Income Tax Rebate On Fixed Deposit Web 9 nov 2020 nbsp 0183 32 What is a Tax Saving FD A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income

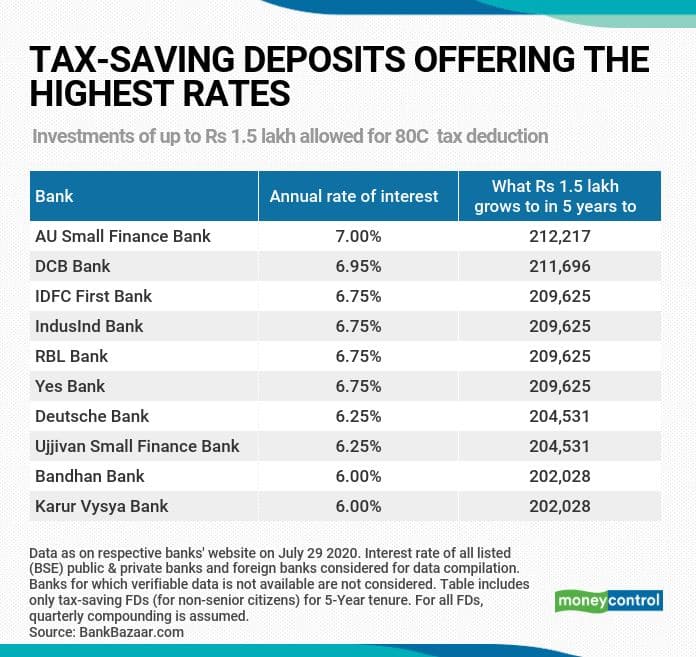

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed Web 8 sept 2023 nbsp 0183 32 Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax deduction

Income Tax Rebate On Fixed Deposit

Income Tax Rebate On Fixed Deposit

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

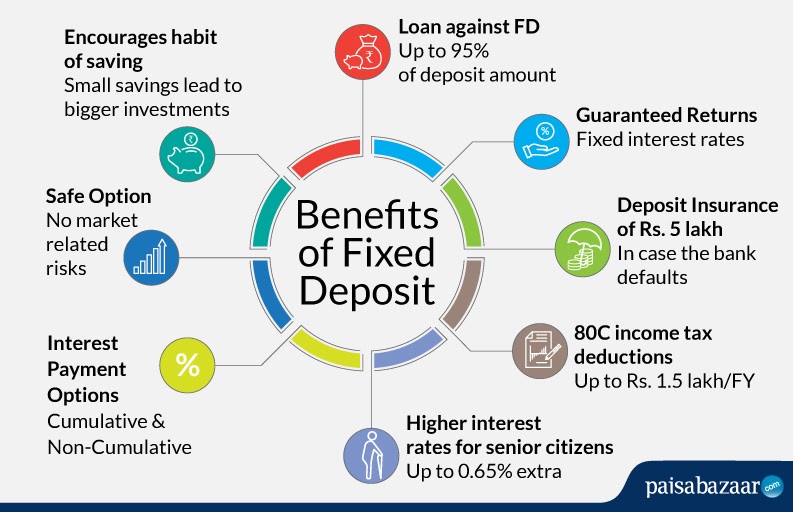

Benefits Of Fixed Deposits FDs In India

https://www.paisabazaar.com/wp-content/uploads/2020/02/fixed-deposit-benefits.jpg

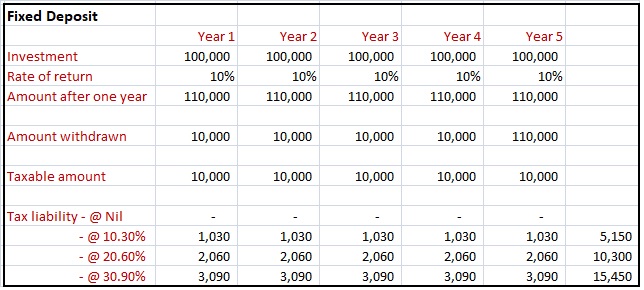

57 Tax Cut On Debt Mutual Funds Vs Fixed Deposits The Wealth Architects

https://2.bp.blogspot.com/-A6id6lQzHcA/WfQw2DeJkaI/AAAAAAAADP0/LvVTHRP3mhEEpAwGejeCZ18JG9LVanInACLcBGAs/s1600/tax-on-fixed-deposits.jpg

Web 18 janv 2022 nbsp 0183 32 The interest you earn on fixed deposits fall under Income from Other Sources in the income tax return and is fully taxable To calculate income tax on Web Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided

Web 29 juin 2022 nbsp 0183 32 Taxpayers can invest in tax saver FD schemes to save taxes under Section 80C of the Income Tax Act 1961 Upon maturity of the FD account investors can Web 9 janv 2018 nbsp 0183 32 According to current income tax laws if an individual opts for old existing tax regime then under Section 80C of the Income tax Act you can claim deduction for investments up to Rs 1 5 lakh in a financial year

Download Income Tax Rebate On Fixed Deposit

More picture related to Income Tax Rebate On Fixed Deposit

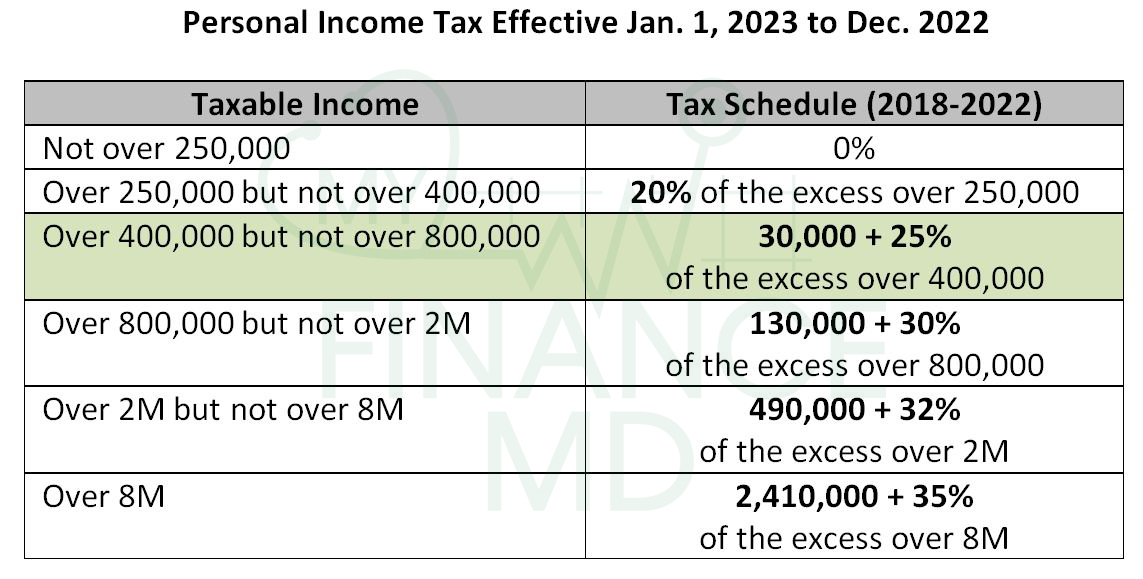

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

https://myfinancemd.com/wp-content/uploads/2018/08/Personal-Income-Tax-myfinancemd.jpg

10 Tax saving Fixed Deposits That Offer The Best Interest Rates 10 Tax

https://images.moneycontrol.com/static-mcnews/2020/07/FD-July-31.jpg

Best FD Rates In India In March 2019

https://myinvestmentideas.com/wp-content/uploads/2019/03/Best-Bank-Fixed-Deposit-FD-Rates-in-India-for-March-2019.jpeg

Web 21 juin 2023 nbsp 0183 32 In the case of fixed deposits the bank or financial institutions deduct tax at the source at the end of each year when they pay the interest The tax deduction rate at Web The interest earned from FDs is added to the income and is taxable However if your tax liability on total income amounts to Nil you can claim for non deduction of TDS on fixed deposit by submitting form 15G or

Web The bank doesn t charge tax on Fixed Deposit if your overall income is less than Rs 2 5 lakh in a year However some lenders may ask you to submit Form 15G or 15H to claim Web 17 avr 2022 nbsp 0183 32 The tax rate on FD interest depends on the tax slab as applicable to the assessee For example if your total income falls in the 20 tax bracket FD interest will

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Web 9 nov 2020 nbsp 0183 32 What is a Tax Saving FD A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income

https://www.valueresearchonline.com/stories/50686/fixed-deposits...

Web 6 avr 2022 nbsp 0183 32 To be eligible for a deduction from taxable income a fixed deposit must have a lock in period of five years In other words only specific five year tax saving fixed

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax On Interest On Fixed Deposit By NRI

Carbon Tax Rebate 2022 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Deductions List FY 2019 20

Income Tax Deductions List FY 2019 20

Income Tax Rebate Under Section 87A

Top 18 5 Year Fixed Deposit Tax Free Calculator En Iyi 2022

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate On Fixed Deposit - Web Individuals with fixed deposit accounts can claim deductions of up to Rs 1 5 lakh on the amount invested by them in fixed deposits This TDS on fixed deposits can be avoided