Income Tax Rebate On Education Loan Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

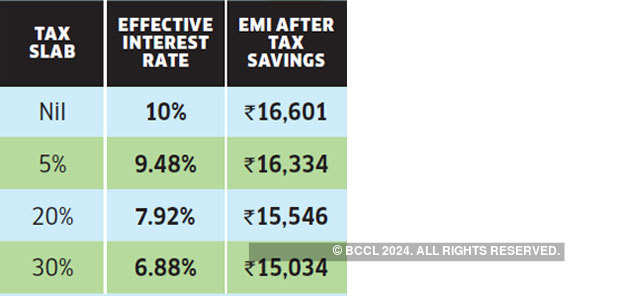

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the

Income Tax Rebate On Education Loan

Income Tax Rebate On Education Loan

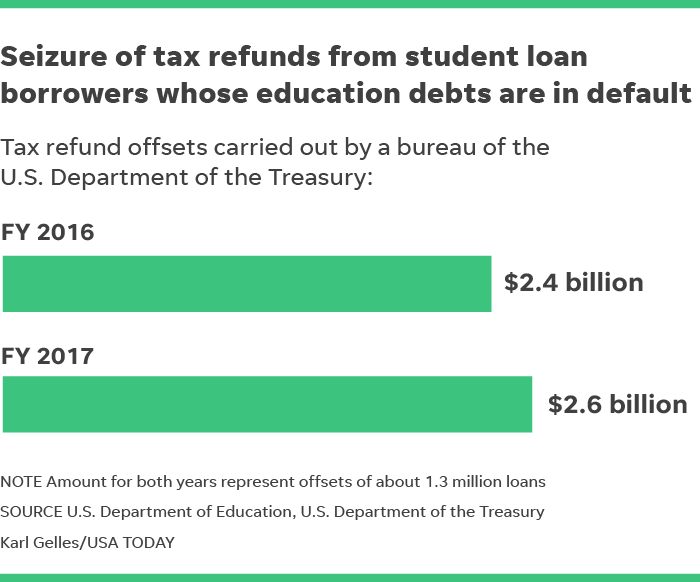

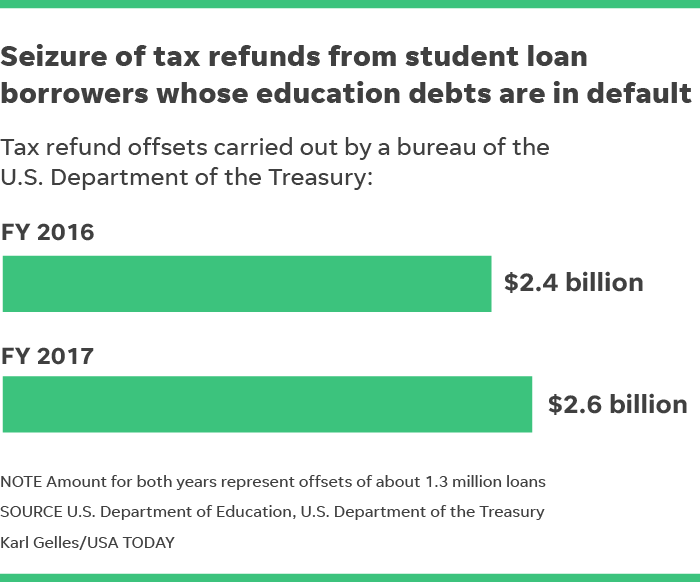

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

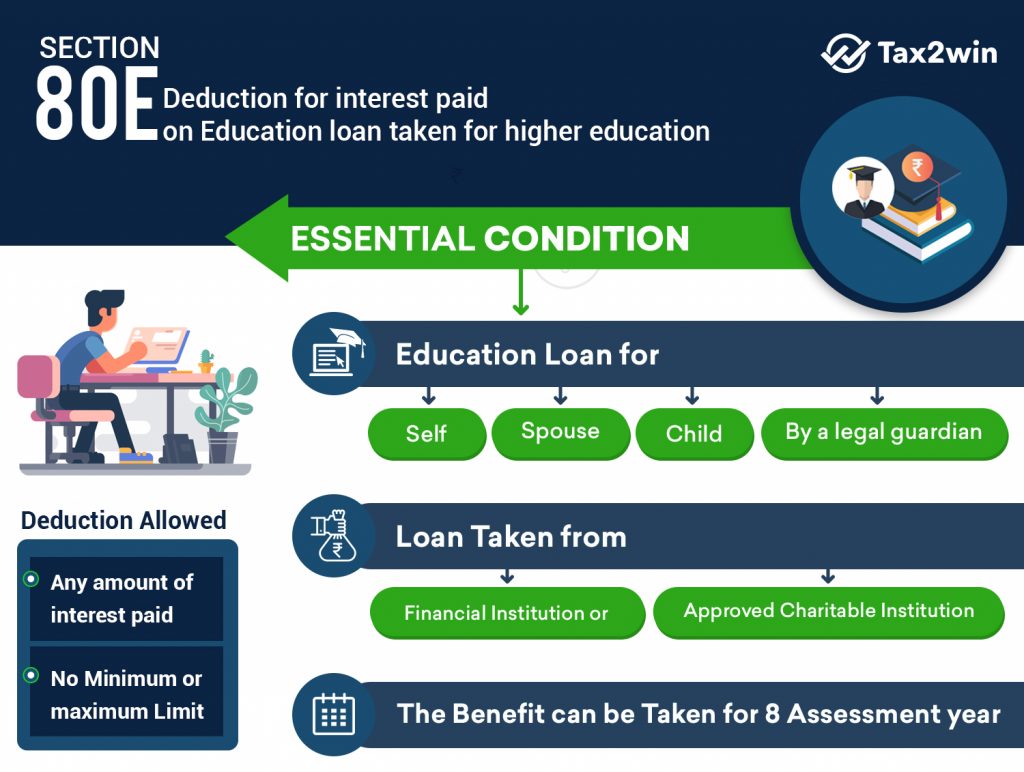

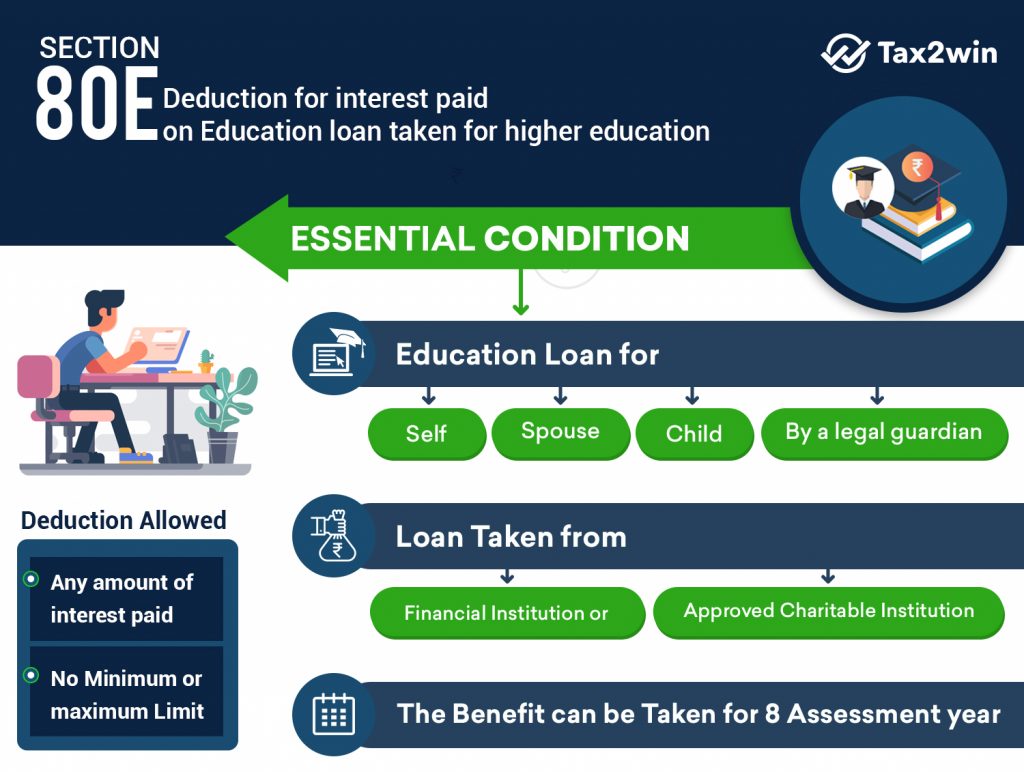

Section 80E Deduction For Interest On Education Loan Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80E-Deduction-for-interest-paid-on-loan-taken-for-higher-education-1024x772.jpg

Income Tax Deduction On Education Loan 80E CAGMC

https://www.cagmc.com/wp-content/uploads/2020/05/Section-80E-_-Income-Tax-Deduction-on-Education-loan-1-1024x538.png

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web 31 mai 2023 nbsp 0183 32 Read about Sec 80E Deduction for ineterst paid on education loan for 8 years Read for eligibility no limit loan period purpose benefit and much more

