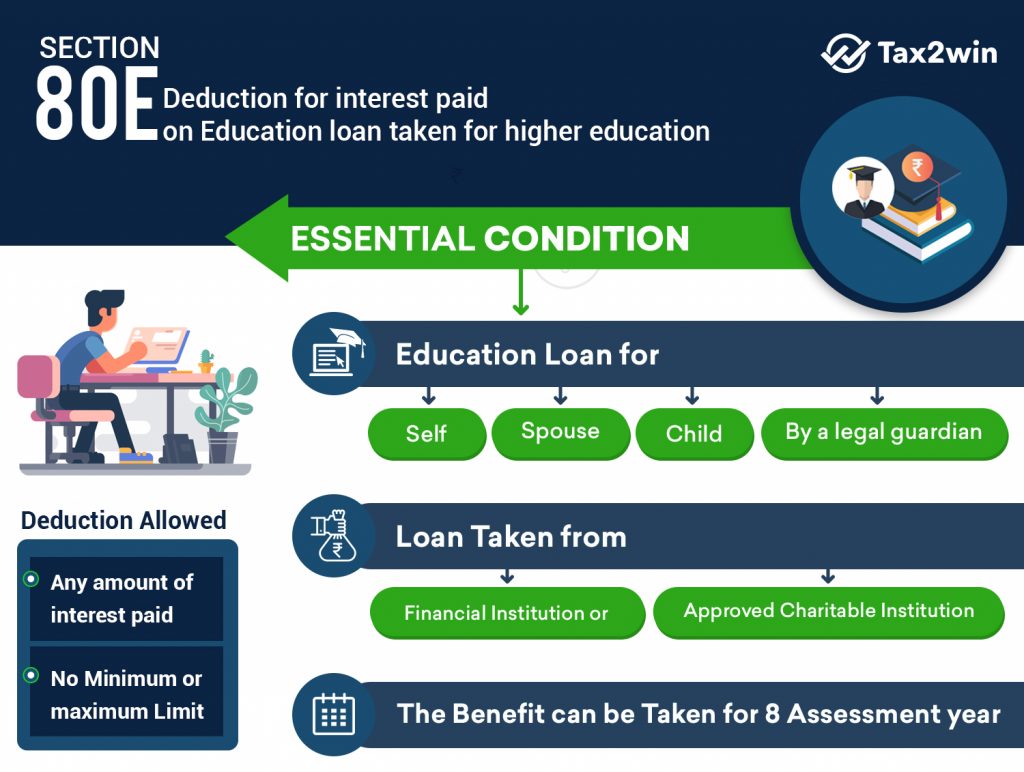

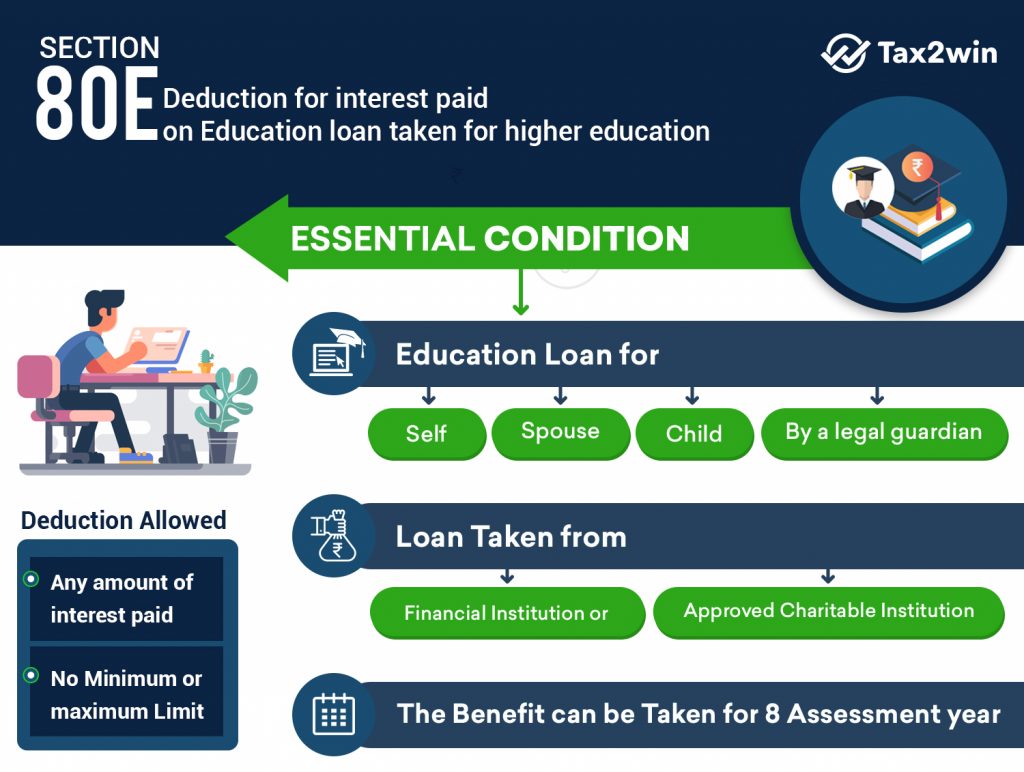

Income Tax Rebate On Education Loan Repayment Web 23 f 233 vr 2018 nbsp 0183 32 There is no upper limit 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is

Web Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings Web 12 avr 2019 nbsp 0183 32 An education loan not only funds higher studies but also provides tax benefit on Student loan Under Section 80E of the Income Tax Act the interest part of the loan

Income Tax Rebate On Education Loan Repayment

Income Tax Rebate On Education Loan Repayment

https://s3.amazonaws.com/newamericadotorg/original_images/income-based-repayment-cost_image.jpeg

What Does Rebate Lost Mean On Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

What Is An Income based Repayment IBR Student Loan Repayment Plan

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2020/11/25180439/image4-2-768x402.png

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is Web 10 ao 251 t 2023 nbsp 0183 32 Section 80E Education Loan operates as special criteria under the Income Tax Act of India It is an education loan tax exemption which means that it deducts not

Web 25 janv 2023 nbsp 0183 32 You can still receive 40 of the American opportunity tax credit s value up to 1 000 even if you earned no income last year or owe no tax For example if you qualified for a refund this Web 31 ao 251 t 2023 nbsp 0183 32 With a starting debt balance of 26 946 the average among borrowers when they graduate according to the National Center for Education Statistics you would pay

