Income Tax Rebate For Senior Citizens Fy 2024 24 IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax Individuals Seniors Retirees Tax Information for Seniors Retirees Older adults have special tax situations and benefits Understand how that affects you and your taxes Get general information about how to file and pay taxes including many free services by visiting the Individuals page Special Interest to Older Adults

Income Tax Rebate For Senior Citizens Fy 2024 24

Income Tax Rebate For Senior Citizens Fy 2024 24

https://fincalc-blog.in/wp-content/uploads/2023/03/income-tax-calculation-examples-FY-2023-24-AY-2024-25-video-1024x576.webp

Income Tax India On Twitter RT nsitharamanoffc As Announced In Budget FY 2022 23 Senior

https://pbs.twimg.com/media/FlsE477aMAA8oz_.jpg

Income Tax Slabs For Senior Citizens FY 2022 23 SuperCA

https://superca.in/storage/app/public/blogs/1673417389.jpg

WASHINGTON The Internal Revenue Service recently awarded 51 million in Tax Counseling for the Elderly TCE and Volunteer Income Tax Assistance VITA grants to organizations that provide free federal tax return preparation This year the IRS awarded grants to 45 TCE and 300 VITA applicants PDF The IRS received 429 applications Plug in your expected income deductions and credits and the calculator will quickly estimate your 2023 2024 federal taxes Taxable income 86 150 Effective tax rate 16 6 Estimated federal

More than half of all people at every income level in Metro Detroit reported having out of pocket expenses for caregiving according to the survey including 56 of people with a household income 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following sources up to 50 lakh Salary Pension One House Property Other sources Interest Family Pension Dividend etc Agricultural Income up to 5 000

Download Income Tax Rebate For Senior Citizens Fy 2024 24

More picture related to Income Tax Rebate For Senior Citizens Fy 2024 24

Income Tax Calculator For Retired Person JossCharlene

https://i.ytimg.com/vi/XQDCOVLK05g/maxresdefault.jpg

Income Tax Rate And Slab 2023 What Will Be Tax Rates And Slabs In New Year For ITR Filing Will

http://cachandanagarwal.com/wp-content/uploads/2022/12/51805DBD-BAC4-4644-8380-1BCEA472764E.png

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25 Academy Tax4wealth

https://academy.tax4wealth.com/storage/uploads/1684828745-know-the-new-income-tax-slab-rates-for-fy-2023-24-ay-2024-25.jpeg

In 2023 you must calculate your property tax rebate separately from your rent rebate Complete Lines 14 and 15 to calculate your property tax rebate and complete Lines 16 through 18 to calculate your rent rebate 15 and 18 To determine the amount for Line 19 start with the amount of your total income in Line 23 In Senior citizens who are 65 or older may be eligible to claim a refundable credit on their state income tax return Senior citizens who are 65 or older may be eligible to claim a refundable credit on their state income tax return town by town presidential election results from the 2024 New Hampshire primary 21h ago

Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 Governor Shapiro continues to deliver on his promise to cut costs and deliver real relief for Pennsylvanians Bethlehem PA Posted Wed 24 Jan 2024 at 11 49pm Wednesday 24 Jan 2024 at 11 49pm Wed 24 Jan 2024 at 11 49pm updated Yesterday at 1 40am Thu 25 Jan 2024 at 1 40am Australians are due to receive a tax cut from July

