Income Tax Rebate On Education Fees Web Tax Benefits on Education and tuition Fees under Section 80C Which Education Fees Deductions are Available Under Income Tax Many taxpayers do not have a clear

Web 30 mars 2023 nbsp 0183 32 Tax credit can be received for 20 of the first 10 000 in eligible expenses Income Limits for 2022 and 2023 the credit starts phasing out at an increased MAGI of Web 30 mars 2023 nbsp 0183 32 There is no maximum deduction amount that can be claimed against an education loan according to Section 80 E of income tax The interest you pay on an

Income Tax Rebate On Education Fees

Income Tax Rebate On Education Fees

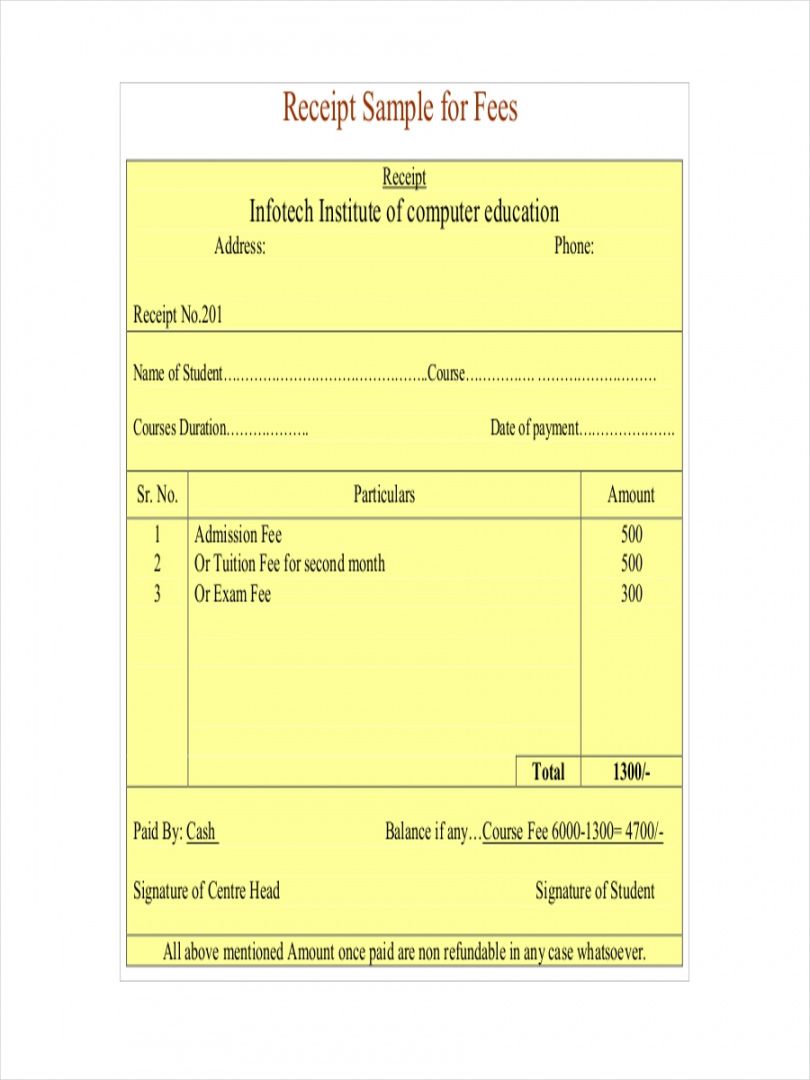

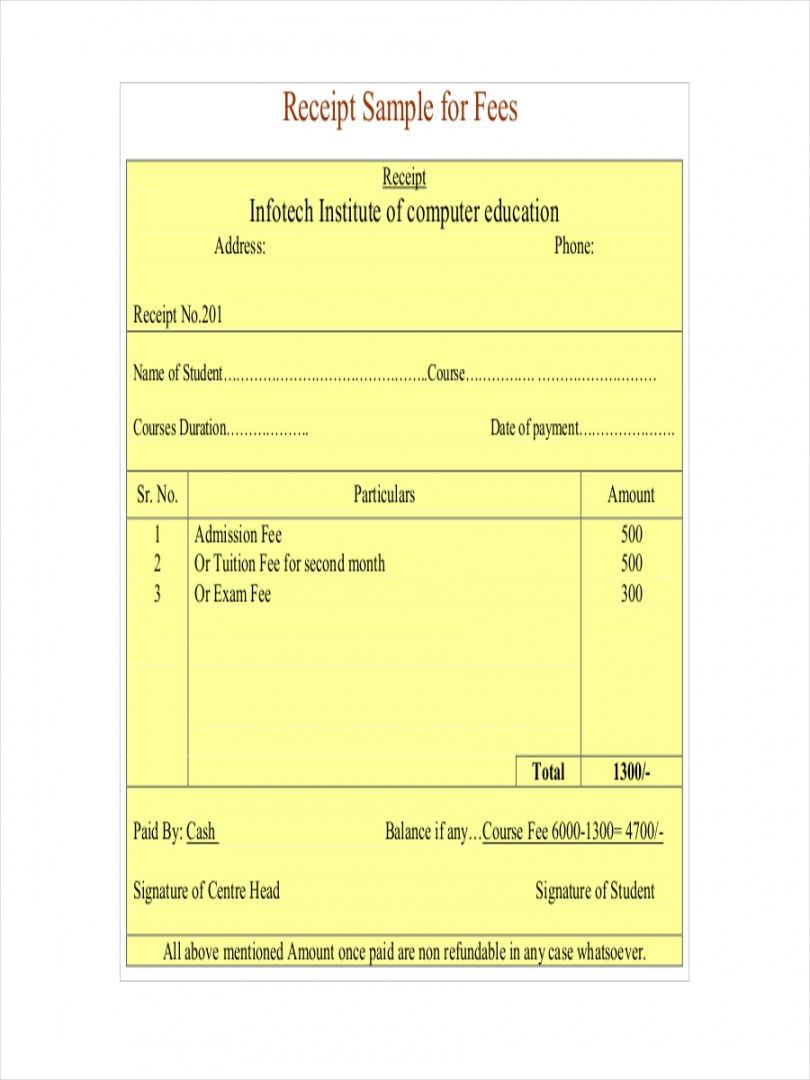

http://www.emetonlineblog.com/wp-content/uploads/2019/03/6-school-receipt-examples-samples-examples-tuition-fee-receipt-template-pdf.jpg

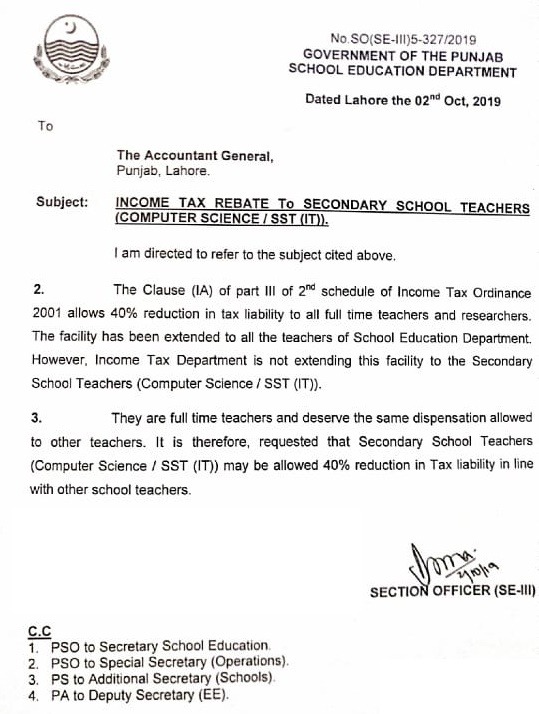

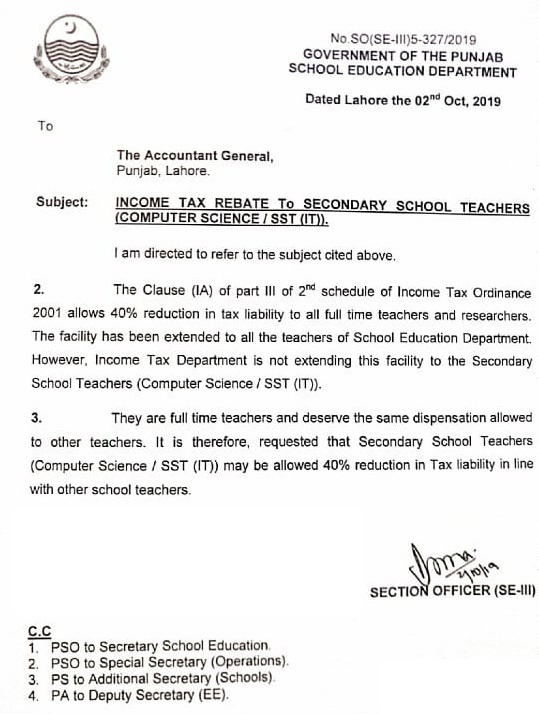

Income Tax Rebate 40 To All Teachers Of School Education Department

https://employeesportal.info/wp-content/uploads/2019/10/Income-Tax-Rebate-40-to-All-Teachers-of-School-Education-Department.jpg

