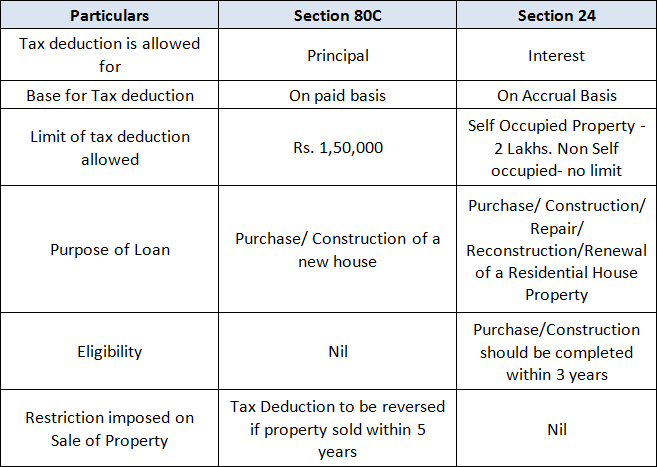

Income Tax Rebate On Home Loan Section 24 Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

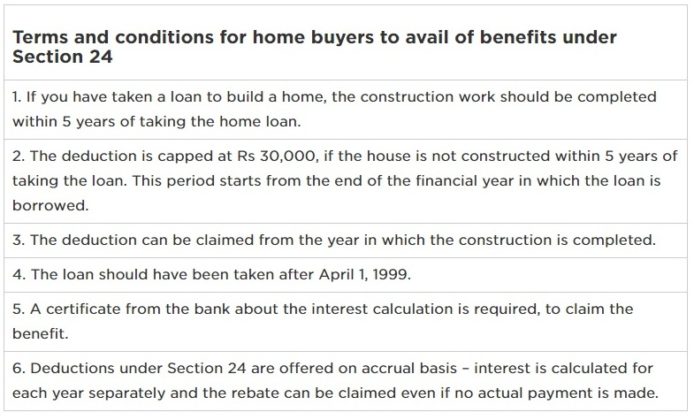

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of Web Section 24 b Deduction from Income from House Property on interest paid on housing loan amp housing improvement loan In case of self occupied property the upper limit for

Income Tax Rebate On Home Loan Section 24

![]()

