Income Tax Rebate On Interest On Saving Account Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return Claim a refund of Income Tax deducted

Web You earn 163 16 000 of wages and get 163 200 interest on your savings Your Personal Allowance is 163 12 570 It s used up by the first 163 12 570 of your wages The remaining Web 26 avr 2023 nbsp 0183 32 Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even if

Income Tax Rebate On Interest On Saving Account

Income Tax Rebate On Interest On Saving Account

https://i.pinimg.com/originals/d1/18/87/d11887462b1c2c98e5fcc972d320db32.jpg

Rhb Saving Account Interest Rate This Applies To Both Average And

http://apnaplan.com/wp-content/uploads/2015/01/Highest-Interest-Rate-on-Bank-Savings-Account-April-1-2016.png

Pnb Saving Account Interest Rate

https://4.bp.blogspot.com/-2Q-hW4ZI5ZU/V6MX2ou4bFI/AAAAAAAAFNE/HFrv0ConrYwFjP-P1Ieo072tUWlJCvo4ACLcB/s1600/Which%2Bbank%2Bhas%2Bthe%2Bhighest%2Binterest%2Brate%2Bfor%2Bsavings%2Baccount%2Band%2B%2Bhighest%2Binterest%2Brate%2Bfor%2Btime%2Bdeposit.jpg

Web 10 mars 2022 nbsp 0183 32 Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income Here s a look at the tax rates for the 2022 tax Web 3 ao 251 t 2023 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is applicable for interest on savings accounts held by individuals or

Web 6 avr 2023 nbsp 0183 32 You may need to claim a repayment of tax if any of your savings income should only have been subject to the starting rate of tax for savings 0 in 2023 24 or should not have been taxed at all for Web 26 juil 2022 nbsp 0183 32 Income tax return ITR filing How savings bank interest is taxed and can you save the income tax on it Here s your answer Anshul Jul 26 2022 1 47 37 PM IST

