Income Tax Rebate List In India Web 16 mars 2017 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Income Tax Rebate List In India

Income Tax Rebate List In India

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

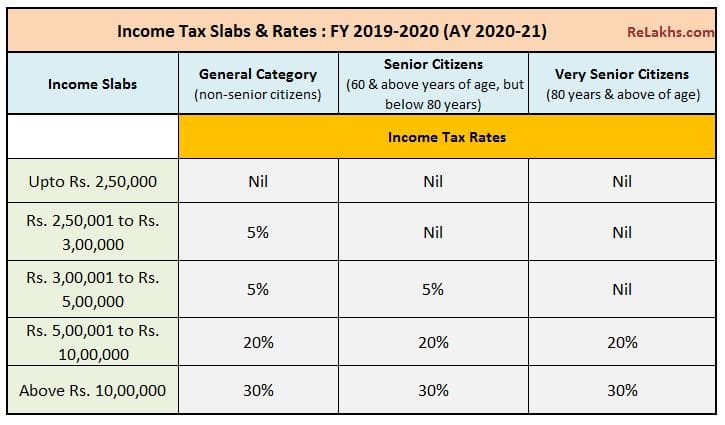

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Web 19 mars 2018 nbsp 0183 32 In this article we try to list some of the major deductions and allowances available to the salaried persons using which one can reduce their income tax liability Web 1 f 233 vr 2023 nbsp 0183 32 Rs 6 9 lakh 10 Rs 9 12 lakh 15 Rs 12 15 lakh 20 Above Rs 15 lakh 30 IncomeTax UnionBudget2023 LIVE https t co OhRKaPZszG radicokhaitan DailyhuntApp

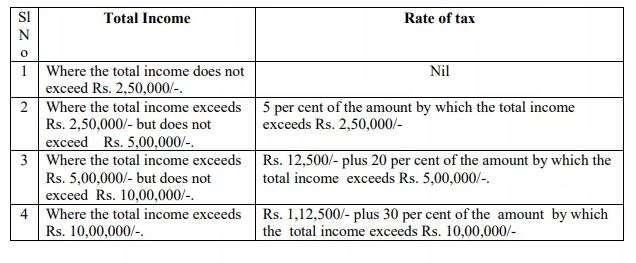

Web Rebates 87A Tax rebate in case of individual resident in India whose total income does not exceed Rs 5 00 000 Quantum of rebate shall be an amount equal to hundred per cent Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be nil of such individual in both New

Download Income Tax Rebate List In India

More picture related to Income Tax Rebate List In India

Standard Deduction For 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3.jpg

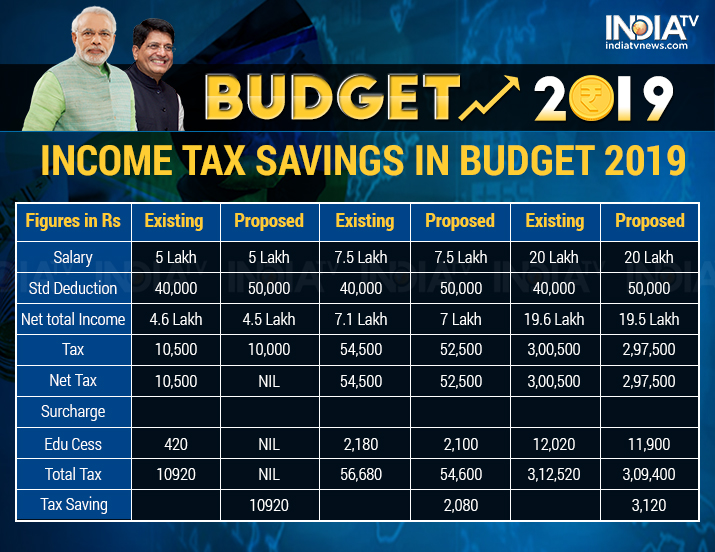

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Comparison Of New Income Tax Regime With Old Tax Regime The Economic

https://economictimes.indiatimes.com/img/74504675/Master.jpg

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate in India follow these steps Determine eligibility Check if you meet the eligibility criteria for claiming an income tax rebate Rebates are Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less This

Web Income Tax rate Upto Rs 3 00 000 Nil 5 20 30 5 20 30 AY 2022 23 Rs 3 00 000 Rs 5 00 000 Rs 5 00 000 Rs 10 00 000 Above Rs 10 00 000 AY 2021 Web Salary Income and Tax Implications For AY 2021 22 Income Tax Department Central Board of Direct Taxes What is Salary Salary is a fixed and regular remuneration

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2019/02/income-tax-savings-in-budget-2019-1549027494.jpg

https://cleartax.in/s/income-tax-rebate-us-87a

Web 16 mars 2017 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5 lakh

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Major Exemptions Deductions Availed By Taxpayers In India

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

Interim Budget 2019 No Change In Income Tax Slab Individuals With

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

80C TO 80U DEDUCTIONS LIST PDF

Interim Budget 2019 20 The Talk Of The Town Trade Brains

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Rebate List In India - Web 13 ao 251 t 2023 nbsp 0183 32 Here Income tax Sections of deductions and rebates for Residents and Non Residents are shown in a tabular format for easy reference and comparison among