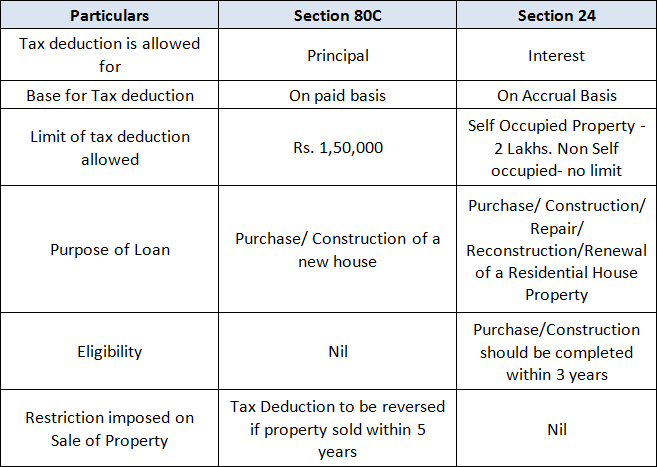

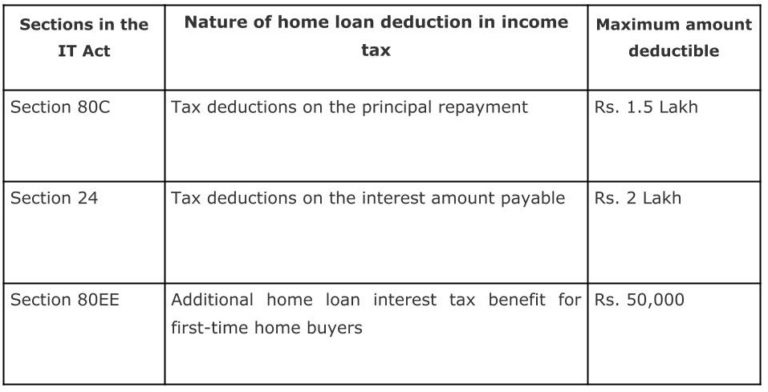

Income Tax Rebate On Interest Paid On Home Loan Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who Web 13 mai 2017 nbsp 0183 32 CONTENTS Show There are four steps to claim interest on your home loan deduction A deduction for interest payments up to Rs

Income Tax Rebate On Interest Paid On Home Loan

Income Tax Rebate On Interest Paid On Home Loan

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Home Loan EMI And Tax Deduction On It EMI Calculator

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on

Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial

Download Income Tax Rebate On Interest Paid On Home Loan

More picture related to Income Tax Rebate On Interest Paid On Home Loan

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

RBI Hikes Repo Rate By 50 Bps EMIs To Shoot Up For Borrowers

https://images.moneycontrol.com/static-mcnews/2022/08/home-loan-700X700.jpg

Web Deduction on the payment of interest The tax deduction on home loan also includes the interest paid on the loan Under section 24 of the Income Tax Act you are eligible for Web Under Sections 80C and 24 both the borrowers are eligible for up to Rs 2 lakh tax rebate on interest payment each and up to Rs 1 5 lakh benefit on the principal repayment each

Web 13 juin 2020 nbsp 0183 32 Let us discuss them one by one When the house is self occupied If you have taken a home loan to build purchase a house for your own use then interest paid is Web If your taxable income in 2021 exceeds 68 507 69 398 in 2022 it s important to note that you can offset the deductible mortgage interest at a maximum rate of 43 in 2021

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

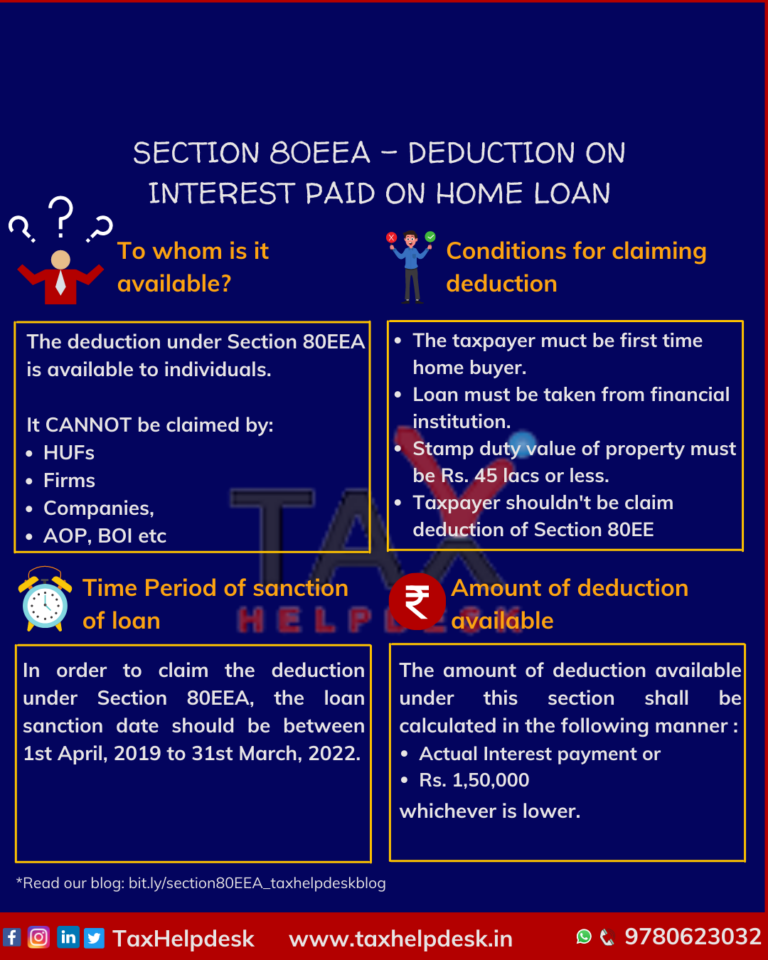

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Section-80EEA-Deduction-on-interest-paid-on-home-loan-768x960.png

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

https://www.thebalancemoney.com/home-mortgage-interest-tax-deductio…

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who

Latest Income Tax Rebate On Home Loan 2023

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Form 12BB New Form To Claim Income Tax Benefits Rebate

INCOME TAX REBATE ON HOME LOAN

INCOME TAX REBATE ON HOME LOAN

Top 10 Tax Saving Tips For FY 2021 Rurash Blog

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate On Interest Paid On Home Loan - Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on