Income Tax Rebate On Home Loan Interest Under Construction Web 23 mars 2019 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 in

Web 4 ao 251 t 2021 nbsp 0183 32 As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction phase Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Income Tax Rebate On Home Loan Interest Under Construction

Income Tax Rebate On Home Loan Interest Under Construction

https://assetyogi.b-cdn.net/wp-content/uploads/2017/08/income-tax-rebate-on-home-loan-for-under-construction-property-1024x576.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 24 avr 2017 nbsp 0183 32 If you have a home loan for an under construction property then it is possible to claim for tax deductions A tax deduction up to 2 Lakhs on the interest payments made in a year and up to 1 5 Lakhs Web 5 f 233 vr 2023 nbsp 0183 32 The Income Tax Act allows to claim a deduction of such interest also called the pre construction interest A deduction in five equal instalments starting from the

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web You can deduct the interest component of your home construction loan under Section 24 of the Income Tax Act The maximum deduction allowed for self occupied property is

Download Income Tax Rebate On Home Loan Interest Under Construction

More picture related to Income Tax Rebate On Home Loan Interest Under Construction

Rising Home Loan Interests Have Begun To Impact Homebuyers

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202210/home-loan-gfx5555.jpg?itok=B2YA7SED

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

Web 4 janv 2023 nbsp 0183 32 You can deduct interest on mortgages used to pay for construction expenses if the proceeds are used exclusively to acquire the land and construct the Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the

Web 14 d 233 c 2021 nbsp 0183 32 If a borrower avails a Home Loan for a property with the intention of residing in the same as per Section 24 of the Income Tax Act they are entitled to a deduction of Web 17 f 233 vr 2023 nbsp 0183 32 Under Construction Property Tax Benefit As Per IT Act 1961 Section 80EEA Section 80EEA of the Income Tax Act offers an extra under construction

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

How To Lower Loan Interest Rates

https://myinvestmentideas.com/wp-content/uploads/2016/04/Latest-and-Lowest-Home-Loan-Interest-Rates-in-India-October-2016.jpg

https://taxguru.in/income-tax/claim-deduction-interest-payments-home...

Web 23 mars 2019 nbsp 0183 32 The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 in

https://stableinvestor.com/2021/08/deduction-loan-interest-under...

Web 4 ao 251 t 2021 nbsp 0183 32 As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction phase

What To Know About Montana s New Income And Property Tax Rebates

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

Latest Income Tax Rebate On Home Loan 2023

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

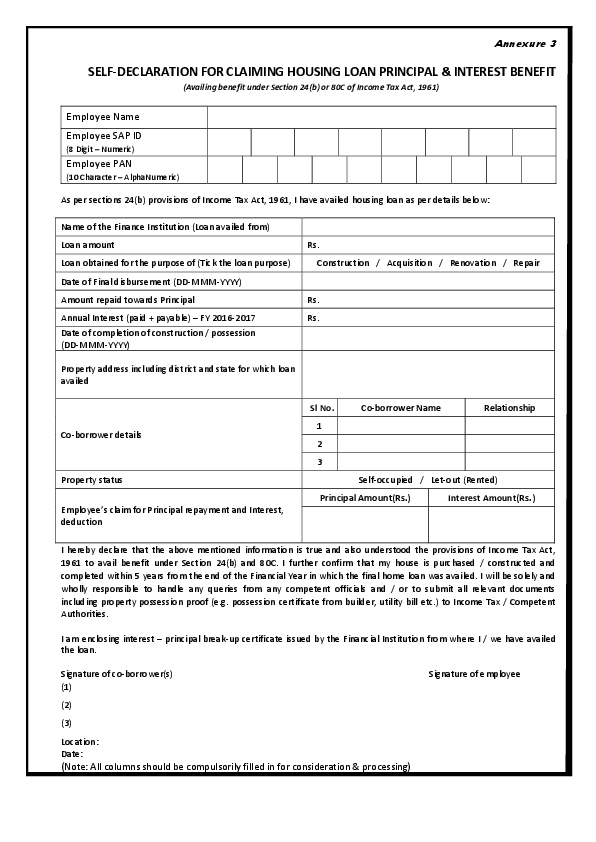

Joint Home Loan Declaration Form For Income Tax Savings And Non

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Interest On House Loan Under Income Tax Act Home Sweet Home

Income Tax Rebate On Home Loan Interest Under Construction - Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that