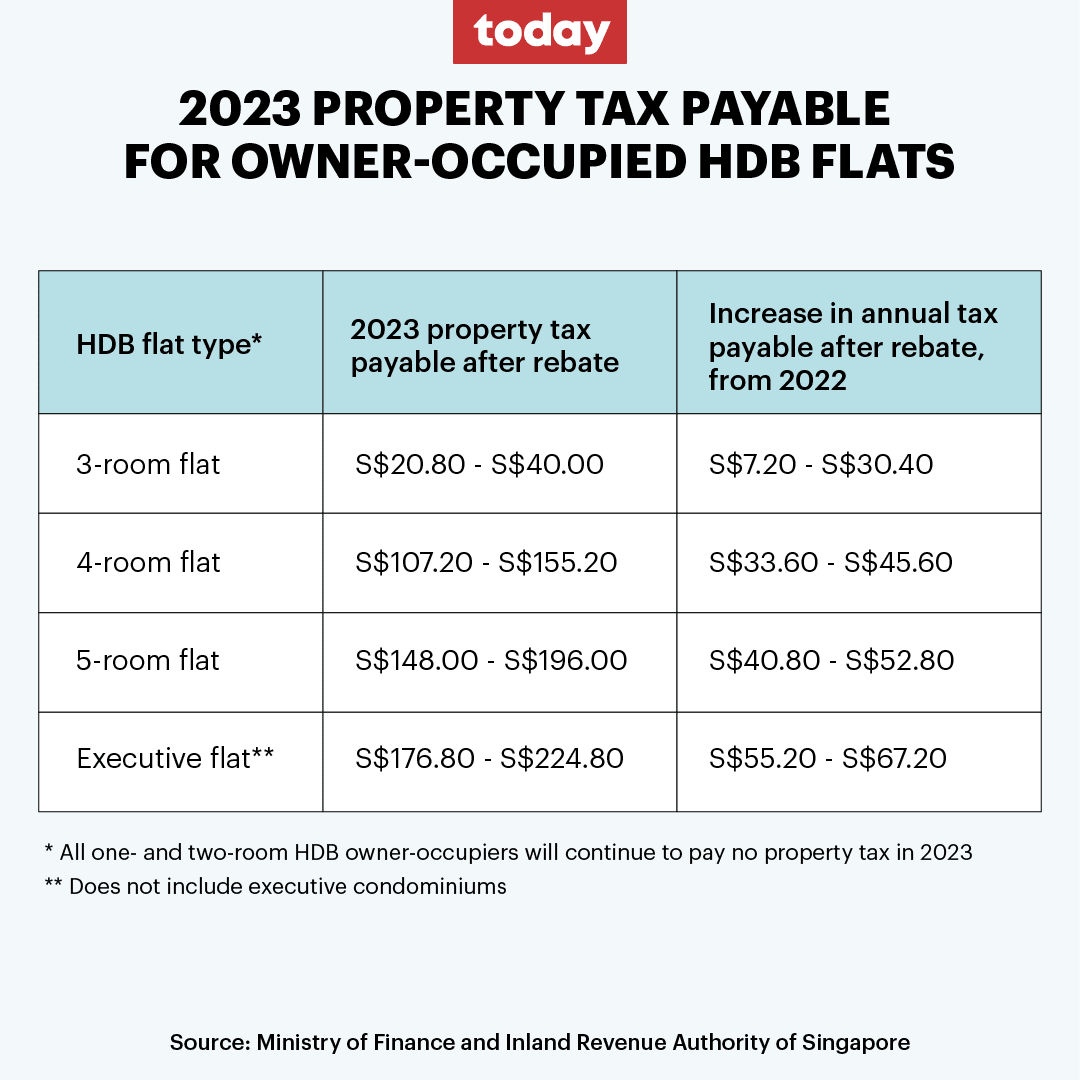

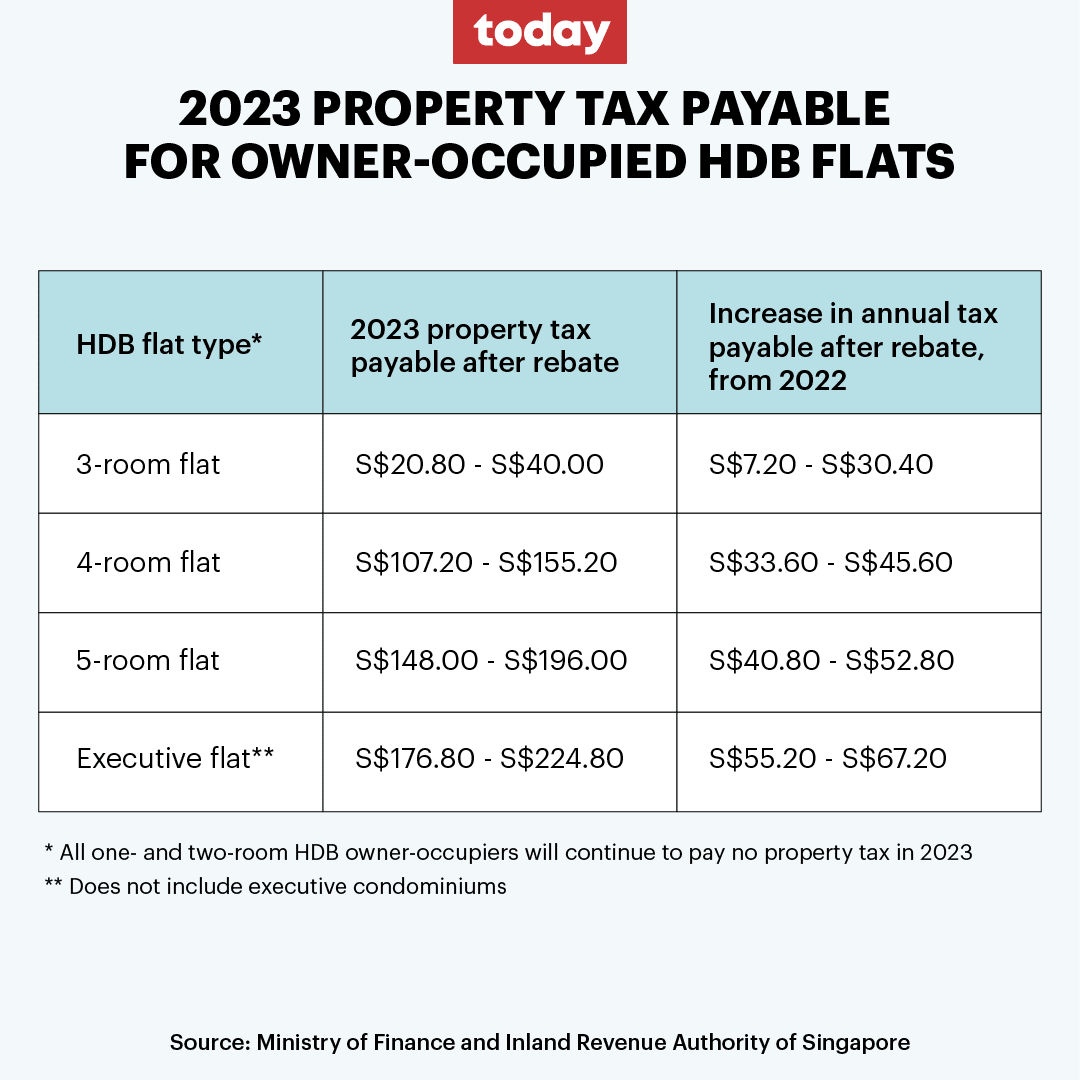

Most Residential Properties To Incur Higher Tax From Jan 1 2023

https://onecms-res.cloudinary.com/image/upload/s--ljAe074S--/f_auto%2Cq_auto/v1/mediacorp/tdy/image/2022/12/02/20221202-sw-hdbtax3.png?itok=IFvC-aSJ

Nova Scotia Gov On Twitter RT ns servicens Applications For The

https://pbs.twimg.com/media/FcigJ-UXoAAP6SS.jpg

https://www.godrejproperties.com/blog/plot-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 There are two ways to gain tax benefits on a plot purchase loan Under Section 80C You may deduct the principal repayment component of both your plot and

https://www.tatacapital.com/blog/loan-for-home/all-about-plot-loan-tax...

