Income Tax Rebate On House Loan Repayment Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

Income Tax Rebate On House Loan Repayment

Income Tax Rebate On House Loan Repayment

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

![]()

Section 24 Income Tax Benefit Of A Housing Loan OneMint

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This Web 31 mai 2022 nbsp 0183 32 How to Claim Tax Benefits for Home Loan Repayment You can claim tax benefits on a home loan when filing your income tax returns ITR or when submitting the home loan interest certificate to your

Web Tax Rebate on a Home Loan that Can be Availed u s 80C For self occupied and also let out properties you are allowed to claim up to a maximum of 1 5 lakhs every year from a taxable income on principal Web 20 f 233 vr 2020 nbsp 0183 32 As the repayment comprises of 2 different components the tax benefit on home loan is governed by different sections of the Income Tax Act and these are claimed as tax deductions under different

Download Income Tax Rebate On House Loan Repayment

More picture related to Income Tax Rebate On House Loan Repayment

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest Web 4 mars 2023 nbsp 0183 32 ITR filing Income tax exemption from long term capital gains is not available in respect of repayment of a home loan A taxpayer can claim deduction under Section

Web Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

INCOME TAX REBATE ON HOME LOAN

http://bit.ly/LcipDI

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax-benefits

Web Section 80C under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Home Loan Tax Benefit Calculator FrankiSoumya

DEDUCTION UNDER SECTION 80C TO 80U PDF

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

ING Home Loan Repayment Calculator

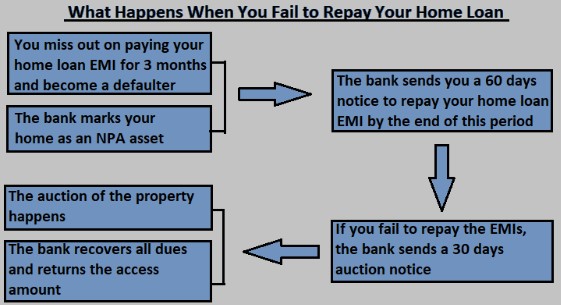

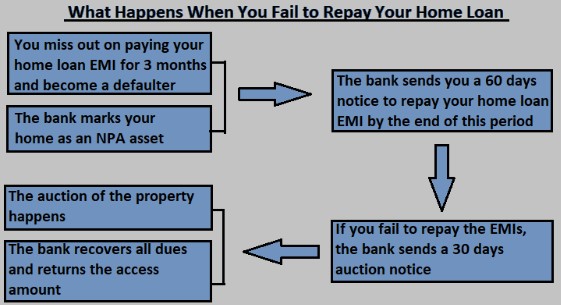

What Happens If You Fail To Repay Your Home Loan Home Loan Repayment

What Happens If You Fail To Repay Your Home Loan Home Loan Repayment

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Home Loan Tax Benefits In India Important Facts

Income Tax Rebate Under Section 87A

Income Tax Rebate On House Loan Repayment - Web 26 juil 2018 nbsp 0183 32 The repayment of the principal amount of loan is claimed as a deduction under section 80C of the Income Tax Act up to a maximum amount of Rs 1 50 Rs 1