Income Tax Rebate On Housing Loan Repayment Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be claimed

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web 31 mai 2022 nbsp 0183 32 Home Loans Tax Benefits Exemptions Under Section 80C 24 b 80EE amp 80EEA One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your

Income Tax Rebate On Housing Loan Repayment

Income Tax Rebate On Housing Loan Repayment

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

![]()

Section 24 Income Tax Benefit Of A Housing Loan OneMint

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

Web Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house loan This is Web Claim a maximum home loan tax deduction of up to Rs 1 5 lakh from your taxable income on the principal repayment This may include deduction on stamp duty and registration

Download Income Tax Rebate On Housing Loan Repayment

More picture related to Income Tax Rebate On Housing Loan Repayment

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

Web Income tax rebate on housing loan repayment case of housing unit cancellation Commenced housing loan first emi including interest Rs 6485 during 2008 09 Settled Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Web The tax laws not only allow you deduction for interest but also allow you rebate for repayment of the principal amount under certain circumstances As per provisions of Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions

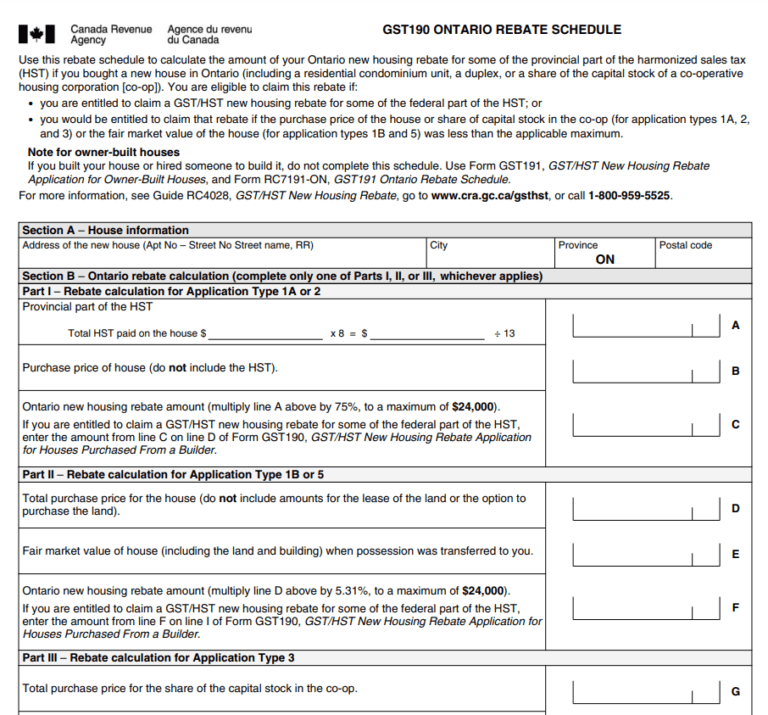

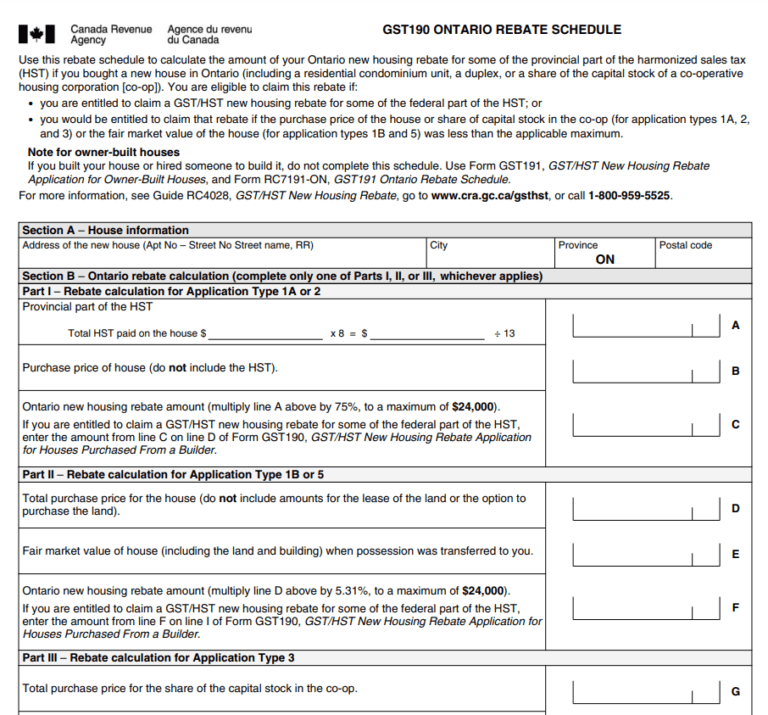

Ontario New Housing Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-New-Housing-Rebate-Form-768x715.png

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

https://incometaxindia.gov.in/Lists/ASKITQA/DispForm.aspx?ID=2174&...

