Income Tax Rebate For Teachers 2024 24 Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline The act created a temporary 250 federal income tax deduction for educators which was later made permanent So how much is the educator expense credit in 2024 This year an individual teacher is allowed to write off a total of 300 on their federal income taxes using the educator expense deduction

Income Tax Rebate For Teachers 2024 24

Income Tax Rebate For Teachers 2024 24

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Limits Phaseout for 2023 2024 a taxpayer whose modified adjusted gross income is 80 000 or less 160 000 or less for joint filers can claim the credit for the qualified expenses of an eligible student The credit begins to phase out above those MAGI levels Classroom teachers use around 550 of their own money each year and nearly 1 in 5 spends upwards of 1 000 to provide their students with basic supplies according to data from savings

WASHINGTON As the new school year begins the Internal Revenue Service reminds teachers and other educators that they ll be able to deduct up to 300 of out of pocket classroom expenses for 2023 when they file their federal income tax return next year 6 Earned Income Tax Credit The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you

Download Income Tax Rebate For Teachers 2024 24

More picture related to Income Tax Rebate For Teachers 2024 24

Personal Income Tax Collection To Monthly Quarterly Declaration

https://cdn.luatvietnam.vn/uploaded/images/original/2022/10/26/personal-income-tax-collection-subject-to-monthly-or-quarterly-declaration_2610153203.jpg

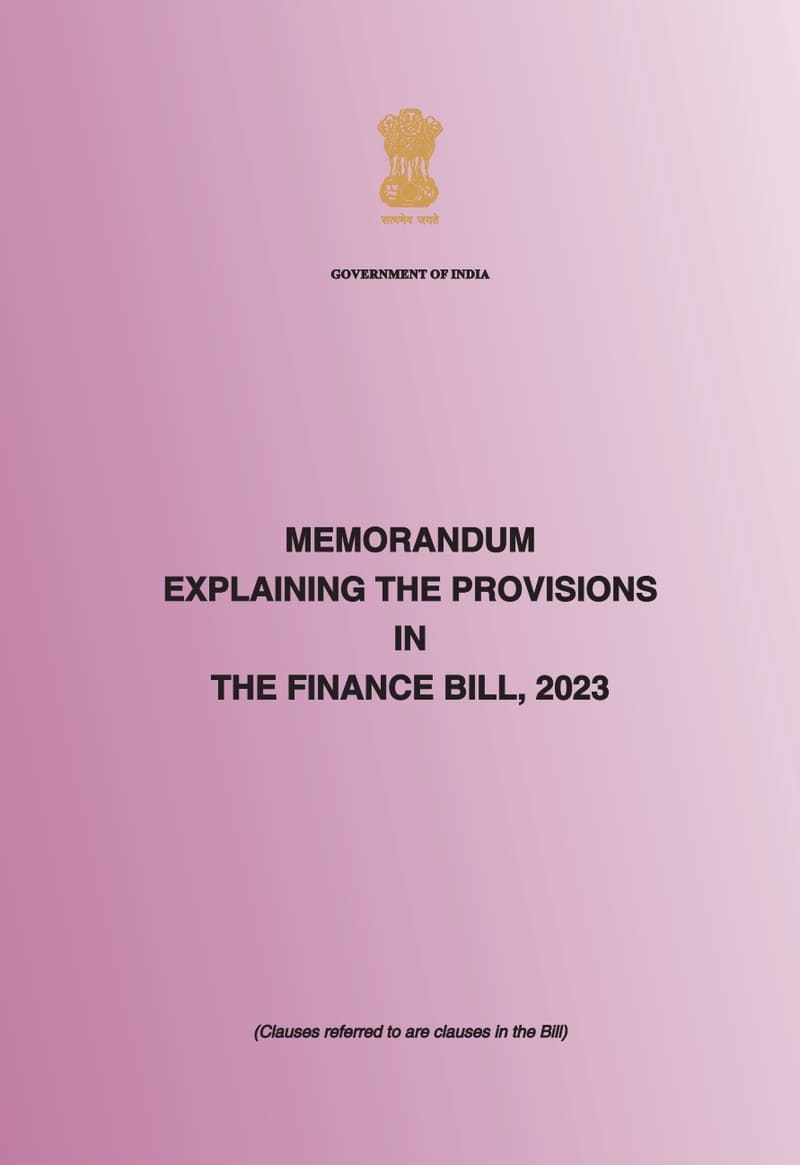

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

https://www.staffnews.in/wp-content/uploads/2023/02/budget-2023-24-finance-bill-2023-rates-of-income-tax.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Part 1 Tax Relief for Working Families Calculation of Refundable Credit on a Per Child Basis Under current law the maximum refundable child tax credit for a taxpayer is computed by multiplying that taxpayer s earned income in excess of 2 500 by 15 percent This provision modifies the calculation of the maximum refundable credit The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child

In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to receive checks of up to 3 600 With that in mind we ve collected practical advice to help teachers and administrators hold on to more of their earnings this tax season The big tax news for educators this year is that the

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Last minute Income Tax Saving Options Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/06/Income-tax-saving-options-1.jpg

https://taxfoundation.org/blog/bipartisan-tax-deal-2024-tax-relief-american-families-workers-act/

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Retirement Income Tax Rebate Calculator Greater Good SA

How To File Income Tax Complaint Against Someone 2023 Guide

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Income Tax Rebate Under Section 87A Rebate For Financial Year GST Guntur

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

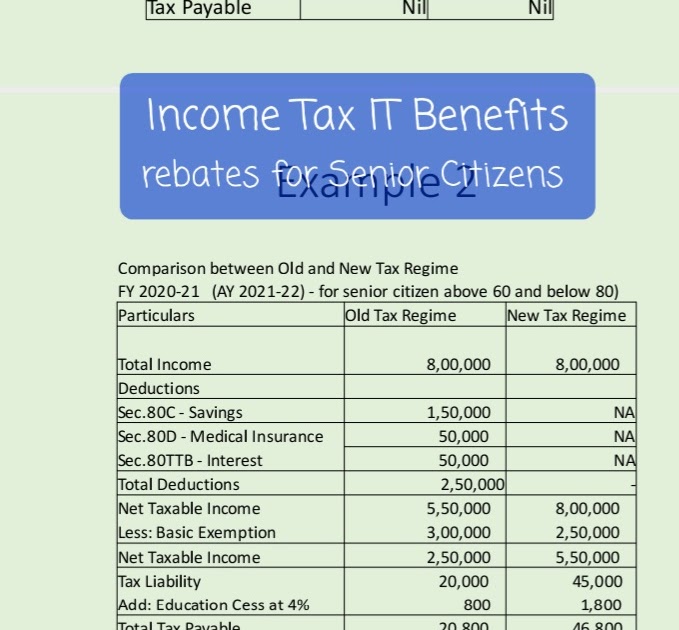

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra Pradesh Telangana

IT Software Income Tax Software 2018 19 With PRC 2015 Arrears For AP TS Teachers Employees

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

Income Tax Rebate For Teachers 2024 24 - Income Limits Phaseout for 2023 2024 a taxpayer whose modified adjusted gross income is 80 000 or less 160 000 or less for joint filers can claim the credit for the qualified expenses of an eligible student The credit begins to phase out above those MAGI levels