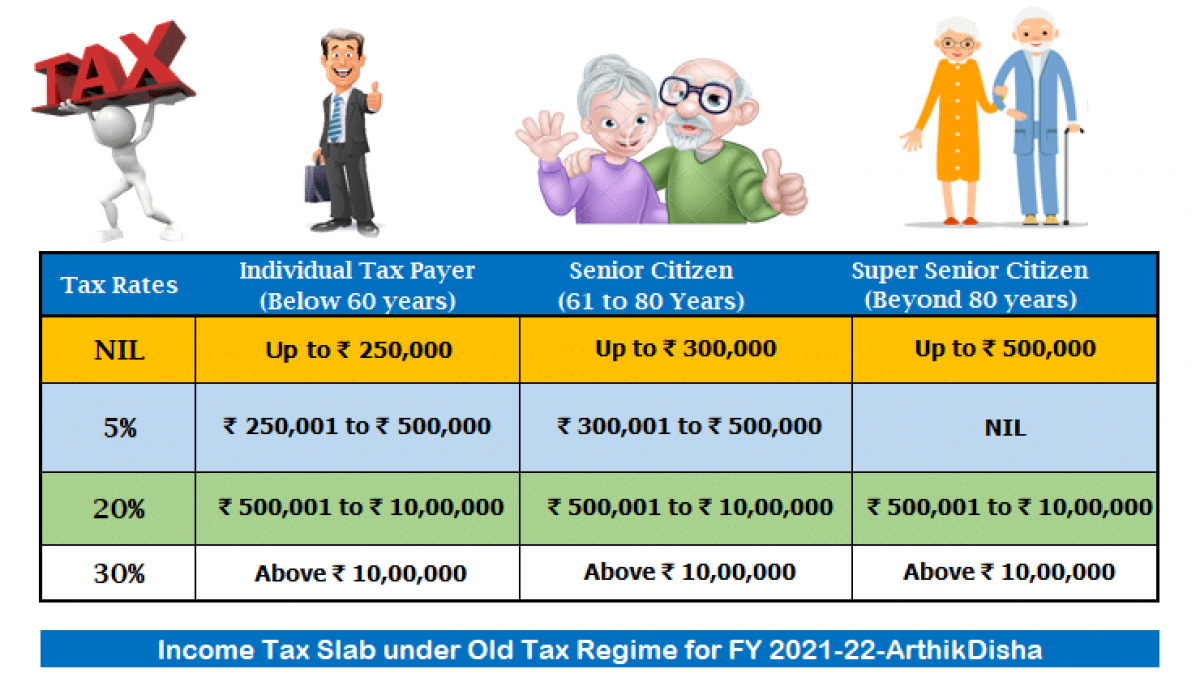

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24 2023

https://i.ytimg.com/vi/GHq5DhLzRhQ/maxresdefault.jpg

New Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/09/Income-Tax-Slab-for-Senior-and-Super-Senior-Citizons-FY-2022-23-AY-2023-24.jpg

