Income Tax Rebate On Gpf Web 20 mars 2023 nbsp 0183 32 22min read As per the 2021 Budget you are liable to pay income tax on General Provident Fund GPF interest above Rs 5 lakh in a financial year To avoid

Web 4 avr 2022 nbsp 0183 32 So it is important for a taxpayer to know the new changes in regard to income tax rule which has become applicable now Taxation on Provident Fund PF Web 2 mars 2022 nbsp 0183 32 If your per annum income is 6 5 lakh per annum you ll avail of a tax rebate If you invest Rs 1 5 lakh in PPF GPF or Insurances If you invest Rs 1 5 lakh in PPF

Income Tax Rebate On Gpf

Income Tax Rebate On Gpf

https://gservants.com/wp-admin/admin-ajax.php?action=rank_math_overlay_thumb&id=30402&type=gservants-news&hash=03693ff4f161c95a86f2c859f7e2f04a

Notification On Calculating Income Tax On GPF Accumulation Govtempdiary

https://i0.wp.com/govtempdiary.com/wp-content/uploads/2023/02/GPF-accumulation.jpg?resize=521%2C420&ssl=1

GPF Interest Calculation On Above 5 Lakhs For Deduction Of TDS From The

https://i0.wp.com/govtempdiary.com/wp-content/uploads/2022/02/calculation-of-Income-tax-on-interest-of-GPF-DOP.jpg?resize=608%2C420&ssl=1&is-pending-load=1

