Income Tax Rebate On Education Loan In India Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

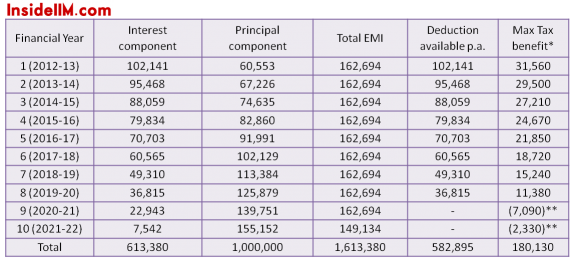

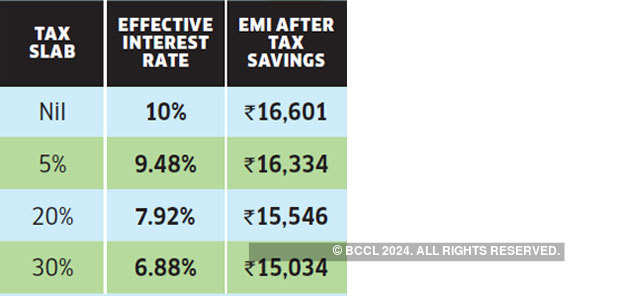

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education

Income Tax Rebate On Education Loan In India

Income Tax Rebate On Education Loan In India

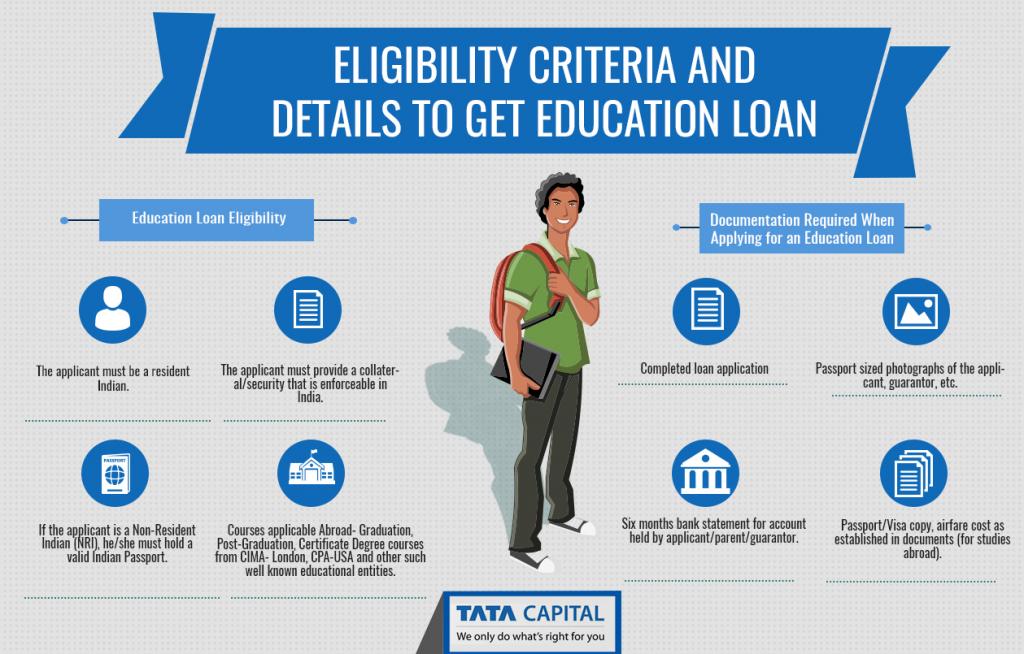