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

IR 2024 04 Jan 8 2024 WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax

Income Tax Calculator Fy 2022 23 Ay 2023 24 Excel Download PELAJARAN

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24 2023

Income Tax 2022 23 Slab Bed Frames Ideas

INCOME TAX REBATES FOR FY 22 23

Page

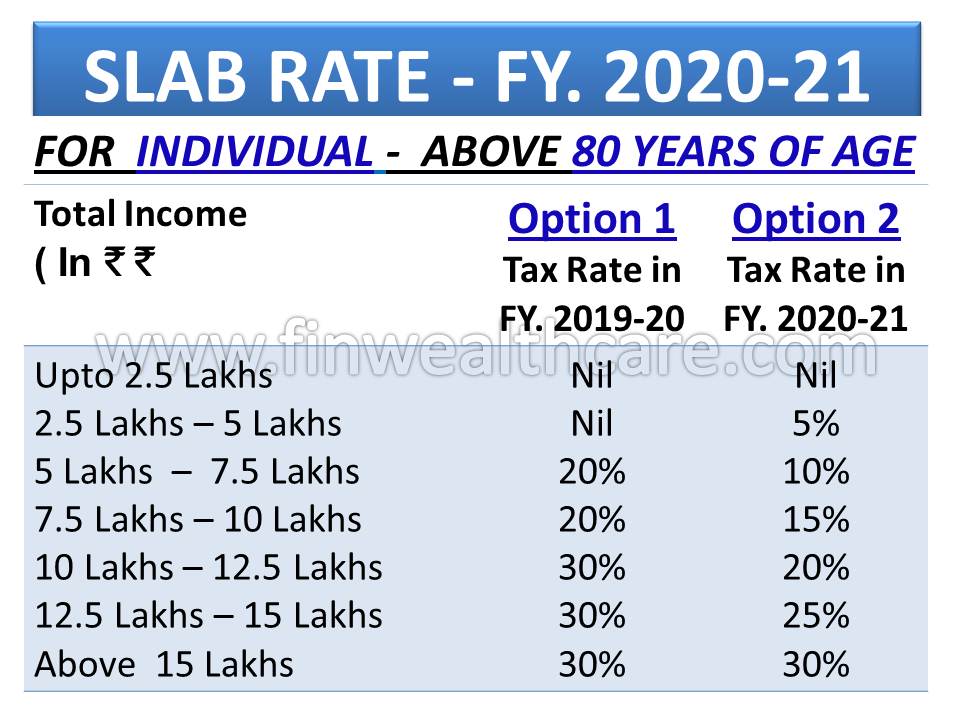

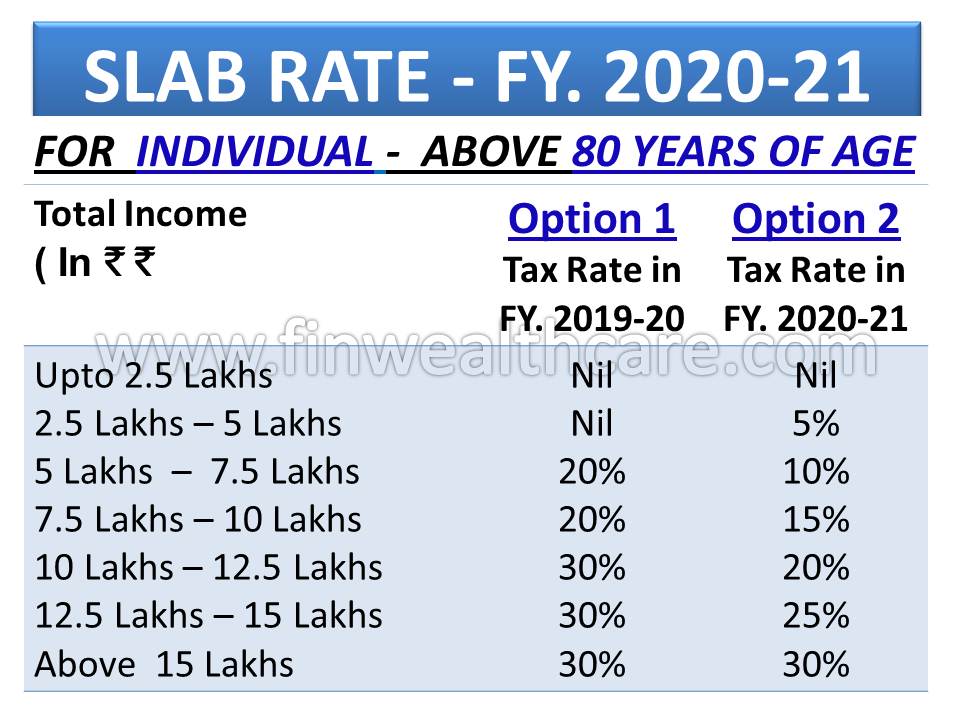

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021 22 Vrogue

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021 22 Vrogue

Income Tax Slab For Senior Citizen For FY 2020 21 Income Tax Slab

Income Tax Benefits For Senior Citizens 2020 Income Tax Rebate For Senior Citizens Fy 2020 21

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra Pradesh Telangana

Income Tax Rebate For Senior Citizens Fy 2024 24 - February 19 2024 This is the first day when you can start filing your 2023 tax return online If you file on paper you should receive your income tax package in the mail by this date April 30 2024 This is the deadline to file a tax return for most Canadians By filing your tax return on time you ll avoid delays to any refund