Income Tax Rebate Interest On House Building Loan Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

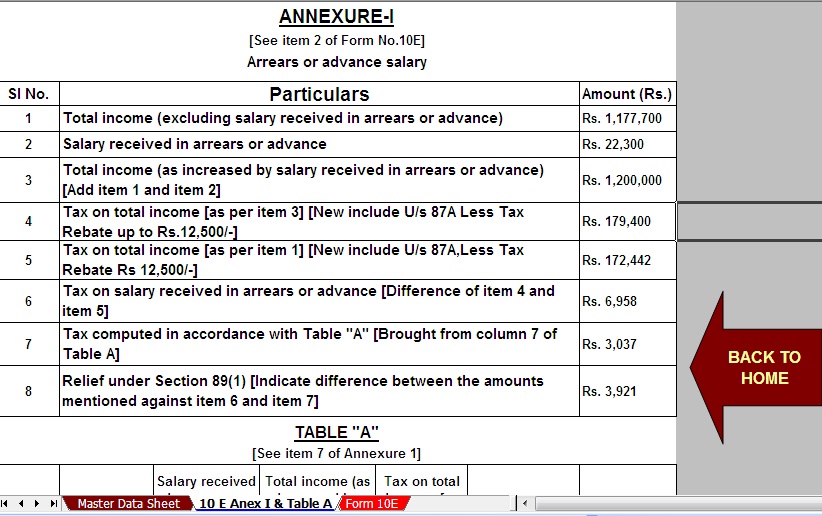

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web 12 janv 2022 nbsp 0183 32 Income tax benefit on home loan s interest in the pre construction period As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid

Income Tax Rebate Interest On House Building Loan

Income Tax Rebate Interest On House Building Loan

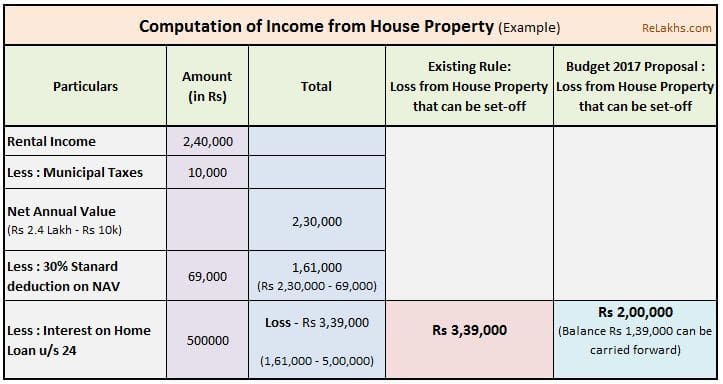

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

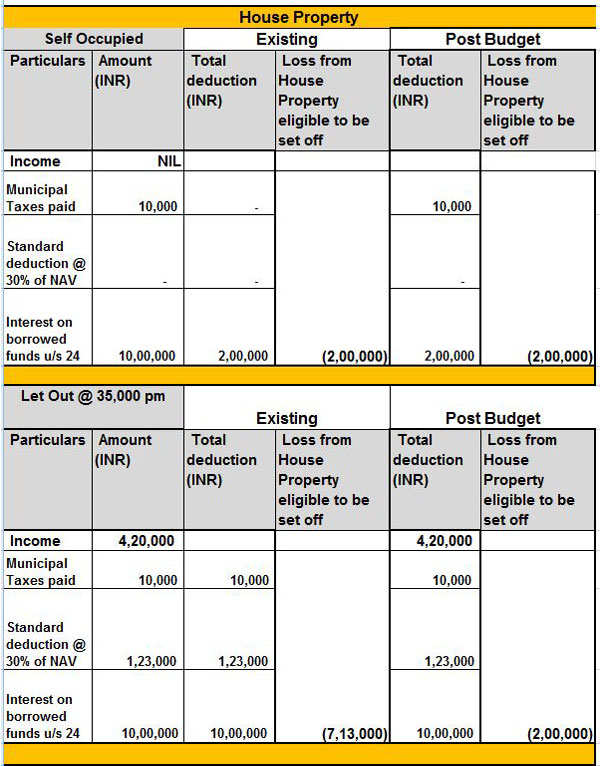

Web 4 ao 251 t 2021 nbsp 0183 32 This means that you get to claim an additional deduction of Rs 44 000 in Prior Period Interest during the next 5 financial years i e 2023 24 2024 25 2025 26 2026 Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest

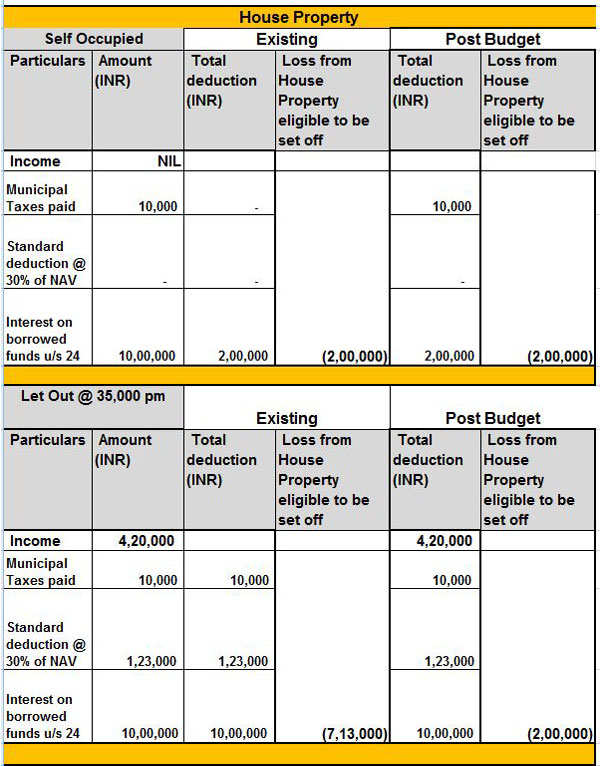

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 11 janv 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax

Download Income Tax Rebate Interest On House Building Loan

More picture related to Income Tax Rebate Interest On House Building Loan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

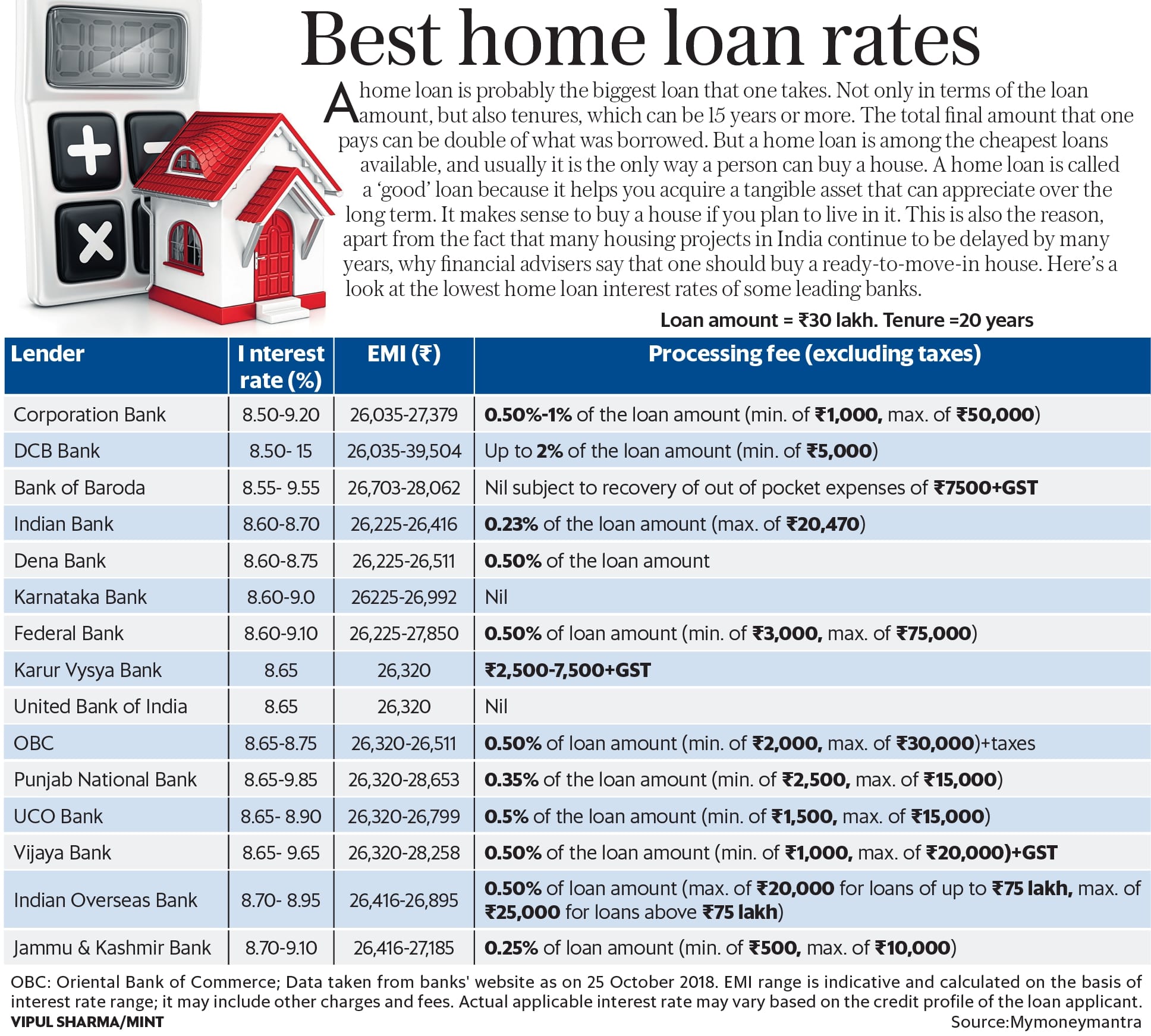

The Best Home Loan Rates Being Offered Right Now Livemint

https://www.livemint.com/r/LiveMint/Period2/2018/10/30/Photos/Processed/home_loan_interest rate.jpg

Web 13 juin 2020 nbsp 0183 32 Yes you can claim an income tax exemption on both house rent allowance HRA and repayment of home loan If you are living in a house on rent and servicing Web 31 mai 2022 nbsp 0183 32 You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your employer The process to claim housing loan tax

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

https://moneyexcel.com/wp-content/uploads/2016/05/home-loan-tax-benefits.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://money.stackexchange.com/questions/27738

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

House Loan Limit In Income Tax Home Sweet Home

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

Latest Income Tax Rebate On Home Loan 2023

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

How To Claim Interest On Home Loan Deduction While Efiling ITR

GST HST New Housing Rebate Rebates House With Land Home Construction

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Income Tax Rebate Interest On House Building Loan - Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest