Income Tax Rebate On Equity Shares Web 29 juil 2023 nbsp 0183 32 Section 87A of the Income Tax Act 1961 allows an income tax rebate of Rs 12 500 for both old and new tax regime for FY 2022 23 AY 2023 24 This tax rebate

Web 1 juil 2022 nbsp 0183 32 The rate of Income Tax on trading in equity shares depends on the income head If it is considered a Non Speculative Business Income it is taxed at income tax Web 12 mars 2021 nbsp 0183 32 Long term capital gains or LTCG from equity is taxable at 10 plus surcharge and cess as applicable after a holding period of

Income Tax Rebate On Equity Shares

Income Tax Rebate On Equity Shares

https://images.livemint.com/img/2019/10/08/original/surchargechart_1570549199533.png

Question No 03 B Chapter No 10 D K Goal 11 Class Tutor s Tips

https://i0.wp.com/tutorstips.com/wp-content/uploads/2021/05/Q-03B-CH-10-USHA-1-Book-2020-Solution-min.png?fit=1280%2C720&ssl=1

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web Listed Equity Share STT paid 12 months 10 in excess of Rs 1 00 000 under Sec 112A 15 under Sec 111A Listed Equity Share STT not paid 12 months 10 without Web 20 d 233 c 2020 nbsp 0183 32 Tax on equity investments Equity linked savings scheme ELSS It is a good option to not only save on tax but also earn higher long term returns There is lock

Web 22 mai 2023 nbsp 0183 32 Purchase price Rs 38 750 Therefore short term capital gain made by Kuldeep will be Rs 48 000 Rs 38 750 Rs 240 Rs 9 010 What if your tax slab rate is 10 or 20 or 30 A special rate of tax of Web 12 juin 2023 nbsp 0183 32 To summarize the grandfathering clause in Section 112A provides relief from LTCG tax on sale of equity shares and units of equity oriented that were acquired

Download Income Tax Rebate On Equity Shares

More picture related to Income Tax Rebate On Equity Shares

Taxation Of Unlisted Equity Shares Under Income Tax Advalyze

https://eqngg5vr3ud.exactdn.com/wp-content/uploads/5.png?lossy=1&ssl=1

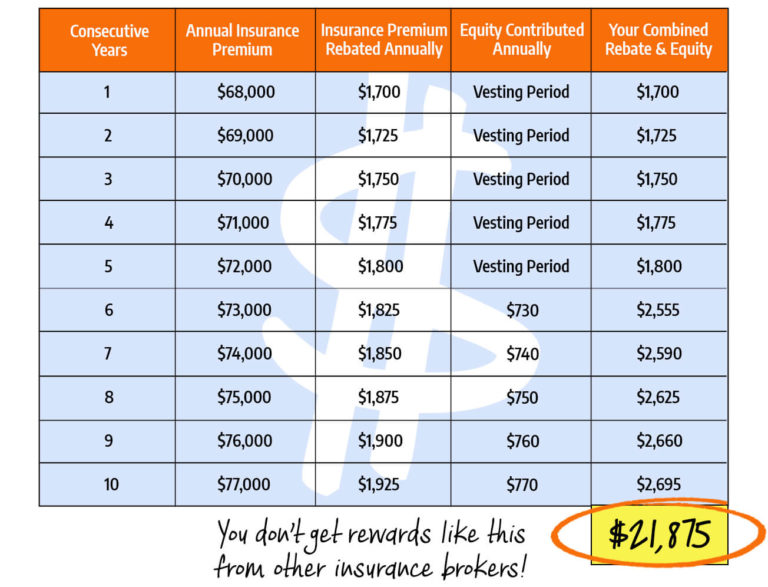

Rebates Equity Green Industry Co op

https://greenindustryco-op.com/wp-content/uploads/2020/06/GICoOp_RebatesEquity_Chart_6-1-20-768x587.jpg

Figure 26a d CVRP Rebate By Vehicle Category And Equity Groups As

https://greeninnovationindex.org/wp-content/uploads/2022/12/Figure-26d-Trans-CVRP-Rebate-By-Vehicle-Equity-Other-Next10-2023.png

Web 14 avr 2021 nbsp 0183 32 Taxation of Gains from Equity Shares a Tax on short term capital gains Passive income from real estate is taxed at a rate of 15 percent I wonder if your tax rate is 10 20 or 30 Regardless of Web Short term capital gains are taxed at 15 3 cess Short term capital gains can be offset against short term losses Short term capital losses can be carried forward for up

Web 1 janv 2016 nbsp 0183 32 Contents Tax reliefs you can claim Income Tax relief Capital Gains Tax relief When you will not get tax relief on your investments Shares that qualify for tax Web 12 sept 2022 nbsp 0183 32 Updated September 12 2022 Equity Compensation About the book Equity and taxes interact in complicated ways and the tax consequences for an employee

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

https://economictimes.indiatimes.com/topic/Income-tax-on-equity-shares

Web 29 juil 2023 nbsp 0183 32 Section 87A of the Income Tax Act 1961 allows an income tax rebate of Rs 12 500 for both old and new tax regime for FY 2022 23 AY 2023 24 This tax rebate

https://learn.quicko.com/equity-share-trading-income-tax-treatment

Web 1 juil 2022 nbsp 0183 32 The rate of Income Tax on trading in equity shares depends on the income head If it is considered a Non Speculative Business Income it is taxed at income tax

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Rebate Under Section 87A

Income Tax And Rebate For Apartment Owners Association

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

2007 Tax Rebate Tax Deduction Rebates

Equity Method Of Accounting Excel Video And Full Examples

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Equity Shares - Web Well there are a lot of advantages with equity investments Equity investments are basically tax free investments Equity market comprises of Shares Futures and