Income Tax Rebate Limit On Education Loan Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file

Web 30 mars 2023 nbsp 0183 32 There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an Web 28 juin 2019 nbsp 0183 32 Read about Sec 80E Deduction for ineterst paid on education loan for 8 years Read for eligibility no limit loan period purpose benefit and much more

Income Tax Rebate Limit On Education Loan

Income Tax Rebate Limit On Education Loan

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-q-a-about-recovery-rebates-student-loans-health-care-4.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Education Tax Credit 2020 Income Limits TIEDUN

https://lh6.googleusercontent.com/proxy/m_W_bwTlWDpF5iljOjgXHPxlTVzu5eIfIbiPtzJfO1roD8DRoz-x1Uo5Z10u1SiKqgPru03YOGGlm8nmrbySkL03qqIipaiYmrKDe3YakCZYd46iCYMEBcqqr8IHxBSo=w1200-h630-p-k-no-nu

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier To claim a deduction for an education loan you must receive a certificate from the financial institution showing the

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the Web 23 f 233 vr 2018 nbsp 0183 32 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is earlier Business Written by

Download Income Tax Rebate Limit On Education Loan

More picture related to Income Tax Rebate Limit On Education Loan

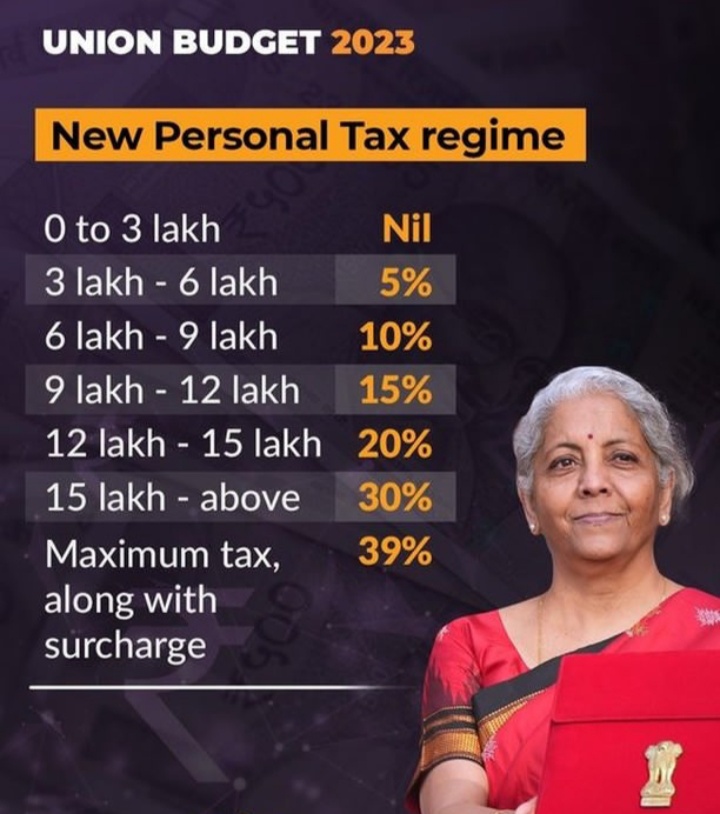

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://shabiba.eu-central-1.linodeobjects.com/2023/02/1675237419-1675237419-ominottsnayo-700x400.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Union Budget 2023 Live Income Tax Rebate Limit Increased To Rs 7 Lakh

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi398zX1SDEi3IHdkz1yEAKz6WYKpIVdW3xbcr6ggRB4HvFwDXiGz9eKnPqBum1NK4aLeBQLjjRI_5h4tSSkdXO4zY4KgXJBYWr3niD5_KLIEEK6qcPosHCSF2Ig5f_pmkAe5IsEH6tKdFaO2Y0sWcNMRruqVjpzR6APyXJ4Asbelu9UwdMrYszV2eHEA/s814/Screenshot_20230201_141555.JPG

Web There is no maximum limit on the tax exemption amount on education loans To claim the deduction you must obtain a certificate from your bank that clearly separates the principal and interest portions of the loan Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Web 12 avr 2019 nbsp 0183 32 Under Section 80E of the Income Tax Act the interest part of the loan is eligible for tax benefit Banks offer a moratorium period for repayment of the loan after Web 16 juin 2021 nbsp 0183 32 You can claim tax deductions against education loans under Section 80E of the Income Tax Act However there are a few things to keep in mind about tax

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

https://www.irs.gov/publications/p970

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you file

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an

Budget 2023 Income Tax Rebate Limit FM Nirmala Sitharaman

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Rebate Under Section 87A

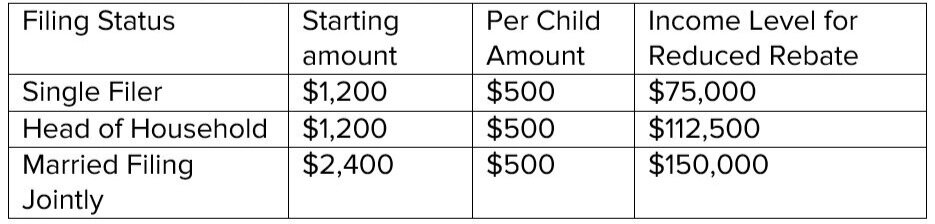

CARES Act Q A About Recovery Rebates Student Loans Health Care

More Tax Credits More Rebates Education Magazine

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Budget 2023 Income Tax Rebate Limit Increased From 5 Lakh To 7

Budget 2023 Income Tax Rebate Limit Increased From 5 Lakh To 7 Lakh

Income Tax Rebate Limit On Education Loan - Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the