Income Tax Rebate On Car Loan Web If the taxable profit of your business in the current year is Rs 50 lakh Rs 2 4 lakh 12 of Rs 20 lakh can be deducted from this amount So your total taxable profit for the year will be Rs 47 6 lakh after deducting the

Web 16 sept 2022 nbsp 0183 32 To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest Web 8 mars 2023 nbsp 0183 32 For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns If you pay 1 000 in interest on your

Income Tax Rebate On Car Loan

Income Tax Rebate On Car Loan

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

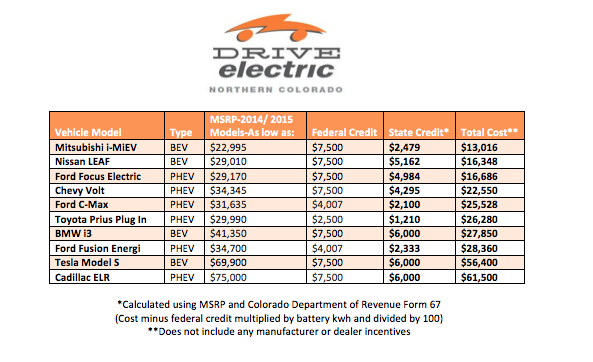

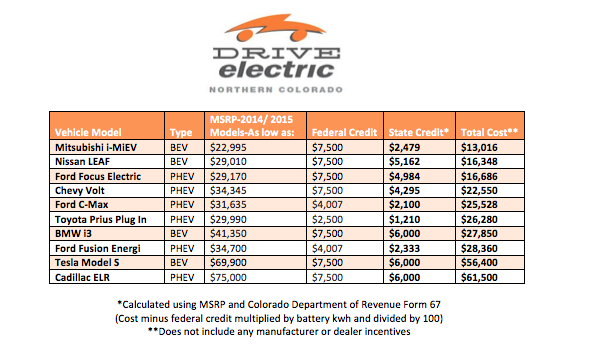

Income Tax Rebate On Electric Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/eligible-vehicles-for-tax-credit-drive-electric-northern-colorado.png

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Web Yes a Car Loan can help you save on tax if you are a self employed professional or business owner and use the car for business purposes But a salaried employee cannot Web 7 mars 2023 nbsp 0183 32 According to the IRS the average tax refund paid out so far in 2023 is around 3 079 This can make a major dent in a car down payment or paying off your current auto loan If you expect a

Web 7 janv 2023 nbsp 0183 32 Cars that qualify for 7 500 right now may only get 3 250 or no credit at all come March And the IRS is clear When it comes to the timing of a purchase it doesn t matter when you pay for a Web The car loan interest rate is 10 and the loan amount is Rs 30 Lakhs Assuming my taxable profits from my current business are Rs 80 Lakhs In this case the treatment

