Income Tax Rebate In 80dd Web Income Tax Department gt Tax Tools gt Deduction under section 80DD As amended upto Finance Act 2023 Deduction Under Section 80DD Assessment Year Whether

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is Web 20 juil 2019 nbsp 0183 32 Section 80DD is the deduction available to the resident individual or HUF for the medical treatment of a disabled dependent The

Income Tax Rebate In 80dd

Income Tax Rebate In 80dd

https://blog.tax2win.in/wp-content/uploads/2019/03/80U-Deduction-in-case-of-disability.jpg

Section 80DD Deduction For Expenses On Disabled Dependent Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

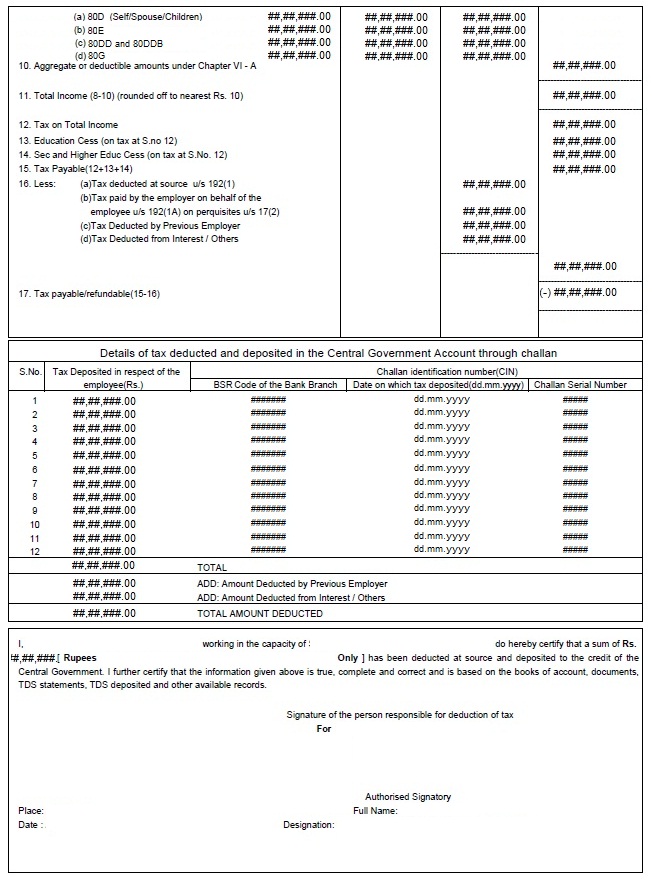

FORM 80DDB PDF

https://www.paisabazaar.com/wp-content/uploads/2017/06/Section-80DDB-Form-Format.png

