Income Tax Rebate Form 10e Web What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file

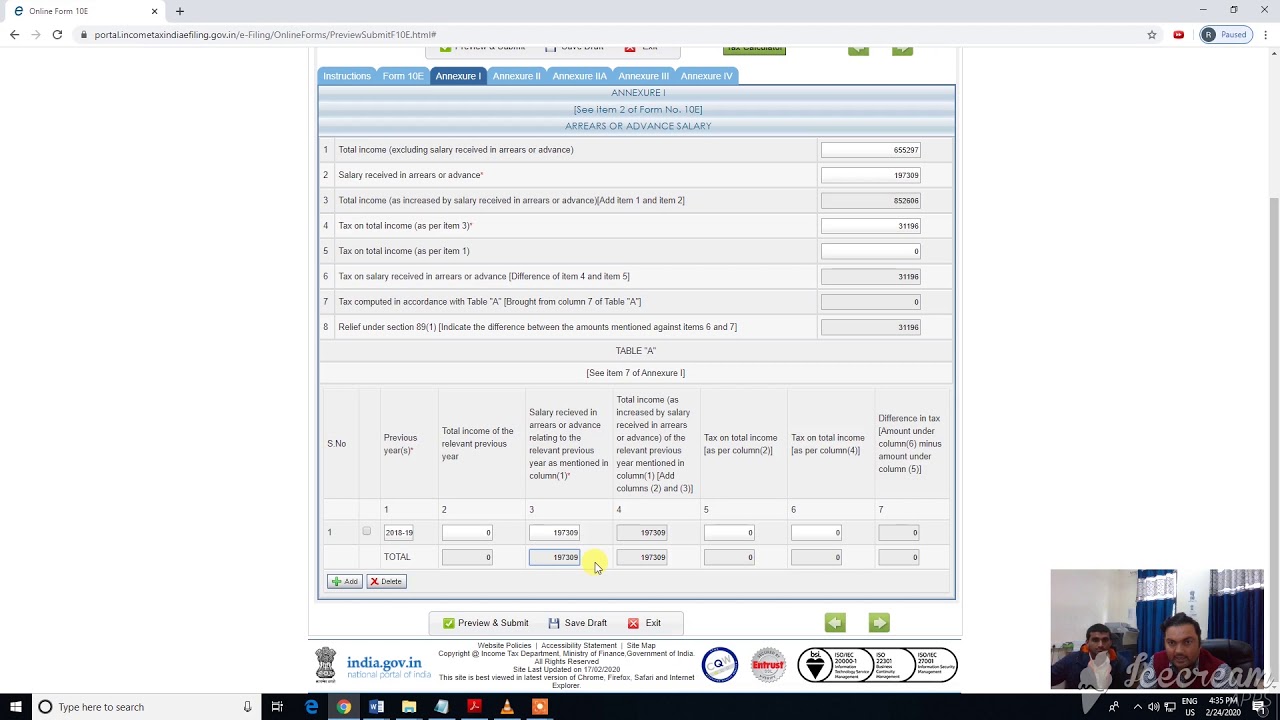

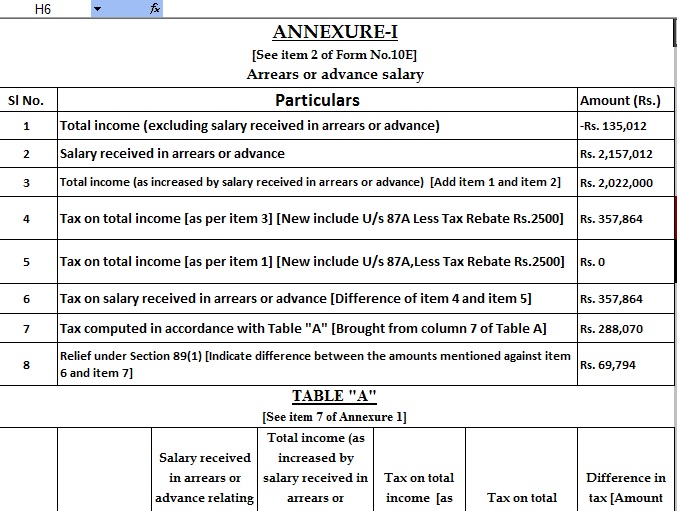

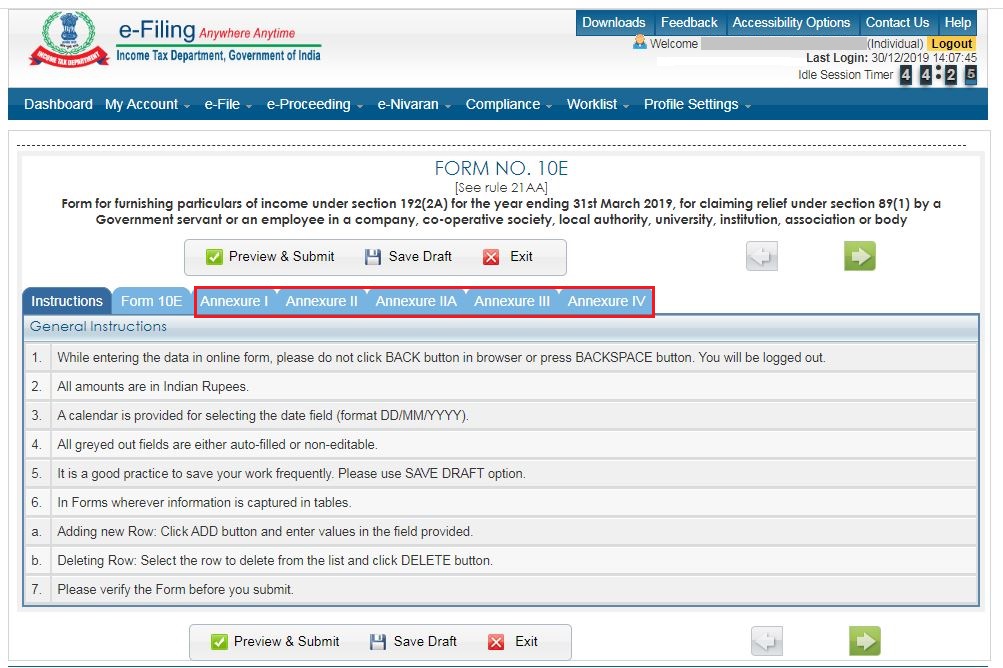

Web 3 avr 2017 nbsp 0183 32 How to File Form 10E Login to https incometaxindiaefiling gov in with your User ID and password along with the date of birth After you have logged in Web 12 juil 2016 nbsp 0183 32 Step 1 Calculate tax payable on the total income including additional salary in the year it is received The arrears provided will reflect in Part B of Form 16 Step 2

Income Tax Rebate Form 10e

Income Tax Rebate Form 10e

https://i0.wp.com/www.askbanking.com/wp-content/uploads/2016/03/form-10E.jpg?fit=848%2C1200&ssl=1

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

https://blogs.sap.com/wp-content/uploads/2016/04/3_925809.png

Form 10E On Income Tax E filing Portal Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2019/12/Form-10E-final.jpg

