Income Tax Rebate On Housing Loan Interest Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

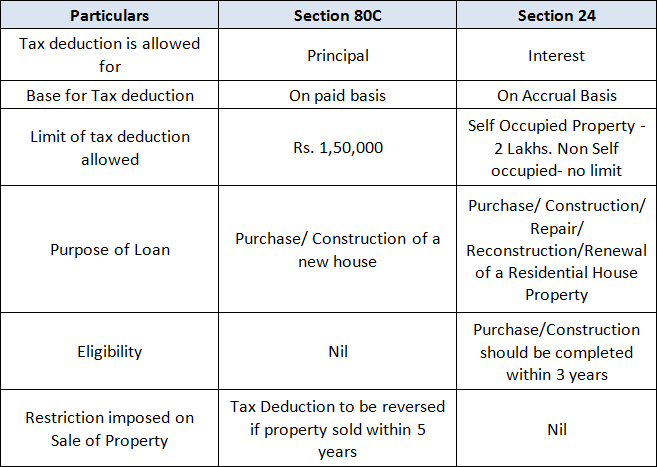

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Income Tax Rebate On Housing Loan Interest

Income Tax Rebate On Housing Loan Interest

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income

Web 7 janv 2023 nbsp 0183 32 The tax rebate on housing loan interest under Section 24 b needs to be hiked to at least Rs 5 lakh This will add momentum to housing demand particularly in the affordable segment said Anuj Puri Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

Download Income Tax Rebate On Housing Loan Interest

More picture related to Income Tax Rebate On Housing Loan Interest

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Interest-Paid-on-Loan-During-the-Initial-Phase-750x362.jpg

Web 30 janv 2023 nbsp 0183 32 Therefore homebuyers expect some relief on home loan tax rebates from Finance Minister Nirmala Sitharaman in the Union Budget 2023 The current tax rebate on housing loan interest under Section Web The total claimed tax rebate is Rs 3 50 000 So the remaining amount is Rs 4 50 000 As we know there is no tax obligation for amount up to Rs 2 50 000 The taxable income

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of Web Section 80C deals with the principal amount deductions For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Section 87A Tax Rebate Under Section 87A

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Union Budget 2023 Tax Rebate On Housing Loan Interest Expected To Hike

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Housing Loan And Interest Paid Thereon For Construction Of Rented House

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Joint Home Loan Declaration Form For Income Tax Savings And Non

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate On Housing Loan Interest - Web You will only receive a tax reduction if the deductible financing interest and fees exceed the amount added to your income for the imputed rental value of your home If your taxable