Download Income Tax Rebate On Interest On Saving Account

More picture related to Income Tax Rebate On Interest On Saving Account

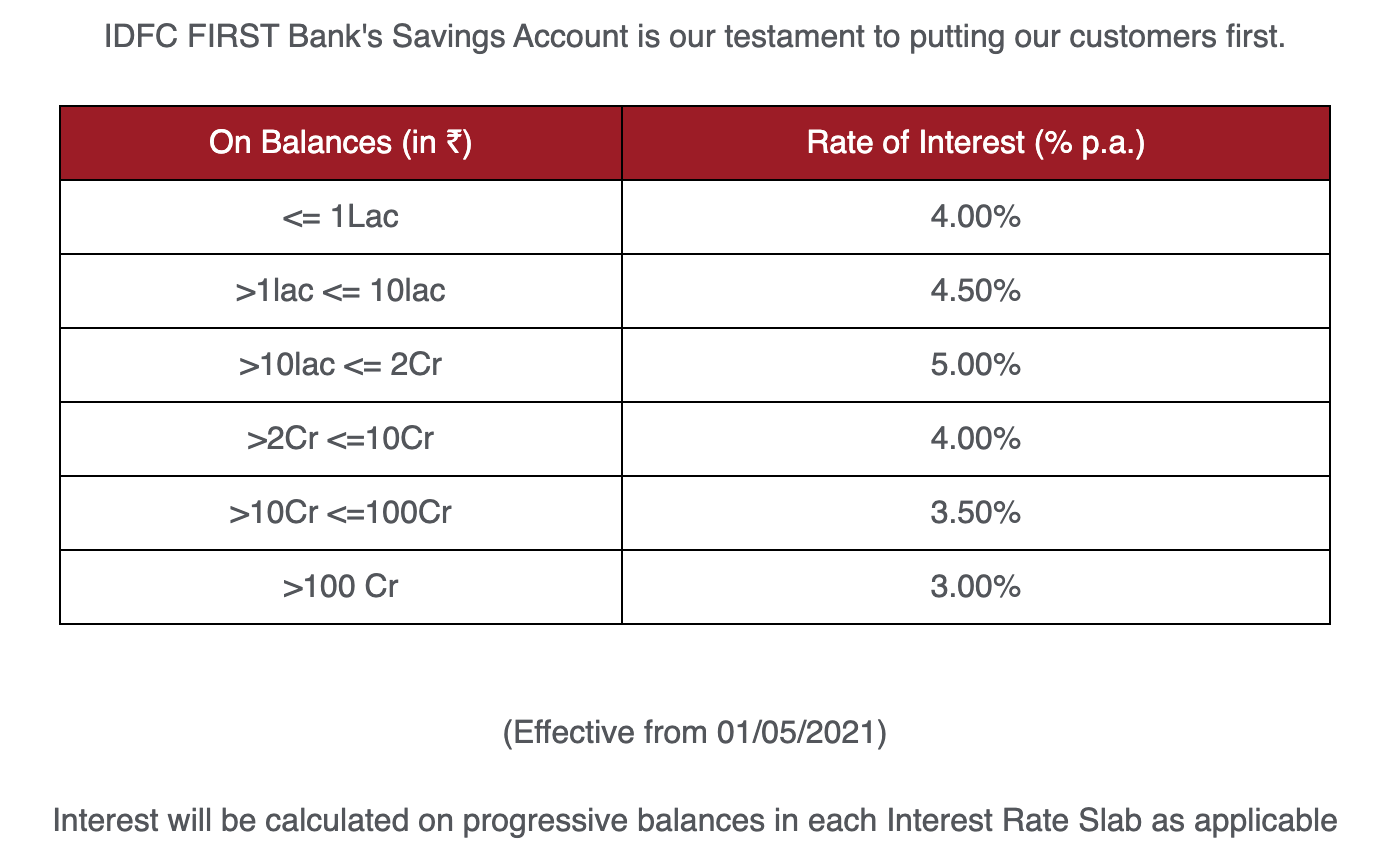

Bank Savings Account Interest Rate

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/07/Savings-Account-Interest-Rates-of-Small-Finance-Banks-August-2020.png?fit=1316%2C874&ssl=1

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

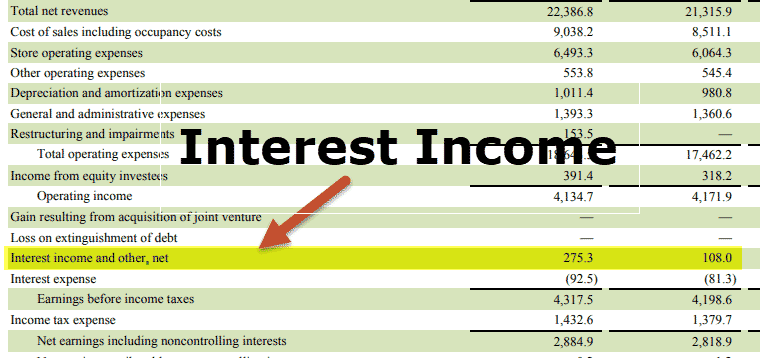

Interest Earned On Savings What Is It And How To Calculate It

https://www.wallstreetmojo.com/wp-content/uploads/2018/09/Interest-Income-1.png

Web 26 juil 2022 nbsp 0183 32 If you opt for the old existing income tax regime while filing ITR for FY 2021 22 AY 2022 23 then you can claim a tax deduction of up to Rs 10 000 on savings Web 10 juil 2023 nbsp 0183 32 Just like any other source of income you need declare any interest you ve earned on an Australian savings account and you ll be taxed at your income tax rate By Alison Banney Updated Jul 10 2023

Web 21 juin 2023 nbsp 0183 32 Tax exemption on savings accounts interest Section 80TTA of the Income Tax Act 1961 provides a deduction of Rs 10 000 on interest income earned on Web The Personal Savings Allowance The PSA is an allowance for how much interest you can earn from non ISA savings accounts before you have to pay any tax on it Whether you

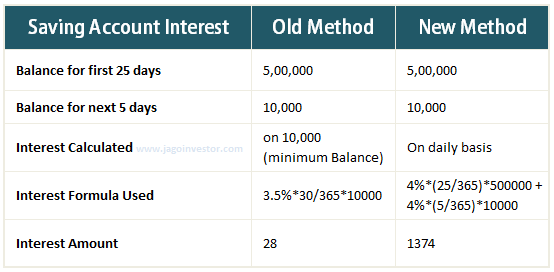

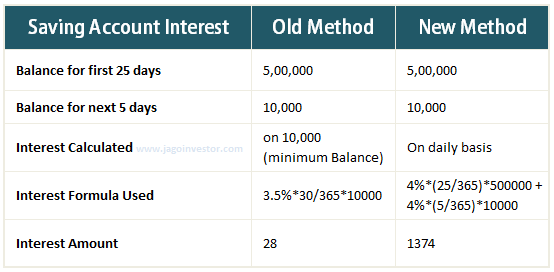

How Is Interest On Saving Bank Account Is Calculated

https://www.jagoinvestor.com/wp-content/uploads/files/img/ji/saving-bank-interest-calculation.png

How To Get Highest Savings Account Interest Rate Investdunia

https://investdunia.com/wp-content/uploads/2017/11/Savings-account-interest-rate-Dec-2020.png

https://www.gov.uk/guidance/claim-a-refund-of-income-tax-deducted-from...

Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return Claim a refund of Income Tax deducted

https://www.gov.uk/apply-tax-free-interest-on-savings

Web You earn 163 16 000 of wages and get 163 200 interest on your savings Your Personal Allowance is 163 12 570 It s used up by the first 163 12 570 of your wages The remaining

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

How Is Interest On Saving Bank Account Is Calculated

Tax Rebate Under Section 87A Investor Guruji Tax Planning

How Much Interest Sbi Gives On Savings Account Lacmymages

Individual Income Tax Rebate

Best Savings Bank Interest Rates InterestProTalk

Best Savings Bank Interest Rates InterestProTalk

Which Bank Gives Highest Interest Rate On Saving Account In India

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate On Interest On Saving Account - Web 6 mars 2023 nbsp 0183 32 Savings Account interest is taxable at your slab rate However interest up to Rs 10 000 is exempt from tax under Section 80TTA This tax exempt limit is Rs