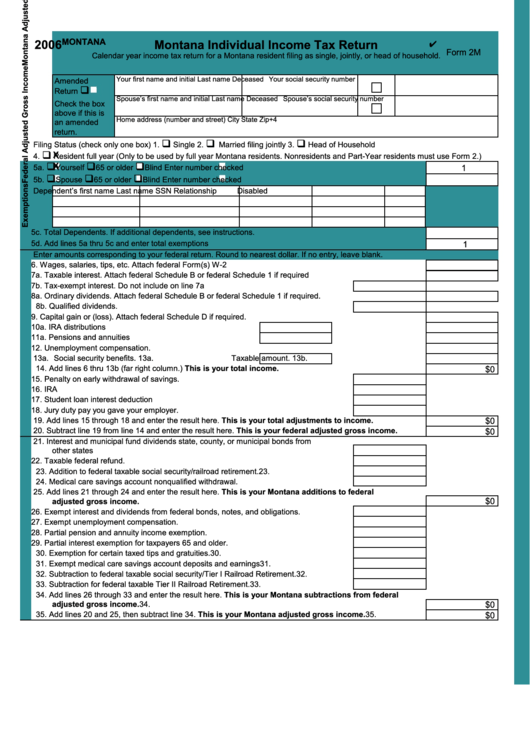

Income Tax Rebate Montana 2024 Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

The individual income tax rebate is 1 250 for individual filers and 2 500 for married couples filing jointly The money comes from House Bill 192 which set aside 480 million of the surplus to These you have to apply for The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 to Oct 1 2023 A second application period for 2023 rebates will be open across the same dates in 2024

Income Tax Rebate Montana 2024

Income Tax Rebate Montana 2024

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

The Montana Income Tax Rebate Are You Eligible

https://www.wordenthane.com/wp-content/uploads/2023/06/AdobeStock_602491697-scaled.jpeg

Friday Mar 24th 2023 Photo NBC Montana p p HELENA Mont Montana s GOP controlled Legislature put 764 million into tax rebates refunding residents income and property taxes January 05 2023 HELENA Mont Governor Greg Gianforte today spotlighted his pro family pro business tax relief agenda in a press conference at the State Capitol All of our tax proposals are rooted in a simple philosophy hardworking Montanans should keep more of what they earn Governor Gianforte said

The latest entrant is Montana where lawmakers passed reforms Monday The top income tax rate will fall to 5 9 in 2024 from 6 75 now Gov Greg Gianforte called it the largest tax cut in Montana history and it builds on his 2021 cut that dropped the rate from 6 9 The state s tax code will also collapse to two brackets from seven For the 2023 property tax rebate the application date will open on August 15 2024 and end on October 1 2024 If you want to learn more about these rebate programs visit the Montana Department of Revenue s webpage 2023 Montana Tax Rebates

Download Income Tax Rebate Montana 2024

More picture related to Income Tax Rebate Montana 2024

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

Montana Income Tax Rebate Of Up To 2 500 Coming To Eligible Taxpayers This July Check

https://www.pelhamplus.com/wp-content/uploads/2023/07/Montana-Free-Press_11zon.jpg

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

https://ridgecrestpact.org/wp-content/uploads/2023/08/Income-and-Property-Tax-Relief-Montanas-675-Rebate-for-2023-Explained-1024x576.jpg

In his Budget for Montana Families the governor proposed a 1 000 property tax rebate in 2023 and 2024 which was in the original version of HB 222 Finally the tax package includes HB 192 a bill from Rep Bill Mercer R Billings to provide income tax rebates for Montana income taxpayers of up to 1 250 After returning over 1 billion Montana s Republican controlled Legislature directed hundreds of millions of dollars from the state s historic budget surplus 899 million in total toward income and property tax rebates during its this year s legislative session

The state has set aside a surplus of 480 million to offer income tax rebates to residents Those who were full year Montana residents and paid state taxes on 2021 income will get a rebate of up In its current form it would provide rebates of up to 500 per homeowner for taxes paid in 2022 and 2023 The Montana Department of Revenue estimates that about 292 000 households would be eligible each year House Bill 192 as amended Friday would put 480 million into income tax rebates Individual taxpayers would qualify for up to 1 250 in

