Income Tax Rebate On Commercial Property Loan Web According to Section 24 of the Income Tax Act 1961 commercial property owners who have taken a loan to buy construct repair or reconstruct can avail of a tax deduction of Rs 2 lakh on the interest

Web In this case the borrower can avail of tax deductions up to Rs 200000 These income tax benefit on loan against property is applicable on interest payments Section 37 1 If Web 30 d 233 c 2011 nbsp 0183 32 Rental income earned from both types of property are taxable under Income from House Property Section 24 of the Act provides deduction for interest paid

Income Tax Rebate On Commercial Property Loan

Income Tax Rebate On Commercial Property Loan

https://data.formsbank.com/pdf_docs_html/135/1354/135427/page_1_thumb_big.png

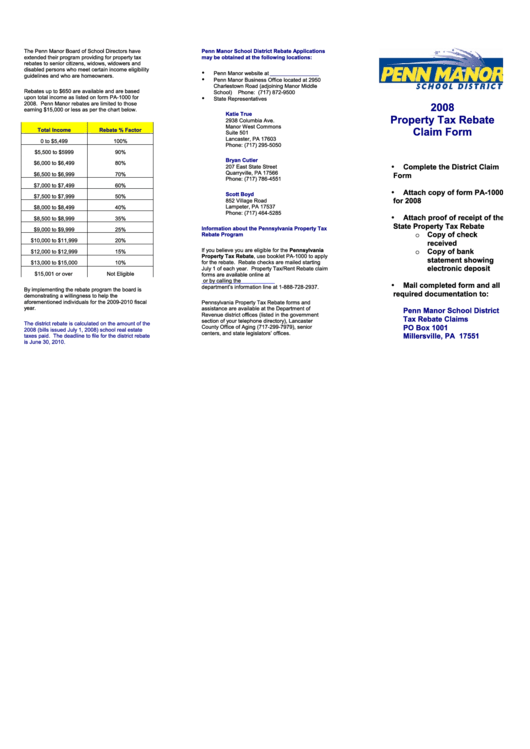

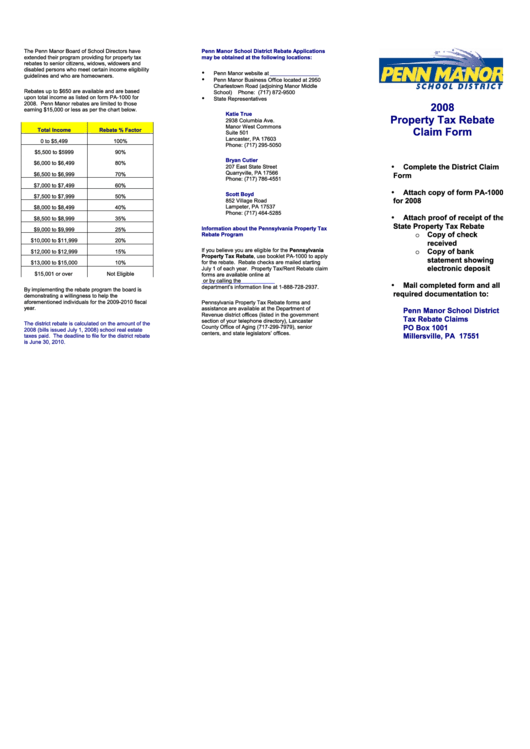

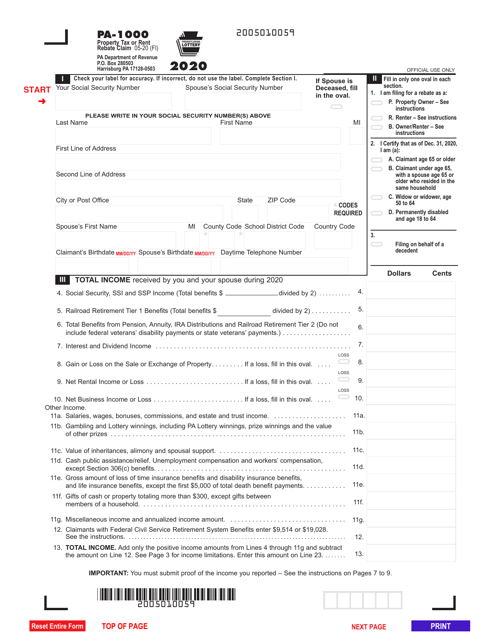

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/PA-Property-Tax-Rebate-Form-768x719.png

Web If you re using the Loan Against Property amount to fund your new residential house then you are eligible for tax deductions up to Rs 2 lakh The tax deductions are applicable on Web In computing the income under the head Income from House Property the assessee has claimed deduction of a sum of Rs 69 84 167 under section 24 b of the Income Tax

Web 25 mai 2021 nbsp 0183 32 25 May 2021 Both salaried and self employed professionals can benefit from loan against property Individuals can pledge residential or commercial properties as Web 16 f 233 vr 2023 nbsp 0183 32 Income Tax Judiciary Interest paid on loan for acquiring commercial property is fully deductible POONAM GANDHI Income Tax Judiciary Download

Download Income Tax Rebate On Commercial Property Loan

More picture related to Income Tax Rebate On Commercial Property Loan

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

https://www.pdffiller.com/preview/101/125/101125610/large.png

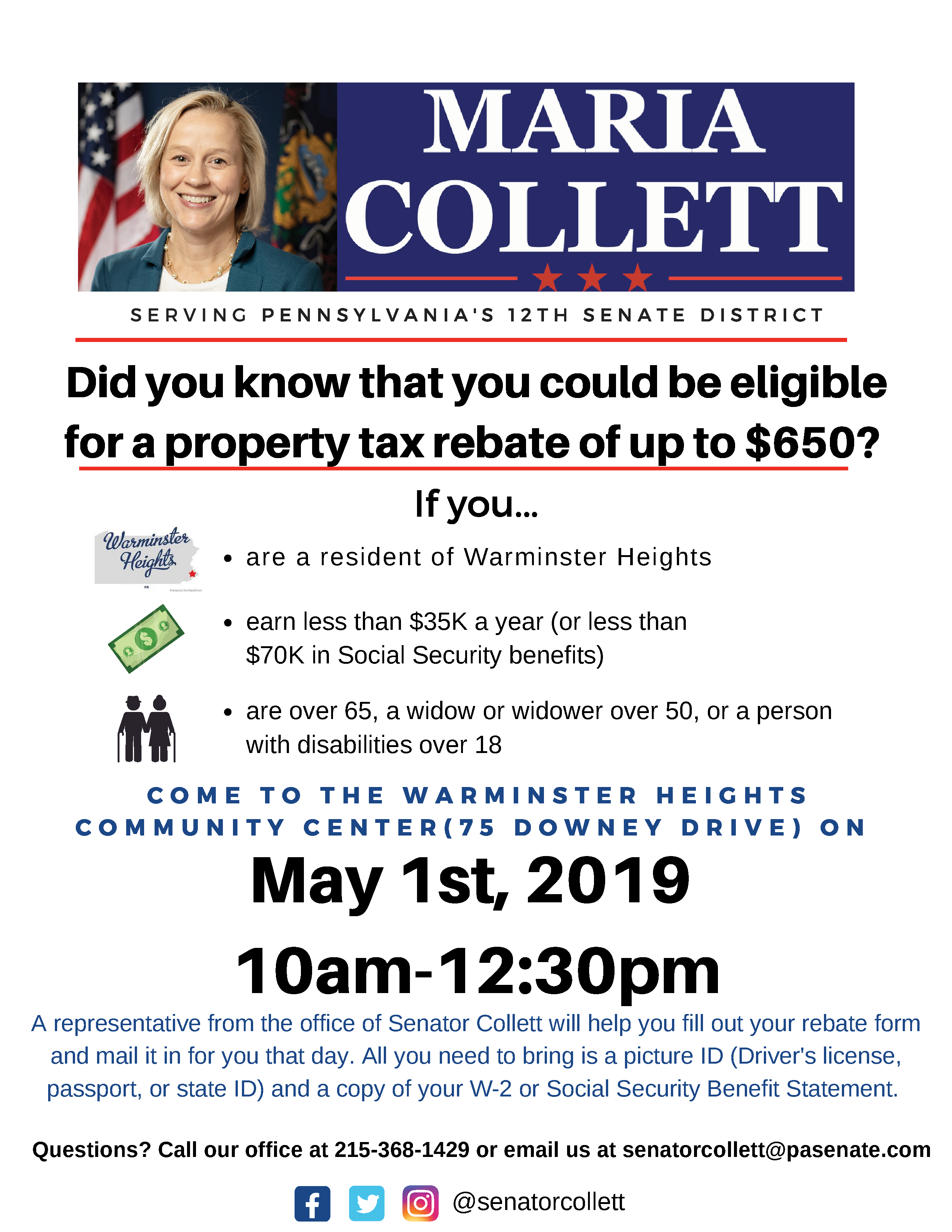

Help With Property Tax Rebate Forms click For Details Warminster

https://warminster-heights.org/wp-content/uploads/2019/04/Final-Warminster-Heights-Property-Tax-Rebate-4.png

Microfinance Loan Application Form

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21100/pa-1000-fg-2014-pa-ownerrenter-schedule-fg-d1.png

