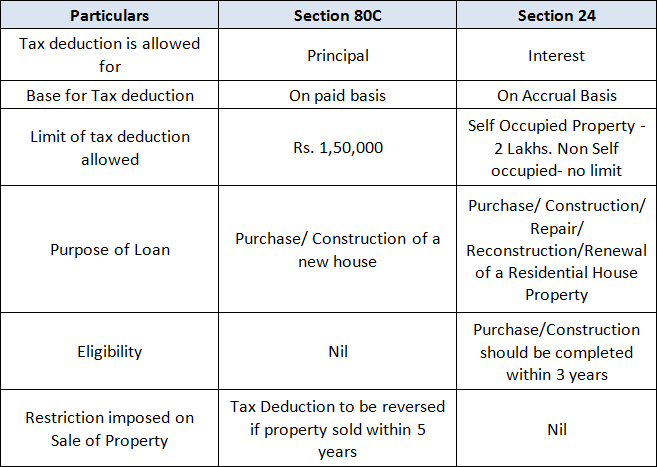

Income Tax Rebate On Housing Loan Interest In India Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

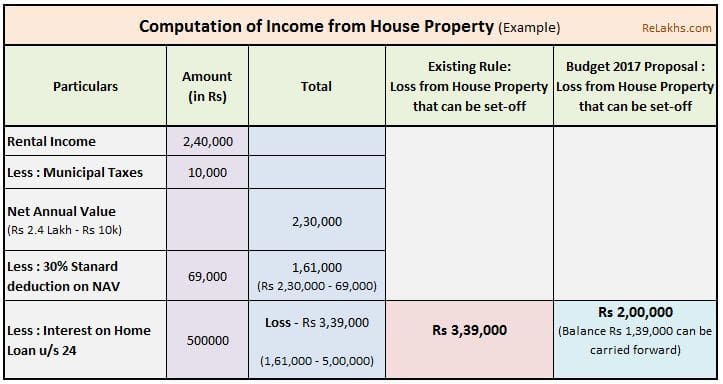

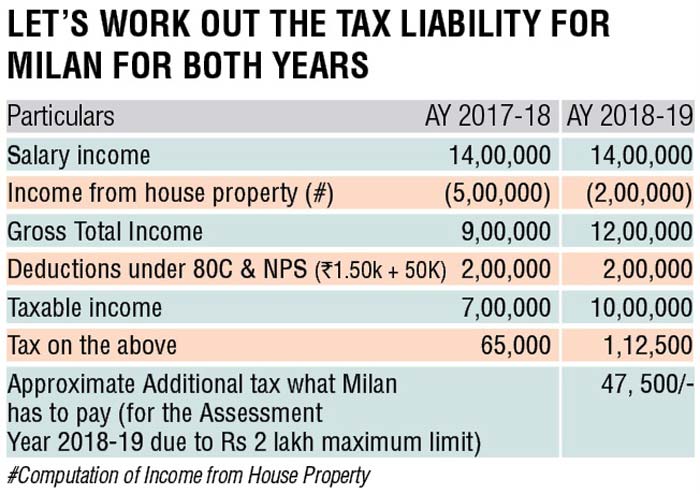

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Web 20 mars 2023 nbsp 0183 32 Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards your home loan in a financial year

Income Tax Rebate On Housing Loan Interest In India

Income Tax Rebate On Housing Loan Interest In India

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be

Download Income Tax Rebate On Housing Loan Interest In India

More picture related to Income Tax Rebate On Housing Loan Interest In India

Housing Loan Interest Rates HDFC Home Loan Interest Rates Housing

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Home Loan Interest Rate Home Sweet Home Insurance Accident

https://moneyexcel.com/wp-content/uploads/2016/05/best-home-loan-interest-rate-india.png

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 31 mars 2019 nbsp 0183 32 Under Section 24 of the Income Tax Act you can claim a deduction on the interest portion of your EMIs paid through a financial year The maximum tax benefit you can get in a financial year for a self Web 24 ao 251 t 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Web Section 80EEA Income Tax Benefit on Interest on Home Loan First Time Buyers The interest deduction can be claimed under Section 80EEA as well which is over and above Web Section 24 b Deduction from Income from House Property on interest paid on housing loan amp housing improvement loan In case of self occupied property the upper limit for

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

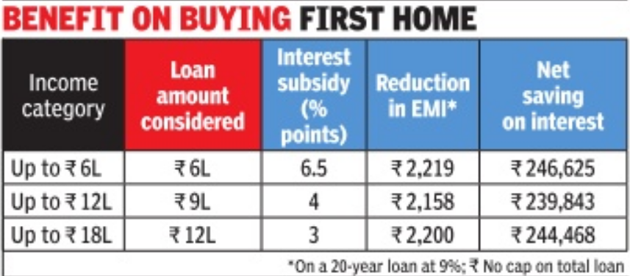

Home Loan Interest First House On 20 year Loan To Cost Rs 2 4 Lakh Less

http://img.etimg.com/photo/57074933/.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Download Home Loan Interest Rates In India Home

Reliance SEZ India Real Estate

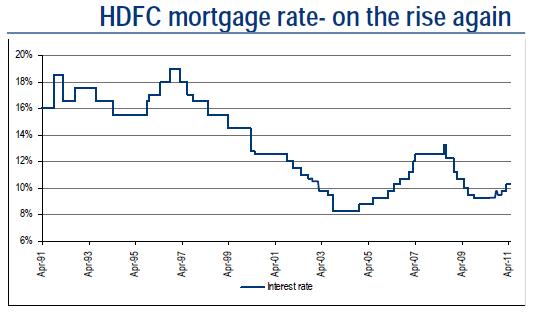

Rising Home Loan Interests Have Begun To Impact Homebuyers

Rising Home Loan Interests Have Begun To Impact Homebuyers

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Understanding The Tax Benefit Of Home Loan Interest

Best Home Loan Interest Rates In India Current Home Loan Interest

Income Tax Rebate On Housing Loan Interest In India - Web 25 mars 2016 nbsp 0183 32 Read Also Tips to Save Income Tax in India Deduction on Pre construction Interest You can also claim interest on a housing loan paid before the completion of the construction of the property It is termed pre construction interest It is allowed in 5 equal instalments beginning from the financial year in which the construction