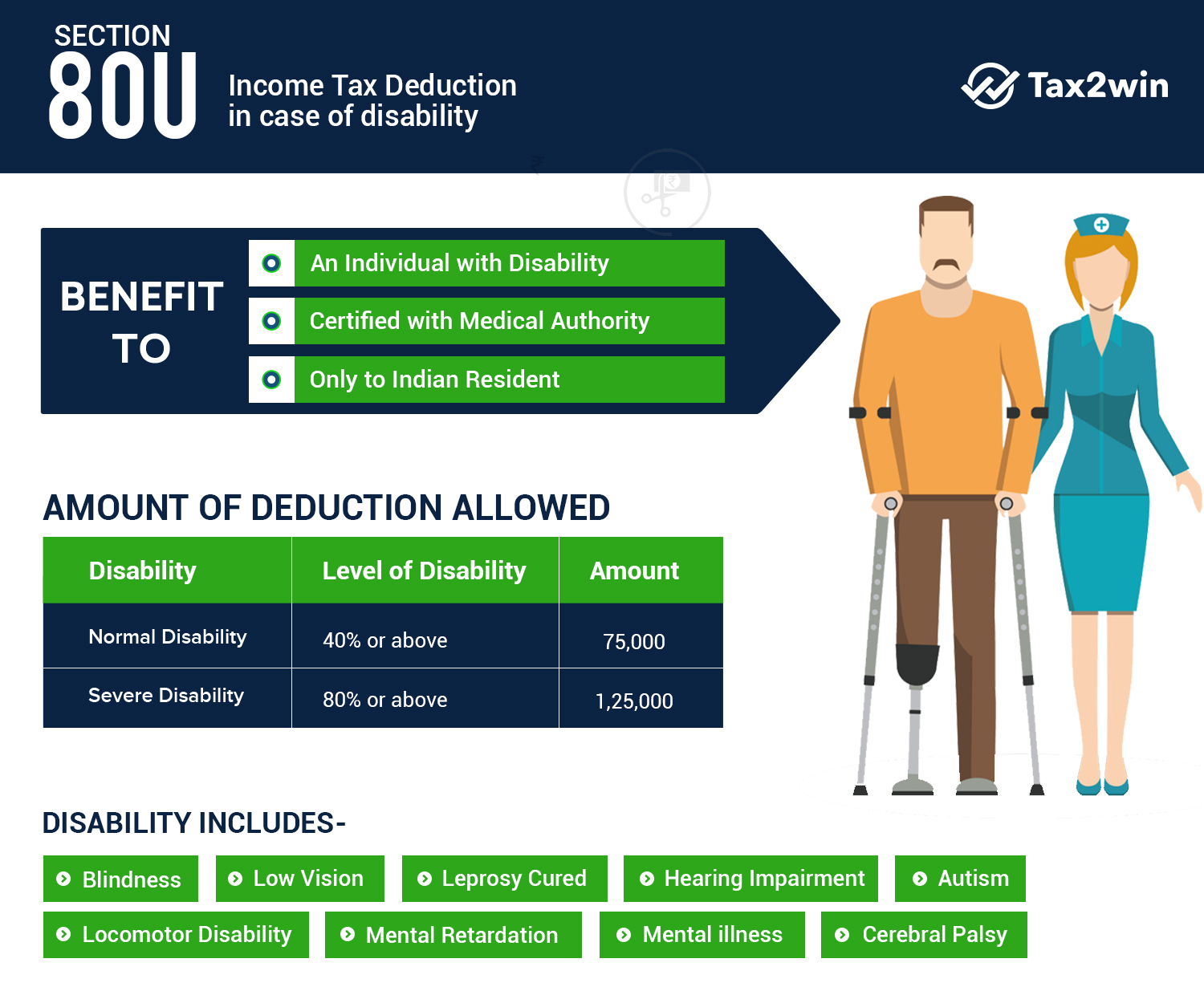

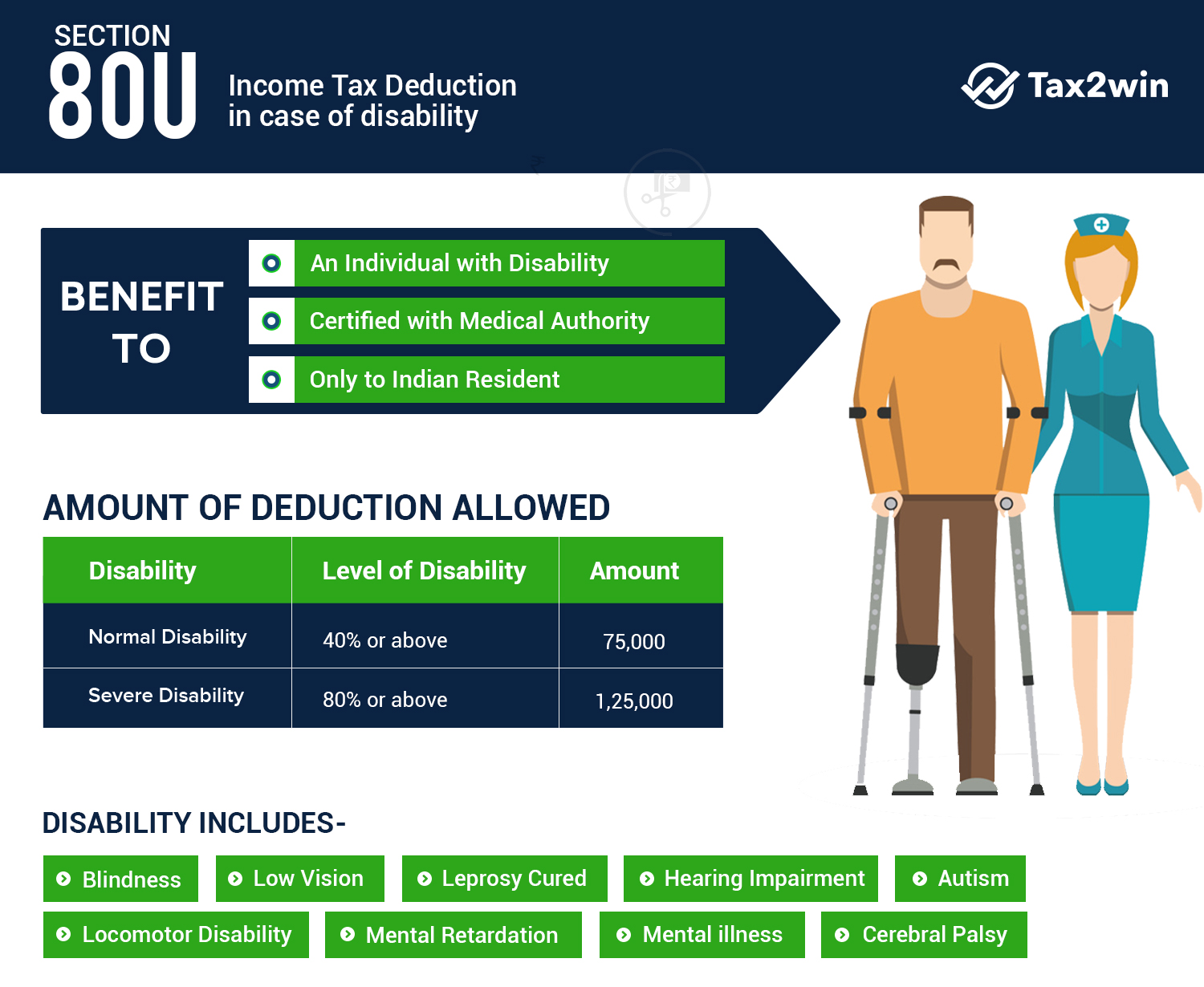

Web 11 sept 2023 nbsp 0183 32 A taxpayer can claim up to Rs 75 000 if the dependent member has a minimum disability of 40 While for a dependent with 80 disability the taxpayer can Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