Web 12 janv 2023 nbsp 0183 32 Post completion of house or building construction the plot owner can claim the below plot loan income tax benefits 1 Plot Loan Tax Benefits under Section 80C

Georgia Income Tax Rebate 2023 Printable Rebate Form

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

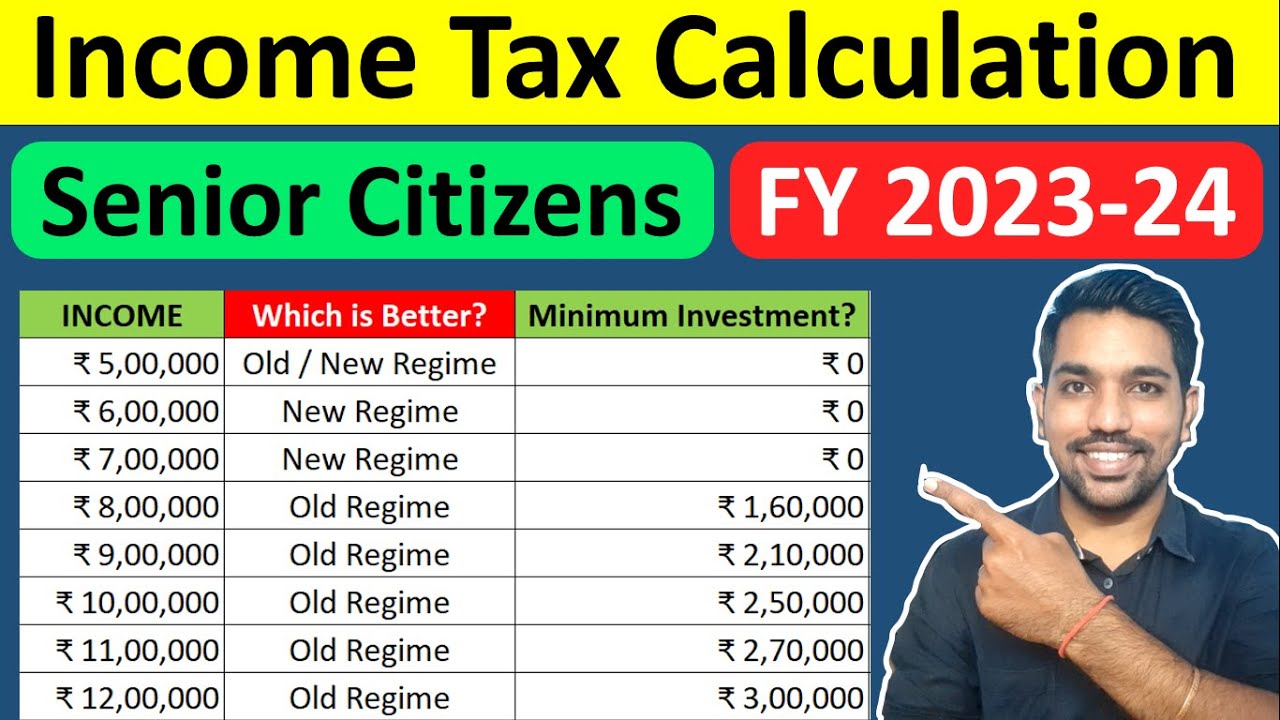

Senior Citizen Income Tax Calculation 2023 24 Examples New Tax Slabs

Individual Income Tax Rebate

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Difference Between Home Loan And Plot Loan

Box plot Of Tax Rebate Time to benefit Measures Download Scientific

Income Tax Rebate For Residential Plot Loan - Web Tax benefit under Section 80C As per Section 80C of the Income Tax Act you can avail deduction on the principal repayment component of your plot loan up to a maximum of 150 000 per annum The principal amount