Income Tax Rebate On Health Insurance Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

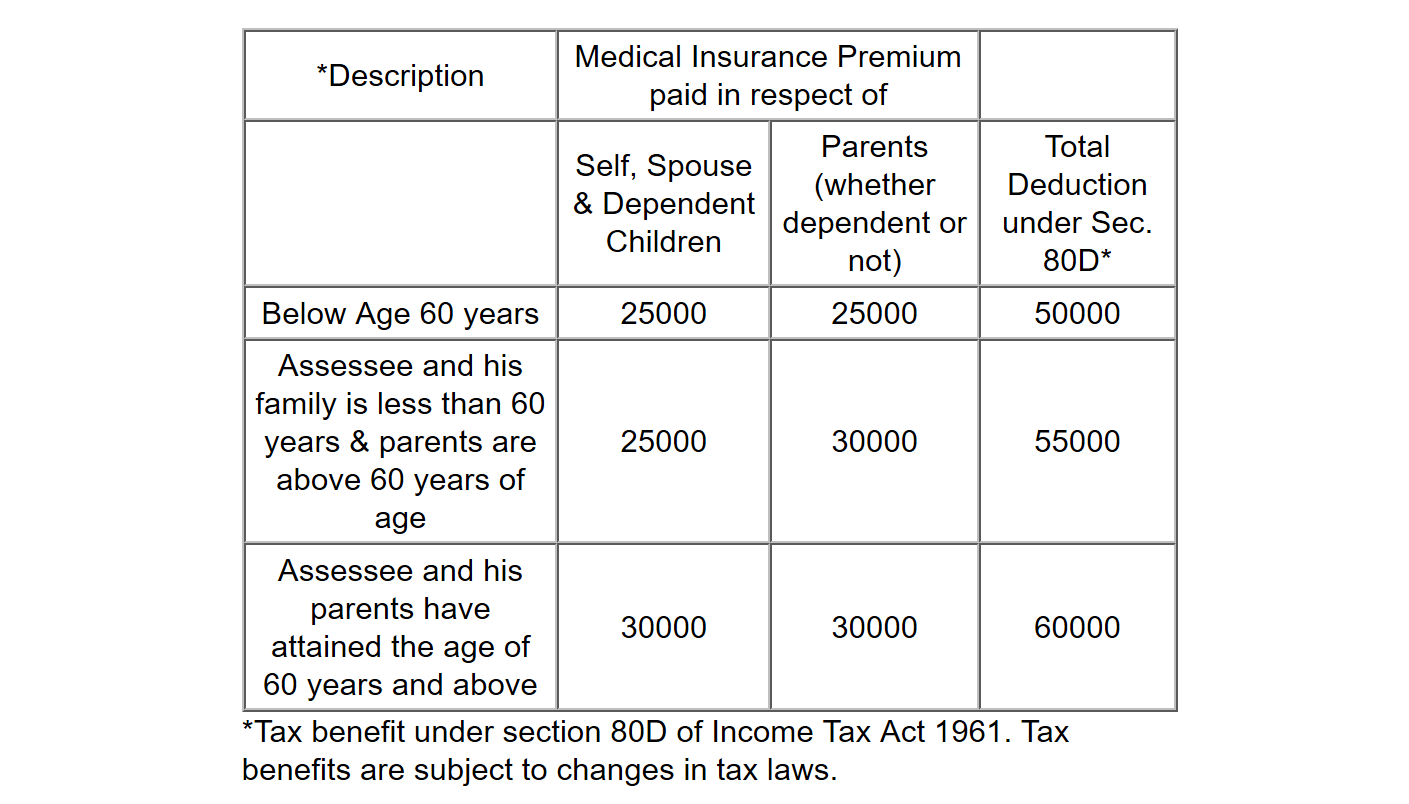

Web 30 juin 2023 nbsp 0183 32 If you are eligible for the rebate you can claim the rebate either through your private health insurance provider your private health insurance provider will apply Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