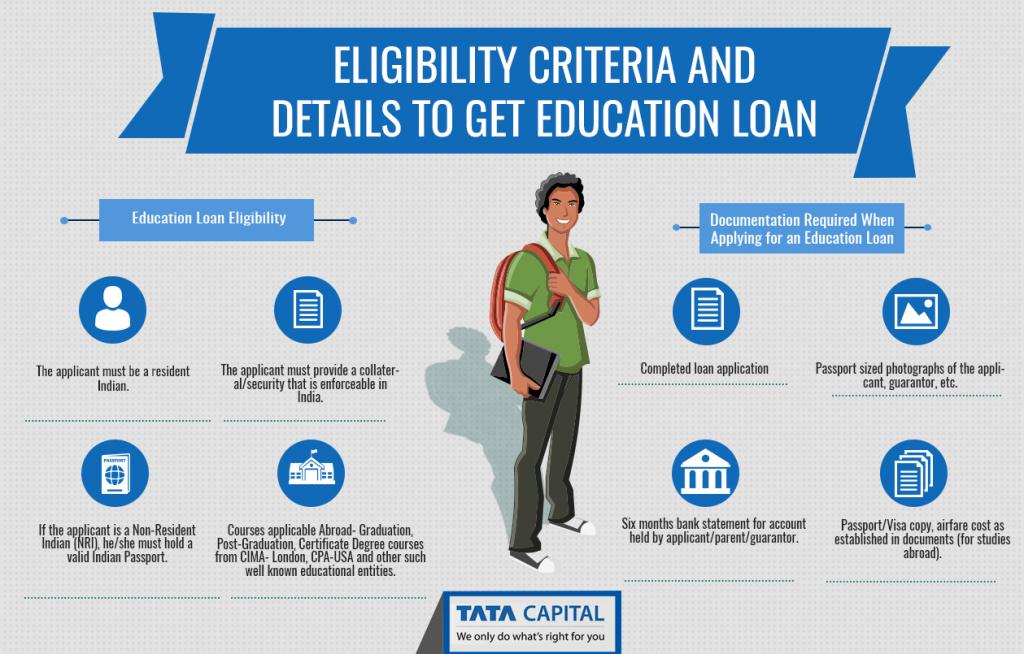

https://onlinemacha.com/wp-content/uploads/2017/09/20170814021818_Info-2_Eligibility-Criteria-and-Details-to-get-Education-Loan.jpg

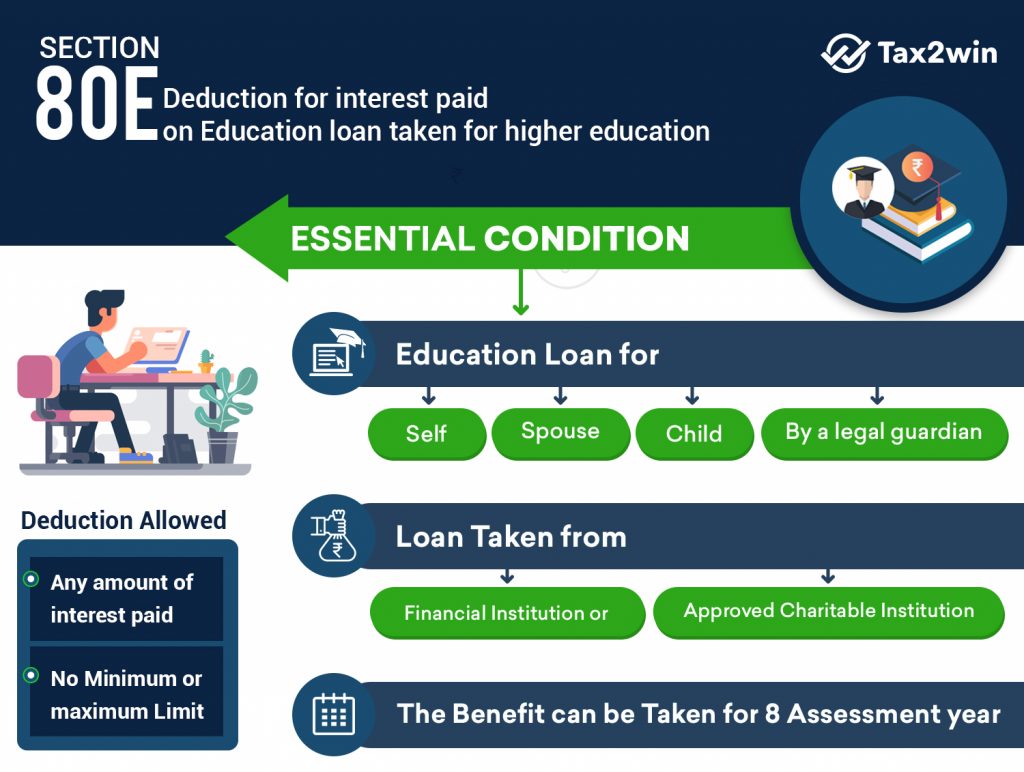

Income Tax Deduction On Education Loan 80E CAGMC

https://www.cagmc.com/wp-content/uploads/2020/05/Section-80E-_-Income-Tax-Deduction-on-Education-loan-1-1024x538.png

