Income Tax Rebate On Interest Of House Building Advance Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

Web 1 avr 1999 nbsp 0183 32 Claiming Exemption for House Building Loan Repayment and Interest on Housing Loan in Income Tax Conditions for Claim of Deduction of Interest on Borrowed Web 4 ao 251 t 2021 nbsp 0183 32 This means that you get to claim an additional deduction of Rs 44 000 in Prior Period Interest during the next 5 financial years i e 2023 24 2024 25 2025 26 2026

Income Tax Rebate On Interest Of House Building Advance

Income Tax Rebate On Interest Of House Building Advance

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/income-tax-rebate-under-section-87a-for-income-up-to-5-lakh.jpeg?w=512&ssl=1

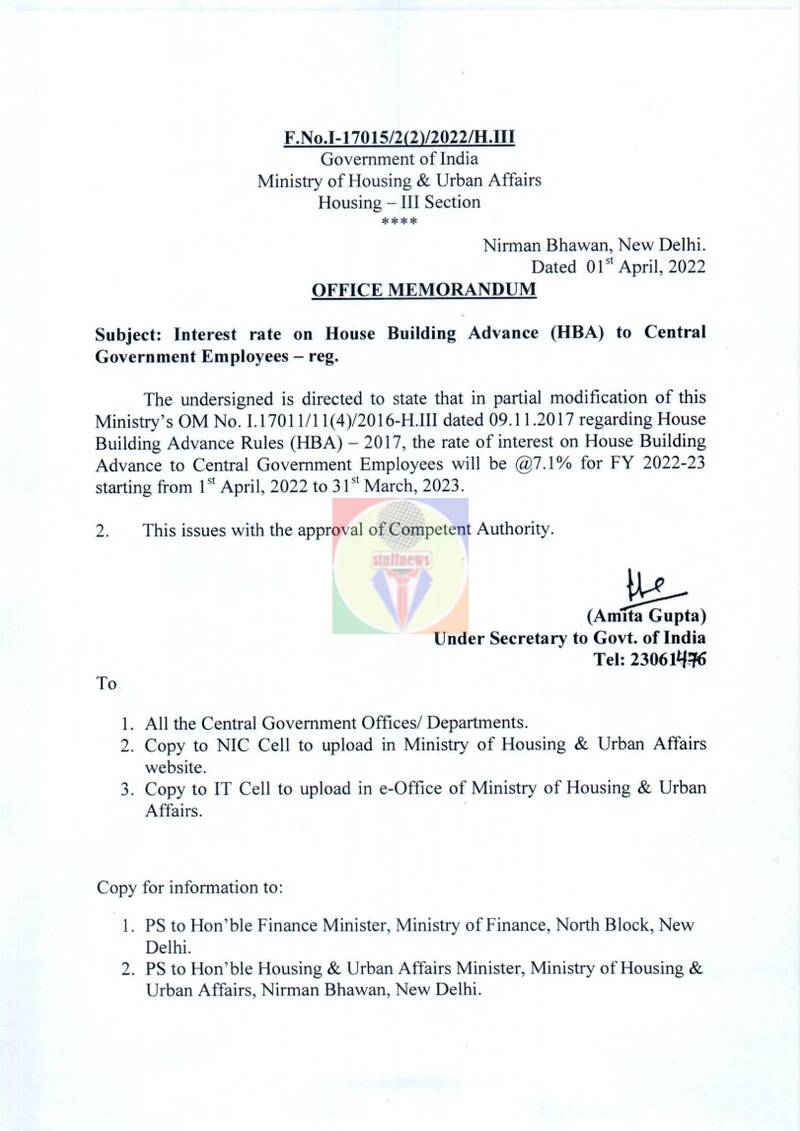

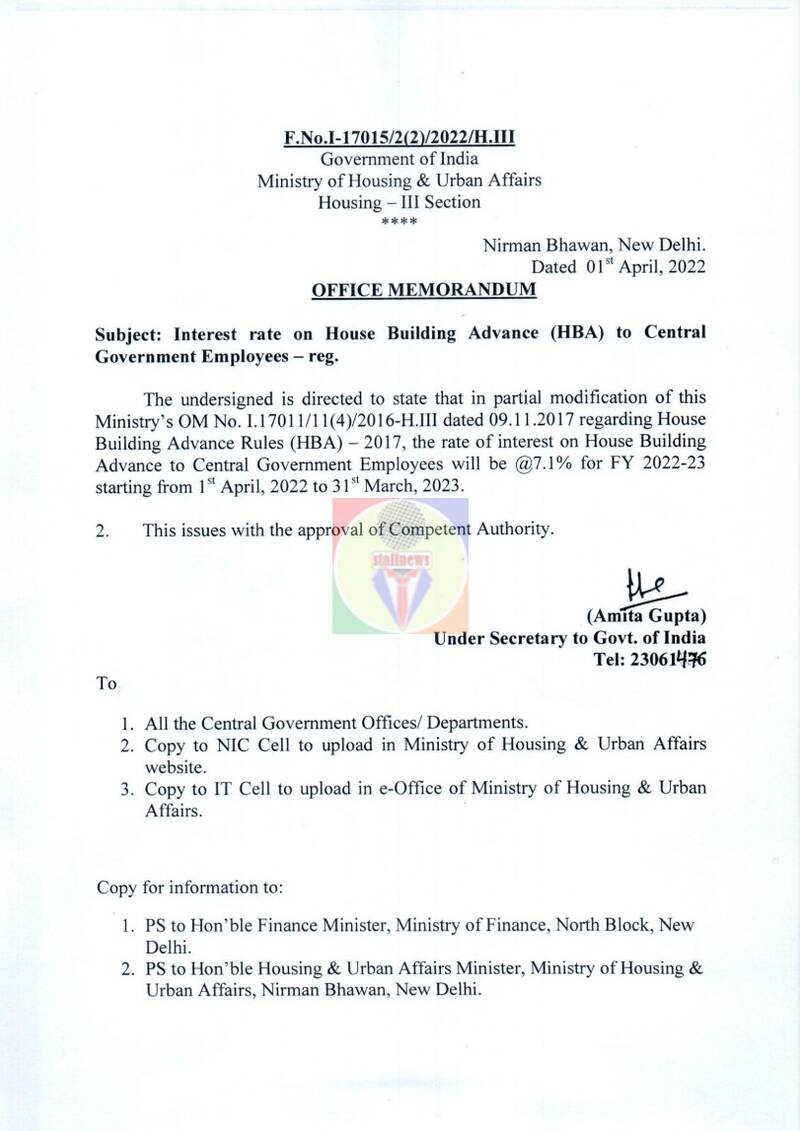

Interest Rate On House Building Advance HBA For FY 2022 23 Starting

https://www.staffnews.in/wp-content/uploads/2022/04/interest-rate-on-house-building-advance-hba-for-fy-2022-23.jpg