Web 23 f 233 vr 2018 nbsp 0183 32 According to Section 80E of the Income Tax Act 1961 the interest paid on the education loan can be claimed as deduction This special deduction is also allowed Web 16 f 233 vr 2021 nbsp 0183 32 16 February 2021 4 mins read Yes a loan for education is one of the easiest and quickest ways to finance higher studies You are eligible for tax benefits on

Download Income Tax Rebate On Education Loan

More picture related to Income Tax Rebate On Education Loan

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to Web Total 1 06 776 Entire amount is available as deduction u s 80 E The repayment period for the student borrowed starts one year after the completion starts of the course or six

Web Thus including enough scholarship or fellowship grant in the student s income to report up to 4 000 in qualified education expenses for your American opportunity credit may increase the credit by enough to Web The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget FY 20 21 How long is your course in months Total Loan Amount

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Education Rebate Income Tested

https://i.pinimg.com/originals/2f/ba/b9/2fbab97c42c295256188fa95c9fb2bbe.png

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

https://www.etmoney.com/blog/education-loa…

Web Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is

Tax Rebate Under Section 87A Investor Guruji Tax Planning

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Education Loan Tax Benefits How Education Loan Can Help Your Child

Individual Income Tax Rebate

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

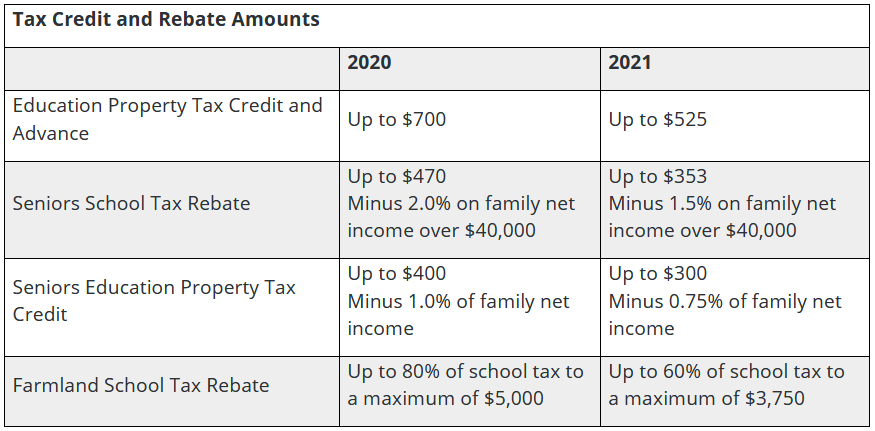

Provincial Education Property Tax Rebate Roll Out Rural Municipality

GST On Educational Institutions

Illinois Tax Rebate Tracker Rebate2022

Income Tax Rebate On Education Loan - Web The income tax rebate will be allowed only on the interest component of the EMI of the education loan paid during the financial year Get A Quick Loan of Rs 2 Lakh from