Web 1 Deduction for interest on housing loan can be claimed u s 24 b under the head Income from house property 2 Deduction for principal amount of repayment can be claimed

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Blog

Ontario New Housing Rebate Form By State Printable Rebate Form

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

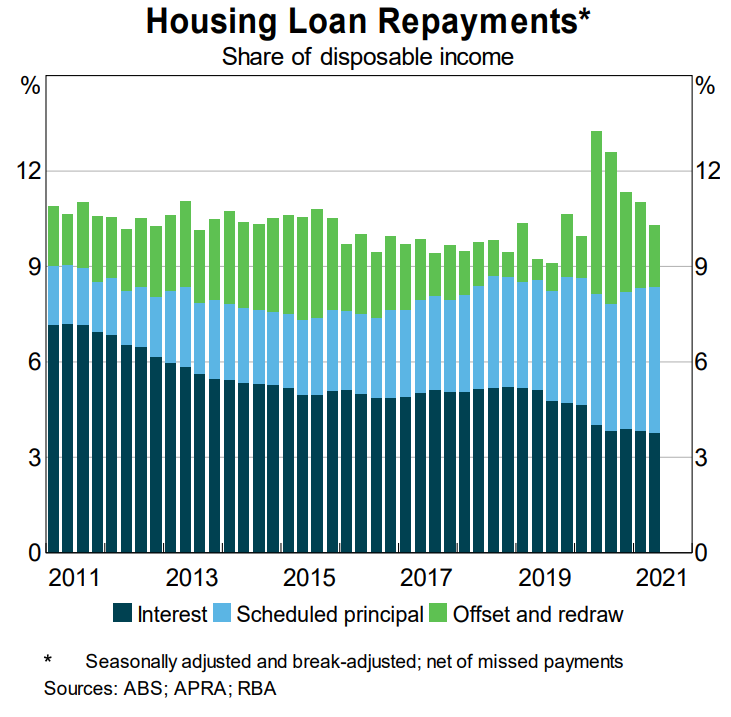

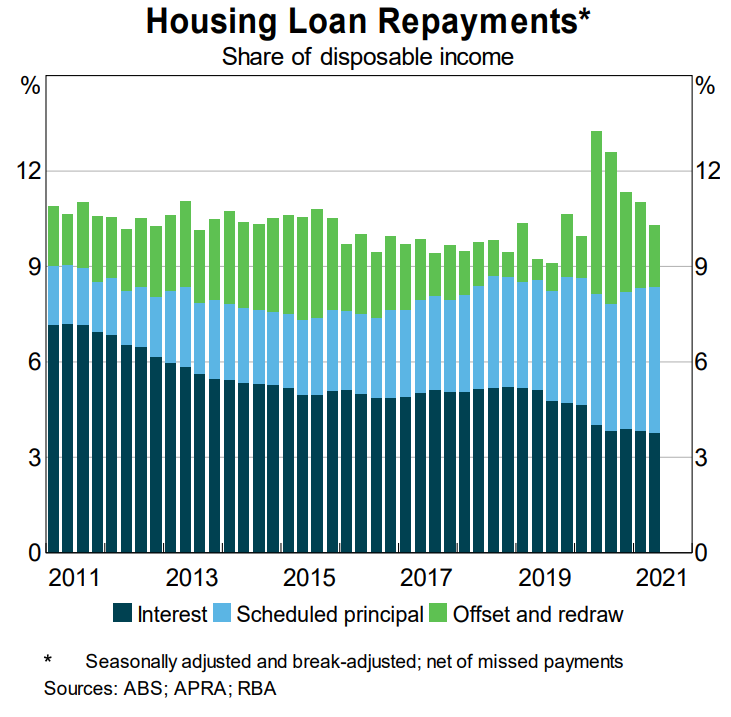

RBA Saving A Deposit The Biggest Housing Barrier MacroBusiness

RBA Saving A Deposit The Biggest Housing Barrier MacroBusiness

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

New Housing Tax Rebate Canada Home Tax Rebate Rebates Tax Canada

PW1023 PRE RECOREDED WEBINAR GST HST And NEW HOUSING REBATES

Income Tax Rebate On Housing Loan Repayment - Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs