Income Tax Rebate On Home Loan Interest Before Possession Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Web 22 juin 2023 nbsp 0183 32 Repayment of the loan before possession does not affect the interest claim There is however provision for reversal of tax benefits Web 28 mars 2017 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Income Tax Rebate On Home Loan Interest Before Possession

Income Tax Rebate On Home Loan Interest Before Possession

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

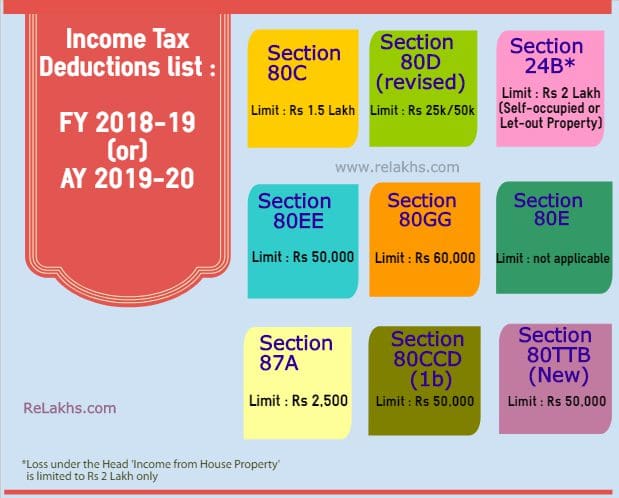

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web 3 ao 251 t 2019 nbsp 0183 32 9 6K views 3 years ago In this video we have discussed about how to claim income tax deduction from interest paid on loan for a house or property before getting Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

Web 24 d 233 c 2021 nbsp 0183 32 Since the house is is being sold within five years from the end of the financial year in which possession of the house was obtained any pre EMI rebate claimed by you for the past three years Web Total interest on home loan is Rs 72 000 for FY 2020 21 Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for

Download Income Tax Rebate On Home Loan Interest Before Possession

More picture related to Income Tax Rebate On Home Loan Interest Before Possession

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Web 9 sept 2023 nbsp 0183 32 A home loan borrower can end up losing up to 85 of tax benefits available on the home loan premium payment if the builder fails to deliver possession of the Web Yes it is possible to claim a tax rebate on Home Loan before possession Know how tax exemptions on the interest component of a Home Loan work in the case of under

Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the Web Income tax benefit on home loan s interest in the pre construction period As you know Section 24 of the Income Tax Act allows you tax benefits on interest paid on home

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

https://www.livemint.com/money/personal-finance/itr-filing-how...

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Repayment of the loan before possession does not affect the interest claim There is however provision for reversal of tax benefits

ITR Filing You Can Claim Interest Paid Before Possession Even If You

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Individual Income Tax Rebate

How To Lower Loan Interest Rates

Joint Home Loan Declaration Form For Income Tax Savings And Non

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate On Home Loan Interest Before Possession - Web Total interest on home loan is Rs 72 000 for FY 2020 21 Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for