Income Tax Rebate India Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5

Web 1 The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87A Resident Individual whose Total Income is not more than Web 1 f 233 vr 2023 nbsp 0183 32 NEW DELHI Feb 1 Reuters India will raise the personal income tax rebate limit to 700 000 rupees 8 565 under the new tax regime from the previous 500 000 rupees Finance Minister Nirmala

Income Tax Rebate India

Income Tax Rebate India

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate as a Non Resident Indian NRI in India follow these steps Determine residential status Understand your residential status as per Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per Section 87A as against Rs 5

Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on Web 1 f 233 vr 2023 nbsp 0183 32 The new income tax slabs under the new tax regime are Rs 0 3 lakh Nil Rs 3 6 lakh 5 per cent Rs 6 9 lakh 10 per cent Rs 9 12 lakh 15 per cent Rs 12 15 lakh 20 per cent Over Rs 15 lakh 30 per cent

Download Income Tax Rebate India

More picture related to Income Tax Rebate India

Income Protector DHAMU Employer employee Insurance A Tax efficient

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Income Tax Slabs For Ay20 21 Which Itr Option Is Better For You Here

https://static.wixstatic.com/media/78f35a_bd55247cf7cc4428b1d9d1697f6e5542~mv2.png/v1/fill/w_600,h_237,al_c,usm_0.66_1.00_0.01/Tax Slabs2_FY 2019-20_PNG.png

Web 13 juin 2023 nbsp 0183 32 Resident individuals are eligible for a tax rebate of the lower of the income tax or INR 12 500 where the total income does not exceed INR 500 000 However in Web 1 avr 2016 nbsp 0183 32 A unit in the IFSC with specified income and subject to prescribed conditions is eligible for a tax exemption of 100 of the specified income for 10 years at the option

Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income Tax Act Must be a resident of India Your overall income after taking Web Income tax rebate in India is made available for Hindu Undivided Families HUF and individuals who reside in India Taxpayer can claim tax rebates for Rs 40 000 or actual

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web 1 The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87A Resident Individual whose Total Income is not more than

Income Upto Rs 5 Lakh To Get Full Tax Rebate FactsToday

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

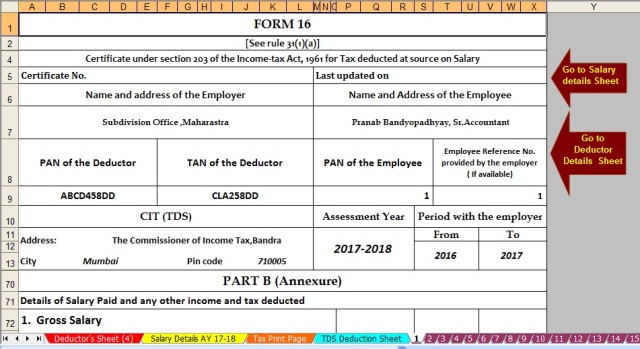

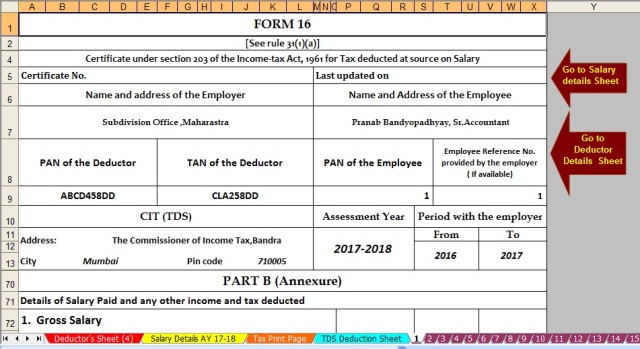

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate India - Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on