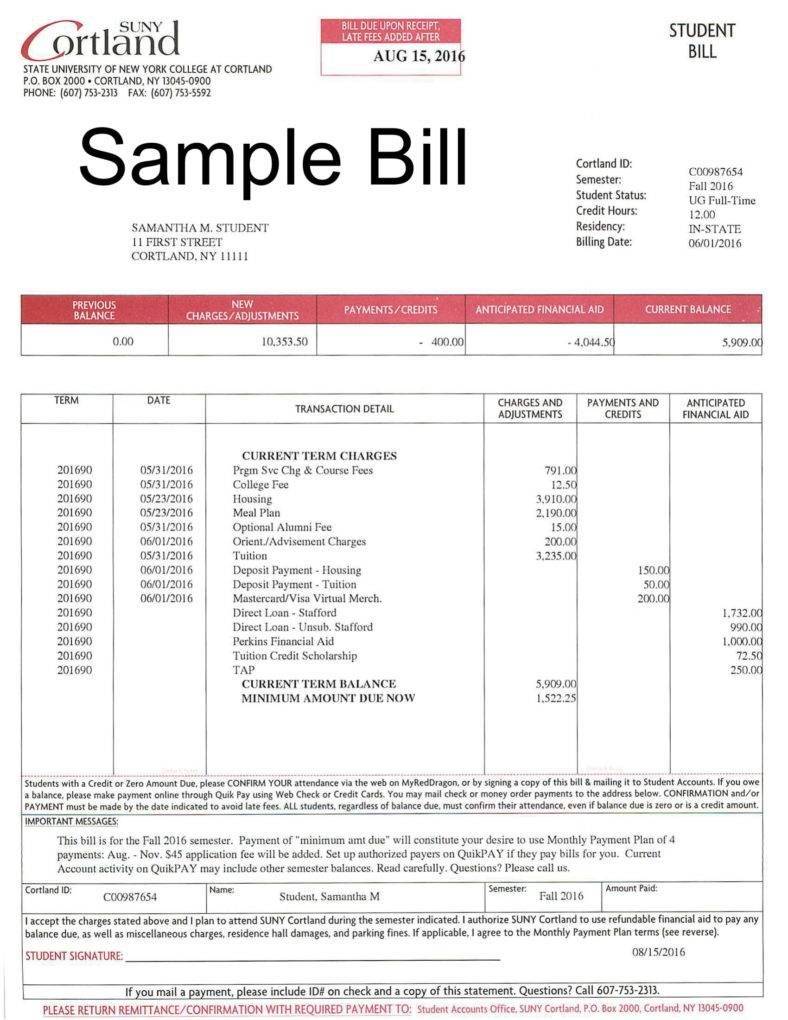

Income Tax Rebate On Higher Education Fees Web 5 janv 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction

Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information Web 30 mars 2023 nbsp 0183 32 The Government of India also offers tax deductions of up to Rs 1 50 000 on the principal loan amount of an education loan under Section 80C of income tax law

Income Tax Rebate On Higher Education Fees

Income Tax Rebate On Higher Education Fees

https://s-i.huffpost.com/gen/1192706/images/o-COLLEGE-COSTS-facebook.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2022/10/bbb-Irish-Tax-Rebates.jpg?fit=1200%2C800&ssl=1

Web 17 f 233 vr 2017 nbsp 0183 32 Let us say you fall in the highest income bracket and you pay 31 2 per cent as tax and you pay Rs 80 000 a year as schools fees Here the tax saved will amount Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taker for higher education when certain conditions are met Tax benefits have been laid down under

Web 7 janv 2020 nbsp 0183 32 The fees should be paid to university college school or other educational institution No deduction available for fees paid for private tuition s coaching courses for Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has

Download Income Tax Rebate On Higher Education Fees

More picture related to Income Tax Rebate On Higher Education Fees

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Excellent School Fee Receipt Template In Html Cheap Receipt Templates

https://images.template.net/wp-content/uploads/2018/05/Sample-Tuition-Bill-Receipt-788x1020.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://www.propertyrebate.net/wp-content/uploads/2023/05/income-tax-rebate-under-section-87a-for-income-up-to-5-lakh.jpeg

Web 5 avr 2023 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax

Web Every taxpayer can avail of tax deductions up to 1 5 lakhsunder the provisions made by section 80C Taxpayers can claim benefits for their two children and the tuition fee tax Web Tax Benefits on Education and tuition Fees under Section 80C Which Education Fees Deductions are Available Under Income Tax Many taxpayers do not have a clear

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=509005338070573

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

https://instafiling.com/tuition-fees-exemption-in-income-tax-2022-23

Web 5 janv 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction

https://okcredit.in/blog/is-education-fee-exempted-from-tax-in-india

Web 25 f 233 vr 2021 nbsp 0183 32 Not only investments but also expenditures like tuition fees are allowed a deduction under the Income Tax Act The following article provides detailed information

Rebate Checks Social Security Income Tax Cuts Plus New Taxes And Fees

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate Under Section 87A

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate On Higher Education Fees - Web 3 oct 2021 nbsp 0183 32 Let us discuss the benefits available under the income tax laws in India in connection with education Deduction under Section 80 C for expenses on full time