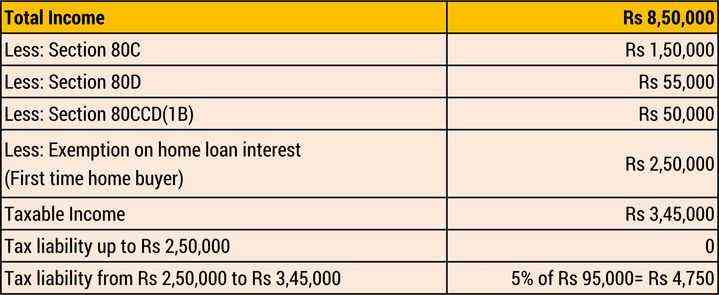

Income Tax Rebate On Interest On Home Loan Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web 13 mai 2017 nbsp 0183 32 There are four steps to claim interest on your home loan deduction A deduction for interest payments up to Rs 1 50 000 is

Income Tax Rebate On Interest On Home Loan

Income Tax Rebate On Interest On Home Loan

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

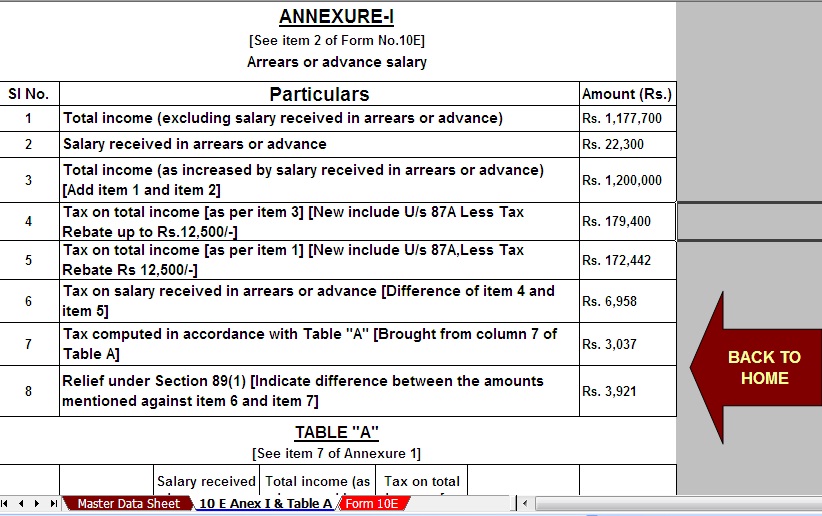

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

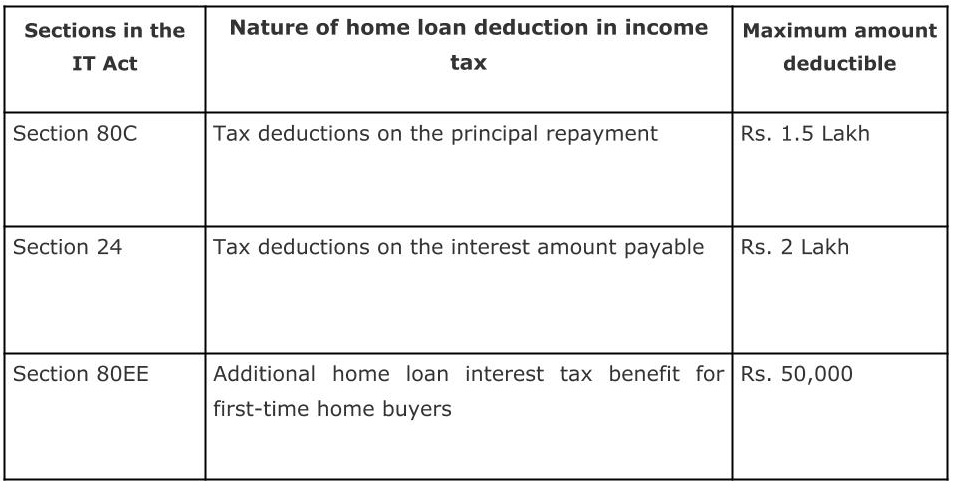

Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Web Tax Deduction on Interest Paid on Home Loan Under Section 24B You can avail deduction on the interest paid on your home loan under section 24 b of the Income

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the Web 20 mars 2023 nbsp 0183 32 Additionally all co borrowers can claim a deduction on the principal amount and interest payment of the home loan under Section 80C upto 1 5lakh each and Section 24 b upto 2 lakh each of the

Download Income Tax Rebate On Interest On Home Loan

More picture related to Income Tax Rebate On Interest On Home Loan

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web You can avail of a home loan tax benefit on both principal repayment and the interest component of your EMI Here s how Section 80C Deductions under this section can

Web 31 mars 2019 nbsp 0183 32 Home Loan Tax Benefit Interest Paid on Home Loan Section 24 Under Section 24 of the Income Tax Act you can claim a deduction on the interest portion of Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

