Income Tax Rebate On E Vehicle Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

Web 9 juil 2019 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Income Tax Rebate On E Vehicle

Income Tax Rebate On E Vehicle

https://www.carrebate.net/wp-content/uploads/2022/08/electric-vehicle-rebate-available-until-3-31-mcleod-cooperative-power-11.png

Ev Car Tax Rebate Calculator 2022 Carrebate

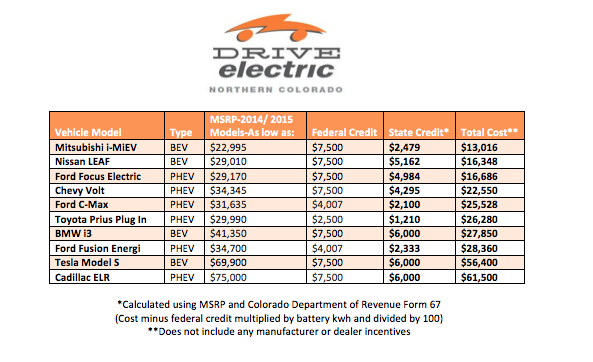

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/going-green-states-with-the-best-electric-vehicle-tax-incentives-the-9.png

Ma Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for

Web 25 juil 2023 nbsp 0183 32 They include a federal income tax credit of up to 7 500 for some new EVs And don t forget added rebates and other perks from state and local utilities While this Web 8 juil 2021 nbsp 0183 32 Here s more to Section 80EEB TAX BENEFITS on purchase of EVs In order to be eligible to claim the tax benefit the following conditions are to be fulfilled Loan

Download Income Tax Rebate On E Vehicle

More picture related to Income Tax Rebate On E Vehicle

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Income Tax Rebate On Electric Car 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/eligible-vehicles-for-tax-credit-drive-electric-northern-colorado.png

Electric Car Tax Credits And Rebates Charged Future

https://www.chargedfuture.com/wp-content/uploads/2020/03/EV-Tax-Credits-and-Rebates.jpeg

Web Income cap for EV tax credit For the most part these changes took effect on Jan 1 2023 and will remain in effect until Jan 1 2032 Always check the IRS website for updates Web Il y a 1 jour nbsp 0183 32 Car buyers also may qualify for a federal tax credit of up to 7 500 for some vehicles with income restrictions of 150 000 for individuals and 300 000 for married

Web 18 avr 2023 nbsp 0183 32 Vehicle Eligibility Vehicles must meet all of the following requirements 1 The vehicle you purchase must be listed on this website Web 7 sept 2023 nbsp 0183 32 The IRS says the manufacturers of the following EVs and PHEVs indicated that they re currently eligible for a full tax credit of 7 500 provided other requirements