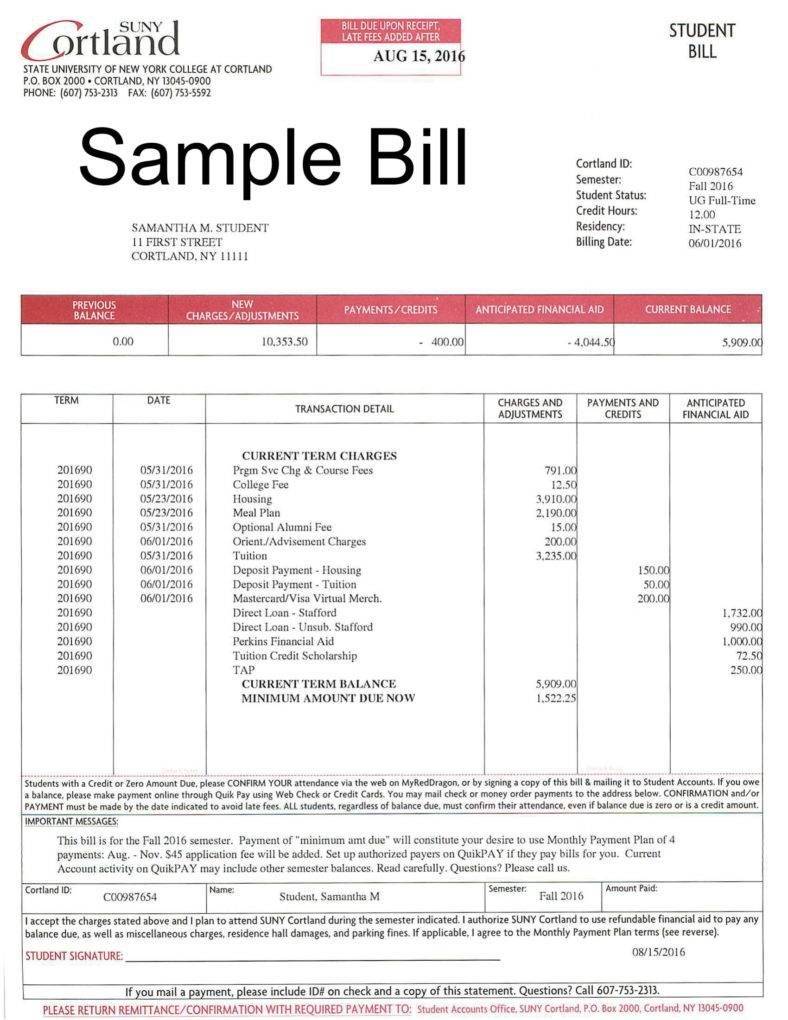

Student Progress Report Template Progress Report Template Progress

https://i.pinimg.com/originals/fc/39/15/fc3915efe8608f013942dfdd963ac382.png

Web 7 janv 2020 nbsp 0183 32 The fees should be paid to university college school or other educational institution No deduction available for fees paid for private Web If anyone receives a refund after 2022 of qualified education expenses paid on behalf of a student in 2022 and the refund is paid before you file an income tax return for 2022 the amount of qualified education

Web If the children don t have any additional income or earnings they ll be able to use their personal tax allowance which stands at 163 12 570 per year for 2023 24 Assets like Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children

Download Income Tax Rebate On Education Fees

More picture related to Income Tax Rebate On Education Fees

Province Of Manitoba Tuition Fee Income Tax Rebate

http://www.gov.mb.ca/asset_library/en/tuition/header-tuition-fee.jpg

Education Rebate Income Tested

https://i2.wp.com/assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-768x402.png