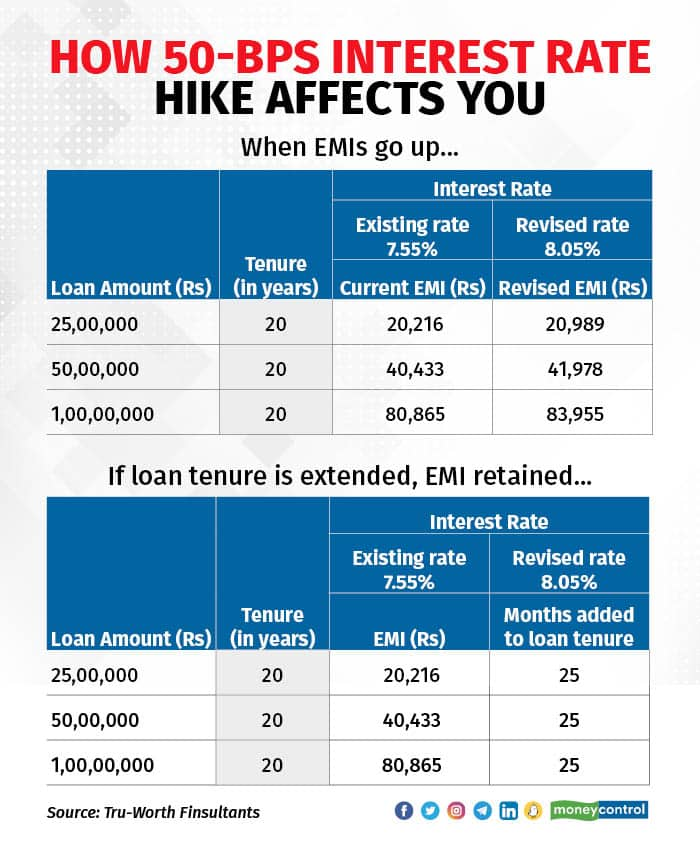

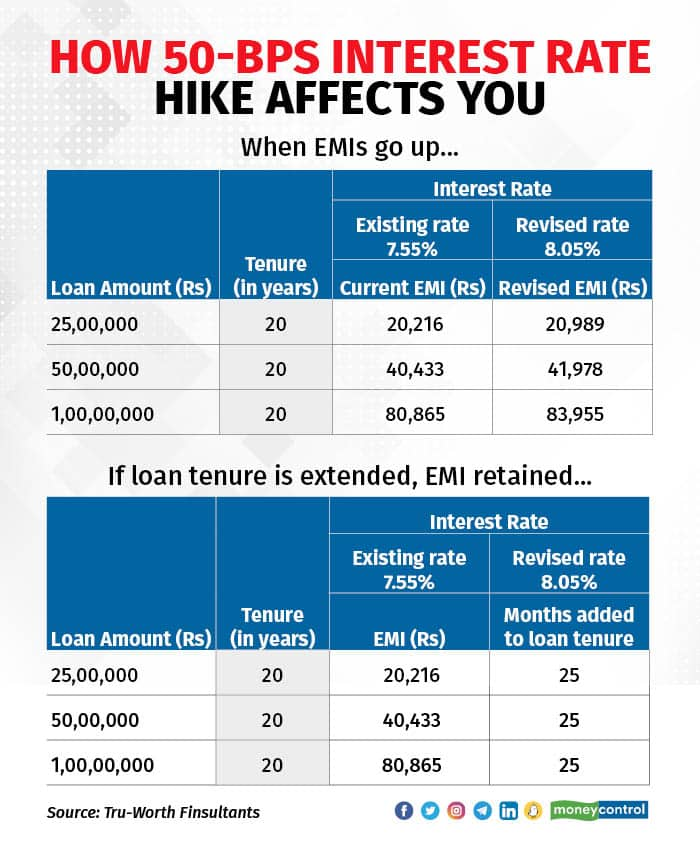

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

https://images.moneycontrol.com/static-mcnews/2022/08/home-loan-700X700.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Home Loan Interest Exemption In Income Tax Home Sweet Home

Latest Income Tax Rebate On Home Loan 2023

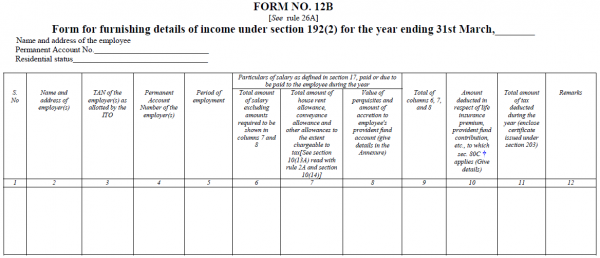

Form 12BB New Form To Claim Income Tax Benefits Rebate

Form 12BB New Form To Claim Income Tax Benefits Rebate

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

INCOME TAX REBATE ON HOME LOAN

Top 10 Tax Saving Tips For FY 2021 Rurash Blog

Income Tax Rebate On Interest On Home Loan - Web 25 mars 2016 nbsp 0183 32 First home Self occupied and I paid home loan interest from 1999 jointly with my wife I am an owner of this flat jointly with my wife Second home Purchased