Income Tax Rebate On Home Loan On Second Home Web 30 mars 2023 nbsp 0183 32 Under Section 80C of the Income Tax Act a maximum of Rs 1 5 lakh deduction is applicable on your principal repayment amount This deduction amount remains the same in the case of a second home However the tax benefit also depends on

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result Web 11 janv 2023 nbsp 0183 32 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases more lucrative for home buyers investors In this article we will discuss at length the various tax rebates that a

Income Tax Rebate On Home Loan On Second Home

Income Tax Rebate On Home Loan On Second Home

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

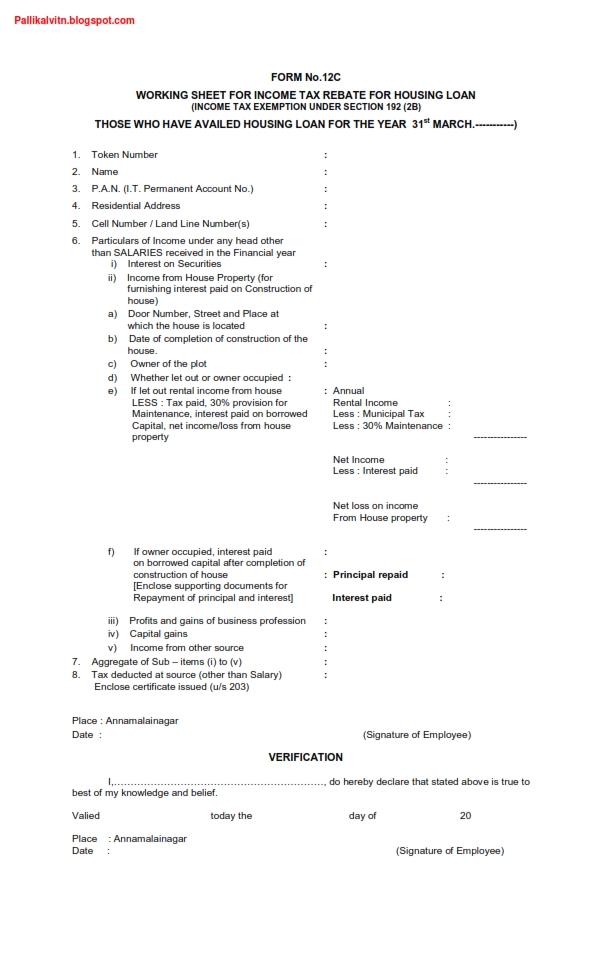

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per annum for Web 9 janv 2021 nbsp 0183 32 1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 per month The approximate home loan interest for this flat is Rs 2 00 000 What

Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax benefit Web Self occupied first home rented second home The rental income from the second residence must be declared You can deduct a typical 30 percent interest on a home loan and municipal taxes from that You can deduct up to Rs 2 lakhs from your other sources

Download Income Tax Rebate On Home Loan On Second Home

More picture related to Income Tax Rebate On Home Loan On Second Home

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-750x375.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web This in cludes any interest you pay on a loan secured by your primary residence or second home This means a mortgage a second mortgage a home equity loan or a home equity line of credit HELOC Web 5 ao 251 t 2016 nbsp 0183 32 Income tax rebate on second home loan Are you planning to buy a second home and also applying for home loan to buy this property You may buy second home for an investment to have regular rental income or to have a home in other city However

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Income Tax Act Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Blog

https://assetyogi.b-cdn.net/wp-content/uploads/2017/08/income-tax-rebate-on-home-loan-for-under-construction-property-1024x576.jpg

https://cleartax.in/s/how-to-claim-income-tax-benefit-on-second-home-lo…

Web 30 mars 2023 nbsp 0183 32 Under Section 80C of the Income Tax Act a maximum of Rs 1 5 lakh deduction is applicable on your principal repayment amount This deduction amount remains the same in the case of a second home However the tax benefit also depends on

https://www.icicibank.com/blogs/home-loan/t…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Georgia Income Tax Rebate 2023 Printable Rebate Form

Home Loan Tax Rebate 5

Individual Income Tax Rebate

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Income Tax Rebate Under Section 87A

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate On Home Loan On Second Home - Web So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per annum for