Section 80E Deduction For Interest On Education Loan Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80E-Deduction-for-interest-paid-on-loan-taken-for-higher-education-1024x772.jpg

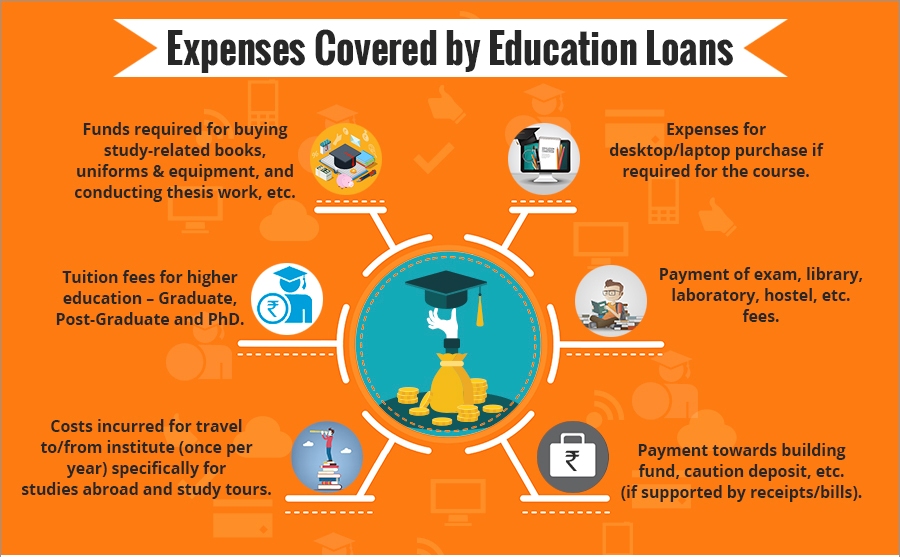

Web 16 f 233 vr 2021 nbsp 0183 32 The Income Tax Act sets no maximum limits on the tax benefits However students can only obtain tax benefits from the interest paid on the education loan Web 25 ao 251 t 2022 nbsp 0183 32 Apart from funding your higher education costs an education loan offers excellent tax benefits No matter if you are a student or a parent you can reduce your

Web 5 avr 2023 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to

Download Income Tax Rebate On Education Loan In India

More picture related to Income Tax Rebate On Education Loan In India

Education Rebate Income Tested

https://i2.wp.com/www.manitoba.ca/asset_library/en/edupropertytax/school-taxes.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

Web 12 janv 2023 nbsp 0183 32 A maximum deduction of up to Rs 40 000 can be availed under Section 80E While availing deduction under section 80E the taxpayer must obtain a certificate from Web This article will cover all the education loan subsidy schemes in India Read the article till the end to gain a clear insight on the schemes features eligibility criteria etc Types of Education Loan Subsidy Schemes

Web 19 juin 2023 nbsp 0183 32 Tax Benefits on Education Loan When you start repaying the education loan the interest segment you pay towards the loan every month can be used to claim Web 23 f 233 vr 2018 nbsp 0183 32 According to Section 80E of the Income Tax Act 1961 the interest paid on the education loan can be claimed as deduction This special deduction is also allowed

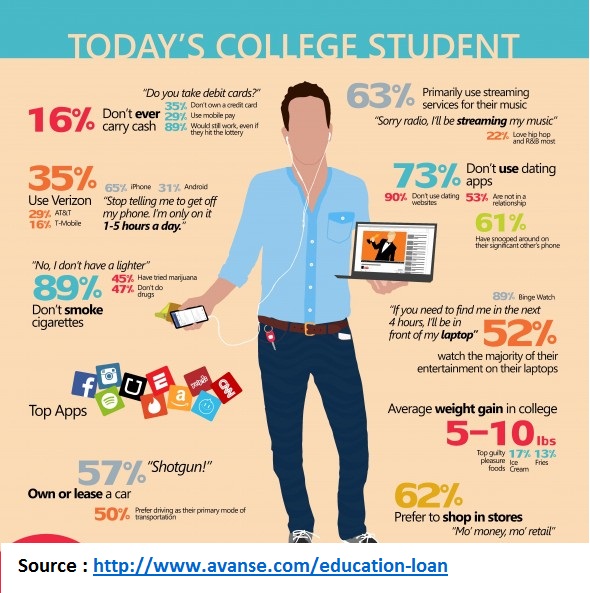

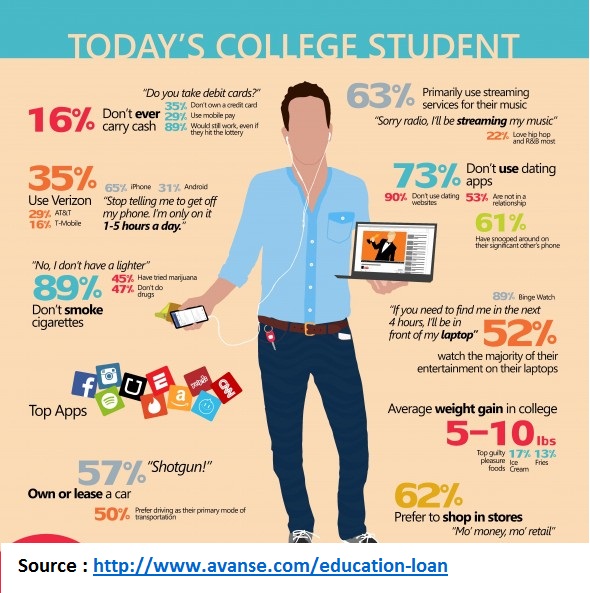

Today s College Student Education Loans In India

https://educationloansinindia.files.wordpress.com/2016/08/student-loan-in-india.jpg?w=700

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 Less Interest paid Deduction u s 80E Rs 1 00 000 Net Taxable Income Rs 5 00 000 The interest paid Rs 1 00 000 on education loan is deducted from the

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Today s College Student Education Loans In India

All You Need To Know About Tax Benefits On Education Loan Interest

Education Loan Tax Benefits How Education Loan Can Help Your Child

Bank Of India Education Loan Interest Rate 2018 Loan Walls

PPT Education Loan In India PowerPoint Presentation Free Download

PPT Education Loan In India PowerPoint Presentation Free Download

Education Loan Jain Finance

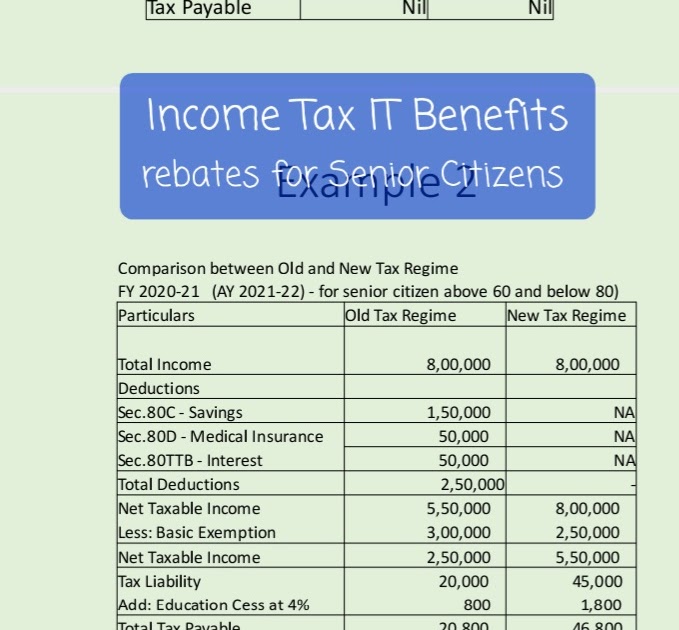

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Education Loan In India - Web Tax benefits in India Section 80E of the Income Tax Act 1961 allows some tax benefits for a loan taken for higher education Since the entire interest can be deducted the