Download Income Tax Rebate On Education Loan Repayment

More picture related to Income Tax Rebate On Education Loan Repayment

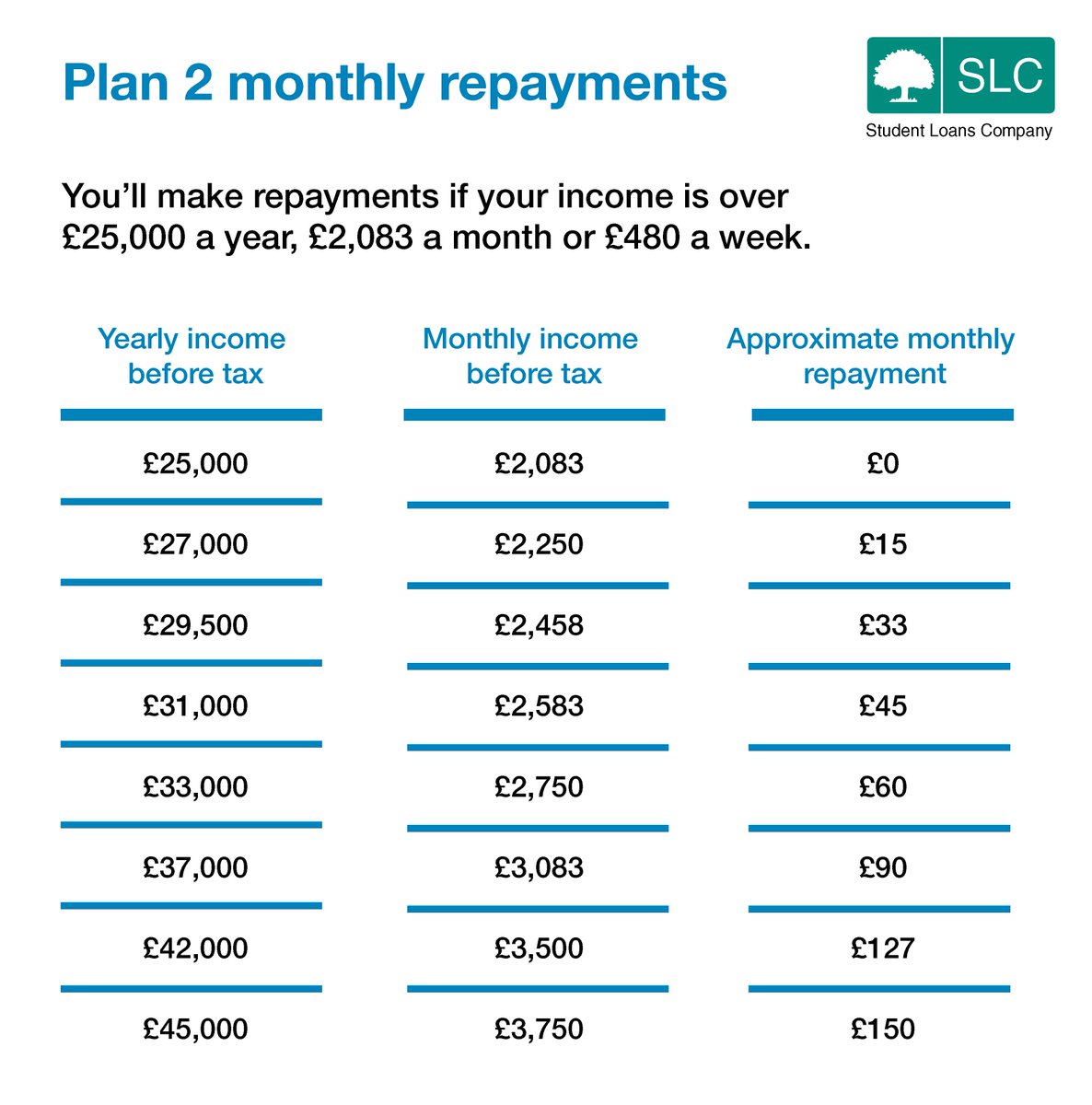

Student Loan Repayment Options Can You Make Repayments During Your

https://i.imgur.com/4K2huRD.png

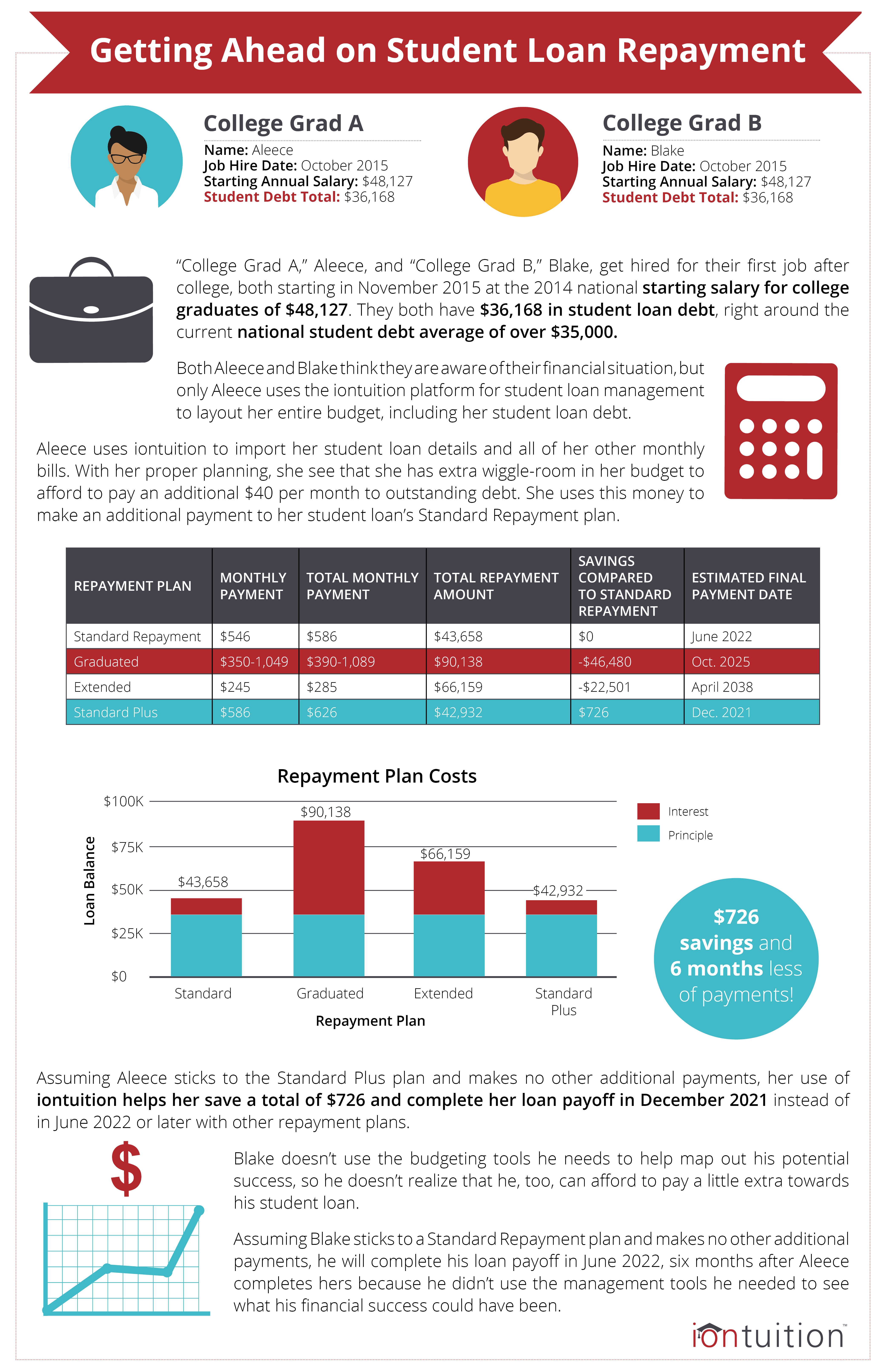

Student Loan Repayment Scenario infographic IonTuition Student Loan

https://s28637.pcdn.co/wp-content/uploads/2016/02/Student-Loan-Repayment-Scenario_infographic.png

Can Student Loan Payments Be Deducted From Taxes Tax Walls

https://pbs.twimg.com/media/Dc5zw1RXUAMEbYB.jpg

Web 16 f 233 vr 2022 nbsp 0183 32 Student loan borrowers can deduct up to 2 500 spent on student loan interest each tax year To qualify for the student loan interest deduction you need to Be legally obligated to make the payments Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Web 31 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law Web The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget FY 20 21 How long is your course in months Total Loan Amount

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

https://www.cakartikmjain.com/wp-content/uploads/2020/06/education-loan-tax-benefits.jpg

Education Loan Tax Deduction Benefits Tax Benefits On Educational Loans

https://financegradeup.com/wp-content/uploads/2020/03/Education-Loan-Tax-Deduction.jpg

https://www.ndtv.com/business/income-tax-benefit-on-education-loan...