Web 19 mai 2020 nbsp 0183 32 Tax benefits available under section 80 C are only for home entity loans not for loans against property Even if you have a home loan running simultaneously there Web When you avail a business loan for shop to buy a commercial property you can claim a deduction at a flat rate of 30 of your taxable income invested in equipment and technology as well as building materials

Web 17 juil 2018 nbsp 0183 32 Section 24 b of the Income Tax Act allows you a deduction for interest on any money borrowed to buy construct or even for repair or reconstruction of a property Web 13 juin 2020 nbsp 0183 32 When the house is let out Frequently Asked Questions Section 24 of income tax act says that if any house is acquired constructed using borrowed capital Then

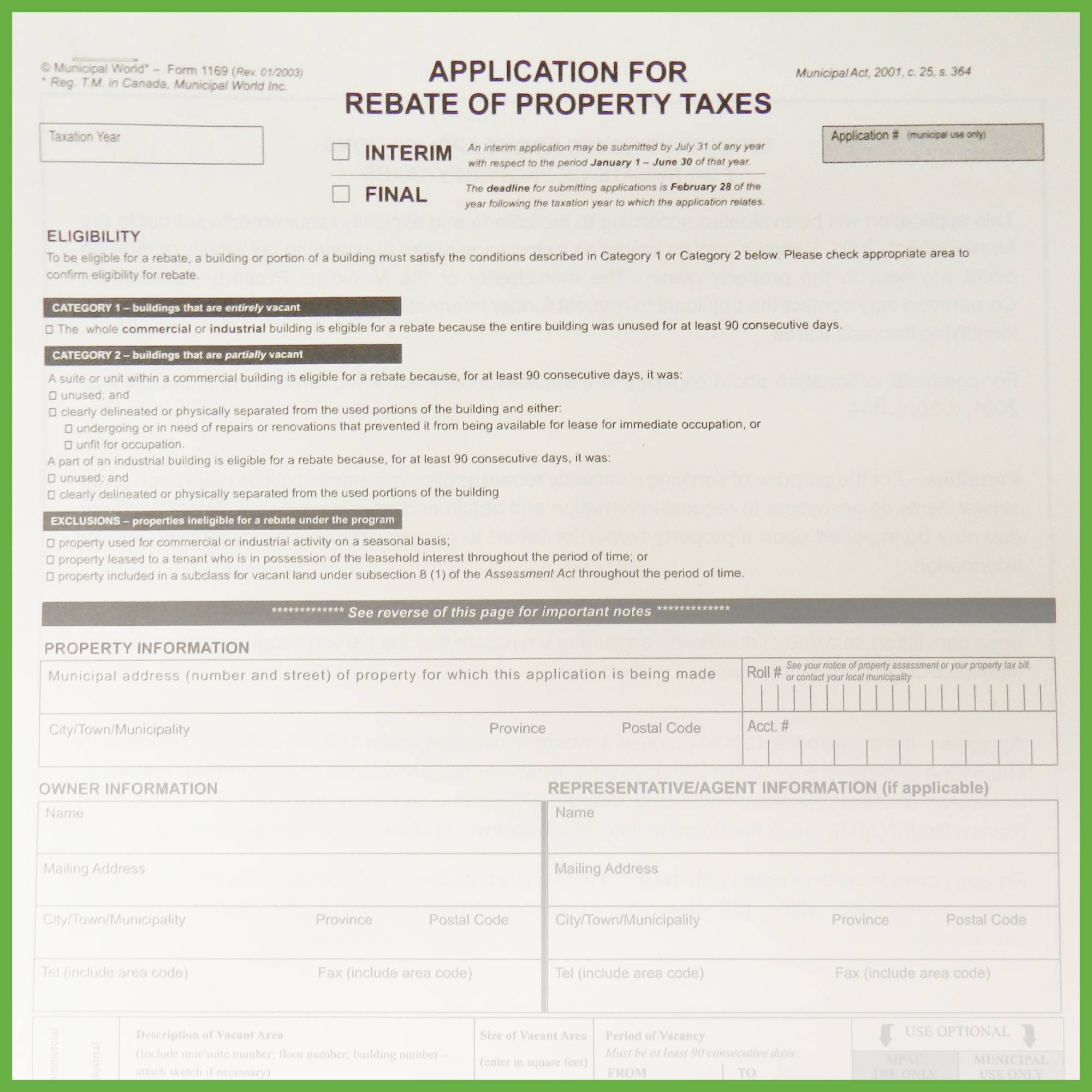

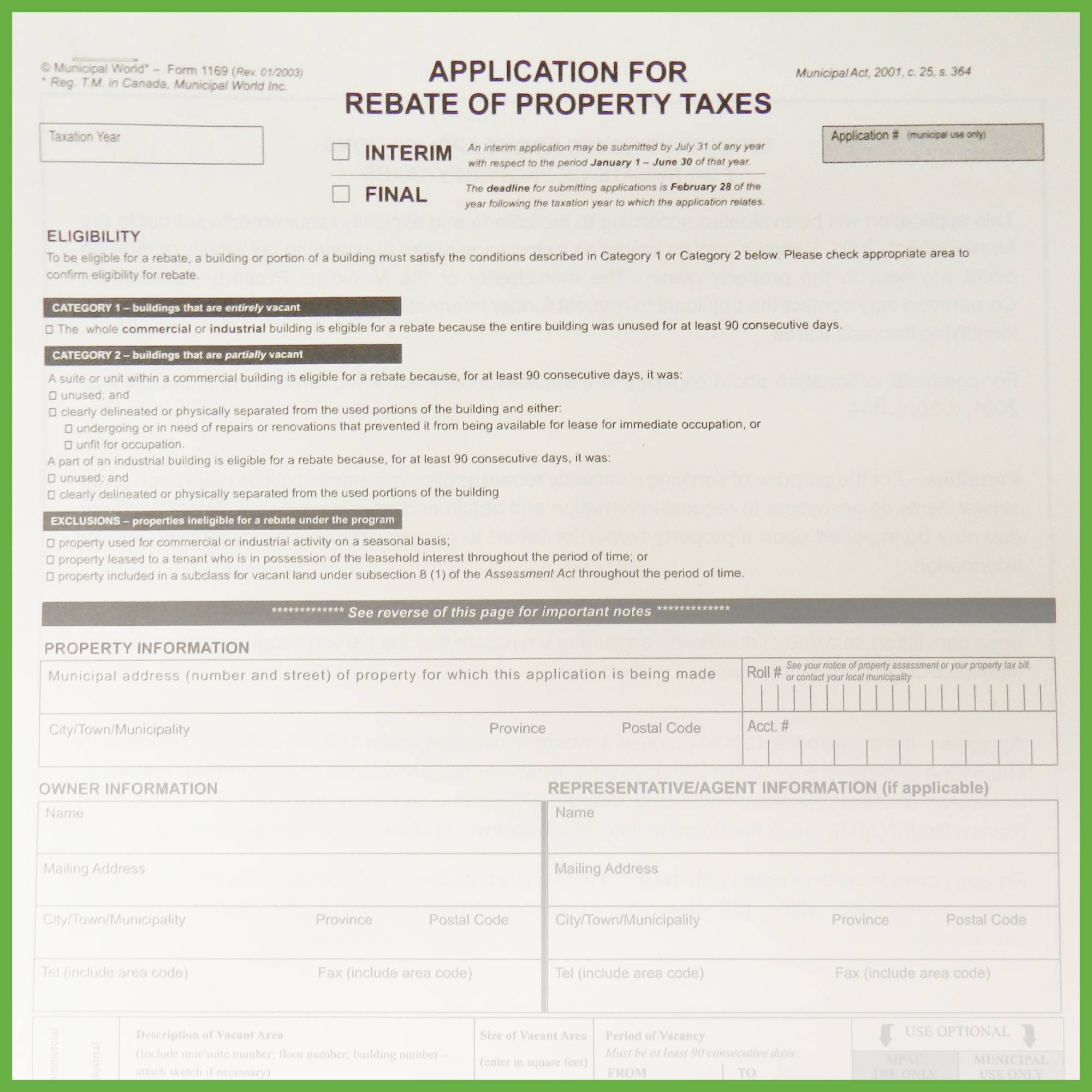

Application For Rebate Of Property Tax 2 Pages Verification Sheet

https://www.municipalworld.com/wp-content/uploads/2018/04/products-1169.jpg

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

https://www.bramhacorp.in/blog-details/how-t…

Web According to Section 24 of the Income Tax Act 1961 commercial property owners who have taken a loan to buy construct repair or reconstruct can avail of a tax deduction of Rs 2 lakh on the interest

https://www.tatacapital.com/blog/loan-on-property/what-are-the-tax...

Web In this case the borrower can avail of tax deductions up to Rs 200000 These income tax benefit on loan against property is applicable on interest payments Section 37 1 If

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Application For Rebate Of Property Tax 2 Pages Verification Sheet

Form Et 1 Pa 2019 Fill Out Sign Online DocHub

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

2021 Illinois Property Tax Rebate Printable Rebate Form

2021 Illinois Property Tax Rebate Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate On Commercial Property Loan - Web Tax Benefits on Loans There are different tax rebates for different loans These range from education loans home loans car loans and personal loans Some loans do not have