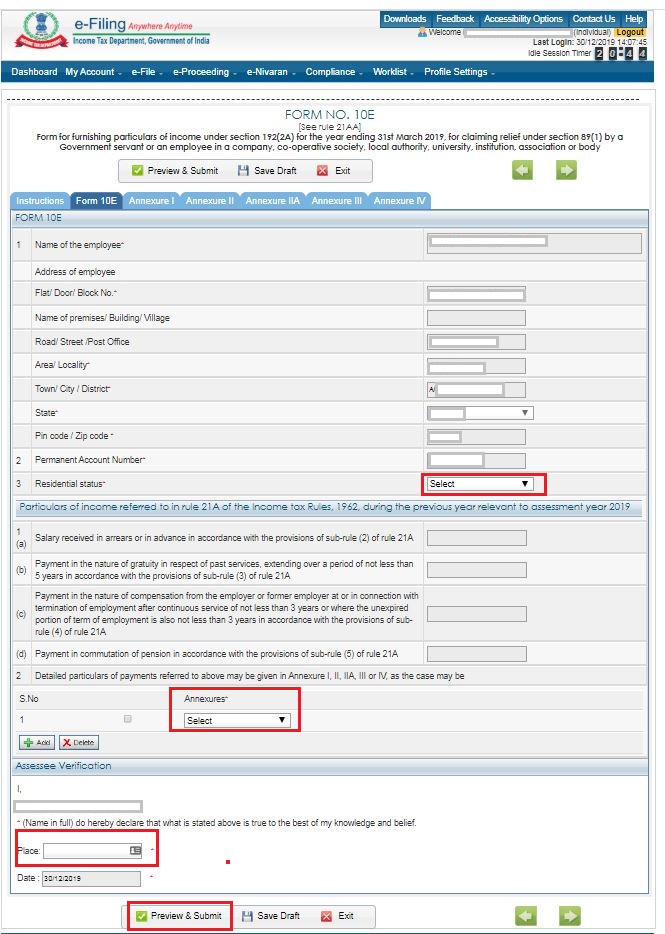

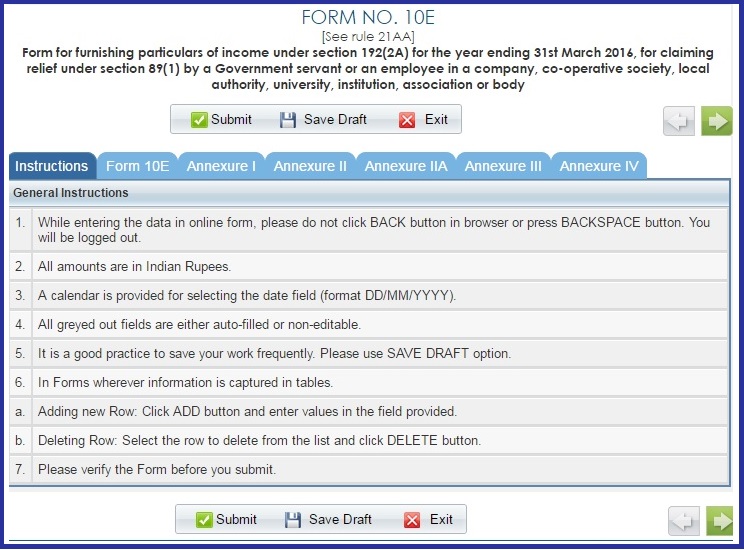

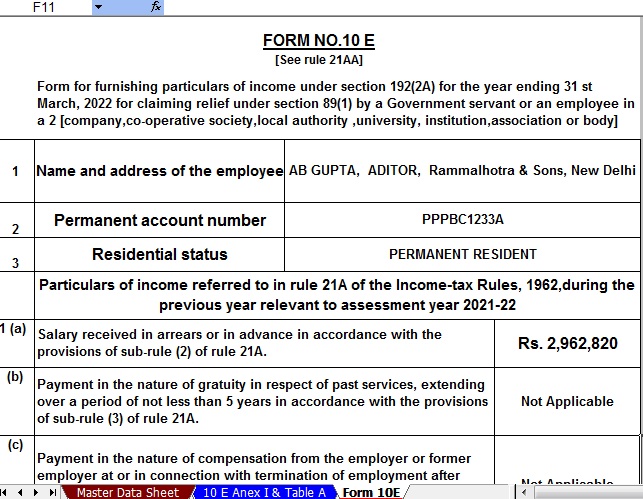

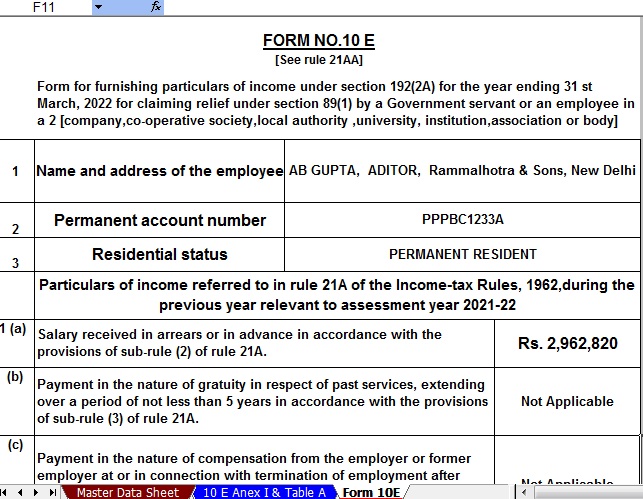

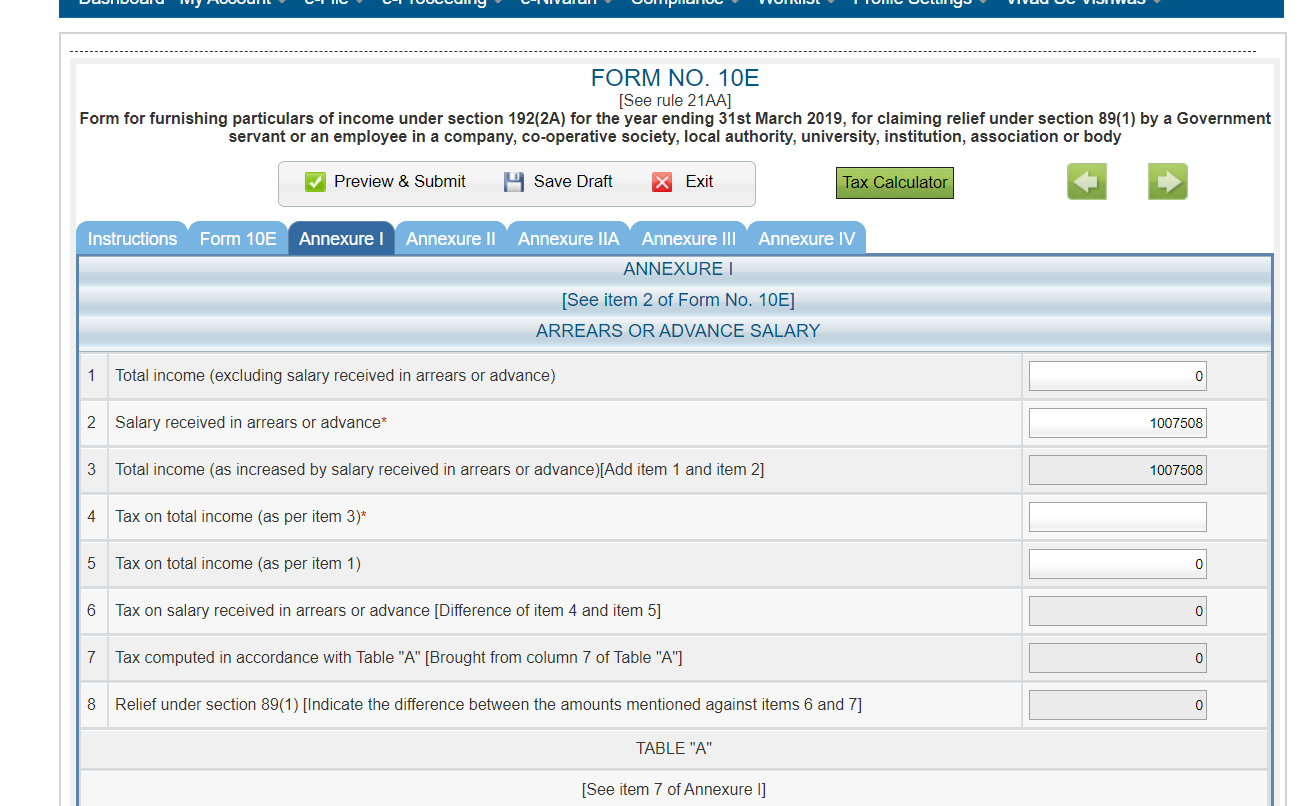

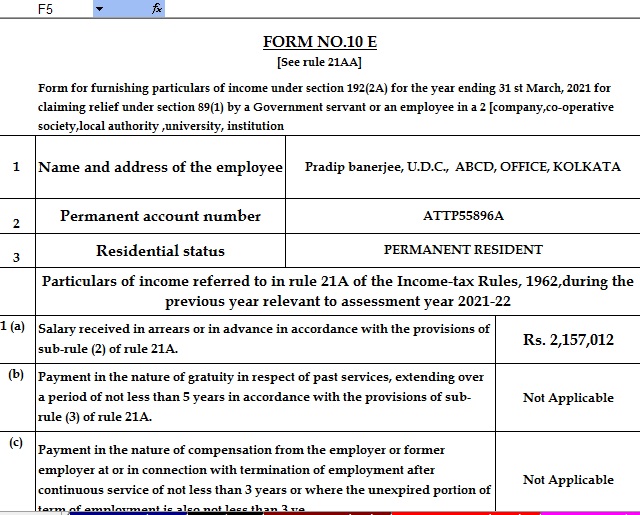

Web 11 janv 2023 nbsp 0183 32 The steps for filing online form No 10E are as under 1 Login to your income tax e filing account 2 Under efile menu go to Prepare and Submit Form Online Other than ITR 3 Select the AY