Web 23 f 233 vr 2018 nbsp 0183 32 There is no upper limit 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is

https://www.irs.gov/publications/p970

Web Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Establish and contribute to a Coverdell education savings

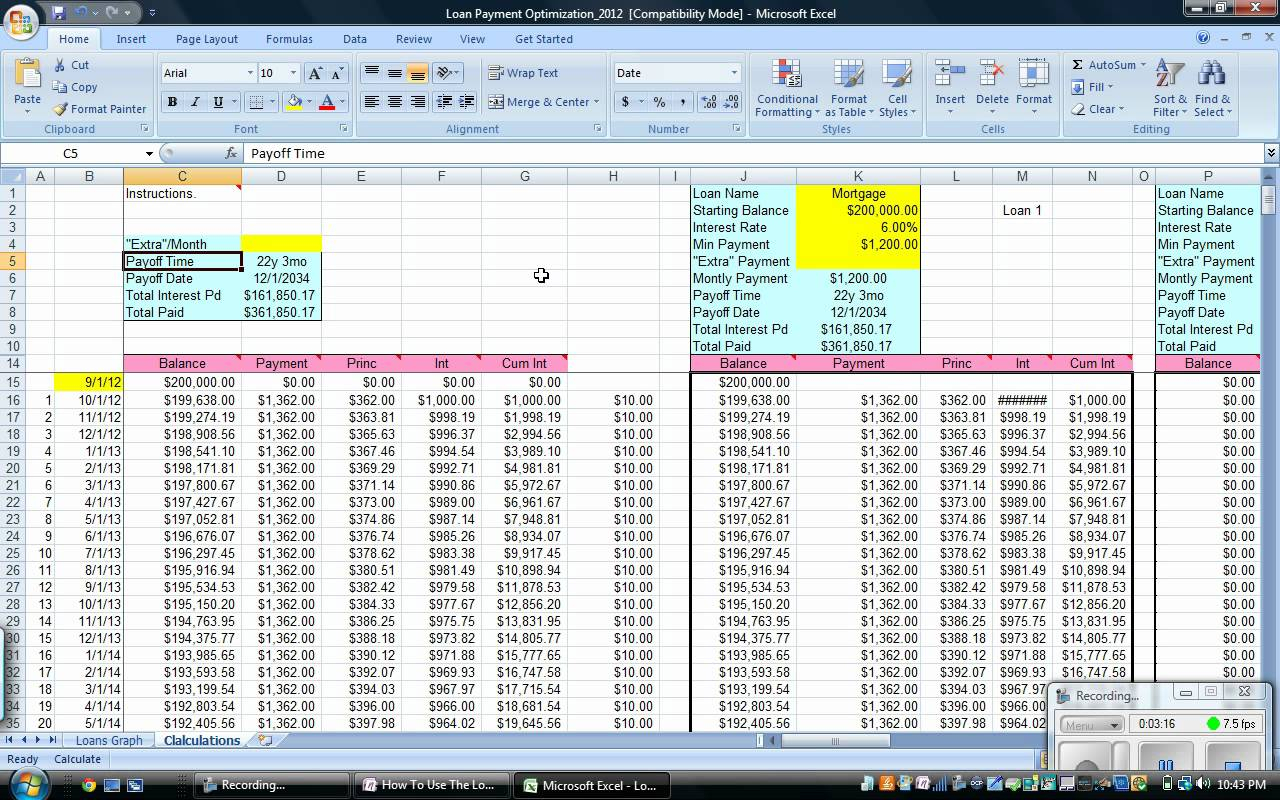

FREE 15 Loan Schedule Samples In MS Word MS Excel Pages Numbers

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

Educate Yourself About Loan Repayments For College Loans Direct

Student Loan Excel Sheet Studentqw

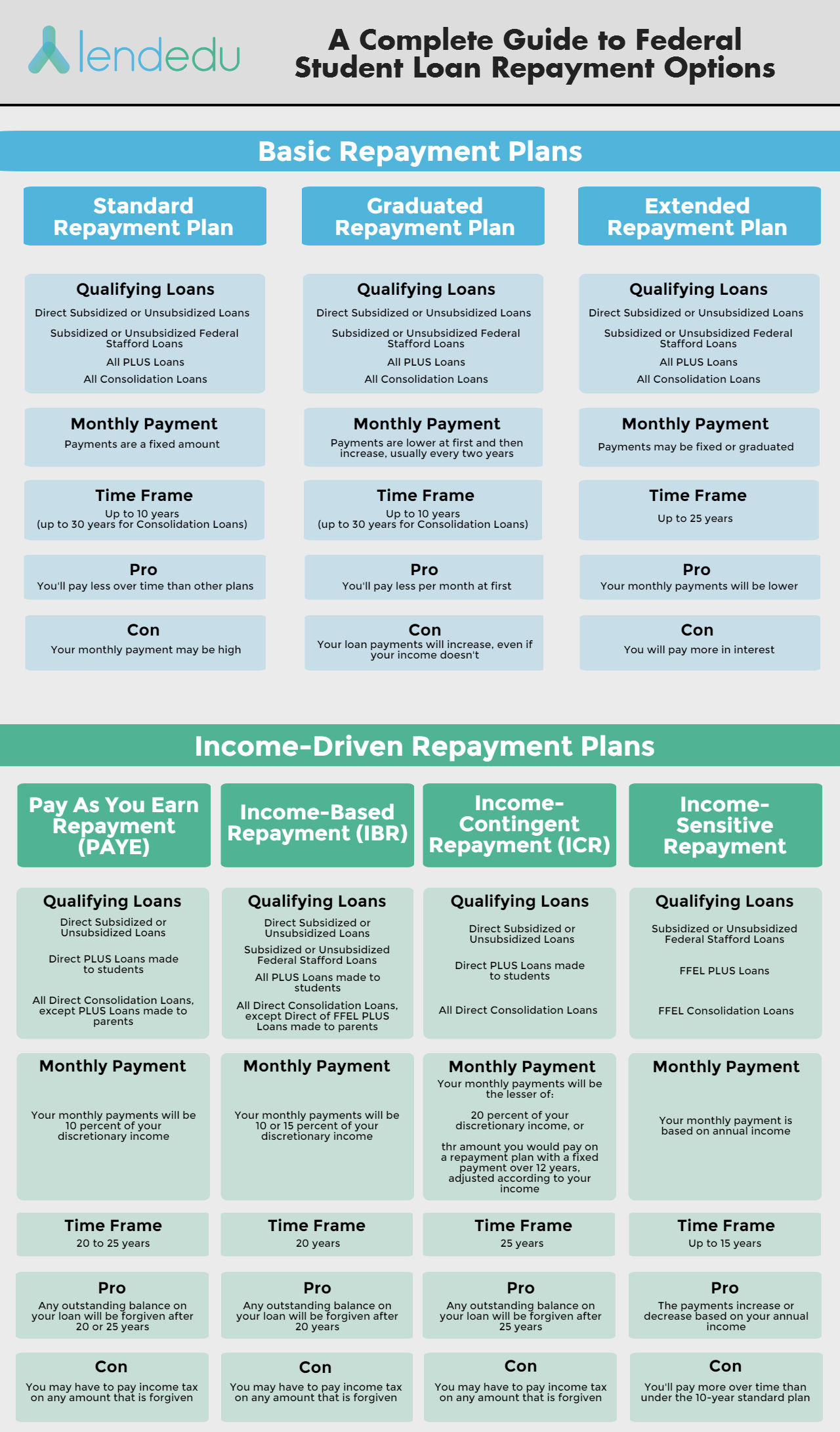

A Complete Guide To Federal Student Loan Repayment Options LendEDU

Section 80E Deduction For Interest On Education Loan Tax2win

Section 80E Deduction For Interest On Education Loan Tax2win

How Can You Find Out If You Paid Taxes On Student Loans

Student Loans Students In Debt Education Financing Student Loan

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Income Tax Rebate On Education Loan Repayment - Web 16 oct 2020 nbsp 0183 32 Tax deductions on education loan Under Section 80E of the Income Tax Act you can claim tax deductions only on the interest paid on your education loan