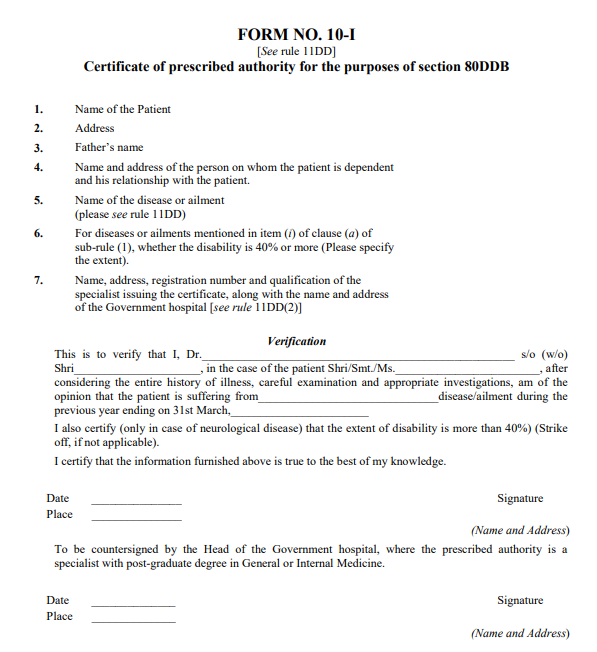

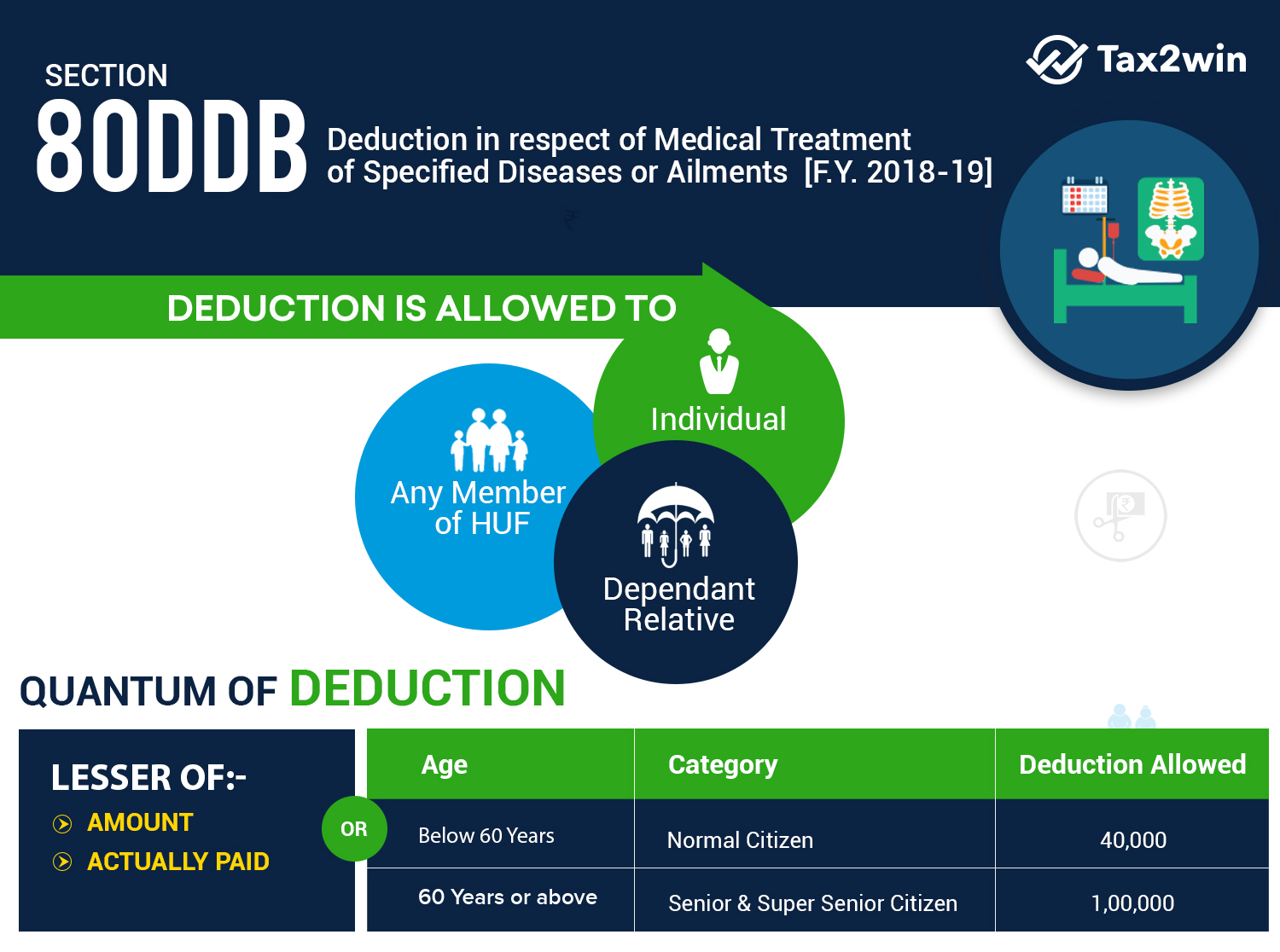

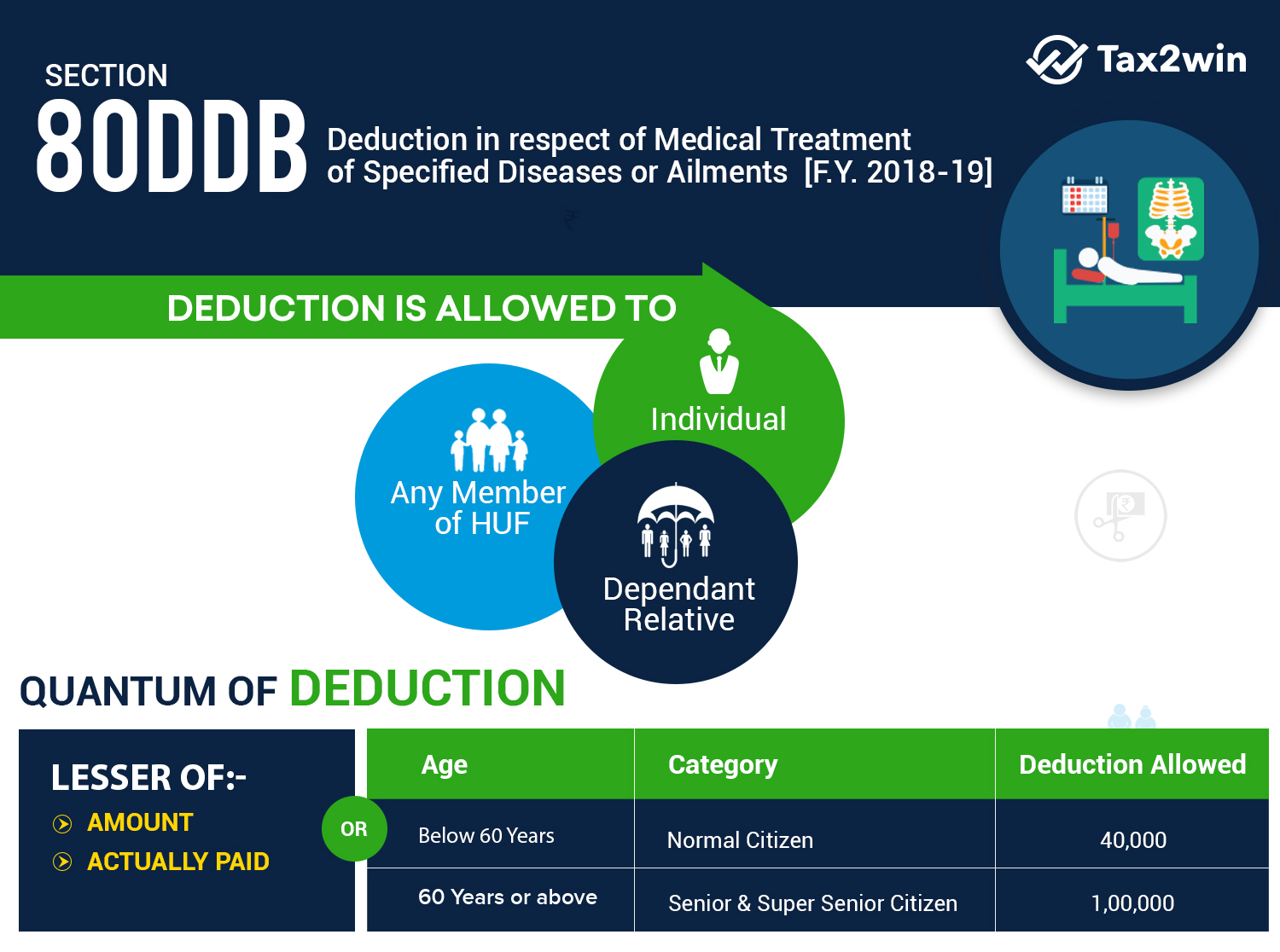

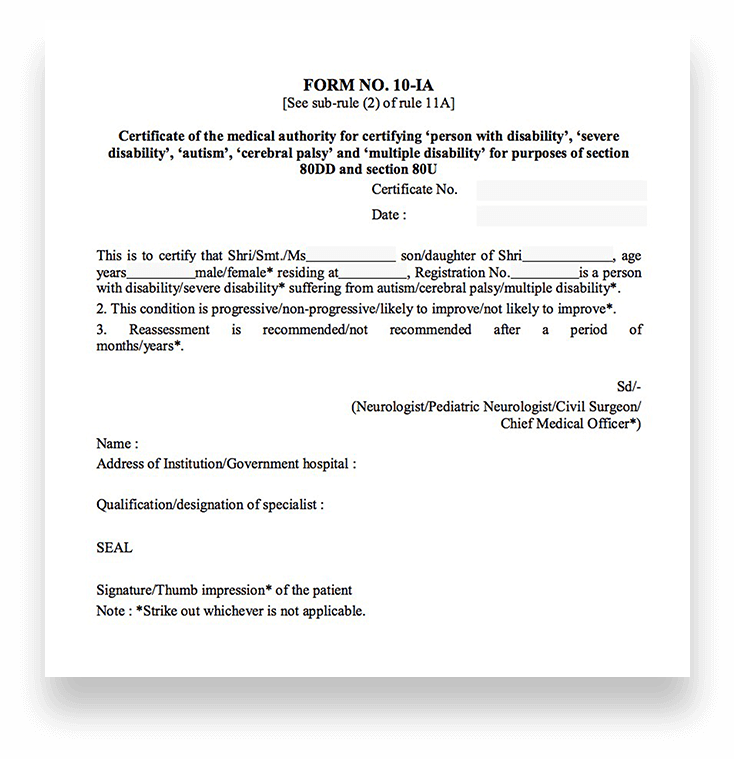

Web 29 mai 2023 nbsp 0183 32 Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax

Download Income Tax Rebate In 80dd

More picture related to Income Tax Rebate In 80dd

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

Anything To Everything Income Tax Guide For Individuals Including

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

80DD FORM PDF

https://www.allindiaitr.com/App_Root/content/img/form30.jpg

Web 3 ao 251 t 2023 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings The Web 11 juin 2018 nbsp 0183 32 If the dependent disabled has 80 or above disability the deduction amount is Rs 1 25 000 What documents are Required to Claim Deduction under Section 80DD