and Form No Web FORM NO 10E See rule 21AA Form for furnishing particulars of income under section 192 2A for the year ending 31st March for claiming relief under section 89 1 by a

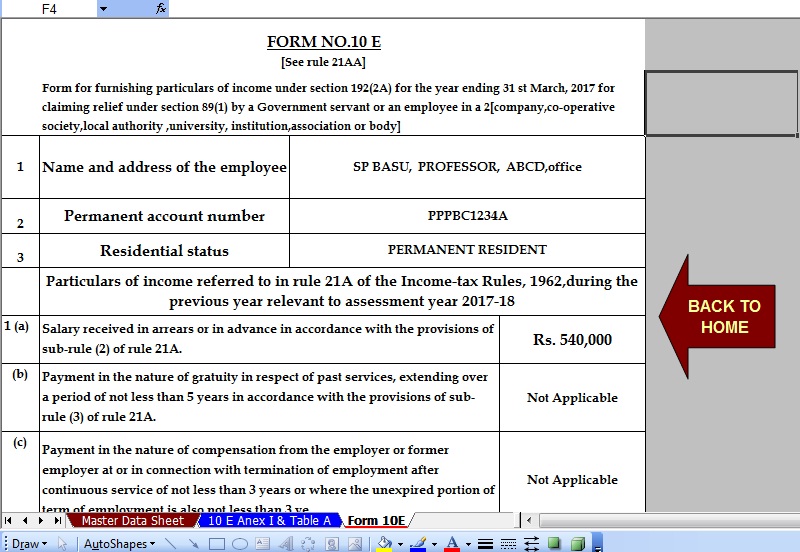

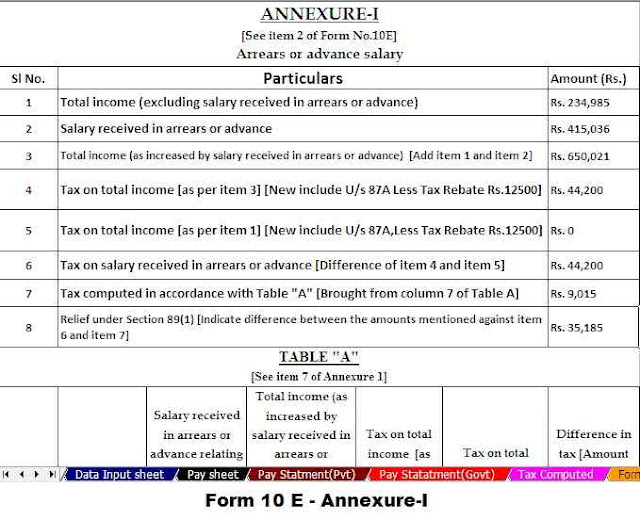

Web 17 juin 2023 nbsp 0183 32 FORM 10E If you are eligible to claim a relief on arrear income under Section 89 1 read with Rule 21A you would have to fill and file Form 10E The form is available on the website of the Income Tax Web Download Excel Form 10E Salary Arrears Relief Calculator U s 89 1 for A Y 2022 23 Under Section 89 1 of the Income Tax Act an income tax exemption is granted in

Download Income Tax Rebate Form 10e

More picture related to Income Tax Rebate Form 10e

INCOME TAX ARREARS REBATE FORM 10E U S 89 1 Edu Plus Official

https://1.bp.blogspot.com/-B0sJQFv1M_c/YCipVEjTjoI/AAAAAAAAGWg/qaoYQyF_5kk3fDIVAVd1uzshl8NNXzvsgCLcBGAsYHQ/s744/10e-form2.jpg

Income Tax Form 10E YouTube

https://i.ytimg.com/vi/TQ-u4T-nuhE/maxresdefault.jpg

Income Tax Relief Income Tax Relief Form 10e

https://1.bp.blogspot.com/-EvZ6PJSYQwI/V0kZe_a_3lI/AAAAAAAACvI/E3y60CObBjIUnR8RqCI_C-dpijEMLs4ewCLcB/s1600/Arrears%2B3.jpg

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web 8 f 233 vr 2023 nbsp 0183 32 Form 10E is a form to be submitted on Income Tax e filing portal to claim relief under Section 89 for any salary arrears or advance salary received during a financial year It gives relief to the taxpayer

Web Log into your Income Tax e filing account Go to e File and then Income Tax Forms Select FORM NO 10E Form for relief u s 89 under Form Name Select the Assessment Year or AY for which you need to file Web 1 View Steps to use this calculator and know all about the useful results it shows 2 Auto filled requisite Columns fields of Form 10E of the calculations displayed here to claim

Download Automated Excel Based Income Tax Arrears Relief Calculator

https://1.bp.blogspot.com/-4dV5YtHhF70/Xo8J1egCMLI/AAAAAAAAMfU/7r7HpM1YoAYGoaBrTr2hL-UL1FOI0m4nACNcBGAsYHQ/s1600/6%2BArrears%2BRelief%2BAY%2B2021-22.jpg

DOWNLOAD AUTOMATED INCOME TAX 89 1 ARREARS RELIEF CALCULATOR WITH FORM

https://1.bp.blogspot.com/-CVaQLrNj-HU/XpkGgoUMkuI/AAAAAAAAMmk/Hdnd2PTYucsC1gYGvX7HYIRrtDbLy3b2gCNcBGAsYHQ/s1600/2%2BArrears%2BRelief%2BAY%2B2021-22.jpg

https://www.incometax.gov.in/.../statutory-forms/popular-form/form10e-faq

Web What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file

https://cleartax.in/s/filing-form-10e-claim-relief-section-89-1

Web 3 avr 2017 nbsp 0183 32 How to File Form 10E Login to https incometaxindiaefiling gov in with your User ID and password along with the date of birth After you have logged in

Form 10E On Income Tax E filing Portal Learn By Quicko

Download Automated Excel Based Income Tax Arrears Relief Calculator

Salary Received In Arrears Or In Advance Don t Forget To File Form 10E

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

Taxexcel Automated Income Tax Preparation Software In Excel For The

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

FORM 10 E FORM 10 F Company Vakil

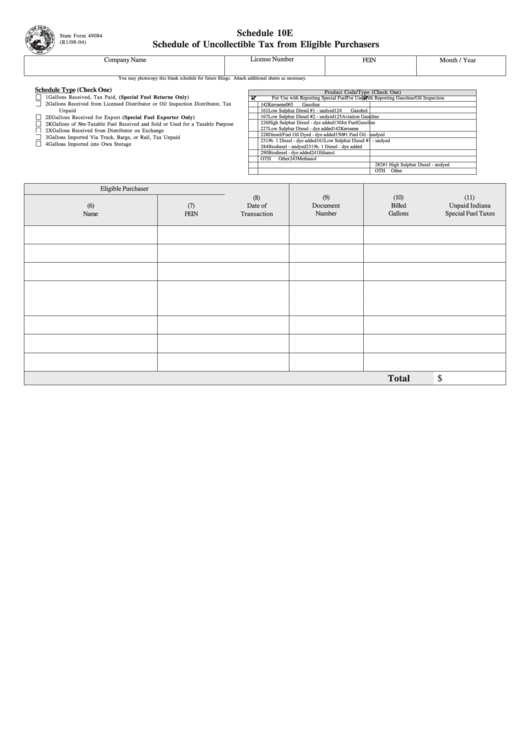

Schedule 10e Schedule Of Uncollectible Tax From Eligible Purchasers

PDF Form 10E Claim Relief Under Section 89 1 PDF Download In English

Income Tax Rebate Form 10e - Web 3 ao 251 t 2023 nbsp 0183 32 Form 10E is to be filed before filing the income tax returns If the form 10E is not filed by the employee and if they claim for the tax relief then the Income Tax