Income Tax Rebate Malaysia Web Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Separate Assessment Wife Husband 350 350 400 400 b Joint Assessment

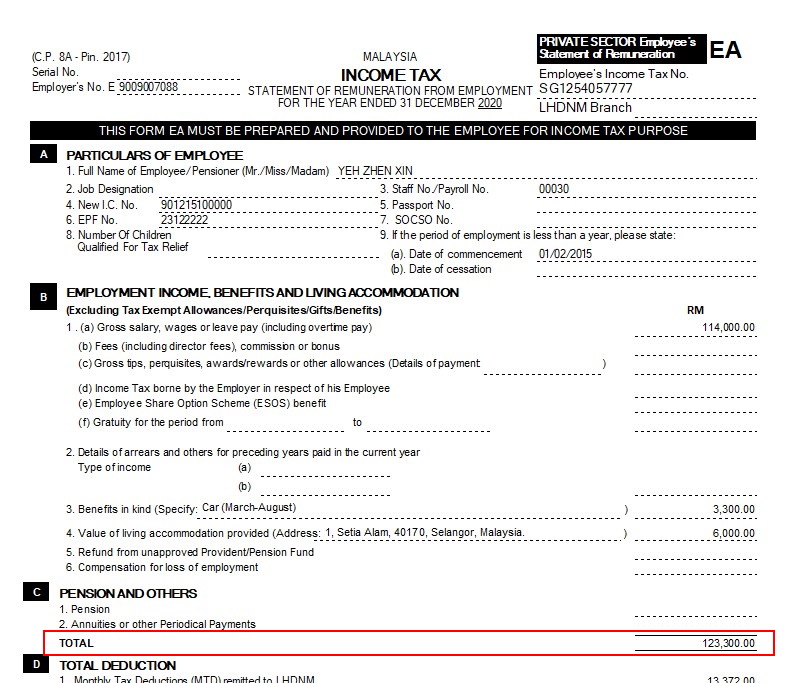

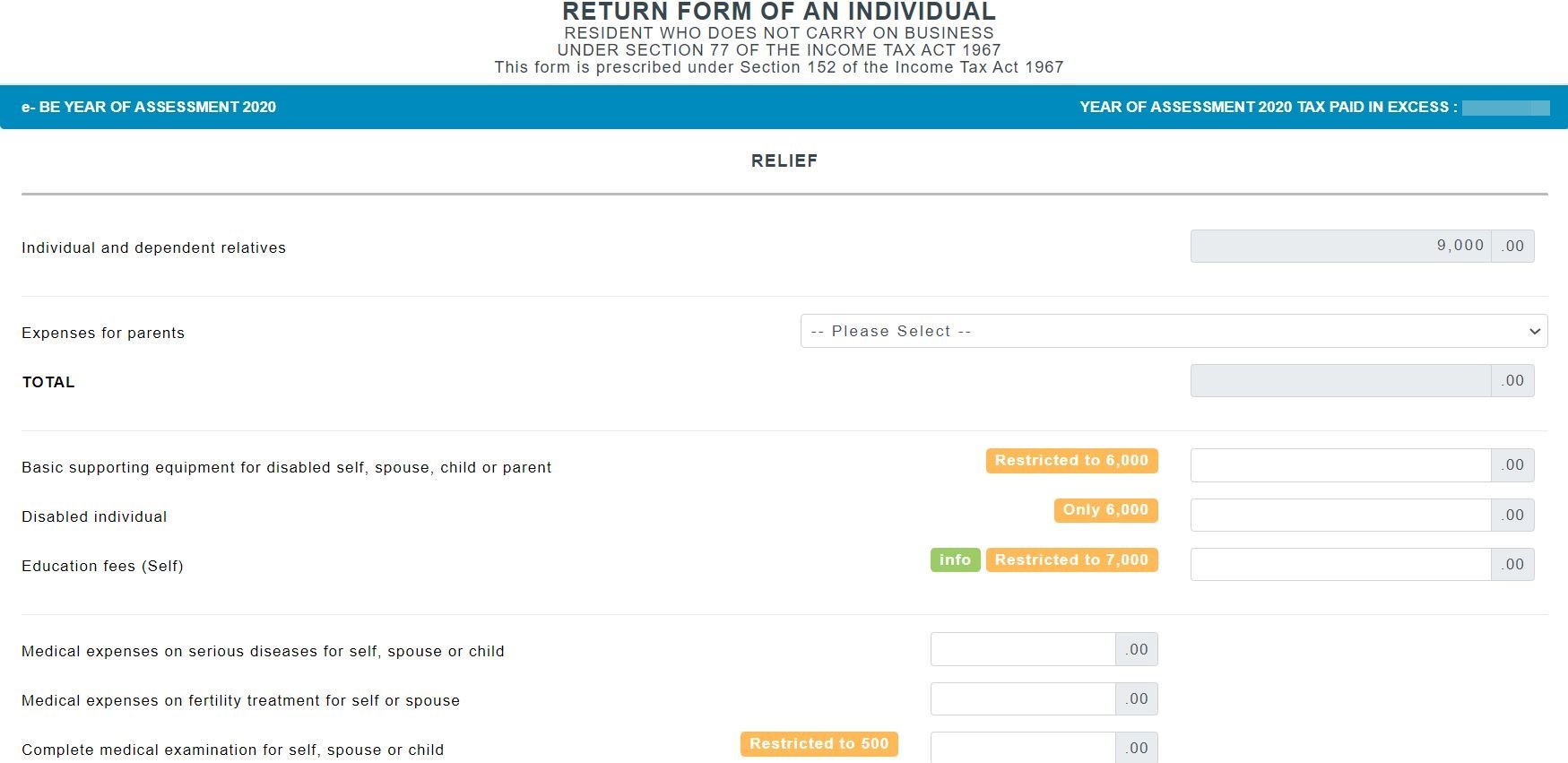

Web 10 mars 2022 nbsp 0183 32 1 Individual and dependent relatives Claim RM9 000 Granted automatically to an individual for themselves and their dependents 2 Medical treatment special Web 4 avr 2023 nbsp 0183 32 Here s an example of how Malaysia income tax rebate is calculated Chargeable income after tax reliefs RM34 610 Total tax RM880 50 As the

Income Tax Rebate Malaysia

Income Tax Rebate Malaysia

https://kindlemalaysia.com/wp-content/uploads/2016/10/14589801_1306153896061278_8083714886436330291_o.jpg

Travelling Expenses Tax Deductible Malaysia Paul Springer

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

Income Tax Relief 2020 Malaysia You Can Claim A Tax Relief Of Up To

https://cdn.sql.com.my/wp-content/uploads/2021/02/tax.jpg

Web 27 f 233 vr 2023 nbsp 0183 32 Tax Rate Reduction for Two Tax Brackets The updated Budget 2023 saw reduced tax rates for a few ranges of taxable income RM35 000 RM50 000 Web Income tax rebate for new SMEs or Limited Liability Partnerships EY Malaysia Trending For CEOs are the days of sidelining global challenges numbered 8 Jul 2019 Workforce

Web 28 mars 2023 nbsp 0183 32 Based on this amount the income tax you should be paying is RM1 000 at a rate of 8 However if you claimed a total of RM11 600 in tax relief your chargeable income would reduce to Web 23 d 233 c 2021 nbsp 0183 32 An income tax rebate up to RM20 000 per year for 3 years of assessment was given to newly established small and medium enterprises SMEs between 1 July 2020 to 31 December 2021 pursuant

Download Income Tax Rebate Malaysia

More picture related to Income Tax Rebate Malaysia

Malaysia Personal Income Tax Guide 2020 YA 2019 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png?is-pending-load=1

How To File Income Tax In Malaysia Using E Filing Mr stingy

https://kcnstingy-95ad.kxcdn.com/wp-content/uploads/2016/04/Step-7-Reliefs-Rebates-and-Exemptions.png

Cukai Pendapatan How To File Income Tax In Malaysia