Get Our Example Of School Fee Receipt Template Receipt Template

https://i.pinimg.com/originals/f7/f7/52/f7f752988740aa3845fc00fd89d85a79.jpg

Web 3 juil 2023 nbsp 0183 32 Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other Web 7 sept 2023 nbsp 0183 32 These can include tuition fees education and textbook amounts interest paid on student loans and moving expenses Tuition credit If you are 16 years or older

Web 17 f 233 vr 2017 nbsp 0183 32 Therefore if an individual opts for the new tax regime in current FY 2022 23 ending on March 31 2023 then s he will not be able to claim the commonly availed Web 22 juil 2019 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Excellent School Fee Receipt Template In Html Cheap Receipt Templates

https://images.template.net/wp-content/uploads/2018/05/Sample-Tuition-Bill-Receipt-788x1020.jpg

https://www.policybazaar.com/income-tax/income-tax-deduction-on-the...

Web Tax Benefits on Education and tuition Fees under Section 80C Which Education Fees Deductions are Available Under Income Tax Many taxpayers do not have a clear

https://20somethingfinance.com/education-tax-credits-deductions

Web 30 mars 2023 nbsp 0183 32 Tax credit can be received for 20 of the first 10 000 in eligible expenses Income Limits for 2022 and 2023 the credit starts phasing out at an increased MAGI of

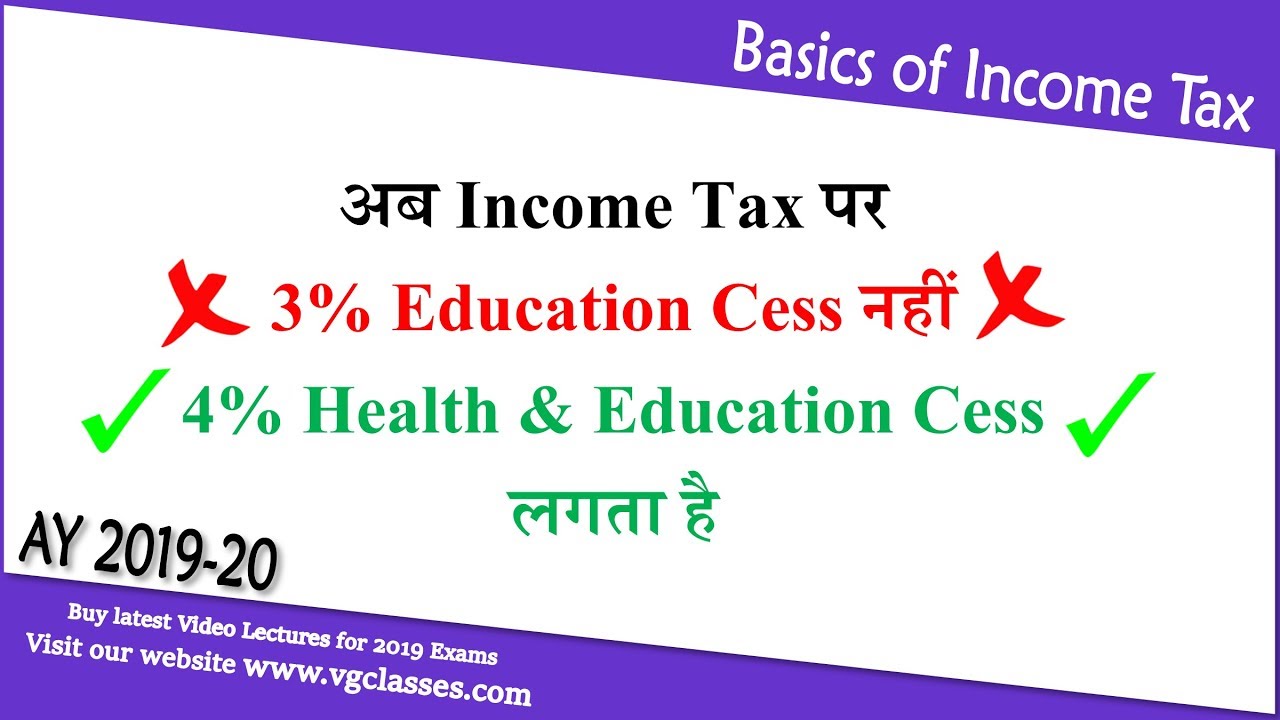

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Individual Income Tax Rebate

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Section 87A Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

More Tax Credits More Rebates Education Magazine

Income Tax Rebate On Education Fees - Web Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children