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

Montana Fillable Tax Forms Printable Forms Free Online

https://data.formsbank.com/pdf_docs_html/213/2130/213013/page_1_thumb_big.png

https://mtrevenue.gov/download/112298/?tmstv=1701716155

Updates from the 2023 Legislature for Tax Year 2024 Simplification Reduced Tax Rate and Expanded Montana Earned Income Tax Credit Long Term Capital Gains Tax Rate Military Retirement Exemption for Certain Military Retirees Expanded Qualified Endowment Credit De Minimis Filing Requirement for Certain Nonresidents 5 5

https://www.ktvh.com/news/what-to-know-about-new-montana-income-and-property-tax-rebates

The individual income tax rebate is 1 250 for individual filers and 2 500 for married couples filing jointly The money comes from House Bill 192 which set aside 480 million of the surplus to

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Montana Income Tax Information What You Need To Know On MT Taxes

Georgia Income Tax Rebate 2023 Printable Rebate Form

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Montana Tax Rebate Checks Up To 2 500 Coming In July

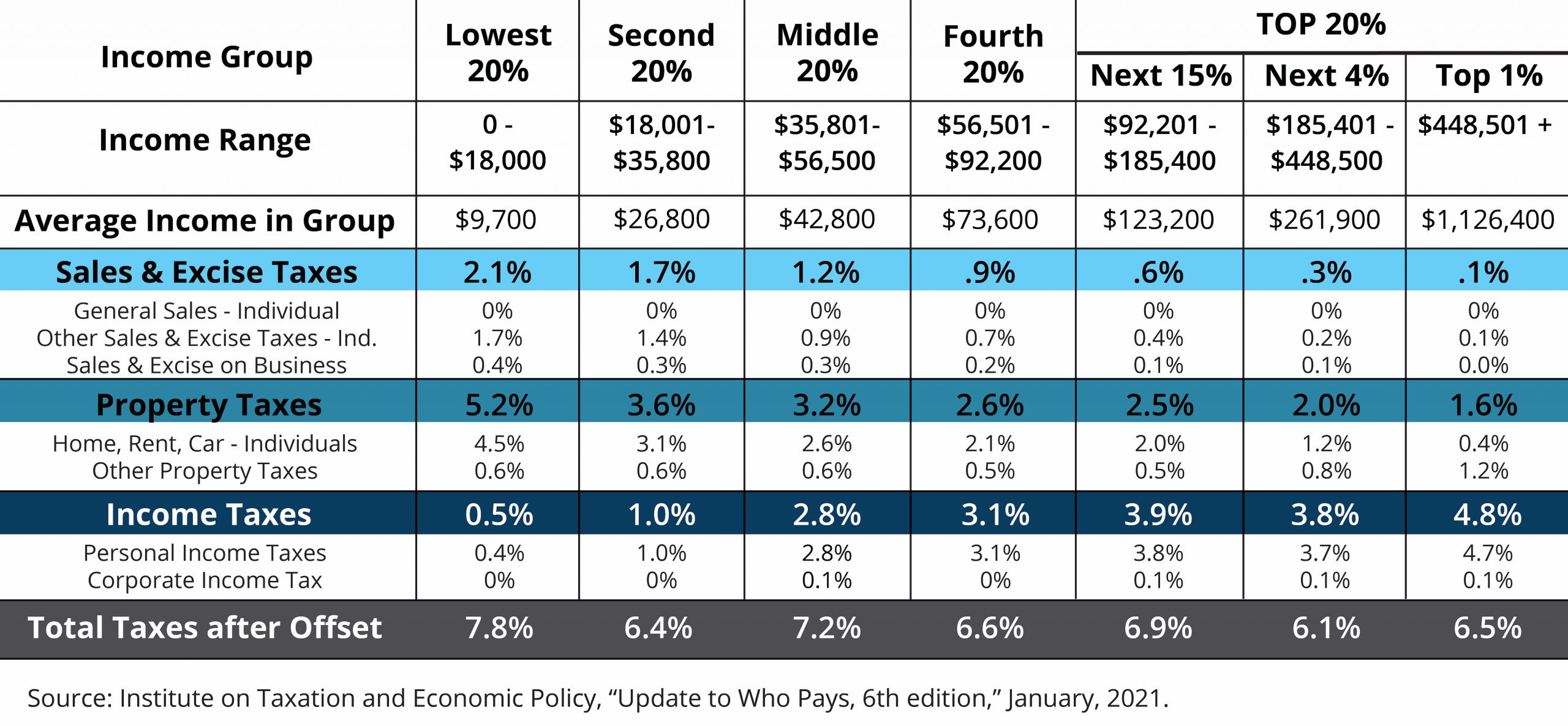

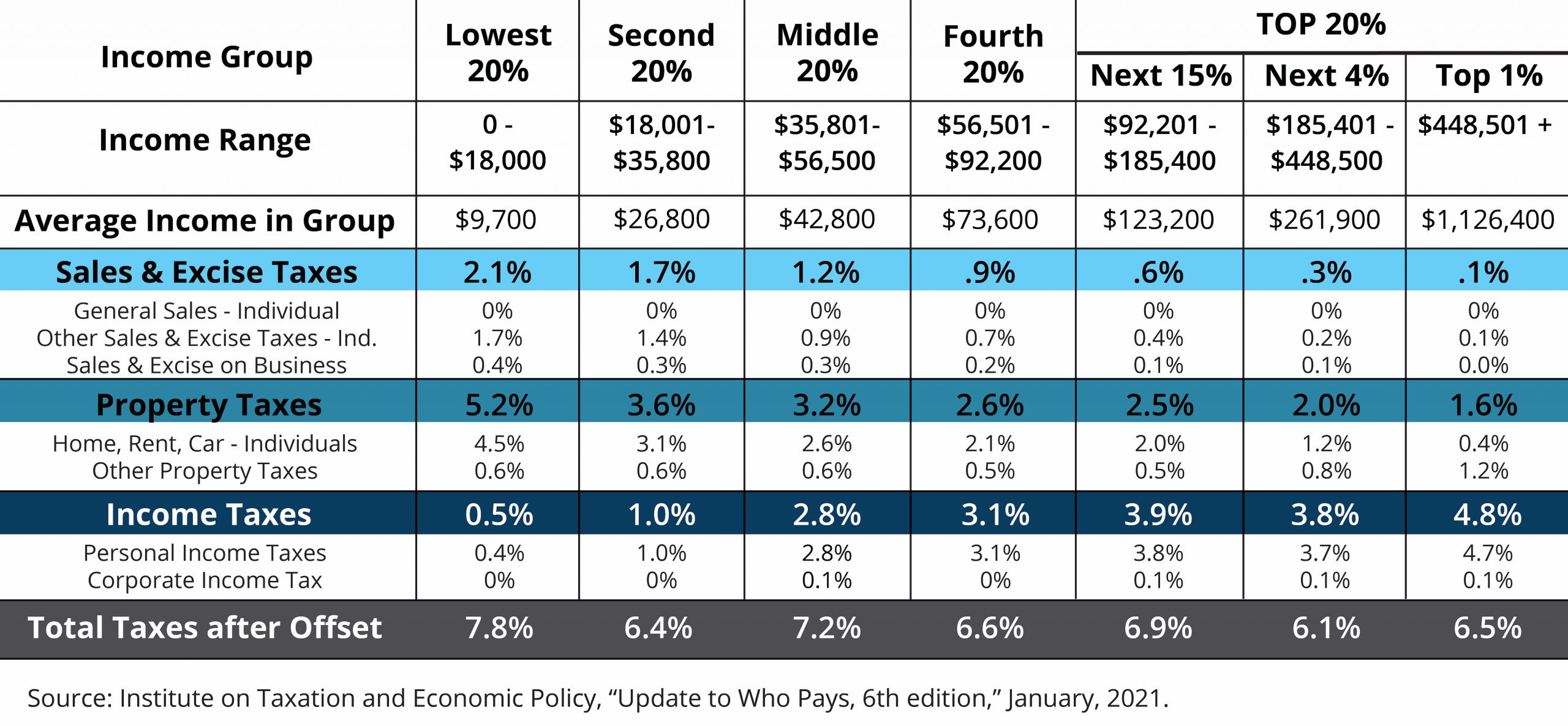

