Income Tax Rebate Limit India Section 87A is a legal provision which allows for tax rebates under the Income Tax Act of 1961 The section which was inserted through the Finance Act of

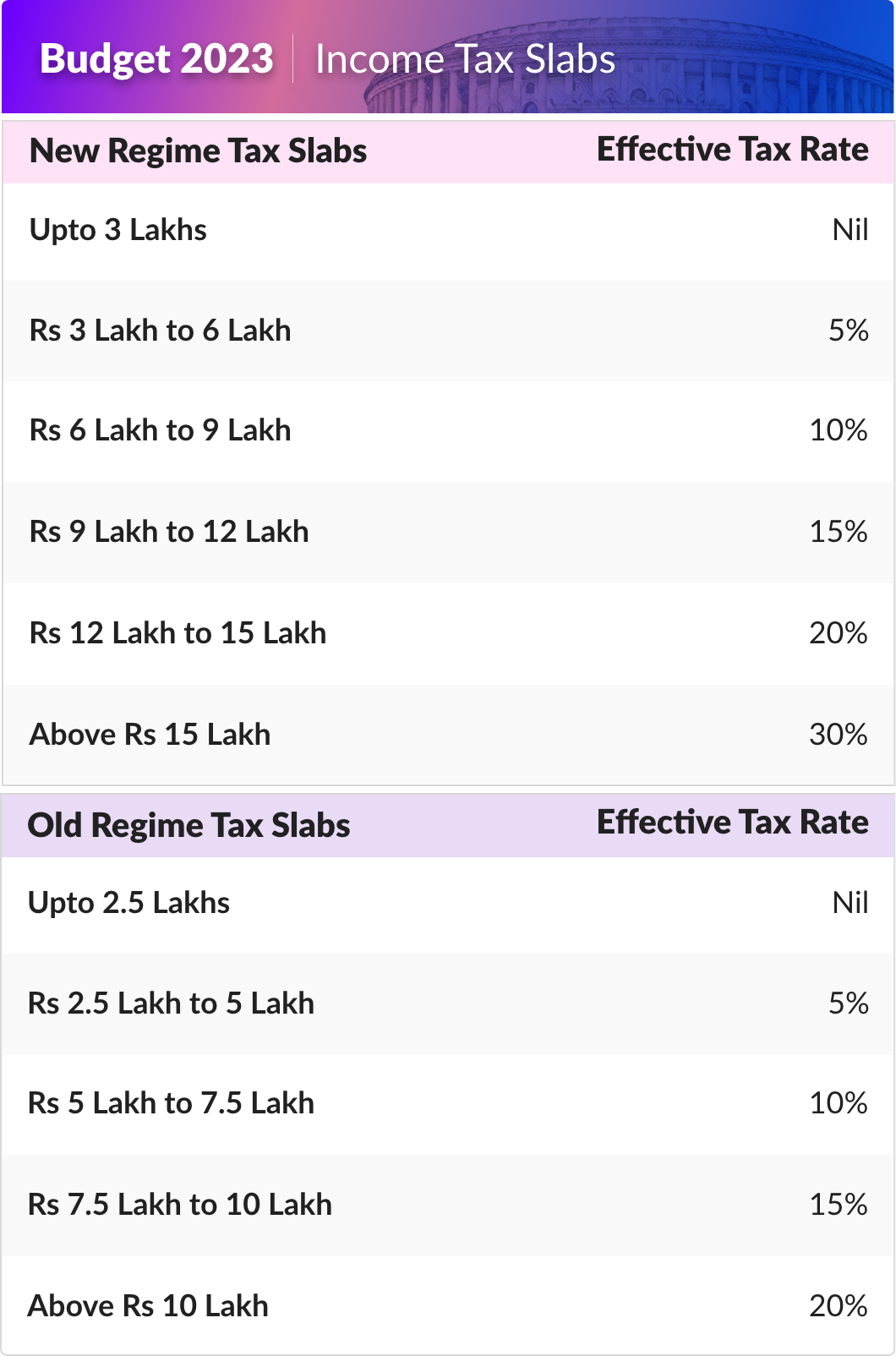

From tweaking the number of slabs to increasing the rebate the Budget 2023 has proposed a host of changes in the new income tax regime While announcing Budget 2023 Finance Minister Nirmala As part of the fifth announcement the budget proposed extension of limit of tax exemption on leave encashment to Rs 25 lakh on retirement of non government salaried employees in line with the

Income Tax Rebate Limit India

Income Tax Rebate Limit India

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202302/new_tax_slab_amounts-sixteen_nine.jpg?VersionId=fwHXK2_vWXcpm_arzu9kYnCvtYzgEmii

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs The FM also announced an increase in the income tax rebate limit from Rs 5 lakh to Rs 7 lakh under the new tax regime Currently those with an income of Rs 5 lakh do not pay any income tax and I

Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with Tax Rebate Individuals with income up to Rs 7 lakhs are eligible for a complete tax rebate under the new regime effectively paying zero tax Increased Liquidity By eliminating the need for tax saving

Download Income Tax Rebate Limit India

More picture related to Income Tax Rebate Limit India

Union Budget 2023 Centre Raises Tax Rebate Limit Reduces Slabs In Key

https://images.hindustantimes.com/img/2023/02/01/1600x900/The-Union-government-made-the-new-income-tax-regim_1675278142042.jpg

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

Nitish Sneers At Proposed Rise In Income Tax Rebate Limit Says it s

https://img.republicworld.com/republic-prod/stories/promolarge/xhdpi/btoa3eczt3ln6qpx_1675350958.jpeg

Budget 2023 Income Tax rebate limit raised to 7 lakh from 5 lakh Finance Minister Nirmala Sitharaman announces that there will not be any new tax for income up to 3 MSMEs and professionals entitled to presumptive tax will now have higher eligibility limits Rs 3 crore vs Rs 2 crore and Rs 75 lakhs vs Rs 50 lakhs respectively

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their Know about the income tax slab rates for the FY 2023 24 and 2024 25 Get the information about the old and new income tax slabs for individuals senior citizens and super senior

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Budget 2023 5 Major Announcements On Personal Income Tax Hindustan Times

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675261561324.png

https://cleartax.in/s/income-tax-slabs

Section 87A is a legal provision which allows for tax rebates under the Income Tax Act of 1961 The section which was inserted through the Finance Act of

https://economictimes.indiatimes.com…

From tweaking the number of slabs to increasing the rebate the Budget 2023 has proposed a host of changes in the new income tax regime While announcing Budget 2023 Finance Minister Nirmala

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Income Tax Rebate Under Section 87A

Union Budget 2019 India Interim Budget News Expectations Tax

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Difference Between Income Tax Deductions Exemptions And Rebate Plan

Twitter Down For Thousands Of Users Biznext India

Budget 2023 Tax Rebate Under The New Regime Explained With Two

Income Tax Rebate Limit India - The FM also announced an increase in the income tax rebate limit from Rs 5 lakh to Rs 7 lakh under the new tax regime Currently those with an income of Rs 5 lakh do not pay any income tax and I