Income Tax Rebate On Health Insurance

Income Tax Rebate On Health Insurance

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

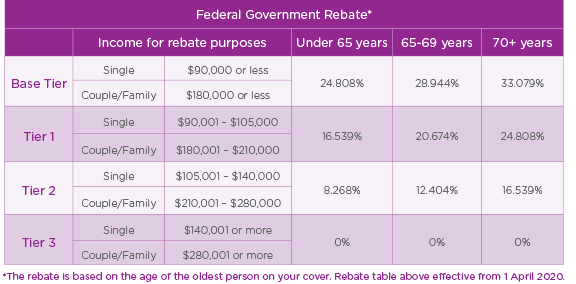

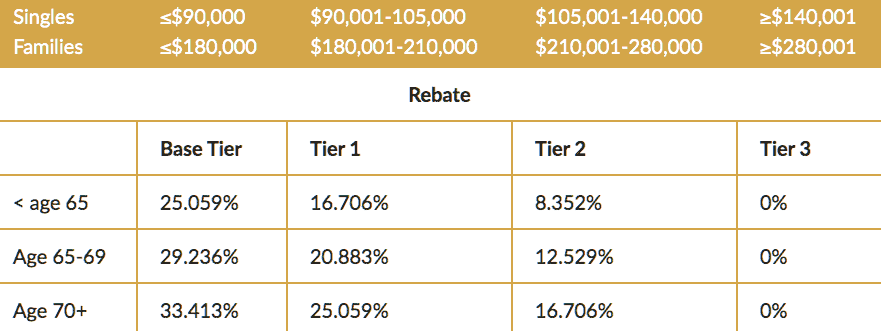

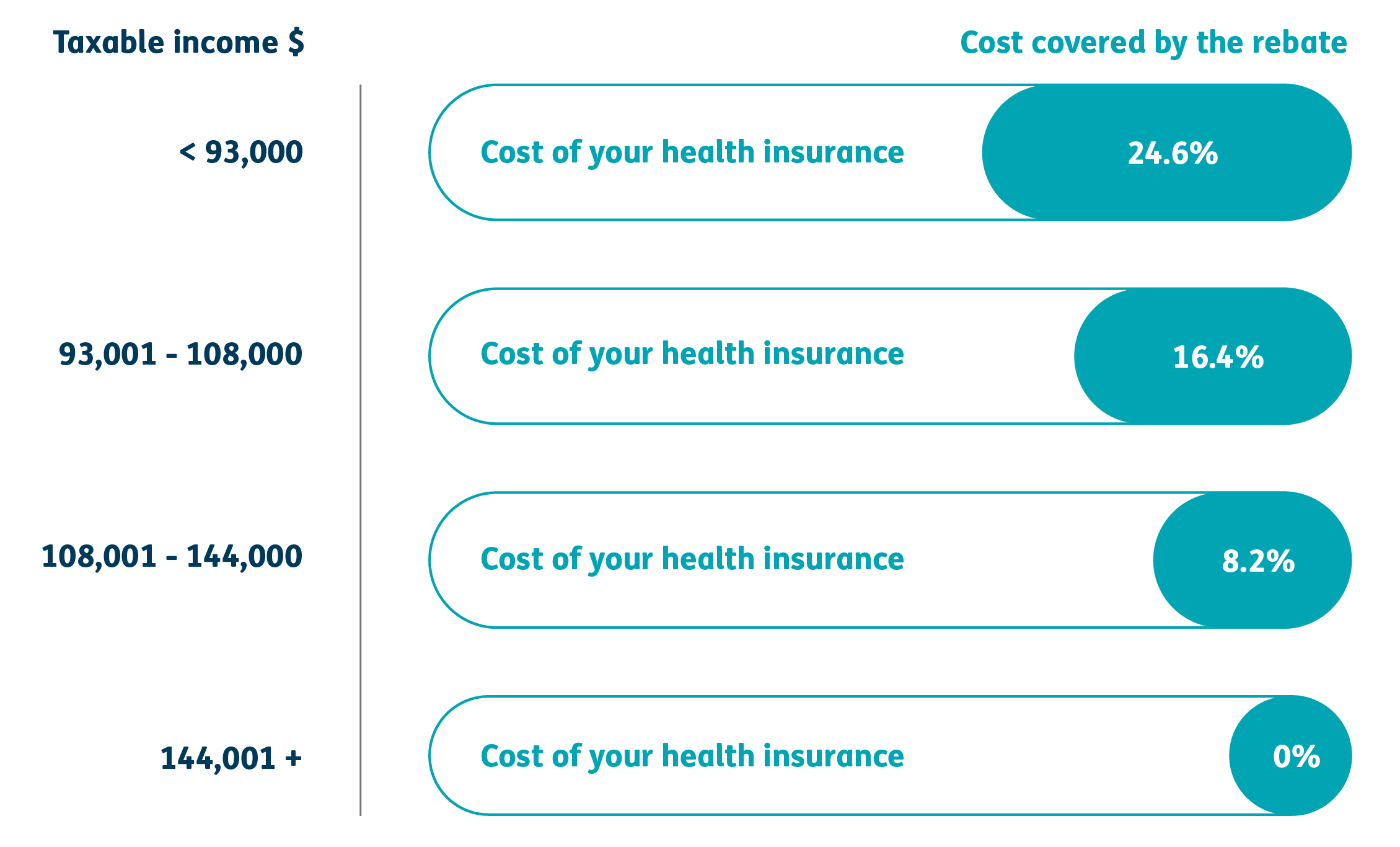

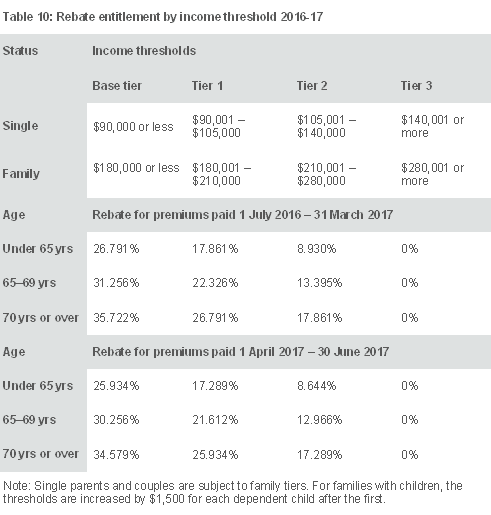