Web 22 sept 2019 nbsp 0183 32 As per section 80DD the assessee is eligible to claim a deduction of INR 75 000 from his gross total income However in case the dependant is a person with severe disability the assessee is eligible to Web Tax deduction under Section 80DD of the Income Tax Act can be claimed by individuals who are residents of India and HUFs for the medical treatment of a dependant with

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80DDB-Deductions.jpg

80DD FORM PDF

https://imgv2-1-f.scribdassets.com/img/document/230646351/original/6a7f4cdcbf/1543346366?v\u003d1

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80dd...

Web Income Tax Department gt Tax Tools gt Deduction under section 80DD As amended upto Finance Act 2023 Deduction Under Section 80DD Assessment Year Whether

https://economictimes.indiatimes.com/wealth/tax/budget-2022-introduces...

Web 1 f 233 vr 2022 nbsp 0183 32 quot Section 80DD of the Income Tax Act provides for a deduction for residents for maintenance of disabled dependents Relief for persons with disabled dependents is

80C TO 80U DEDUCTIONS LIST PDF

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Medical Expenditure Claim U s 80D 80DD 80DDB In Income Tax Return

Section 80DD 80DDB 80U Of Income Tax Act Ll Ministerial Staff Exam

Section 80DD Deduction Income Tax IndiaFilings

Section 80DD Tax Deduction For Care Of Handicapped Disabled Persons

Section 80DD Tax Deduction For Care Of Handicapped Disabled Persons

Section 80DD 80U Of Income Tax II Deduction For Disabled II How 80DD

89 INFO FORM FOR 80DDB PDF ZIP DOCX PRINTABLE DOWNLOAD Form

What Are Sections 80DD 80DDB And 80U All About Rupiko

Income Tax Rebate In 80dd - Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax