Income Tax Rebate On Home Loan Interest After Possession Web 6 avr 2016 nbsp 0183 32 Yes you can claim a tax deduction on the interest part upto Rs 1 5 lakhs once your construction is completed within a time span of 3 years You can t claim

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that allows

Income Tax Rebate On Home Loan Interest After Possession

Income Tax Rebate On Home Loan Interest After Possession

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

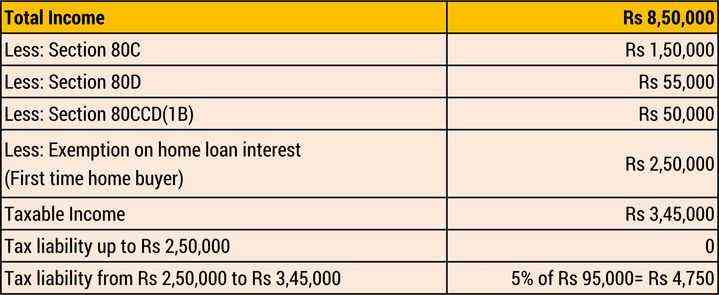

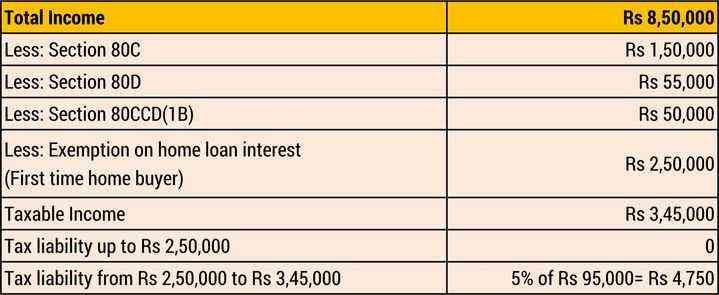

Web 13 nov 2013 nbsp 0183 32 Tax deduction available on home loan only after possession 2 min read 13 Nov 2013 08 26 PM IST Parizad Sirwalla If the property is self occupied then deduction Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the

Web 28 janv 2023 nbsp 0183 32 Tax and investment experts say that a home loan borrower can get an income tax rebate on the home loan interest repayment under Section 24 B They Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to possession can be claimed over the next 5 years but not principal

Download Income Tax Rebate On Home Loan Interest After Possession

More picture related to Income Tax Rebate On Home Loan Interest After Possession

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Web 9 sept 2023 nbsp 0183 32 A home loan borrower can end up losing up to 85 of tax benefits available on the home loan premium payment if the builder fails to deliver possession of the Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B of Web 16 mai 2013 nbsp 0183 32 After the possession is received the deduction can be claimed normally up to a maximum cap of Rs 1 lakh under section 80C Interest Component The interest

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

https://www.caclubindia.com/forum/tax-rebate-on-home-loan-interest...

Web 6 avr 2016 nbsp 0183 32 Yes you can claim a tax deduction on the interest part upto Rs 1 5 lakhs once your construction is completed within a time span of 3 years You can t claim

https://money.stackexchange.com/questions/27738

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

Individual Income Tax Rebate

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

Home Loan Tax Benefits In India Important Facts

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate On Home Loan Fy 2019 20 A design system

How To Lower Loan Interest Rates

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Rebate On Home Loan Interest After Possession - Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the