Income Tax Rebate On Home Loan Principal Before Possession Web 16 mai 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are

Income Tax Rebate On Home Loan Principal Before Possession

Income Tax Rebate On Home Loan Principal Before Possession

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

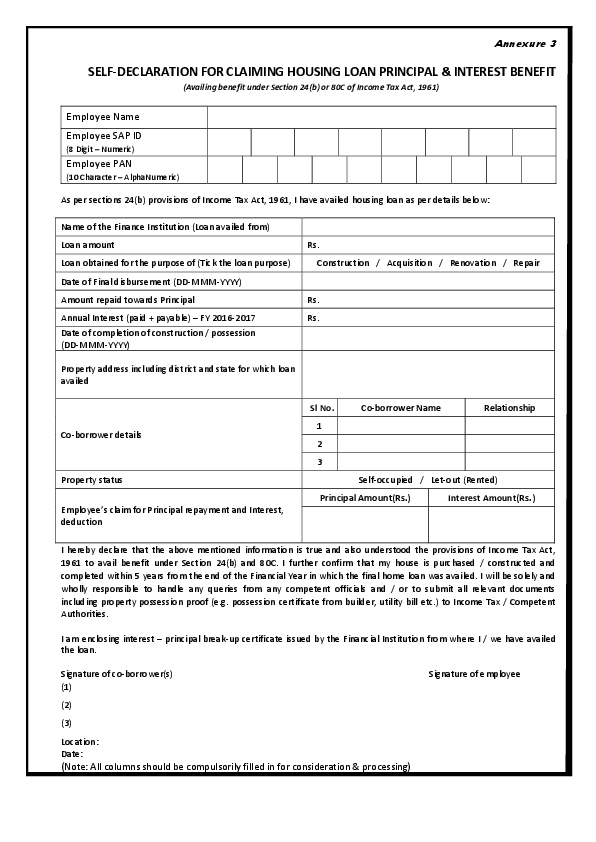

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

https://0.academia-photos.com/attachment_thumbnails/51719845/mini_magick20180818-9322-1ak7apf.png?1534603265

Web 12 janv 2022 nbsp 0183 32 Combined with tax exemptions on the principal amount a home loan for under construction property makes your dream house more affordable Yes you can Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Web 9 sept 2023 nbsp 0183 32 In case of delayed possession over the stipulated period considering that the tax deduction limit over the first 5 years in Rs 2 lakh and the tax deductible limit after

Download Income Tax Rebate On Home Loan Principal Before Possession

More picture related to Income Tax Rebate On Home Loan Principal Before Possession

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

ITR Filing You Can Claim Interest Paid Before Possession Even If You

https://www.livemint.com/lm-img/img/2023/06/22/600x338/Home_loan_1687401215877_1687401216035.jpg

Maximize Your Tax Savings On Home Loan Principal Repayments

https://certicom.in/wp-content/uploads/2023/06/4-5.jpg

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the

Web 4 ao 251 t 2021 nbsp 0183 32 Or how to claim income tax exemption on loans taken for under construction property As per the current income tax rules you cannot claim any tax benefits for the Web 24 avr 2008 nbsp 0183 32 As discussed earlier you can start claiming the income tax benefit of the principal amount u s 80C starting from the financial year in which you get the

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

What Does Rebate Lost Mean On Student Loans

What To Know About Montana s New Income And Property Tax Rebates

INCOME TAX REBATE ON HOME LOAN

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate Under Section 87A

Loan Principal Definition Deltapart

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate On Home Loan Principal Before Possession - Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that