Income Tax Rebate On Home Loan For Purchase Of Plot Web 24 ao 251 t 2023 nbsp 0183 32 There are two ways to gain tax benefits on a plot purchase loan Under Section 80C You may deduct the principal repayment component of both your plot and

Web 12 janv 2023 nbsp 0183 32 If a buyer buys a plot to build a home villa or any other building then they can claim income tax benefits on the plot loan Both the plot plus construction loan tax Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Income Tax Rebate On Home Loan For Purchase Of Plot

Income Tax Rebate On Home Loan For Purchase Of Plot

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web Tax benefit under Section 80C As per Section 80C of the Income Tax Act you can avail deduction on the principal repayment component of your plot loan up to a maximum of 150 000 per annum The principal amount Web 30 sept 2022 nbsp 0183 32 You may be allowed for a deduction under this section for the portion of your home and plot loans that relates to the principal payments and ignores the plot loan interest rate This permits a

Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only Web 12 mai 2021 nbsp 0183 32 While in the case of home loan some financial institutions can offer you up to 90 percent of the property value as loan For a plot loan it is typically not more than

Download Income Tax Rebate On Home Loan For Purchase Of Plot

More picture related to Income Tax Rebate On Home Loan For Purchase Of Plot

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Web 18 juil 2018 nbsp 0183 32 In this article we will discuss the tax benefits which one can avail under the Income Tax Act 1961 on Purchase of House property Including the Expenses on Stamp Duty and Registration expenses and Web Taxable Income Tax Amount 8 lakh per annum 3 50 000 Housing Loan Principal Interest Rs 4 50 000 Rs 4 50 000 2 50 000 free Rs 2 00 000 5 of 2 00 000

Web 31 mars 2022 nbsp 0183 32 According to section 80C of the Income Tax Act 1961 you can avail Tax Exemption on Home Loan on the amount you repaid if the property is self occupied In Web 19 avr 2022 nbsp 0183 32 You can avail of a maximum deduction of Rs 2 lakhs and you can claim this deduction only if you reside in the house constructed in that particular plot Thus if you

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

https://www.godrejproperties.com/blog/plot-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 There are two ways to gain tax benefits on a plot purchase loan Under Section 80C You may deduct the principal repayment component of both your plot and

https://www.tatacapital.com/blog/loan-for-home/all-about-plot-loan-tax...

Web 12 janv 2023 nbsp 0183 32 If a buyer buys a plot to build a home villa or any other building then they can claim income tax benefits on the plot loan Both the plot plus construction loan tax

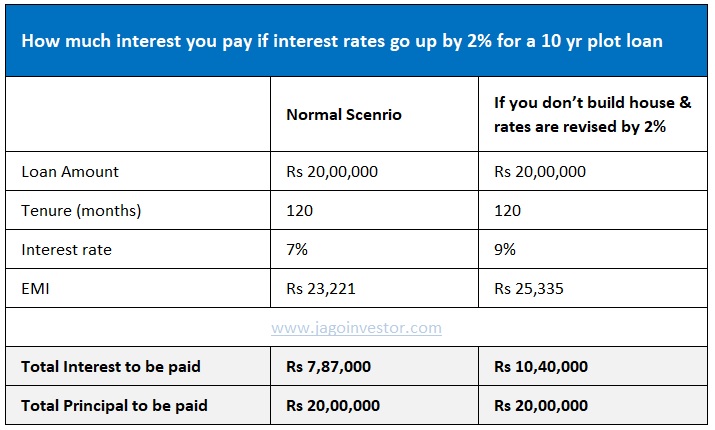

Can You Get A Plot Loan If You Don t Want To Construct A House

DEDUCTION UNDER SECTION 80C TO 80U PDF

Individual Income Tax Rebate

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Georgia Income Tax Rebate 2023 Printable Rebate Form

Blog

Blog

INCOME TAX REBATE ON HOME LOAN

Latest Income Tax Rebate On Home Loan 2023

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Income Tax Rebate On Home Loan For Purchase Of Plot - Web Tax benefit under Section 80C As per Section 80C of the Income Tax Act you can avail deduction on the principal repayment component of your plot loan up to a maximum of 150 000 per annum The principal amount