Income Tax Rebate On Home Loan For Co Applicant Web For home loan repayment each co borrower can claim tax benefits under Section 80C upto Rs 1 50 lakhs every year together with other eligible items So you will get the

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Web 7 avr 2022 nbsp 0183 32 Each candidate has the authority to claim the maximum tax refund through the house loan which is Rs 1 50 lakh per person and around Rs 2 lakhs for principal

Income Tax Rebate On Home Loan For Co Applicant

Income Tax Rebate On Home Loan For Co Applicant

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

Web 22 janv 2020 nbsp 0183 32 1 You need to be a co owner of the property purchased on loan To qualify for the tax benefits that go with the loan you need to be Web How to Claim Tax Benefit for Joint Home Loan More than one person can enjoy tax benefits as the tax for joint loans as it is divided among the co applicants Tax rebate of

Web Section 80c As per this section the repayment of principal amount of up to Rs 1 5 Lakh can be claimed as tax deduction by the applicants individually All the co borrowers can Web 30 juil 2015 nbsp 0183 32 Doing so not only enhances the potential amount of the loan it also allows both the borrowers to become eligible to claim tax benefit against the same house For instance if you take a home loan

Download Income Tax Rebate On Home Loan For Co Applicant

More picture related to Income Tax Rebate On Home Loan For Co Applicant

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web 11 avr 2023 nbsp 0183 32 Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards a home loan for a self occupied property Each co Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on Web 11 janv 2023 nbsp 0183 32 Deductions under Section 24 Terms and conditions for home buyers to avail of benefits under Section 24 Deduction under Section 24 is also available to buyers who

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://appleusdt.com/a75b6694/https/43b72c/lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For home loan repayment each co borrower can claim tax benefits under Section 80C upto Rs 1 50 lakhs every year together with other eligible items So you will get the

https://cleartax.in/s/home-loan-tax-benefit

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Notice To Home Loan Applicant Purchasingautoheaterseat

Joint Home Loan Declaration Form For Income Tax Savings And Non

INCOME TAX REBATE ON HOME LOAN

Individual Income Tax Rebate

Latest Income Tax Rebate On Home Loan 2023

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Home Loan Tax Benefits In India Important Facts

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

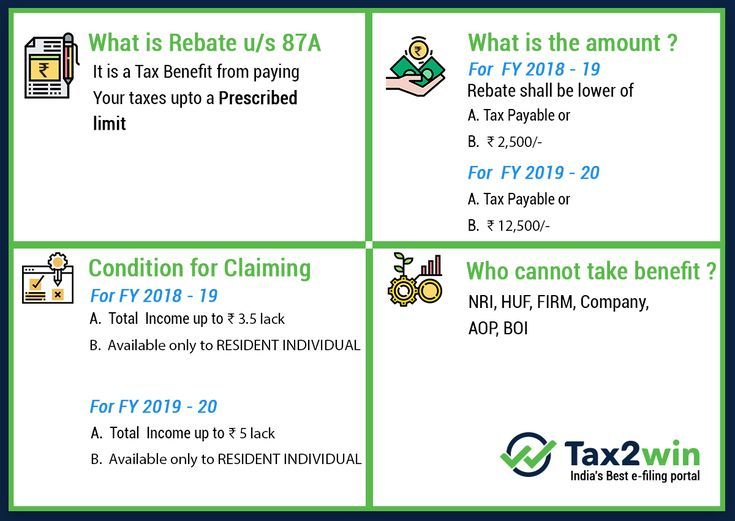

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate On Home Loan For Co Applicant - Web 25 oct 2021 nbsp 0183 32 Adding a younger co applicant may help such borrowers avail loans with a longer tenure quot Higher tax benefits Repayment of home loan qualifies for income tax