Income Tax Rebate On Housing Loan Principal Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

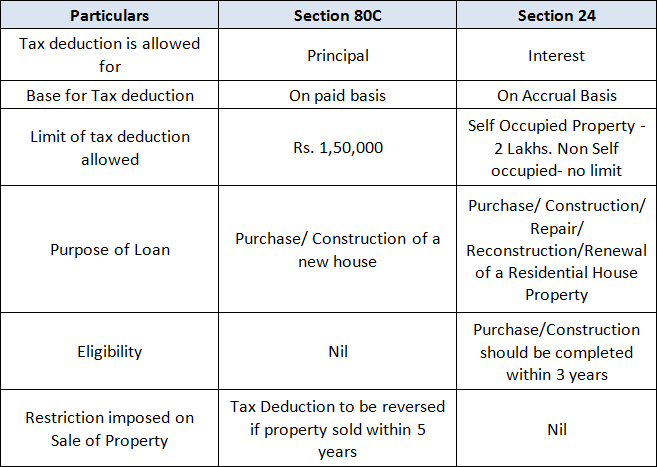

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Income Tax Rebate On Housing Loan Principal

Income Tax Rebate On Housing Loan Principal

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Web 31 mai 2022 nbsp 0183 32 Is it possible to get a tax exemption on the principal repaid on a housing loan Ans Yes under Section 80C of the Income Tax Act you can get tax benefits on the repaid principal amount Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Web Yes the home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of Web Deduction on Principal Repayment The principal component of your home loan EMI can be claimed as a deduction under Section 80C of the Income Tax Act subject to a maximum limit of Rs 1 5 lakh per year

Download Income Tax Rebate On Housing Loan Principal

More picture related to Income Tax Rebate On Housing Loan Principal

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Interest-Paid-on-Loan-During-the-Initial-Phase-750x362.jpg

Web Income tax rebate on home loan Tax deductions Homebuyers in India may deduct up to Rs 1 5 lakhs in principal payments under Section 80C and up to Rs 2 million in interest Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Web 28 janv 2014 nbsp 0183 32 As per the law I can get tax benefits on principle up to 1L rs and interest 2 5L for first 2 years then 1 5L if first loan and loan amount lt 25L I am starting my Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

https://incometaxindia.gov.in/Lists/ASKITQA/DispForm.aspx?ID=2174&...

Web Answer An Individual can claim following tax benefits relating to home loan repayment 1 Deduction for interest on housing loan can be claimed u s 24 b under the head

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Income Tax Rebate Astonishingceiyrs

Latest Income Tax Rebate On Home Loan 2023

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Income Tax Rebate On Home Loan Principal

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Home Loan Tax Benefits Get Income Tax Rebate On Home Loans

Govt May Increase Tax Exemption Limit To Rs 5 Lakh From Rs 2 5 Lakh

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

Income Tax Rebate On Housing Loan Principal - Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the