Download Income Tax Rebate On Car Loan

More picture related to Income Tax Rebate On Car Loan

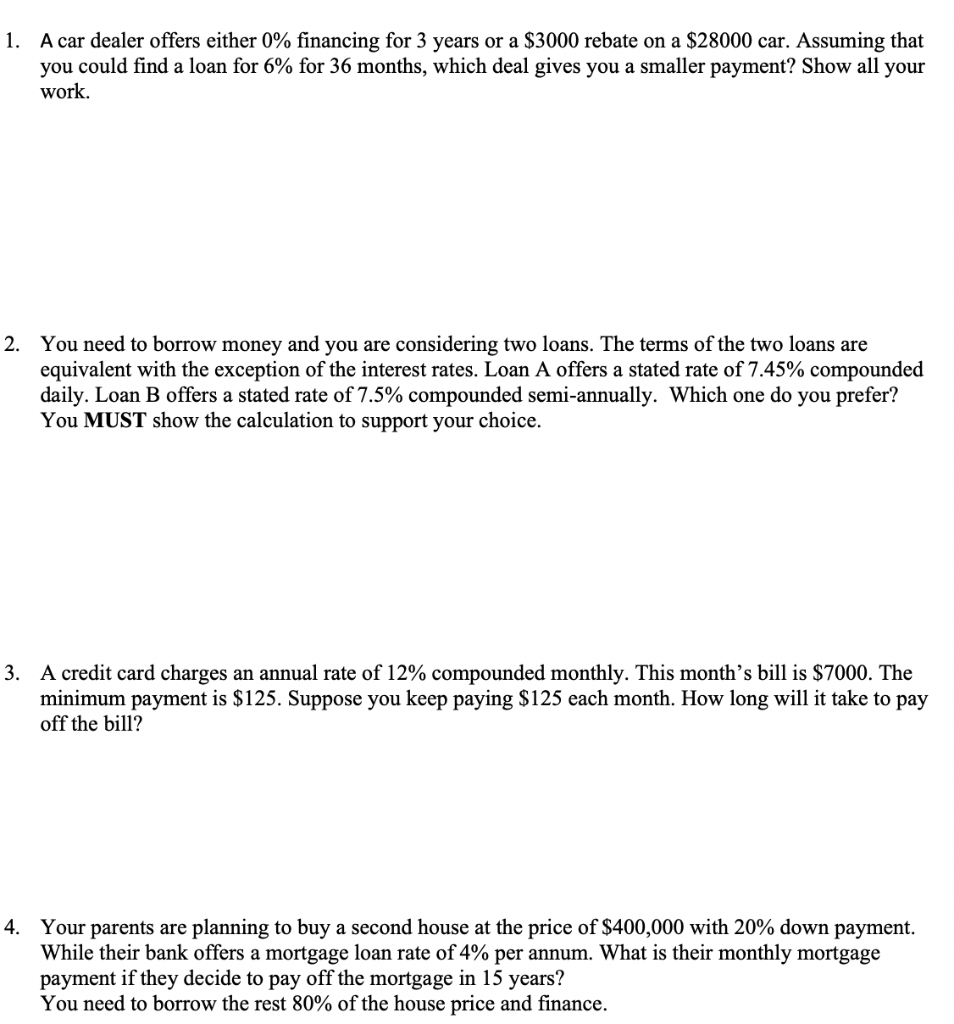

Solved A Car Dealer Offers Either 0 Financing For 3 Years Chegg

https://media.cheggcdn.com/media/af0/af04b4f8-4eac-46c7-9bde-9027d1471593/phpqbjc66.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Auto Loan Rebate Financing Comparison Calculator

https://www.carpaymentcalculator.net/images/rebate-check.jpg

Web 15 mai 2019 nbsp 0183 32 How does tax rebate on car loan work For example you own a business and have taken a loan for a car for your business For this you take a loan of Rs15 lakh Web 21 oct 2022 nbsp 0183 32 How to get an auto rebate Unlike 0 percent financing car rebates don t have any set criteria If you pick a model and trim with a rebate you qualify Search manufacturer deals on new cars

Web 23 sept 2020 nbsp 0183 32 If the IRS ever determines you re not eligible to claim car loan interest as a deduction on your income tax return you ll probably be penalized quite severely In fact Web 23 f 233 vr 2021 nbsp 0183 32 Pour inciter les conducteurs 224 se tourner vers des v 233 hicules 233 lectriques le gouvernement vient de d 233 cider que le montant des frais de d 233 placement calcul 233 s en

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Pin On Tigri

https://i.pinimg.com/originals/10/8d/67/108d67ba03bfbe29e6cc964fb355f5ea.jpg

https://www.icicibank.com/blogs/car-loan/car …

Web If the taxable profit of your business in the current year is Rs 50 lakh Rs 2 4 lakh 12 of Rs 20 lakh can be deducted from this amount So your total taxable profit for the year will be Rs 47 6 lakh after deducting the

https://www.tatacapital.com/.../income-tax-benefits-on-car-loan

Web 16 sept 2022 nbsp 0183 32 To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest

Can I Claim Ppi Back From My Catalogue

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Individual Income Tax Rebate

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

Carbon Tax Rebate 2022 Printable Rebate Form

Carbon Tax Rebate 2022 Printable Rebate Form

Income Tax Rebate Under Section 87A

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate On Car Loan - Web Is there Tax Exemption on Car Loan Cars are considered as a luxury item which is why there is no tax exemption on car loan So if you have availed a car loan then it will not