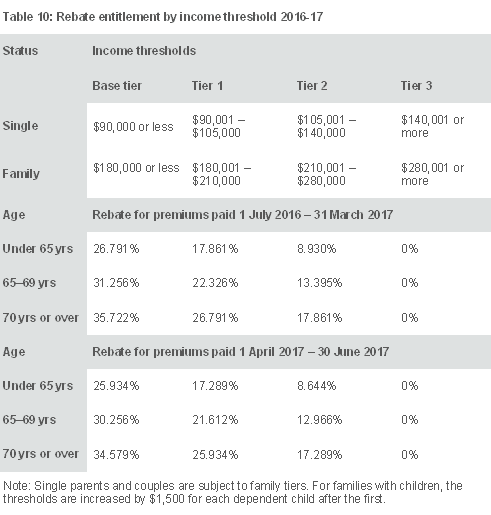

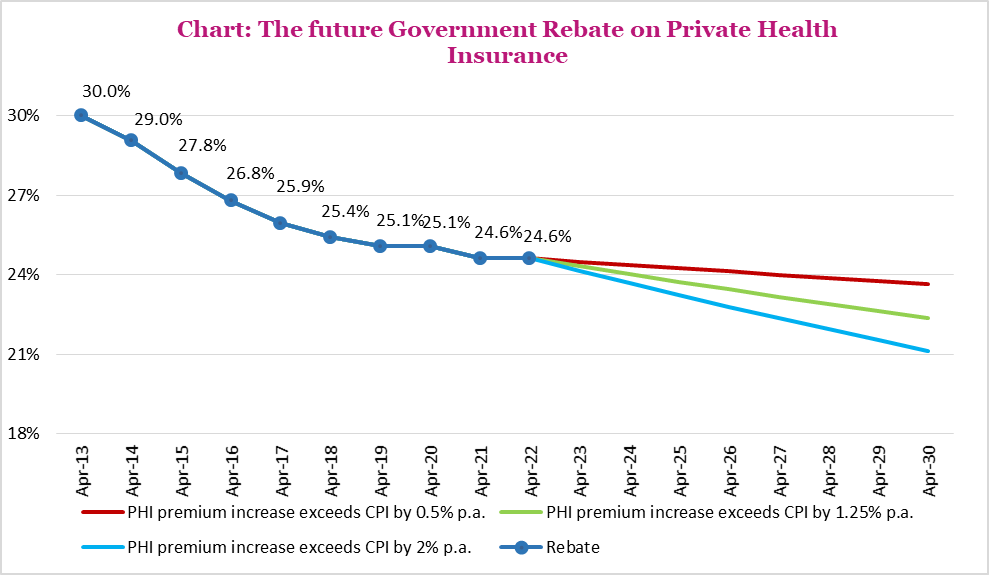

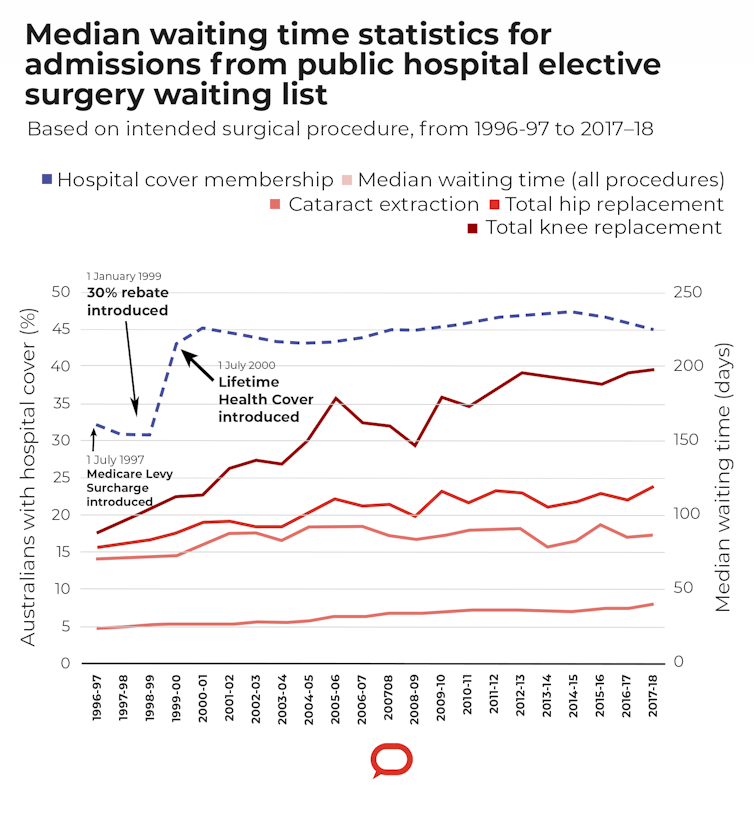

Web The private health insurance rebate is income tested If you share the policy you will be income tested on your share Your rebate entitlement depends on your family status on Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction Yet the rebate s

