Income Tax Rebate On Home Loan For Second House Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

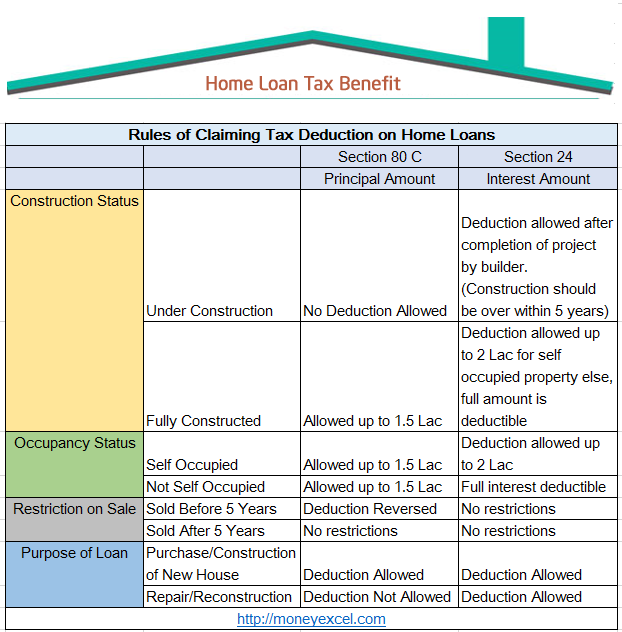

Web 24 janv 2022 nbsp 0183 32 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the second home loan In that case a deduction of up to Rs 2 lakh will be available for taxpayers Note that as Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Income Tax Rebate On Home Loan For Second House

Income Tax Rebate On Home Loan For Second House

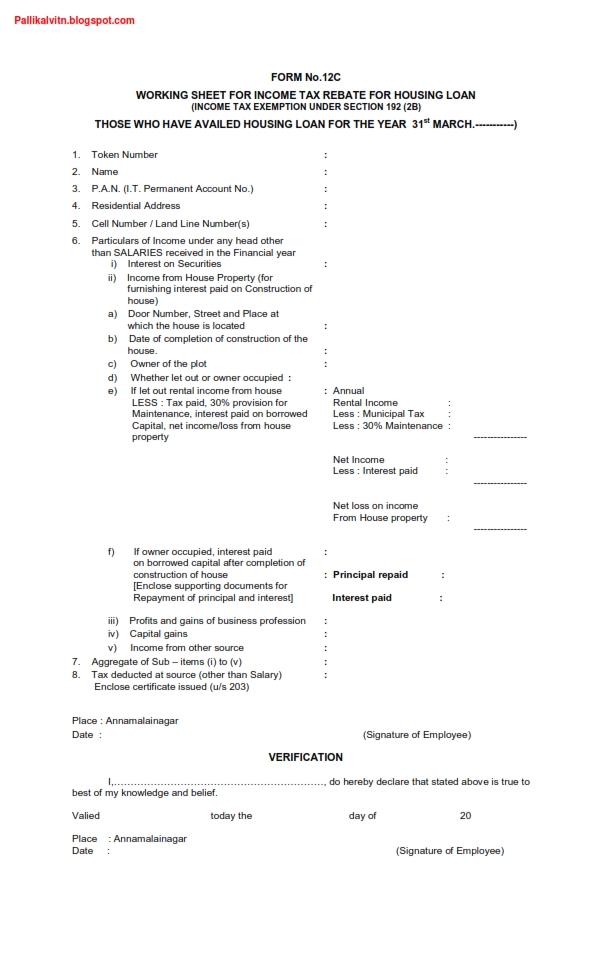

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web Although you are allowed to claim Rs 2 lakhs for your self occupied property as well as full interest for let out or deemed to have been let properties there is a restriction of Rs 2 lakhs on the amount of the Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items

Web There are two possibilities here Both residences are self occupied According to the most recent budget provisions the second property cannot be considered rent As a result Web 20 mai 2016 nbsp 0183 32 E g if you have taken second home loan and it has Rs 2 5 Lakhs as interest and Rs 1 Lakh as principal amount you can claim this Rs 2 5 Lakhs as an income tax

Download Income Tax Rebate On Home Loan For Second House

More picture related to Income Tax Rebate On Home Loan For Second House

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

https://moneyexcel.com/wp-content/uploads/2016/05/home-loan-tax-benefits.png

Web To be deductible the interest you pay must be on a loan secured by your main home or a second home regardless of how the loan is labeled The loan can be a first or second Web Income Tax benefit on Second Home Loan As discussed above the second house is considered as let out whether it is actually rented out or not You have to add rental

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 Web Income tax rebate on home loan Perks of tax advantaged home loans with second homes Second homeowners may take advantage of tax breaks on interest that become