https://www.jobstreet.com.my/career-resources/wp-content/uploads/sites/4/2021/10/3-What-You-Need-To-Know-About-Income-Tax-Calculation-in-Malaysia.jpg

Web 3 janv 2022 nbsp 0183 32 From YA 2021 a tax rebate section 6D 4 will be provided to resident Companies or Limited Liability Partnerships LLPs hereinafter referred to as Qualifying Entity incorporated registered in Malaysia Web Rebates for Individuals with Chargeable Income not exceeding RM35 000 A rebate of RM400 is available to individuals with an annual chargeable income not exceeding

Web Chargeable income RM YA 2022 YA 2023 Tax RM on excess Tax RM on excess 5 000 0 1 0 1 20 000 150 3 150 3 35 000 600 8 600 6 50 000 1 800 Web 27 juin 2023 nbsp 0183 32 Types of rebate MYR Individual s chargeable income does not exceed MYR 35 000 400 If husband and wife are separately assessed and the chargeable income of

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

https://4.bp.blogspot.com/-JTsquM0HYuI/XmW7noYMLVI/AAAAAAAAIt8/upx_BvbleAMpvjOk73KfmRmQcO37CDOqwCLcBGAsYHQ/s1600/LHDN%2Btax%2Brelief%2Bassessment%2Byear%2B2019.jpg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

https://www.hasil.gov.my/.../how-to-declare-income/rebates

Web Tax Rebates Year Of Assessment 2001 2008 RM Year Of Assessment 2009 Onwards RM a Separate Assessment Wife Husband 350 350 400 400 b Joint Assessment

https://ringgitplus.com/en/blog/income-tax/everything-you-should-claim...

Web 10 mars 2022 nbsp 0183 32 1 Individual and dependent relatives Claim RM9 000 Granted automatically to an individual for themselves and their dependents 2 Medical treatment special

IncomeTax Handy Guide To Malaysia s Personal Income Tax Filing In

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

Inspirasi Pcb Malaysia Skema Pcb

Malaysia Personal Income Tax Guide 2021 YA 2020

Malaysia Personal Income Tax Rate 2016 DominiquetaroConley

Malaysia Personal Income Tax Guide 2017

Malaysia Personal Income Tax Guide 2017

Malaysia Personal Income Tax Relief 2020 Walang Merah

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Malaysia Personal Income Tax Guide 2017

Income Tax Rebate Malaysia - Web 28 janv 2022 nbsp 0183 32 28 01 2022 share Welcome to our Crowe Chat Vol 1 2022 In this issue we will cover the following topics Implementation of 2 Withholding Tax on Payments