Income Tax Rebate Home Loan Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Afficher plus

Web Home Loan Tax Benefit Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as Web 3 mars 2023 nbsp 0183 32 Income Tax Rebate on Home Loan for Interest Paid Principal payment Interest payment

Income Tax Rebate Home Loan

Income Tax Rebate Home Loan

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

https://theviralnewslive.com/wp-content/uploads/2023/02/income-tax-rebate-home-loan-Savings_11zon.jpg

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web 31 mai 2022 nbsp 0183 32 Under Section 80EEA first time homebuyers can claim additional tax benefits of up to Rs 1 5 lakh if their loan was sanctioned in FY 2019 20 extended to FY 2020 21 This exemption is over and Web Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house loan This is

Download Income Tax Rebate Home Loan

More picture related to Income Tax Rebate Home Loan

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

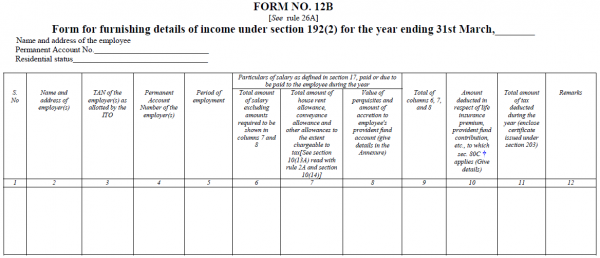

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

How To Rebate Home Loan Interest Income Tax Profit To Cash Salary

https://new-img.patrika.com/upload/2022/03/24/home_loan.jpg

Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web Il y a 1 jour nbsp 0183 32 New Income Tax Act of 2023 replaced the 1984 Ordinance in June It s been praised but there are concerns among finance professionals about compliance The

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Afficher plus

https://www.kotak.com/.../home-loan/home-loan-tax-benefit-calculator.html

Web Home Loan Tax Benefit Whether you are a salaried or a self employed individual you are eligible to invest in a housing property as well as for the income tax deductions as

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Latest Income Tax Rebate On Home Loan 2023

DEDUCTION UNDER SECTION 80C TO 80U PDF

Home Loan Rebate In Income Tax In Hindi

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Danpirellodesign Income Tax Rebate On Home Loan And Hra

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate Home Loan - Web 31 mai 2022 nbsp 0183 32 Under Section 80EEA first time homebuyers can claim additional tax benefits of up to Rs 1 5 lakh if their loan was sanctioned in FY 2019 20 extended to FY 2020 21 This exemption is over and