Turbo Tax Rebate Info Questions Tesla Motors Club

https://i.imgur.com/cugEMRL.jpg

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

https://funnyinterestingcool.com/download/file.php?id=418

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit

https://cleartax.in/s/section-80eeb-deduction-purchase-electric-vehicle

Web 9 juil 2019 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car

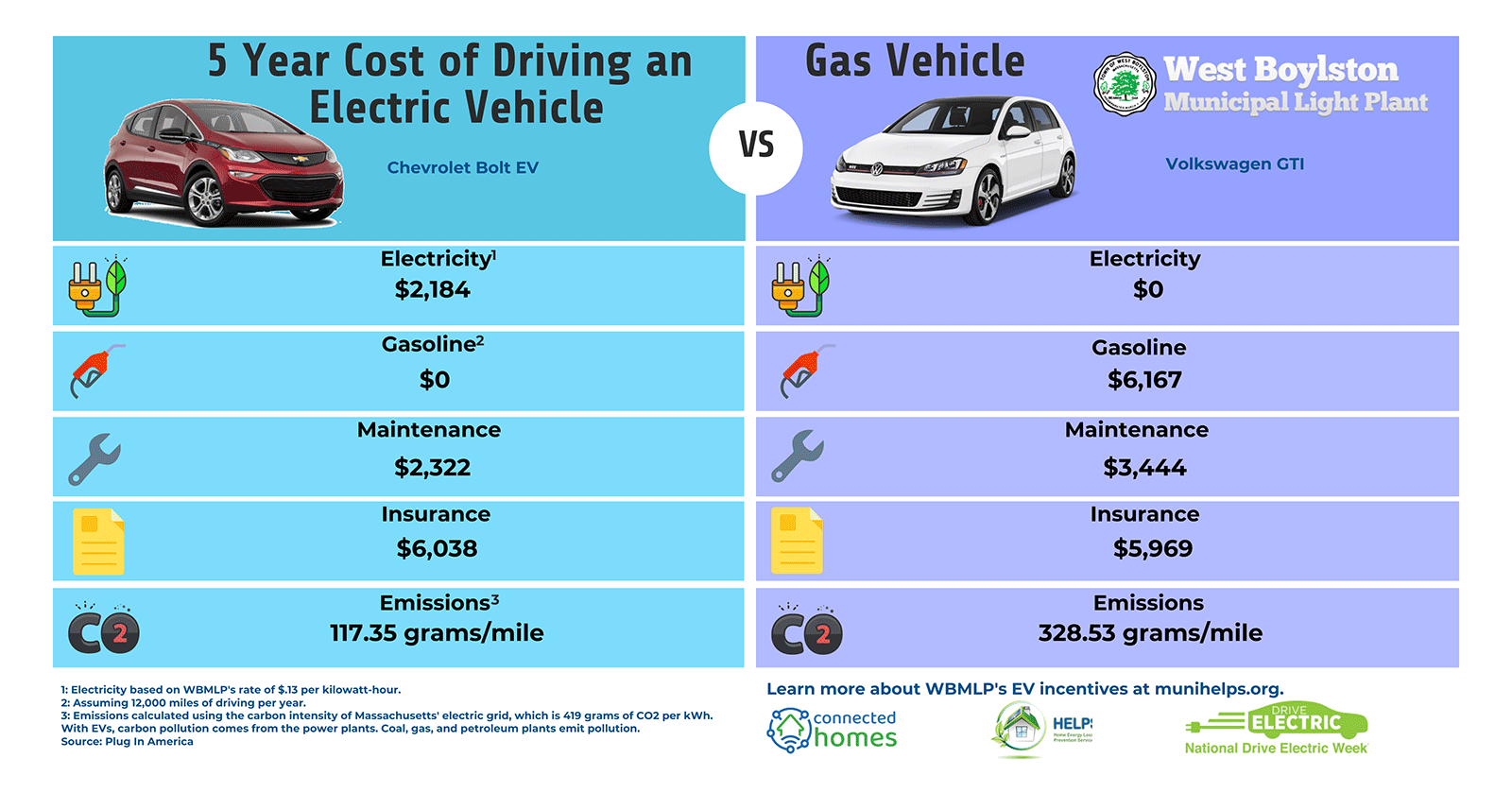

Electric Vehicle EV Incentives Rebates

Turbo Tax Rebate Info Questions Tesla Motors Club

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

Car Allowance In Australia The Complete Guide Easi

Section 87A Tax Rebate Under Section 87A

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

10

New SRO 215 Rebate On Income Motor Vehicle

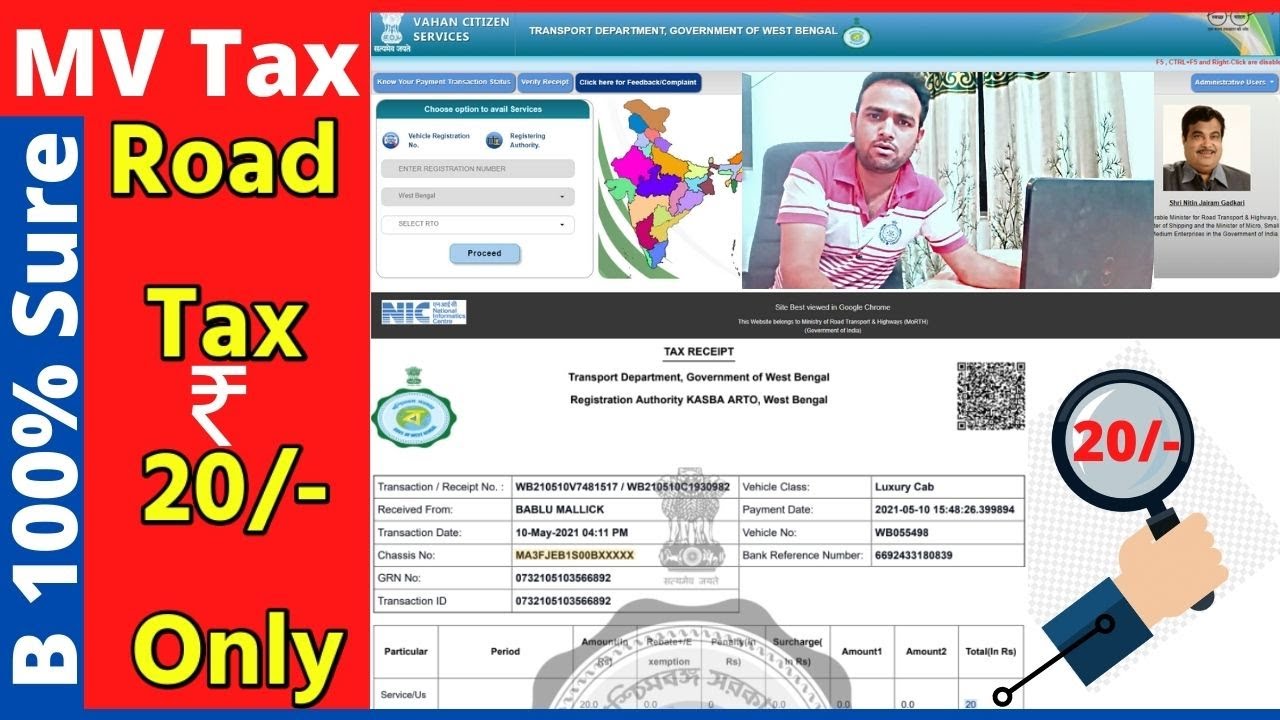

MV Tax 20 Vehicle Tax Rebate How To Pay Road Tax Online Full Process

Income Tax Rebate On E Vehicle - Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used