Income Tax Rebate On Donation To Political Parties Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Web 19 d 233 c 2022 nbsp 0183 32 What is Section 80GGC Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral Web 27 f 233 vr 2020 nbsp 0183 32 1 What is the Political Party 2 What is the Electoral Trust 3 Who eligible to contribute or donate to the Electoral Trust or Political Parties 4 What is the

Income Tax Rebate On Donation To Political Parties

Income Tax Rebate On Donation To Political Parties

https://i.ytimg.com/vi/sMVNp-_Y66M/maxresdefault.jpg

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

https://ebizfiling.com/wp-content/uploads/2023/05/Section-80GGC-Donation-of-Political-Parties.png

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

https://www.autospyders.com/how-to/wp-content/uploads/2022/08/Meta-App-Installer-1.jpg

Web 28 f 233 vr 2023 nbsp 0183 32 80GGC Chapter VI A Income Tax Tax Benefits Last updated on February 28th 2023 Political donations are a way for individuals to express their support for a Web 12 avr 2023 nbsp 0183 32 Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

Web Treasurer of political party any person authorised by political party in this behalf has furnished a report of donations received in excess of Rs 20 000 to Election Commission Web 10 avr 2023 nbsp 0183 32 In the last 2 weeks of March 2023 the Income Tax department has issued several notices to taxpayers who have claimed deduction under section 80GGB and 80GGC of the Income Tax Act

Download Income Tax Rebate On Donation To Political Parties

More picture related to Income Tax Rebate On Donation To Political Parties

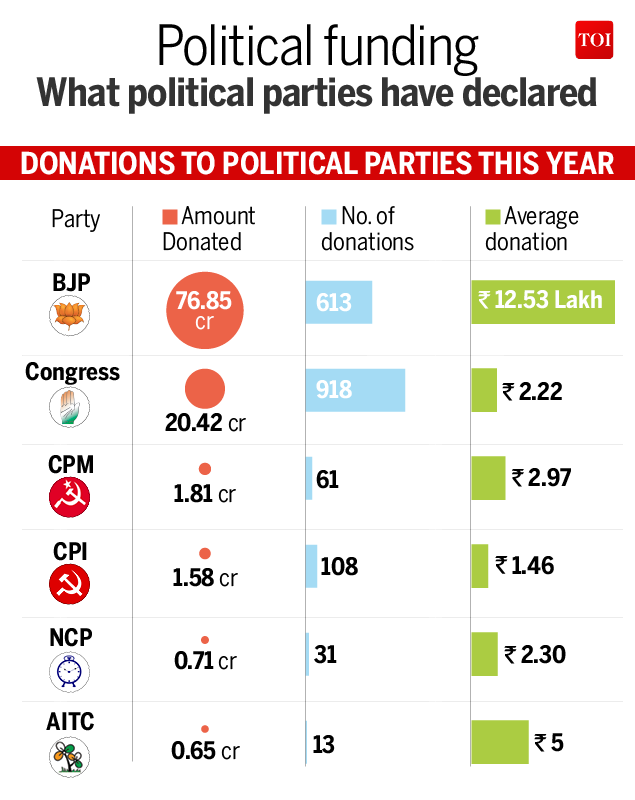

Infographic Political Parties Got Just Rs 102 02 Crore In Donations In

https://static.toiimg.com/photo/imgsize-,msid-56109025/56109025.jpg

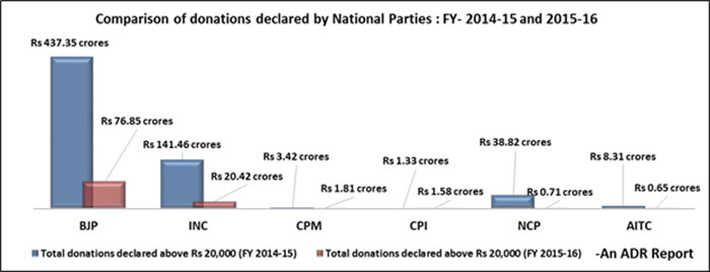

Donations To BJP Far More Than To Other Parties ADR Governance Now

http://www.governancenow.com/files/political-donation-3.jpg

How To Get Maximum Tax Rebate On Donation In USA

https://i0.wp.com/www.transparenthands.org/wp-content/uploads/2018/10/How-to-Get-maximum-Tax-rebate-on-Donation-in-USA.jpg?fit=770%2C385&ssl=1

