Income Tax Rebate On Home Loan And Hra Web 24 nov 2021 nbsp 0183 32 You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act 1961 the Act are met This

Web 6 juil 2022 nbsp 0183 32 Can such a person claim income tax benefit for both HRA and home loan repayment quot Yes if you are living on rent in your city of job and own house in another city then income tax benefit can be Web 27 nov 2020 nbsp 0183 32 The answer is yes quot One can claim HRA exemption and interest deduction on a housing loan simultaneously if one satisfies all of the conditions for claiming so quot says Kapil Rana Founder amp

Income Tax Rebate On Home Loan And Hra

Income Tax Rebate On Home Loan And Hra

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/HRA.jpg

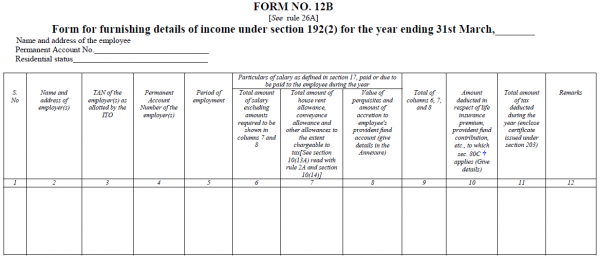

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

http://pmjandhanyojana.co.in/wp-content/uploads/2016/05/New-Form-12BB.png

Can I Claim Both Home Loan And HRA Tax Benefits

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

Web 13 mai 2019 nbsp 0183 32 As per Section 24 of the Income Tax Act home loan borrowers individually can claim tax benefit of up to Rs 2 lakh per financial year FY on the Home Loan Web 30 juil 2022 nbsp 0183 32 ITR filing How to claim Home Loan tax benefit and HRA exemption together The Financial Express Sensex Web Stories NSE Top Losers Auranga Dist 232 75

Web Actual rent paid 10 of salary Rs 12 000 10 of 30 000 0 12 000 3 000 Rs 9 000 Rs 9 000 being the least of the three amounts will be the exemption from HRA The balance HRA of Rs 6 000 15 000 Web 18 oct 2022 nbsp 0183 32 The Income Tax Act 1961 offers a home loan tax benefit on the repayment of a home loan by a taxpayer under several of its sections If you have made a principal

Download Income Tax Rebate On Home Loan And Hra

More picture related to Income Tax Rebate On Home Loan And Hra

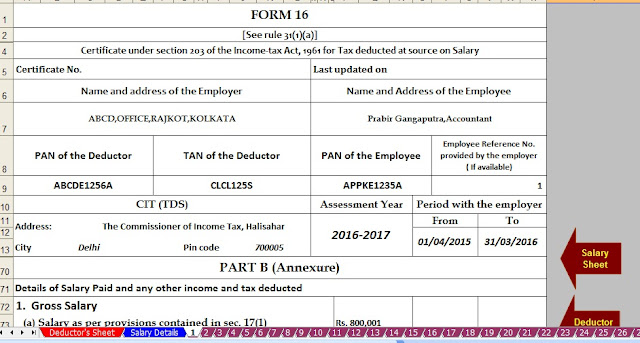

Prepare At A Time 50 Employees Form 16 Part B For F Y 2016 17 With

https://4.bp.blogspot.com/-Hgoun30u-eQ/WGpx_o49OgI/AAAAAAAADzk/bl06AvJ-lJA3PbMmC8AlShcyQb03EKPHwCLcB/s640/Form%2B16%2B3.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax Web 12 avr 2023 nbsp 0183 32 Actual rent paid 10 of basic salary DA HRA Calculator Use Now Can I Claim HRA and Deduction on Home Loan Interest Yes you may claim the HRA as it has no bearing on your home loan interest

Web 31 janv 2022 nbsp 0183 32 Answer There is no restriction on you claiming HRA while claiming tax benefits in respect of home loan as long as you are satisfying the conditions laid down Web 13 juil 2022 nbsp 0183 32 Most of us are under the impression that we can either claim income tax deduction on HRA or on home loan repayment However the income tax law has

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Danpirellodesign Income Tax Rebate On Home Loan And Hra

https://s3-ap-southeast-1.amazonaws.com/com.ft.uploads/wp-content/uploads/2019/03/21121510/Income-Tax-Rebate-87A1.jpg

https://tax2win.in/guide/claim-hra-deduction-home-loan-interest

Web 24 nov 2021 nbsp 0183 32 You may claim both HRA exemption and interest deduction on a home loan provided certain requirements as per the Income Tax Act 1961 the Act are met This

https://economictimes.indiatimes.com/wealth/t…

Web 6 juil 2022 nbsp 0183 32 Can such a person claim income tax benefit for both HRA and home loan repayment quot Yes if you are living on rent in your city of job and own house in another city then income tax benefit can be

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Form 12BB To Claim HRA Deduction By Salaried Employees

INCOME TAX REBATE ON HOME LOAN

HRA House Rent Allowances Can You Claim Both HRA And Home Loan For

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

Home Loan Tax Benefits In India Important Facts

How To Get More Out Of Your HRA Taxpayers Forum

Section 87A Tax Rebate Under Section 87A

Income Tax Rebate On Home Loan And Hra - Web Actual rent paid 10 of salary Rs 12 000 10 of 30 000 0 12 000 3 000 Rs 9 000 Rs 9 000 being the least of the three amounts will be the exemption from HRA The balance HRA of Rs 6 000 15 000