Income Tax Rebate Investment Web 27 janv 2022 nbsp 0183 32 Le dispositif fiscal IR PME permet d investir dans les PME non cot 233 es et de b 233 n 233 ficier d une r 233 duction d imp 244 ts port 233 e de 18 224 25 pour les investissements

Web 3 ao 251 t 2023 nbsp 0183 32 A single flat rate tax of 30 is applied on savings and investment income and gains comprising of income tax at 12 8 and social charges of 17 2 Capital Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return Claim a refund of Income Tax deducted

Income Tax Rebate Investment

Income Tax Rebate Investment

https://www.relakhs.com/wp-content/uploads/2019/02/Income-Tax-Deductions-List-FY-2019-20-Latest-Tax-exemptions-for-AY-2020-2021-tax-saving-optionschart-tax-rebate.jpg

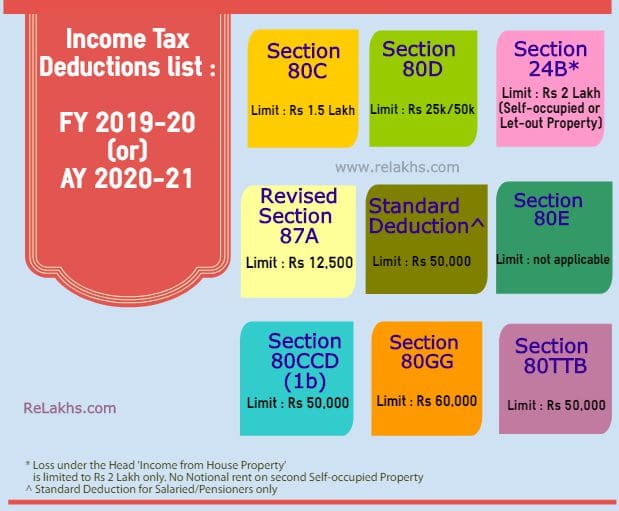

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://i1.wp.com/myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg?resize=321%2C543&ssl=1

Web 1 janv 2016 nbsp 0183 32 Social Investment Tax Relief will not be available for new investments made on or after 6 April 2023 You can invest directly in a qualifying company or enterprise Web 22 janv 2022 nbsp 0183 32 A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the

Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such Web The rates of Surcharge and Health amp Education cess are same under both the tax regimes 2 Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000

Download Income Tax Rebate Investment

More picture related to Income Tax Rebate Investment

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Invest-for-Tax-Rebate.jpg

Know New Rebate Under Section 87A Budget 2023

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Tax Rebate Under Section 87A Investor Guruji Tax Planning

https://investorguruji.com/wp-content/uploads/2022/04/Section-87A.jpg

Web 2 juil 2023 nbsp 0183 32 Income Tax Rebate Investment July 2 2023by tamble If you are looking for Income Tax Rebate Investmentyou ve come to the right place We have 32 rebates Web 11 ao 251 t 2023 nbsp 0183 32 Taxes on investments depend on the investment type See current tax rates for capital gains dividends mutual funds 401 k s and real estate investments

Web The same income in the form of corporate profits is first taxed under the weight of the corporate income tax and then when distributed as dividends it falls under the yoke of Web Income Tax Rebate When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

https://teachersbuzz.in/wp-content/uploads/2020/05/TAX2BRebate.png

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://www.boursorama.com/patrimoine/actualites/dispositif-ir-pme...

Web 27 janv 2022 nbsp 0183 32 Le dispositif fiscal IR PME permet d investir dans les PME non cot 233 es et de b 233 n 233 ficier d une r 233 duction d imp 244 ts port 233 e de 18 224 25 pour les investissements

https://www.expatica.com/fr/finance/taxes/a-guide-to-taxes-in-france...

Web 3 ao 251 t 2023 nbsp 0183 32 A single flat rate tax of 30 is applied on savings and investment income and gains comprising of income tax at 12 8 and social charges of 17 2 Capital

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

How You May Not Have To Pay Tax Even With Rs 9 5 Lakhs Income Yadnya

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate Investment - Web 14 juin 2022 nbsp 0183 32 Under the current provisions they are allowed to invest 25 or Tk1 50 000 on which they will get a rebate of 15 As such the amount of their rebate or tax credit