Income Tax Rebate Formula In Excel Verkko 31 jouluk 2014 nbsp 0183 32 If we assume a taxable income of 50 000 we need to write a formula that basically performs the following math 5081 25 50000 36900 25 We can use

Verkko Income tax bracket calculation Related functions Summary To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example The formula in Verkko Click into the cell you will place the income tax at and sum all positive numbers in the Tax column with the formula SUM F6 F8 See screenshot So far you have figured out the income tax of the

Income Tax Rebate Formula In Excel

Income Tax Rebate Formula In Excel

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

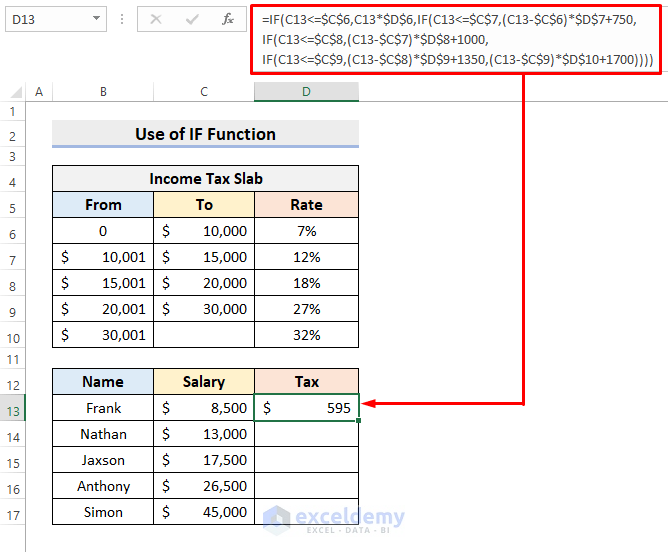

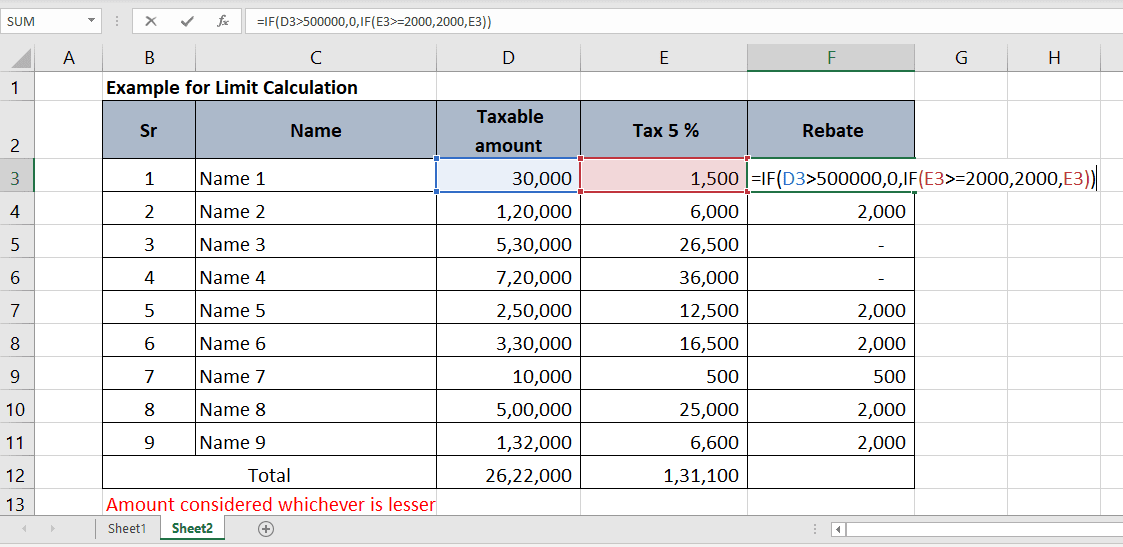

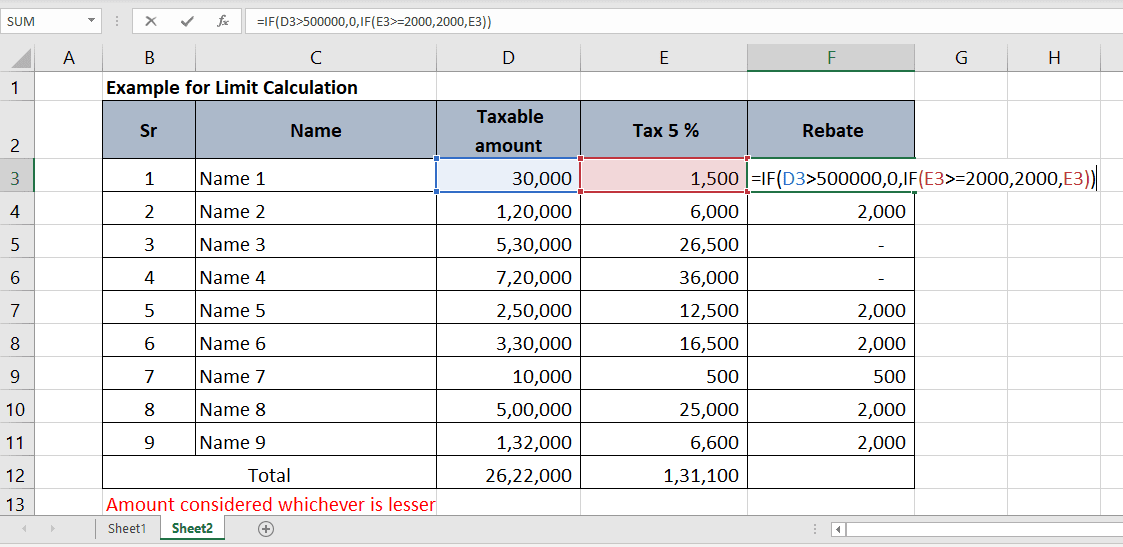

Verkko Using Excel functions to calculate income tax Explore the various Excel functions that can be utilized to calculate income tax based on taxable income tax brackets and Verkko 31 jouluk 2019 nbsp 0183 32 Condition 1 IF D3 gt 500000 then 0 else Condition 2 Meaning if the value of taxable amount cell D3 in condition 1 is more than 500000 then rebate zero and taxable amount is less then condition 2

Verkko 26 jouluk 2019 nbsp 0183 32 As you can see the formula returned the proper tax rate for all three Multiplying the tax rate by the total income is simple and will give you the amount of tax that you owe on each amount It s Verkko The tax payer age which is specified on the TaxCalc and Monthly sheets is used only in calculating which income tax rebate primary secondary or tertiary is applicable to

Download Income Tax Rebate Formula In Excel

More picture related to Income Tax Rebate Formula In Excel

How Can Taxpayers Obtain Income Tax Rebate In India

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate Astonishingceiyrs

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

Piszkos Kavics Rugalmas Sc Tax Calculator Vil g Ablak V d B b

https://www.exceldemy.com/wp-content/uploads/2022/06/calculate-income-tax-in-excel-using-if-function-3.png