Income Tax Rebate On Home Loan Section 24

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

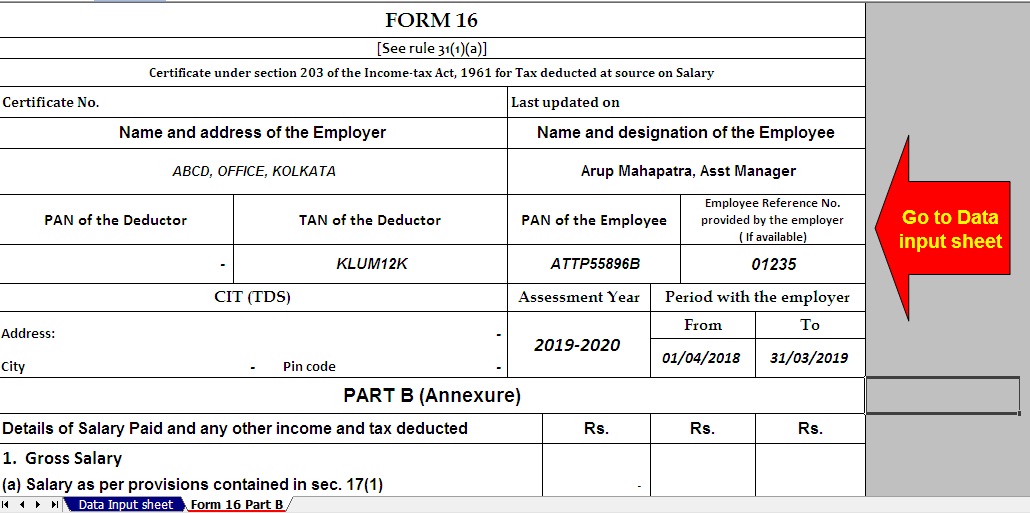

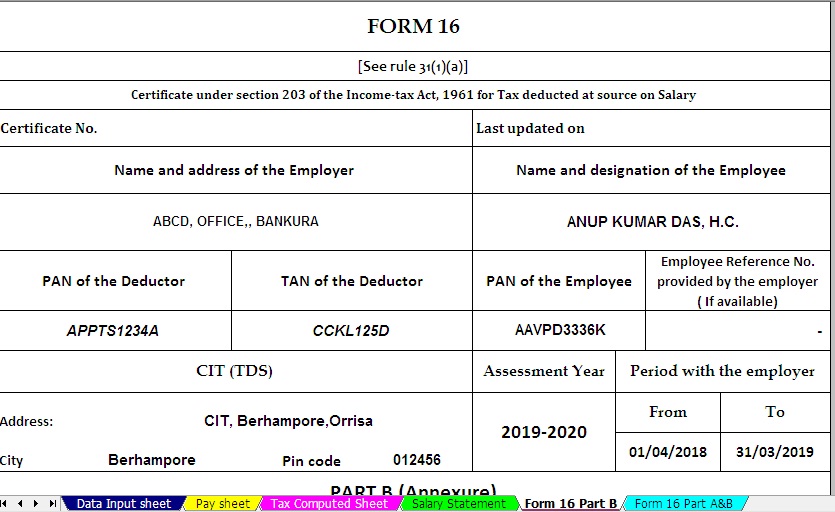

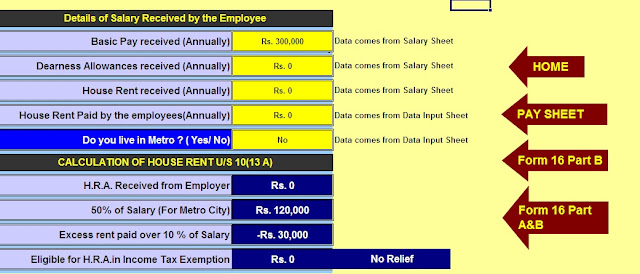

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

https://1.bp.blogspot.com/-iMxeS2BunP0/XqBA6tBeFDI/AAAAAAAAMqY/z1n5gJ66fQovpJMvwhx1NLTrJ58TLiUZACNcBGAsYHQ/s1600/Picture%2B4%2Bof%2BNew%2BForm%2B16%2BPart%2BB.jpg

Web 9 f 233 vr 2018 nbsp 0183 32 The interest that you pay on your Home Loan is allowed as a deduction under Section 24 of the Income Tax Act If you are receiving Web 20 juil 2023 nbsp 0183 32 Section 24A provides a flat 30 deduction on net annual value of the rented property if the property is bought using the owner s own money So if Ram bought a

Web 7 janv 2023 nbsp 0183 32 There is an express need for more tax sops for home buyers as well as investors The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum Web 5 f 233 vr 2023 nbsp 0183 32 Maximum interest deduction under Section 24 b is capped to Rs 2 lakh including current year interest pre construction interest However if your home loan

Download Income Tax Rebate On Home Loan Section 24

More picture related to Income Tax Rebate On Home Loan Section 24

How Housing Loan Tax Benefit

https://financialcontrol.in/wp-content/uploads/2020/02/section-24-of-income-tax-act.jpg

How Section 24 Of Income Tax Act Makes Your Income Tax Free

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2020/09/Home-Loan-Tax-Benefit-as-per-Section-24b-of-Income-Tax-Act.png?fit=2240%2C1260&ssl=1

Home Loan Tax Benefits Section 24 80EE 80C 10 Less Known Facts

https://moneyexcel.com/wp-content/uploads/2016/05/home-loan-tax-benefits.png

Web Section 24 of Income Tax Act Tax Benefit on Home Loan Section 24 of the Income Tax Act Owning a house to live in is no less than a dream However with the high property Web Section 24 Under this section you are allowed to enjoy tax benefits on the interest amount and up to Rs 2 lakhs

Web 20 juil 2023 nbsp 0183 32 Borrowers can claim a tax deduction of up to Rs 2 lakh in a year under section 24B of the income tax law if The property is self occupied This rules out an application on rented property The home Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh on home loan interest paid This deduction is applicable in case of

Taken Home Loan Must Read This Article On Section 24 For Huge Tax

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

All About Home Loan Income Tax Benefits Qualcon Dreams

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Section 24 Of Income Tax Act Types Deductions Exceptions And How To

Tax Benefit For Interest On Home Loan Under Income Tax Section 24

Comparison Of OLD And NEW Income Tax Deduction Exemptions And Rebate

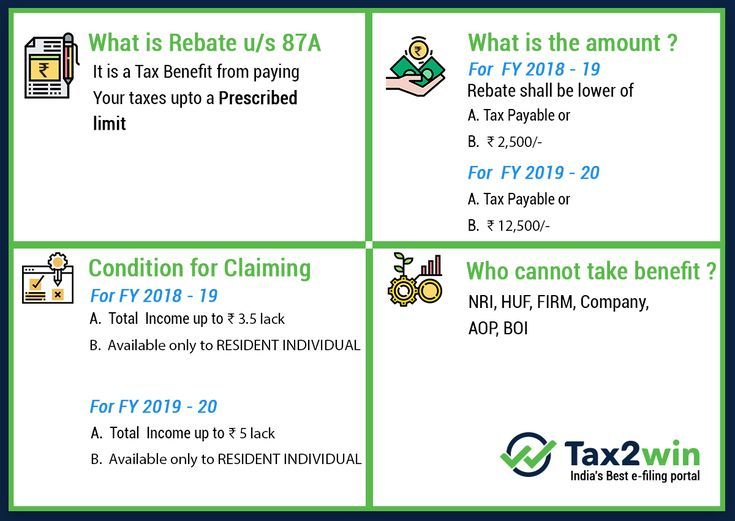

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate On Home Loan Section 24 - Web Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can