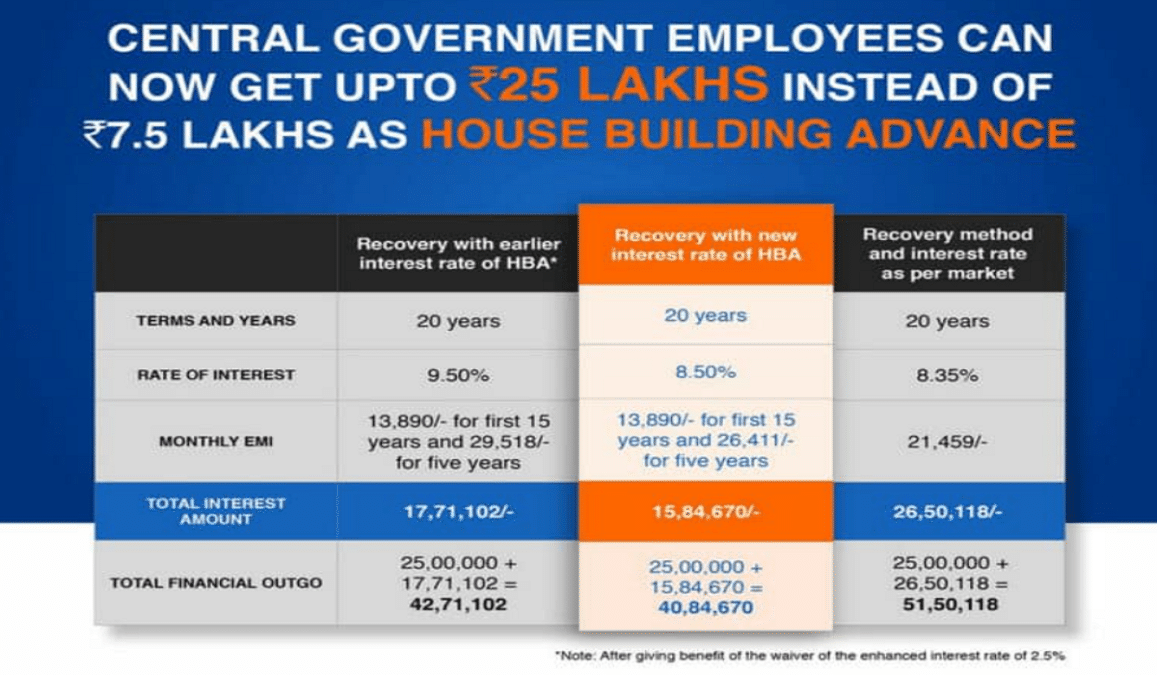

House Building Advance Scheme 2021 For Central Government Employees

https://sarkariyojana.com/wp-content/uploads/2017/11/house-building-advance-scheme-interest-rate-1157x675.png

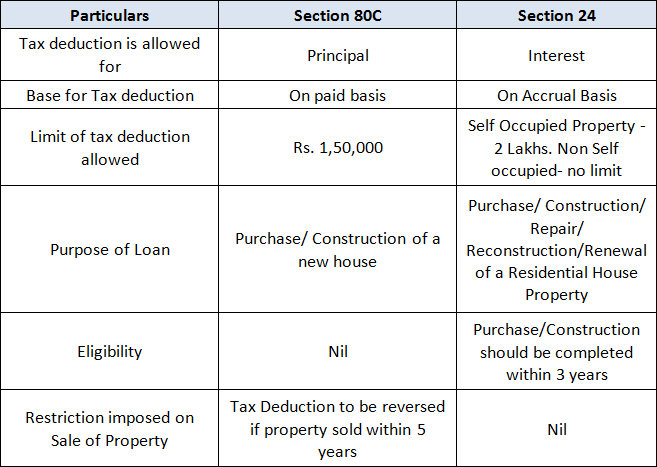

Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to Rs Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get tax benefits

Web g The rates of interest on house building cases sanctioned after 1 6 1981 will be as under i 7 per annum for advances up to Rs 25 000 ii 81 2 per annum for Web MEMORANDUM Sub Clarification regarding income tax treatment on interest on House Building Advance taken from Government It has been observed that some DDOs are

Download Income Tax Rebate On Interest Of House Building Advance

More picture related to Income Tax Rebate On Interest Of House Building Advance

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Benefits On Housing Loan Interest And Principal House Poster

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Web 5 f 233 vr 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh let out property there is no Web 30 ao 251 t 2022 nbsp 0183 32 For example if you are availing of an interest benefit of Rs 1 80 000 on the home loan amount and also you are paying interest on home improvement loan

Web You can claim up to Rs 150 000 or the actual interest repaid whichever is lower You can claim thisinterest only when Web 15 avr 2013 nbsp 0183 32 1 What are Income tax benefits of taking and repaying a housing loan under EMI Plan You will be eligible to claim both the interest and principal components of

Interest Rate On House Building Advance HBA To Central Government

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgdd7llmB-o6FKLhHhOnH9hIZetPPayjc-Tlc4ATrrkOULZX4gy_QgHUTfppBKGnvghbCpXhTsrSY4xM1Cl54ke2Gjbc8F-xMkVBP7gbTiYwDmZ6rIp5-Ln7mN0ONvobGJMIO9B8puwer0GE-oNsUKPKWlGooGi33aa_izwDh-4Ge9It3WyRerwxZ_B/w584-h819/ECE_7883_002.png

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

https://www.bankbazaar.com/tax/7th-cpc-house-building-advance.html

Web 5 juil 2021 nbsp 0183 32 2 5 rebate is applicable on HBA loan if the conditions related to the sanction of the advance and recovery of the entire amount are fulfilled completely 0 5 interest

https://www.apteachers.in/2013/12/it-exemptions-house-building-loan.h…

Web 1 avr 1999 nbsp 0183 32 Claiming Exemption for House Building Loan Repayment and Interest on Housing Loan in Income Tax Conditions for Claim of Deduction of Interest on Borrowed

Income Tax Rebate Under Section 87A

Interest Rate On House Building Advance HBA To Central Government

Latest Income Tax Rebate On Home Loan 2023

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

HOUSE BUILDING ADVANCE 1 2 CSIR

Individual Income Tax Rebate

Individual Income Tax Rebate

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

2022 State Of Illinois Tax Rebates

Download Form Of Reconveyance For House Building Advance

Income Tax Rebate On Interest Of House Building Advance - Web Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a deduction of up to Rs