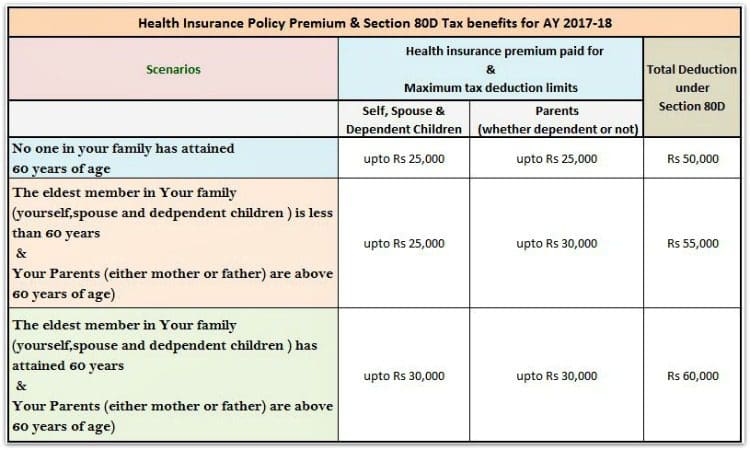

Web Income for surcharge purposes is used to test your eligibility for the private health insurance rebate It is not the same as your taxable income To be eligible for the Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have

Download Income Tax Rebate On Health Insurance

More picture related to Income Tax Rebate On Health Insurance

Health Insurance Rebate Is It Time To Ditch The Private Health

https://healthdeal.com.au/wp-content/uploads/2020/02/rebate-tier.png

Tax And Rebates HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

ISelect What You Need To Know Tax Rebates On Health Insurance And

https://www.iselect.com.au/content/uploads/2017/06/Rebates-Table.jpg

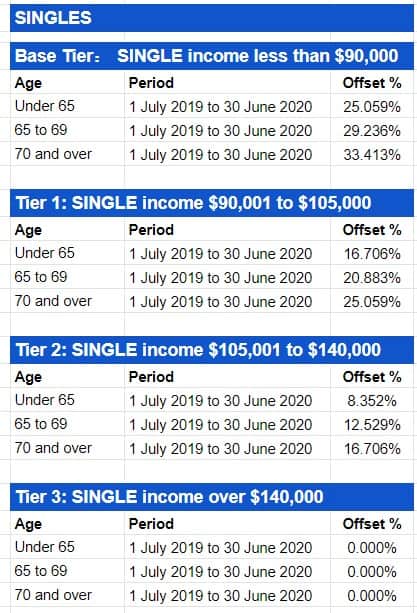

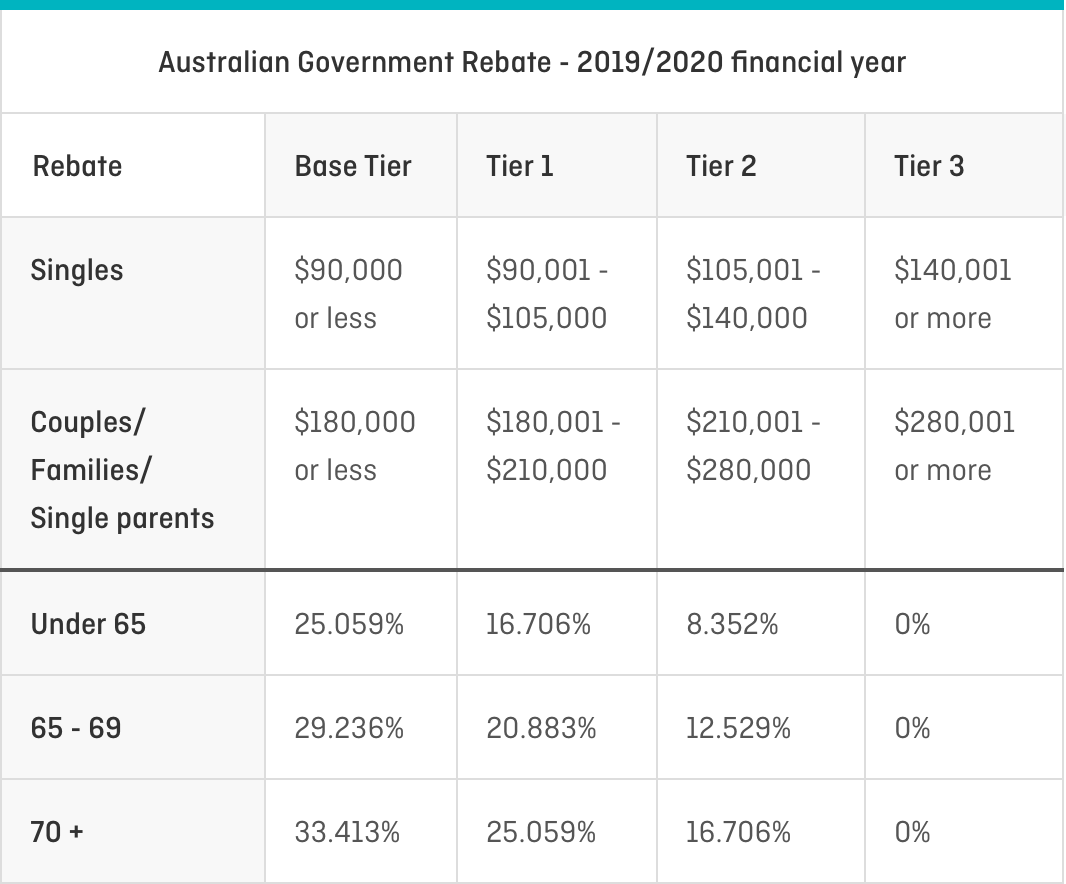

Web In most cases there will be two rows of information on your private health insurance statement One row relates to premiums you paid and rebates you received before 1 Web 65 or younger 65 to 69 70 or older 16 405 20 507 24 608 105 001 to 140 000 210 001 to 280 000 65 or younger 65 to 69 70 or older 8 202 12 303 16 405

Web Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the Income Web The offset is an amount the government contributes towards your private health insurance You may take it as a reduced premium or a refundable offset when you lodge your tax

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

https://www.ato.gov.au/.../Claiming-the-private-health-insurance-rebate

Web 30 juin 2023 nbsp 0183 32 If you are eligible for the rebate you can claim the rebate either through your private health insurance provider your private health insurance provider will apply

How Does Private Health Insurance Affect My Tax Return Compare Club

Medicare Levy Surcharge Private Health Insurance What s The Link

Not For Profits Call For Pledge To Restore 30 Per Cent Private Health

Private Health Insurance Quote Qantas Insurance

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

Awasome Tax Rebate On Health Insurance References

Awasome Tax Rebate On Health Insurance References

What Should Happen To The Private Health Insurance Rebate This Election

What Is Australian Government Rebate On Private Health Insurance

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Income Tax Rebate On Health Insurance - Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have