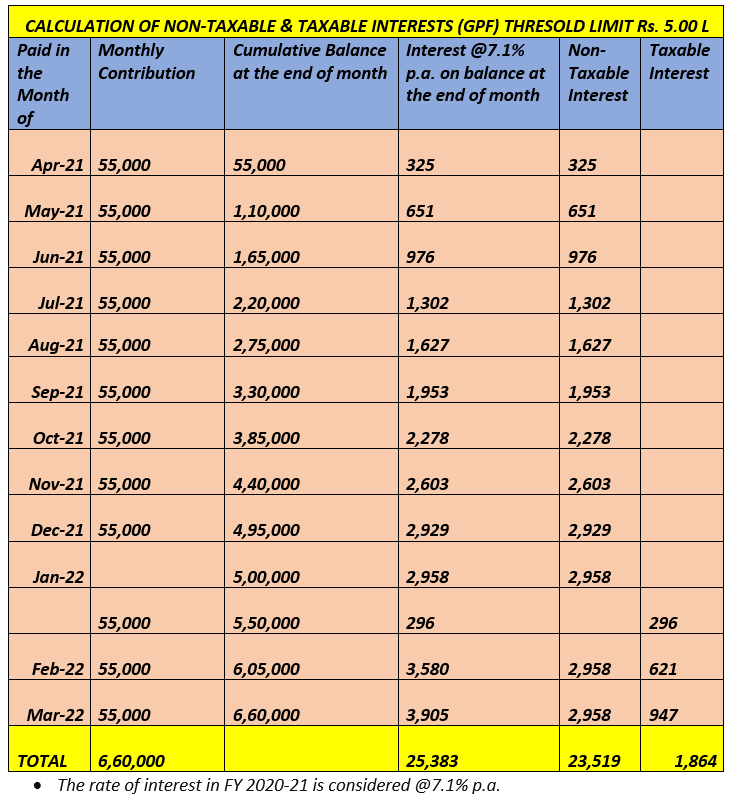

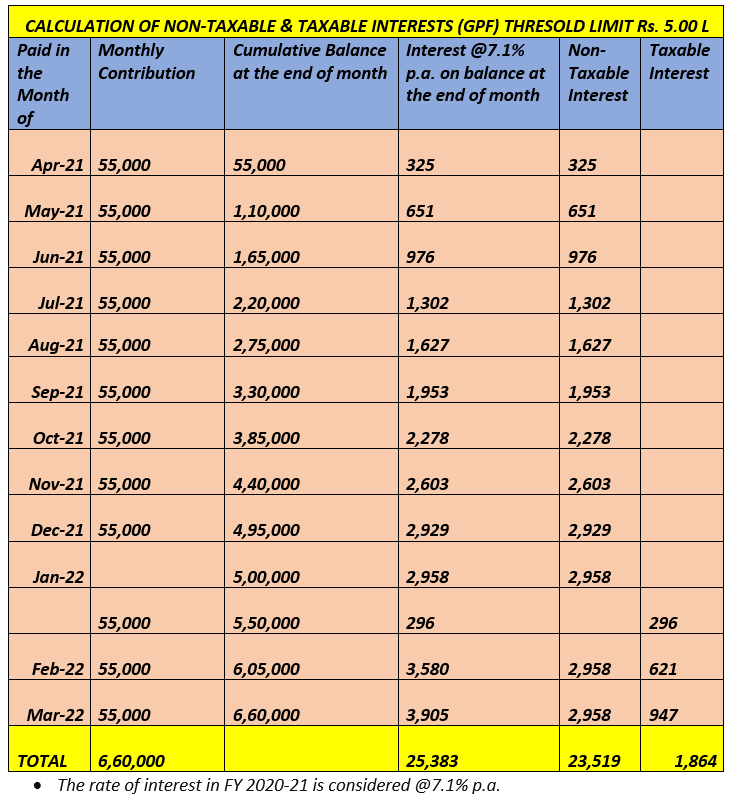

Web 5 f 233 vr 2021 nbsp 0183 32 Talking on PPF contributions Gopal Bohra Partner NA Shah Associates said As per the budget proposal interest accrued to a taxpayer on contribution made Web 28 f 233 vr 2022 nbsp 0183 32 ii The interest earned on contribution above Rs 5 Lakhs during FY 2021 22 should be treated as income from other sources for the FY 2021 22 AY 2022 23 and

Web Income Tax Department Central Board of Direct Taxes BENEFITS UNDER DIRECT TAXES FOR RETIRED EMPLOYEES I have retired from service after serving for 35 Web 24 f 233 vr 2022 nbsp 0183 32 Calculation of Taxable and Non Taxable Interest Under EPF GPF Income Tax 25 th Amendment Rules 2021 The Government has changed the rules for

Download Income Tax Rebate On Gpf

More picture related to Income Tax Rebate On Gpf

Income Tax On GPF GPF Interest On PF

https://i.ytimg.com/vi/mfV9BjzWi7c/maxresdefault.jpg

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

Calculation Of Income Tax On Interest Of GPF CDA Govtempdiary

https://i0.wp.com/govtempdiary.com/wp-content/uploads/2022/02/income-tax-cda.jpg?resize=750%2C420&ssl=1

Web 20 juin 2023 nbsp 0183 32 Income Tax Provision Employee Contribution to the Fund Deduction allowed under section 80C Employer s Contribution to the Fund Exempt up to 12 of Salary Web 16 juin 2021 nbsp 0183 32 Tax Benefit Investing in GPF one can avail tax benefits on interest earned contributions and the returns under Section 80C of the Income Tax Act 1961 GPF

Web Is GPF taxable after retirement All the three provident funds provide tax deduction under Section 80C of the Income Tax Act 1961 Furthermore the interest earned on all three Web 1 sept 2021 nbsp 0183 32 The rules will come into effect from April 1 2022 the notification added Government has issued rules for calculating taxable interest on contribution to provident

GPF Interest Calculation On Above 5 Lakhs For Deduction Of TDS From The

https://i0.wp.com/govtempdiary.com/wp-content/uploads/2022/02/calculation-of-Income-tax-on-interest-of-GPF-DOP.jpg?w=608&ssl=1

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

https://cleartax.in/s/income-tax-on-gpf-interest

Web 20 mars 2023 nbsp 0183 32 22min read As per the 2021 Budget you are liable to pay income tax on General Provident Fund GPF interest above Rs 5 lakh in a financial year To avoid

https://www.livemint.com/money/personal-finance/new-income-tax-rules...

Web 4 avr 2022 nbsp 0183 32 So it is important for a taxpayer to know the new changes in regard to income tax rule which has become applicable now Taxation on Provident Fund PF

Income Tax Rebate On Electric Car 2023 Carrebate

GPF Interest Calculation On Above 5 Lakhs For Deduction Of TDS From The

INCOME TAX REBATE ON INVESTMENT

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

How To Search Income Tax Rebate On Women YouTube

Calculation Of Interest On EPF Or GPF Income Tax Amendment Rules 2021

Calculation Of Interest On EPF Or GPF Income Tax Amendment Rules 2021

Income Tax Rebate Under Section 87A

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate On Gpf - Web Budget 2021 22 has rationalised tax free income on provident fund contribution by high income earners by making the exemption on interest income earned on annual