Web You can claim a credit for the amount of contributions that you or your spouse or common law partner made in the year to a registered federal political party a registered Web 17 d 233 c 2020 nbsp 0183 32 Lorsque les dons sont effectu 233 s au profit d un parti ou d un groupement politique ils ne donnent droit 224 r 233 duction d imp 244 t que dans la limite de 7 500 euros par

Web 17 nov 2015 nbsp 0183 32 Individuals can donate money to a recognised political party or an electoral trust and claim full tax deduction To avail the tax exemption under Section 80GGC of Web 30 d 233 c 2022 nbsp 0183 32 Section 80GGC under the Income Tax Act 1961 provides tax deduction benefits on donations made by any individual to political parties subject to certain

Deduction For Donation To Political Party Section 80GGC YouTube

https://i.ytimg.com/vi/8rJWaANPLd8/maxresdefault.jpg

Report On Income And Donations Received By Political Parties

https://img.yumpu.com/16818376/1/500x640/report-on-income-and-donations-received-by-political-parties.jpg

https://tax2win.in/guide/section-80ggc

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

https://cleartax.in/s/section-80ggc-of-income-tax-act

Web 19 d 233 c 2022 nbsp 0183 32 What is Section 80GGC Section 80GGC provides for tax deductions with respect to donations made by taxpayers towards political parties or any electoral

Political Party Contributions

Deduction For Donation To Political Party Section 80GGC YouTube

BJP Top Recipient Of Donations To Political Parties In Fiscal 2015 Mint

Donation To Political Party IncomeTax Planning Goes Wrong shorts

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

Tax Rebate Digital Tax Filing Taxes Tax Services

Tax Rebate Digital Tax Filing Taxes Tax Services

Deduction For Donations Given To Political Parties FinancePost

Petition Ban Cash Donation To Political Parties Change

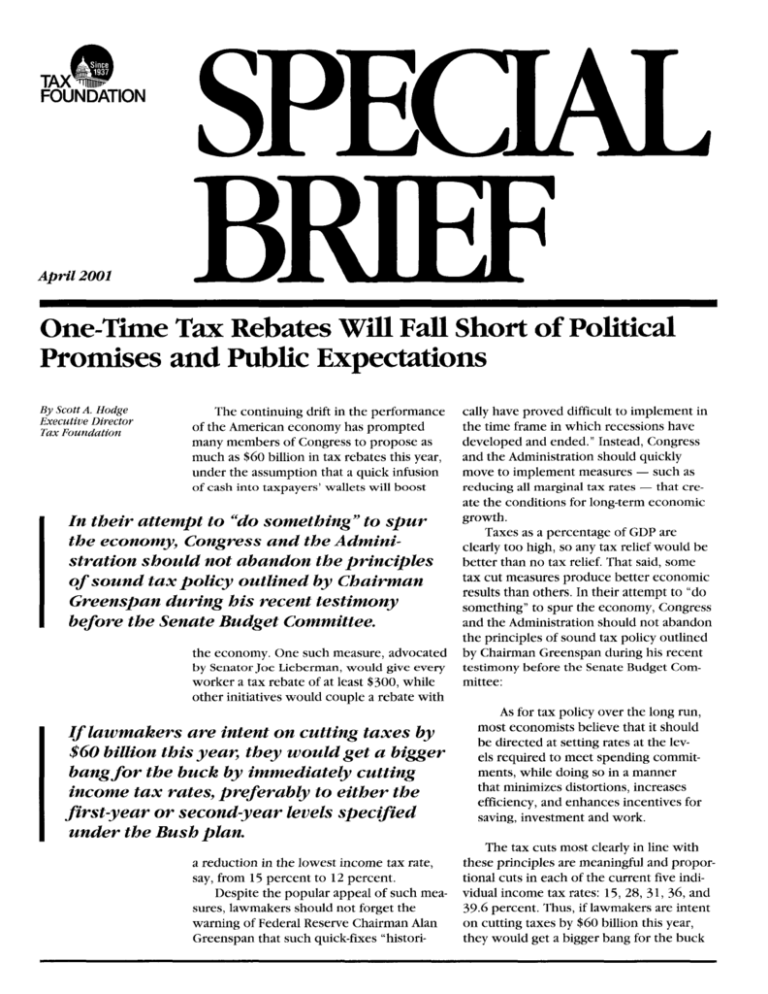

One Time Tax Rebates Will Fall Short Of Political

Income Tax Rebate On Donation To Political Parties - Web Treasurer of political party any person authorised by political party in this behalf has furnished a report of donations received in excess of Rs 20 000 to Election Commission