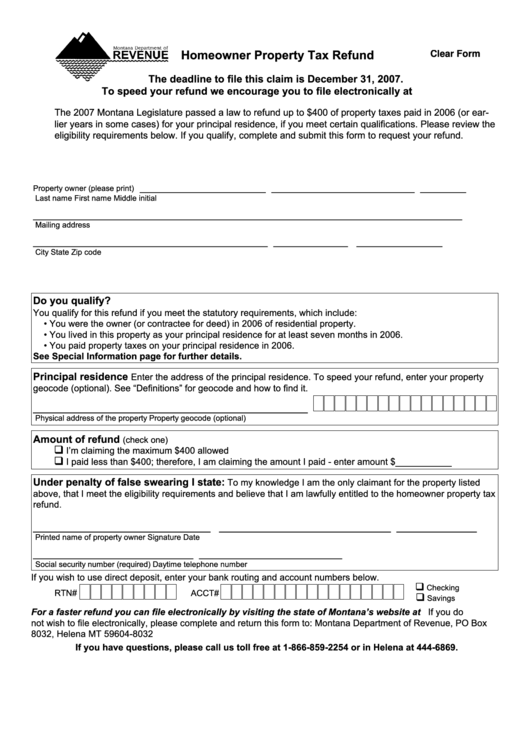

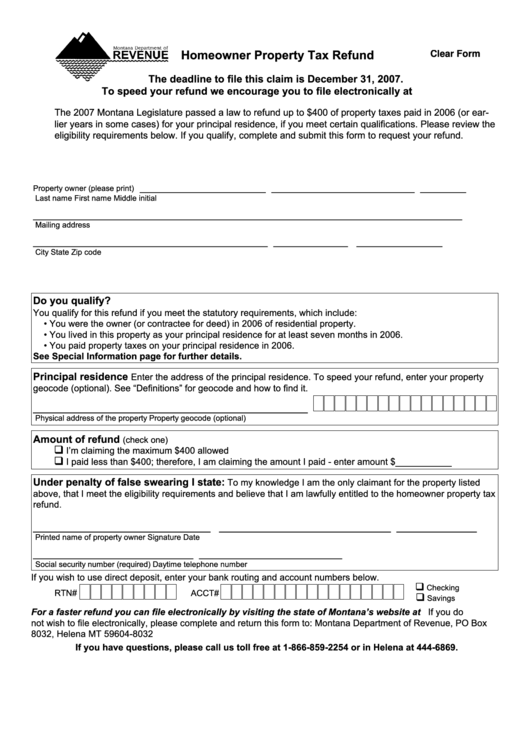

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

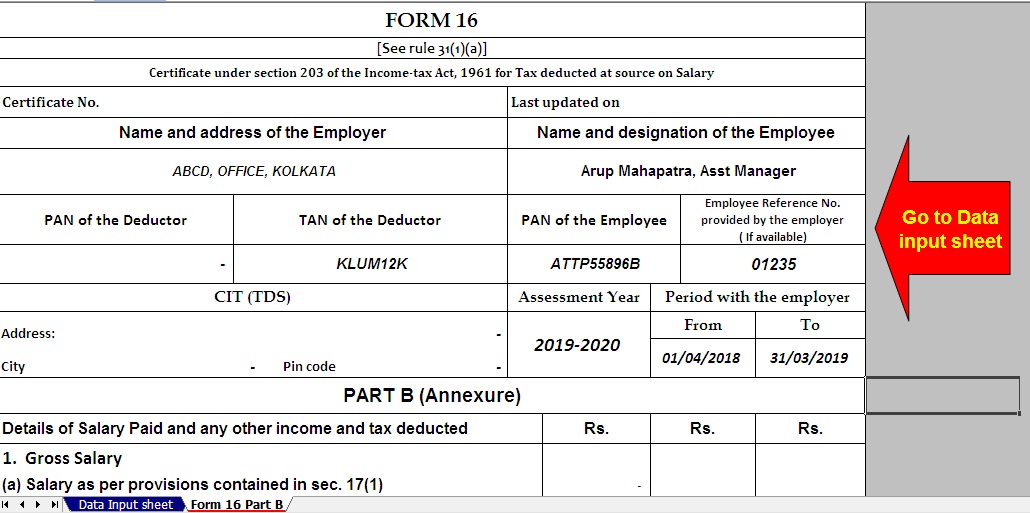

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

https://navi.com/blog/second-home-loan

Web 24 janv 2022 nbsp 0183 32 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the second home loan In that case a deduction of up to Rs 2 lakh will be available for taxpayers Note that as

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Fillable Homeowner Property Tax Refund Form Montana Department Of

DEDUCTION UNDER SECTION 80C TO 80U PDF

Danpirellodesign Income Tax Rebate On Home Loan And Hra

INCOME TAX REBATE ON HOME LOAN

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Income Tax Rebate On Home Loan For Second House - Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items