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

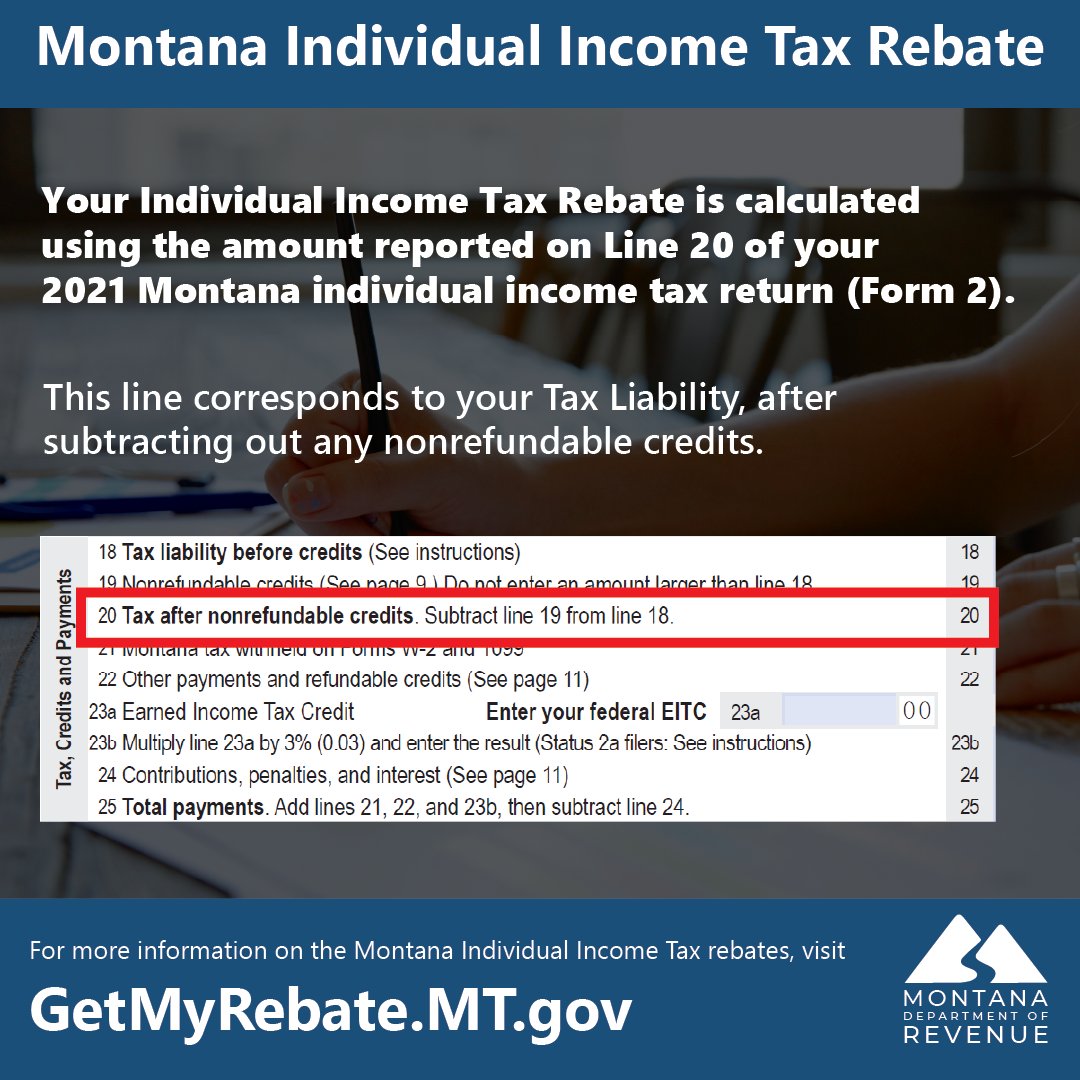

Montana Department Of Revenue On Twitter Your Individual Income Tax Rebate Is Calculated Using

When Will We Get The Extra Tax Rebate Checks In Montana Details

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Income Tax Rebate Montana 2024 - For the 2023 property tax rebate the application date will open on August 15 2024 and end on October 1 2024 If you want to learn more about these rebate programs visit the Montana Department of Revenue s webpage 2023 Montana Tax Rebates