Verkko Select OK With the same data highlighted click on the Data ribbon and click Subtotal In the pop up window select Category under quot At each change in quot Verkko 13 syysk 2022 nbsp 0183 32 To calculate this rate take the sum of all your lost income and divide that number by your earned income In the above case the government has taken a

Verkko 10 elok 2021 nbsp 0183 32 rebate87A incometax excelfirca adroitprofessionals Verkko Hope you get the different methods to calculate the income tax in Excel Income tax calculating formula in Excel with topics of ribbon and tabs quick access toolbar mini

Calculate Income Tax In Excel Ay Template Examples Hot Sex Picture

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1-1024x640.png

Income Tax Calculator FY 2021 22 AY 2022 23 Excel Download FinCalC

https://fincalc-blog.in/wp-content/uploads/2021/02/how-to-calculate-income-tax-fy-2021-22-excel-examples-calculation-video1.webp

https://www.excel-university.com/income-tax-formula

Verkko 31 jouluk 2014 nbsp 0183 32 If we assume a taxable income of 50 000 we need to write a formula that basically performs the following math 5081 25 50000 36900 25 We can use

https://exceljet.net/formulas/income-tax-bra…

Verkko Income tax bracket calculation Related functions Summary To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example The formula in

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator

Calculate Income Tax In Excel Ay Template Examples Hot Sex Picture

Rebate Formula In Excel Printable Rebate Form

One time Direct Payments From 50 To 700 Still Going Out How You Can

HRA Exemption Calculator In Excel House Rent Allowance Calculation

IF Formula In Excel Example For Value Base Calculation Tax Rebate

IF Formula In Excel Example For Value Base Calculation Tax Rebate

Income Tax Framework Calculations Rebates Income Tax Individuals

Calculate My Income Tax SuellenGiorgio

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

Income Tax Rebate Formula In Excel - Verkko The tax payer age which is specified on the TaxCalc and Monthly sheets is used only in calculating which income tax rebate primary secondary or tertiary is applicable to